even if the results are very much positives.....will it last? do you have the stomach to hold on to it when it falls?....portfolio is best to have diversities...

Tip #3: DIVERSIFY, DIVERSIFY, DIVERSIFY

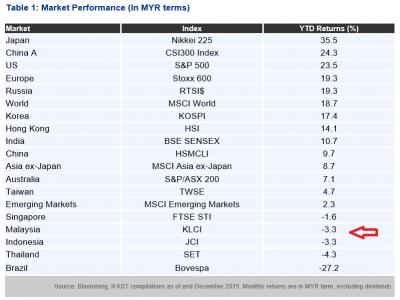

This is one tip or rule to bear in mind. By diversifying your money into different types of investments, you stand to reduce your portfolio risk as losses from some investments are offset by gains in others. In the long run, this strategy helps to increase your ability to take advantage of market gains.

http://www.fundsupermart.com.my/main/resea...-Jan-2016--6682

Fundsupermart.com v13, Merry X'mas and Happy 牛(bull!) Year

Jan 10 2016, 09:55 AM

Jan 10 2016, 09:55 AM

Quote

Quote

0.0464sec

0.0464sec

0.57

0.57

7 queries

7 queries

GZIP Disabled

GZIP Disabled