QUOTE(kkk8787 @ Jan 18 2016, 02:45 PM)

got different price one? where?even though KLCI dropped,...the fund NAV not be cheaper b'cos the stocks that are being held in the Fund may not have dropped

Fundsupermart.com v13, Merry X'mas and Happy 牛(bull!) Year

|

|

Jan 18 2016, 02:47 PM Jan 18 2016, 02:47 PM

Return to original view | Post

#101

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

|

|

|

Jan 18 2016, 02:58 PM Jan 18 2016, 02:58 PM

Return to original view | Post

#102

|

Senior Member

5,143 posts Joined: Jan 2015 |

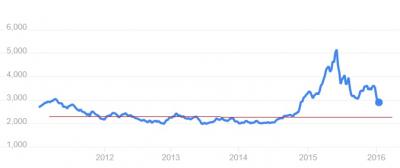

QUOTE(ZH888 @ Jan 18 2016, 02:50 PM) Bro, buy when down la, not buy when the market up wrong wrong thinking but its in the head of most of the investors Market drop 20% = 20% discount for the fund you bought. buy buy buy Now MEGA sale !!!! dropped 40%, now is still 20% higher than normal Attached thumbnail(s)

|

|

|

Jan 18 2016, 03:05 PM Jan 18 2016, 03:05 PM

Return to original view | Post

#103

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(ragu91 @ Jan 18 2016, 03:01 PM) it is good you realise your fear and readjust....hopefully the RM value is not much...read, understand and reflect upon yourself honestly..... Keep Your Risks In Check ..... May 8, 2015 Different investments come with different levels of risks and investors need to understand and know the risks that they can stomach given the circumstances that they are in before making a decision on what to invest. We explain how Fundsupermart.com Risk Rating can help investors to identify which unit trusts suit their risk appetite. To stay ahead of the game, it is not only important to understand the risks of the investments you are looking at, but also to understand your personal risk appetite. And the best way to do it is to assess your actual experience in investing. Investors who need advice or want a second-opinion on their investments can contact our Client Investment Specialists. They are able to assist you in distinguishing between unit trusts on our platform. Another method is to take the investor suitability assessment form by answering some questions such as your invesment objectives, risk tolerance, financial profile and investment experience. For instance, you might have thought you are an aggressive investor who can cope with a high level of risk. However, in practice, if you find that you always panic too soon every time the market dips, and get overly euphoric and pump in more money whenever markets are on a roll, then high-risk investments may not so suitable for you because they are likely to cause you to lose money. Our research team has also built the recommended portfolios as a guideline for investors based on different risk appetite. For more investment ideas, investors can take note of the articles we put out highlighting our research views of a particular region, market or sector. http://www.fundsupermart.com.my/main/resea...-May-2015--5825 |

|

|

Jan 19 2016, 12:36 PM Jan 19 2016, 12:36 PM

Return to original view | Post

#104

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(nexona88 @ Jan 19 2016, 12:20 PM) lol what happen to u all today morning? All very feeling2 only.. Something happen last night in your dream ah? Got some 'hint' from God it is always good to reflects upon the what we had been given and what we had achieved so far...... even though some peopled achieved more than others Attached image(s)  |

|

|

Jan 19 2016, 09:04 PM Jan 19 2016, 09:04 PM

Return to original view | Post

#105

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Jan 19 2016, 09:32 PM Jan 19 2016, 09:32 PM

Return to original view | Post

#106

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

|

|

|

Jan 19 2016, 10:08 PM Jan 19 2016, 10:08 PM

Return to original view | Post

#107

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(twhong_91 @ Jan 19 2016, 09:38 PM) your post# 1804 is your average price?I don't know your average price, so it will have to be daily fund price. anyway....since you got it last Saturday....I think it a good price since it had dropped for a few days before that. |

|

|

Jan 20 2016, 02:55 PM Jan 20 2016, 02:55 PM

Return to original view | Post

#108

|

Senior Member

5,143 posts Joined: Jan 2015 |

Let’s put this double-dip correction in context ......January 15, 2016

By Dr. Brian Jacobsen, CFA, CFP® Stocks seem to be trading as though we’re back in the midst of the global financial crisis, but the economy is much healthier now than back then. I think stock prices will eventually reflect this. For investors, it might be painful to wait, but waiting is all you can really do. This is why investors need to line up their investments and exposure to risk with their temperament and ability to wait. In the meantime, it helps to understand four things: 1.What caused January’s volatility 2.Whether stock fundamentals are really that bad or are being punished unfairly 3.What market corrections mean to the average investor 4.What history can teach us about market corrections https://secure.fundsupermart.com/main/artic...n-context-11222 |

|

|

Jan 20 2016, 06:32 PM Jan 20 2016, 06:32 PM

Return to original view | Post

#109

|

Senior Member

5,143 posts Joined: Jan 2015 |

for those that had missed the "What & Where To Invest 2016!"event held on 16th January 2016 in Singapore....here is the recap of highlight of what was presented.

https://secure.fundsupermart.com/main/artic...est-2016--11227 |

|

|

Jan 21 2016, 07:49 AM Jan 21 2016, 07:49 AM

Return to original view | Post

#110

|

Senior Member

5,143 posts Joined: Jan 2015 |

Anyone with money in the market can tell you what's been going on with stocks since January 1: down, down, down.

Hardly anyone is buying stocks. To turn this selloff around, investors need oil prices to stabilize. Oil and stocks are locked in an intense tango. In the past month, the correlation between stocks (S&P 500) and crude oil prices has spiked to 96%. That's highly unusual given that over the past decade that correlation is 0%. No doubt oil is driving the wild market swings and needs to calm down for markets to turn around. However, another key factor at play is that the usual "bargain buyers" aren't jumping in during big selloff moments. Those are the big buyers who have longer-term horizons. Sovereign wealth funds are among those buyers. They know that stocks are likely to be higher years from now, and they are able to wait out the volatility. http://money.cnn.com/2016/01/20/investing/...drop/index.html |

|

|

Jan 21 2016, 08:34 AM Jan 21 2016, 08:34 AM

Return to original view | Post

#111

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(adamdacutie @ Jan 21 2016, 08:24 AM) Its funny how the articles can sound like .... start of the tumbling us market ... get out frm stock blablabla worst is yet to come blablabla .... once rebound on the same trading day... this is the correction everyone is looking for .... isit time to buy now .... blablabla... bullshitssss I would just take it as entertainment lor....just like some TV series... Don't be emotional attached to it This post has been edited by T231H: Jan 21 2016, 08:37 AM |

|

|

Jan 21 2016, 10:08 PM Jan 21 2016, 10:08 PM

Return to original view | Post

#112

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(lukenn @ Jan 18 2016, 04:12 PM) Most funds a priced end of day (forward pricing). Transactions before a certain time (for me it's 3pm) is transacted at the price published at 8pm. FSM came out an article about it on 21 Jan..... Understanding Forward Pricing ..... January 21, 2016 In this Idea of the Week, we seek to explain to investors what is forward pricing and why such a pricing system is adopted. http://www.fundsupermart.com.my/main/resea...-Jan-2016--6735 Coincident or what? |

|

|

Jan 21 2016, 10:15 PM Jan 21 2016, 10:15 PM

Return to original view | Post

#113

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(sunshine-kc @ Jan 21 2016, 10:02 PM) Forget China and oil, this global stock market rout has deeper causes, warns investing guru http://business.financialpost.com/investin...-investing-guru |

|

|

|

|

|

Jan 21 2016, 10:39 PM Jan 21 2016, 10:39 PM

Return to original view | Post

#114

|

Senior Member

5,143 posts Joined: Jan 2015 |

Nine things investors should remember

1) The power of compound returns – saving regularly in growth assets can grow wealth substantially over long periods. Using the “rule of 72” it will take 29 years to double an asset’s value if it returns 2.5% pa (ie 72/2.5) but only 9 years if the asset returns 8% pa. 2) The cycle lives on – markets cycle up and down and we need to allow for it and not get thrown off by rough patches, like the one we are currently going through. 3) Diversify – don’t put all your eggs in one basket and consider active asset allocation to enhance returns/protect against falls. 4) Turn down the noise – the information revolution is making us more jittery and leading to worse investment decisions. 5) Starting point valuations matter – so buy low and sell high. Selling after major falls (like those seen recently) just locks in losses. 6) Remember that while share values can be volatile, the dividend or income stream from a well-diversified portfolio of shares is more stable over time (and now much higher) than the income flow from bank deposits. 7) Avoid the crowd – because at extremes it’s invariably wrong. 8) Focus on investments providing sustainable and decent cash flows – not financial engineering. 9) Accept that it’s a low return world to avoid disappointment – low nominal growth & lower bond yields and earnings yields mean lower long term returns. When inflation is 2.5% an 8% return is pretty good. ....... Dr Shane Oliver Head of Investment Strategy and Chief Economist AMP Capital A-List-of-Lists-regarding-the-Macro-Investment-Outlook http://www.fundsupermart.com.my/main/resea...nt-Outlook-6730 |

|

|

Jan 21 2016, 10:47 PM Jan 21 2016, 10:47 PM

Return to original view | Post

#115

|

Senior Member

5,143 posts Joined: Jan 2015 |

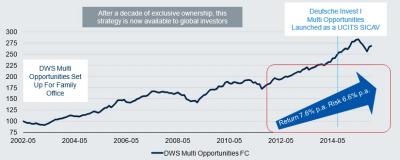

normally one looks for Returns X % per annum,..... here they consider this too......Risk X % per annum. where and how to get this Risk in % pa data ? Which Egg and Which Basket?: Turning Volatility into Opportunities https://secure.fundsupermart.com/main/artic...rtunities-11226 Attached thumbnail(s)

|

|

|

Jan 21 2016, 11:22 PM Jan 21 2016, 11:22 PM

Return to original view | Post

#116

|

Senior Member

5,143 posts Joined: Jan 2015 |

China Vice President Vows to ‘Look After’ Stock Market Investors “An excessively fluctuating market is a market of speculation where only the few will gain the most benefit when most people suffer,” Li said in an interview with Bloomberg News after arriving at the World Economic Forum’s annual meeting in Davos, Switzerland. “The Chinese government is going to look after the interests of most of the people, most of the investors.” http://www.bloomberg.com/news/articles/201...arket-investors |

|

|

Jan 22 2016, 11:37 PM Jan 22 2016, 11:37 PM

Return to original view | Post

#117

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Jan 23 2016, 01:07 PM Jan 23 2016, 01:07 PM

Return to original view | Post

#118

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(kkk8787 @ Jan 23 2016, 12:58 PM) Everyone's Got a China Call as Markets Grapple With Who's Right George Soros says China is headed for a hard landing. Templeton Global Advisors Ltd. says it’s making a normal economic shift, while Goldman Sachs Group Inc. says investors are overstating the slowdown’s impact on the world. Who to believe? Traders are struggling to decide. http://www.bloomberg.com/news/articles/201...ith-who-s-right |

|

|

Jan 23 2016, 07:20 PM Jan 23 2016, 07:20 PM

Return to original view | Post

#119

|

Senior Member

5,143 posts Joined: Jan 2015 |

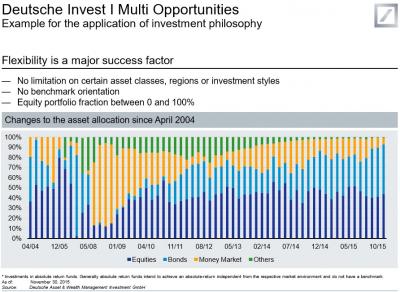

see the EQ and bond % in 07~09... https://secure.fundsupermart.com/main/artic...portunities.pdf Attached thumbnail(s)

|

|

|

Jan 23 2016, 11:34 PM Jan 23 2016, 11:34 PM

Return to original view | Post

#120

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(rapple @ Jan 23 2016, 08:12 PM) I'm new to fsm, lets say I wanna do reallocation. Can I switch from eastspring to the Rhb cmf? Any charges for switching from a different find house? YEs, you can switch from Eastspring (or any FH) to RHB CMF or vice-versa.Q: Can I perform switches for OSK-UOB Cash Management Fund ? A: You can place an inter-switch order to switch your Cash Management Fund to another unit trust or vice-versa however not an intra-switch. Q: Where can I see the charges applicable for Intra/Inter fund house switching? A: To view the switching fees for Intra and Inter fund house switches, please look under FUNDS INFO-> FUNDS SALES CHARGES-> SWITCHING and select either INTRA FUND HOUSE or INTER FUND HOUSE. http://www.fundsupermart.com.my/main/faq/1...f-Funds-8922#10 |

|

Topic ClosedOptions

|

| Change to: |  0.0287sec 0.0287sec

0.09 0.09

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 03:33 PM |