QUOTE(Jay.C1992 @ Jul 18 2022, 12:10 PM)

I do believe that there is a calculation model for Any Audit firm in earning the expected Profit Margin (Those Big Boss mind set or event Global Partnership Requirement)

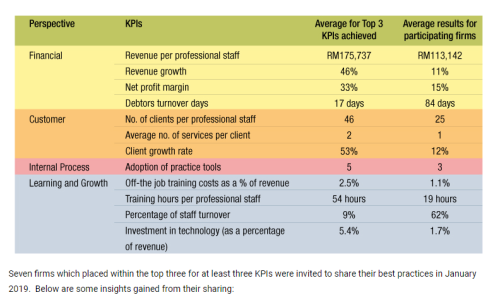

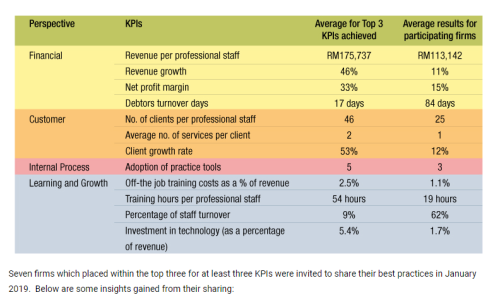

Extracted from MIA Accountant Today

By the way, the data is related to the FY 2019.

If Based on this calculation, if a audit firm need to have at least 25% Net Profit Margin, they will need to take into account of their own Costing (Staff cost, rental, Leasing of printing machine/laptop, water, electricity and etc).

Bigger firm might have much more complex model and based on this in calculating the Charge out rate as per above mentioned.

For example, the charge rate of below:

Junior Associate RM 150 per hour

Senior Associate RM 250 per hour

Assistant Manager/Manager RM 400 per hour and etc.

Noted that in Big 4 or even Mid-Tier, the boss or Manager don't even tell you the target Revenue needed, you just do the work as per instructed. (Perhaps you generated more than the Revenue that you are really targeted for).

From my Senior Manager from one of the Big 4, "Audit Industry is not a place that you come to earn a lot of Salary unless you sit inside the Room (Partner/Director)".

In the end, Audit is also a business where you boss want their Profit Sharing, low recoverability rate from the engagement will cause less profit sharing. (Somehow unhealthy for long term, that why i would foresee that less applicant will join into Audit, its just a matters of Time.

Look at KPMG Singapore increase the Paid scale of Fresh Graduate by 20% as i think that no 1 wish to join into Big 4 anymore.

Just to share further points:

1) Business strategy: Audit and tax is the cash cow for the firm as it's a statutory requirement, consulting/ advisory is the growth where amount charged can be higher. It's common for the audit dept to charge fixed/ low growth fees to ensure they get the consulting work. With disclosure required by Bursa, this is less likely as firms need to disclose ratio of audit Vs consulting work. For example, audit can be pwc, system audit by KPMG and consulting by EY.

https://www.google.com/url?sa=t&source=web&...JsOat5bbb8xIL7z2) Retention rate: Audit needs lots of associates to do field work. Only need a handful of manager and definitely not many partners are needed. No fixed numbers but 10% retention rate won't make partners blink. Yes, most money comes from profit sharing partnerships. Big 4 is increasingly using titles like directors/ partners to entice staff to stay longer with same/ lower pay. Banks been doing this long ago.

https://www.afr.com/companies/professional-...20190724-p52adf3) You are right about costing, there are many other fixed cost to be absorbed chiefly from staff salaries, rentals, laptops, royalties, ...etc. In Asia, it's mostly unspoken that full OT rates are not charged in to keep the fees reasonable to client until the client grow in size to be next Maybank or Petronas. Best clients are actually subsidiaries of large MNCs that can easily afford the lower local currency fees.

4) Charge rate quota. There is also a minimum hours to be clocked by partners for certain engagements especially PLCs. Whether they spend that much time in actual is different story but most budget is worked backward and the stress is always on the manager to ensure timeline and budget is met and associate to deliver it .

Audit definitely not for everybody due to slow market growth, demanding timeline, lack of resources and increasing regulation by AOB and Bursa. However, the statutory requirement and highly standardised work provides lots of employment opportunities. There are staffs that left big4 to setup their own smaller firm to absorb clients their ex bosses deferred/ referred to. Win win for everybody.

Jun 17 2022, 11:14 PM

Jun 17 2022, 11:14 PM

Quote

Quote

0.0421sec

0.0421sec

0.36

0.36

6 queries

6 queries

GZIP Disabled

GZIP Disabled