QUOTE(Pink Spider @ Dec 18 2015, 09:35 PM)

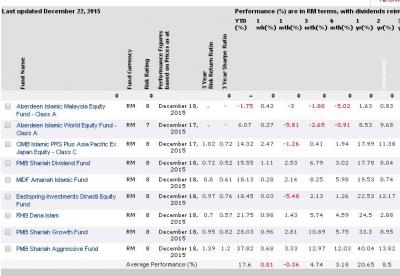

I AM TOTALLY LOST. What the hell is wrong with Aberdeen Islamic World???

I have a very simple theory, but I'm not sure if you'd agree.

The shariah compliance list is very short. The generally prohibited sectors include

1. Alcohol

2. Casinos

3. Restaurants

4. Broadcasting

5. Cable / Satellite

6. Entertainment

7. Tobacco

8. Conventional banking

9. Insurance

10. Real estate

So the only major areas left are O&G, plantations, pharma, FMCG. From the malaysian perspective, this is very apparent as 2014-2015 has turned out to be severely disappointing for all local shariah compliant funds.

Most of these funds are invested in the O&G and plantation/commodity sectors, which have tanked in value. In the preceding 3-4 years, it was magnificent as an over-weighted O&G sector was soaring.

On a grander scale, this is what we call concentration risk. If you're right, you're a star, if you're wrong you burn.

With that being said, its quite unfair to be expecting a single fund to be performing when all the others seem to be.

Dec 22 2015, 02:42 PM

Dec 22 2015, 02:42 PM

Quote

Quote

0.0198sec

0.0198sec

0.65

0.65

6 queries

6 queries

GZIP Disabled

GZIP Disabled