QUOTE(dwRK @ May 1 2025, 04:44 PM)

bro... my understanding of the 10 yr extension (by correction of the old June 2024 guideline section 5, while waiting for the new one)...

5.2 Foreign income received in Malaysia which is exempted from tax from 1 January 2022 until 31 December

2026 2036... so pushed back 10 yrs, but start date remains in effect...

5.2.2.1

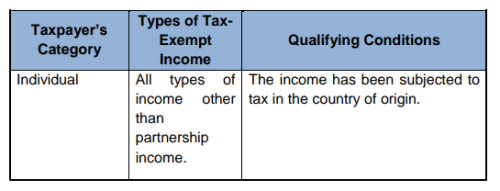

All foreign income other than partnership income received in Malaysia by a resident individual

from 1 January 2022 until 31 December 2026 2036 is exempt from tax provided the income has been subjected to tax in the country of origin.... if non taxable they don't need all the weasel words after "provided..." and since our 2024 tax form has a section to declare fsi, implies that fsi is active and taxable for some ppl...

5.2.2.2 Qualifying conditions... has a subsection on foreign dividend income... but i lazy to understand it fully since am not vested...

long ago all fsi was fully taxable... then come full exemption... then no exemption with 6 months special flat tax but rakyat protested so partial exemption till 2026... then extended till 2036... come 2036 no more partial exemption...

anyways... to me its clear... if you repatriat fsi that hasnt been taxed, check the qualifying conditions for exemption... dun just read the headlines...

and your action is simple... get clarification from IRB or if audited feign wrong interpretation and beg for mercy...

Hi bro,...

Appreciated your write-up in the above.

I have checked with the tax authorities, they told me to just read the ann'ts,.... so that's what I'm doing,...

No need to beg-lar, bro,... tax is a normal thing is life,...

Big editing here : 'The document' has changed from when I last saw it.

This post has been edited by Hansel: May 2 2025, 06:32 PM

Nov 8 2024, 08:13 PM

Nov 8 2024, 08:13 PM

Quote

Quote

0.1878sec

0.1878sec

0.32

0.32

7 queries

7 queries

GZIP Disabled

GZIP Disabled