Outline ·

[ Standard ] ·

Linear+

Investors Club V9, Previously known as Traders Kopitiam

|

river.sand

|

Dec 3 2015, 02:47 PM Dec 3 2015, 02:47 PM

|

|

Regarding BPPLAS, I haven't done proper study yet. But at first glance...

1. Its profit and EPS have dropped substantially from the height of 2010.

2. Dividend payout ration is quite high.

Moving forwards, do you see positive signs of this counter?

|

|

|

|

|

|

river.sand

|

Mar 21 2016, 10:36 PM Mar 21 2016, 10:36 PM

|

|

QUOTE(Pink Spider @ Mar 17 2016, 11:45 AM) cash rich after taking profit on BPPLAS and PMETAL...ada apa boleh beli? :confused: I am looking into SCGM. It's past performance has been good. Price-wise ok. Downside is four of the directors seem to be siblings. Just imagine one day they fall out with each other  |

|

|

|

|

|

river.sand

|

Mar 22 2016, 01:39 PM Mar 22 2016, 01:39 PM

|

|

QUOTE(gark @ Mar 22 2016, 09:49 AM) My family still do.. for entertainment purpose only. The star is much less political than utushit..  The Star editor Wong Chun Wai last time sued by perkasa chief. NST is worse. |

|

|

|

|

|

river.sand

|

Mar 22 2016, 09:51 PM Mar 22 2016, 09:51 PM

|

|

QUOTE(Pink Spider @ Mar 22 2016, 04:15 PM) CPO...apasal my Ta Ann kaboom then?  Sales = price x volume El Nino effect - price up but volume down |

|

|

|

|

|

river.sand

|

Mar 23 2016, 05:40 PM Mar 23 2016, 05:40 PM

|

|

QUOTE(Pink Spider @ Mar 23 2016, 03:16 PM) Gonna hold til after the next results announcement Generally my required rate of return (paper gain) is 30-33% before considering to exit Mr Accountant, Required rate of return not usually annualized meh? 30% very high wor... |

|

|

|

|

|

river.sand

|

Mar 23 2016, 06:47 PM Mar 23 2016, 06:47 PM

|

|

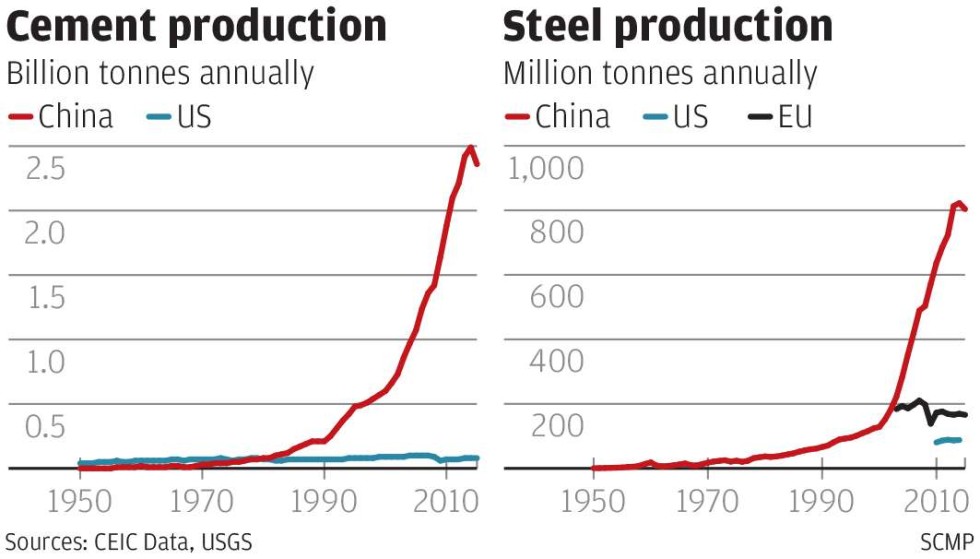

Another view on steel... QUOTE It is an extraordinary fact that in just three years, 2011, 2012 and 2013, China used more cement than the United States did in the 20th century, 6.6 billion tonnes compared with 4.4 billion, according to figures from the US Geological Survey.

And a whole lot of iron ore, steel, copper and just about every other industrial commodity you can think of.

Too much property was built too quickly, particularly in smaller, new cities. Too much capacity was built to feed what was an unsustainable rate of construction in industries such as steel. And too much debt, often of dubious quality, was accumulated in the credit binge. http://www.smh.com.au/business/mining-and-...l#ixzz43iocyYNt |

|

|

|

|

|

river.sand

|

Mar 23 2016, 07:08 PM Mar 23 2016, 07:08 PM

|

|

QUOTE(gark @ Mar 23 2016, 06:51 PM) Short term trading ok. Medium term investment possibly not. But... our Mr Accountant has transformed from a dividend investor to a trader  |

|

|

|

|

|

river.sand

|

Mar 28 2016, 12:49 PM Mar 28 2016, 12:49 PM

|

|

QUOTE(tehoice @ Mar 28 2016, 11:33 AM) got already. disappointing. wanna resign soon, got vacancy for me? Me looking for job also. Anyone hiring  |

|

|

|

|

|

river.sand

|

Mar 28 2016, 05:05 PM Mar 28 2016, 05:05 PM

|

|

QUOTE(gark @ Mar 28 2016, 02:29 PM) Don't think I can afford you.. you too high class liao.  I can pour water deliver tea. Low class enough  |

|

|

|

|

|

river.sand

|

Mar 29 2016, 08:58 PM Mar 29 2016, 08:58 PM

|

|

QUOTE(tehoice @ Mar 29 2016, 09:26 AM) nola i wanna work near home la. need to take care of my family here... dont wanna join PE firm la, work life also not balance 1, need to be a bit more balance liao, old ad, need more time to do own things, earn a bit lesser is okay. want my life back... damn sien everyday work at least 12-15 hrs. If you are already a HNW person, you can retire now, and start a small business just to pass time and keep your mind active. (Do consider hiring me  ) And you can spend more time on studying stocks. |

|

|

|

|

|

river.sand

|

Mar 30 2016, 08:17 PM Mar 30 2016, 08:17 PM

|

|

QUOTE(gark @ Mar 30 2016, 04:53 PM) Busy busy day... Sold BWPT, @ 4X% gain  Sold SRIL, @ 1X% gain..  Bought ROTI, @ 12XX  all indo mie  |

|

|

|

|

|

river.sand

|

Mar 31 2016, 10:52 AM Mar 31 2016, 10:52 AM

|

|

QUOTE(gark @ Mar 31 2016, 10:30 AM) Why beyond you? Actually very easy only mah... For growth 1. Average palm oil age 2. Unplanted landbank For Income 1. FFB Yield (Ton FFB/ha) 2. OER (Oil Extraction rate) (% Oil recovered form each ton of FFB) 3. EV / ha planted That's it.  And its really simple, plantation cost are more or less fixed, so every RM 100 up in oil price = additional RM 100 in profit per ton CPO produced. RHB Report Link.Soybean price MYR RSPO Palm oil tax Other regulations El nino China's slow down Need free lectures from master gark  |

|

|

|

|

|

river.sand

|

Mar 31 2016, 12:06 PM Mar 31 2016, 12:06 PM

|

|

QUOTE(Pink Spider @ Mar 31 2016, 11:44 AM) So...no go again?  UP lagi teruk la...P/E tahap dewa for Plantations sector, macam Nestle  My Ta Ann need to trim a bit or add a bit, else will end up with odd lot when the Bonus Issue comes  Condom also proposes bonus issue. I just added some to avoid odd lots. |

|

|

|

|

|

river.sand

|

Apr 7 2016, 01:59 PM Apr 7 2016, 01:59 PM

|

|

QUOTE(gark @ Apr 7 2016, 10:46 AM) A LOT!.. just dont look at KV lar...  Yes, a lot outside KV. And the stupid gomen still want to launch pr1ma in Teluk Intan  |

|

|

|

|

|

river.sand

|

Apr 11 2016, 04:51 PM Apr 11 2016, 04:51 PM

|

|

QUOTE(PhakFuhZai @ Apr 11 2016, 10:13 AM) telco stocks all drop  why ah if maxis alone drop i can understand though price war, Webe  |

|

|

|

|

|

river.sand

|

May 26 2016, 01:13 PM May 26 2016, 01:13 PM

|

|

I-BHD reports: QUOTE The unbilled sales at the start of the year are more than three times the 2015 revenue generated from property development segment, thus providing a good base for the growth in revenue and profit for this year. http://www.theedgemarkets.com/my/article/i...p-1q-net-profitDo the unbilled sales come from units already booked, or do they merely refer to projected sales only? |

|

|

|

|

|

river.sand

|

Jul 25 2016, 07:08 PM Jul 25 2016, 07:08 PM

|

|

QUOTE(Pink Spider @ Jul 22 2016, 04:04 PM) I already have no idea on HLIND  HLIND manufactures motorcycles in Vietnam right? Hanoi plans to ban motorcycles in city center. But that is 2025 lah... |

|

|

|

|

|

river.sand

|

Jul 29 2016, 01:21 PM Jul 29 2016, 01:21 PM

|

|

QUOTE(Pink Spider @ Jul 28 2016, 11:54 AM) All Men Are Brothers!  Broke 9.00, u wanna help push further?  Dunno what to buy... Any tipsy  |

|

|

|

|

|

river.sand

|

Aug 2 2016, 10:35 AM Aug 2 2016, 10:35 AM

|

|

QUOTE(Pink Spider @ Aug 2 2016, 10:23 AM) Fundamentally good but share liquidity is an issue, not much lots done every day. But this CAN also be a good thing, if a shark were to play it  Peter Lynch loved stocks which were not too hot. So low liquidity may not be bad. |

|

|

|

|

|

river.sand

|

Aug 3 2016, 08:52 AM Aug 3 2016, 08:52 AM

|

|

QUOTE(Pink Spider @ Aug 2 2016, 04:01 PM) If mega...won't sink lor  QUOTE(tehoice @ Aug 2 2016, 04:23 PM) mega also can sink 1 mah. even lehman brothers sink too. How do you guys value a property stock? |

|

|

|

|

Dec 3 2015, 02:47 PM

Dec 3 2015, 02:47 PM

Quote

Quote

0.2817sec

0.2817sec

0.25

0.25

7 queries

7 queries

GZIP Disabled

GZIP Disabled