QUOTE(Hansel @ Mar 17 2017, 06:36 PM)

Bro/Sis,... appreciated yr comments,....

1) The HY funds are said to have properties closer to equities than to bonds. With a growing economy in the US, if equities do well,...theoretically, the HY funds will do well too.

2) I have reinvested the dividends I've collected over the years INTO other asset classes besides these HY funds themselves. It's not easy to calculate the returns from there, but I hold on to the concept that the faster I get my money in my hands, the faster I can reinvest them into other instruments to generate more returns.

3) The table that you showed are in SGD terms, meaning the returns have been converted into the SGD and then calculated in SGD, hence,... exchange rate effect is there. In their absolute currency terms, my returns are higher.

4) Your performance table was pulled from either Fundsupermart SG or POEMS, and the returns are in SGD terms because their investors normally convert the dividends received into the SGD. I don't, I collect my returns in the foreign currencies that such dividends were generated in,... and,... when the exchange rate is favourable, I may convert over. Otherwise, I my use the same currency cash in hand to invest into instruments of similar currencies.

Egs,... I will use the USD divvies I earned to invest into Manulife US REIT. I may use the AUD divvies I earned to invest into the ASX !

I guessed I don't have specific numerics to illustrate my returns,... but I noticed I keep getting more and more foreign currencies dropping into my different wallets.

What is the average return of a good US Equity fund ?

Sigh, this is why I malas ni

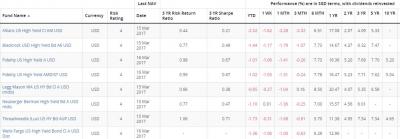

The table i showed is USD denominated funds; the forex gain/loss in SGD is not considered. Your returns may be higher due to the timing you bought in; but since you don't use XIRR to calculate, actually we can't really tell what's your returns in annualised % terms.

All this "I feel my returns is good" is hard to be quantified. No offense but you really do that a lot. Including how much forex gains you made by converting RM to SGD and AUD, without doing the maths, it's just shiok sendiri. Not too different from the property talk folks; "I made RM100k from one project" etc; without quantifying the net returns and time apportion the gains

This is US EQ fund sorted by 3 years annualised returns. All those in the list are >10% per annum over the past 3 years. So if you say HY bond behaves like EQ funds, then the returns definitely is no where near

QUOTE(Ramjade @ Mar 17 2017, 06:45 PM)

Check out Fidelity America/Fidelity Global Tech (this one is in Eur but 70-80% coverage of the US so it's basically a US fund).

For fidelity America, you can choose to pay in SGD or USD (there are 2 funds with different currency). For me I will choose SGD as there's no way to do online transfer from a USD/MCA account into FSM/Phillip. Heck even SG banks does not allow one to transfer USD/HKD/AUD between banks via online which I thought they can. Kind of a let down considering SG is suppose to be "advanced". They only let you transfer SGD

You don't have to buy using USD. You can send SGD into FSM SG and they convert into USD to buy into this fund for you. But rate good or not I didn't compare lor. That's how I bought the Fidelity America USD fund. Haven't sell it so not sure if I can keep the USD in cash account or must convert to SGD. I suspect it's the former as there is USD denominated cash account

Well yeah I don't want the hassle of trying to selling them off, then didn't get the "glitched" amount, then I have to purchase them all over again. Well I will just leave it probably.

Well yeah I don't want the hassle of trying to selling them off, then didn't get the "glitched" amount, then I have to purchase them all over again. Well I will just leave it probably.

Mar 13 2017, 10:28 AM

Mar 13 2017, 10:28 AM

Quote

Quote

0.0215sec

0.0215sec

0.26

0.26

6 queries

6 queries

GZIP Disabled

GZIP Disabled