QUOTE(Jake2 @ Jun 7 2025, 01:03 PM)

I believe that is all (Note:I am not a tax advisor). There are two disadvantages by this approach 1. You are forced to sell the share (or at least part of the holding) in order to separate the capital gain in cash form. 2. Your initial investment is still abroad. This amount might be larger than the capital gain you can prove.

Btw.. let it be clear that my initial investment is completely legit. I gained the funds from selling my share in a private company when that company was sold. All local taxes have been paid on it. It's just that this happened 20 years ago and I did not keep the paper trail ever since. I do still have the sales contract. I wonder if it is possible to discuss my case and potential taxation with LHDN before initiating the remittance and then decide to remit or not based on their response.

Tq for your reply, bro,...

1) To ur first pararaph :

Pt 1 is a certainty, but if you have been actively managing your portfolio abroad, there will be times that you will certainly sell stocks. If you incur capital gain, you can, of course use this to justify the funds you are remitting back. Is there a problem here ?

Pt 2 is abt the initial investment abroad. So it's large, what's the problem here ? Why do we need to prove anything or say anything more abt these assets which we have abroad ?

2) To ur second paragraph :-

This is related to Pt 2 in ur first paragraph, why do we have to prove anymore,... the legitimacy of our assets abroad ? And that all taxes have been paid ? These are all in the past.

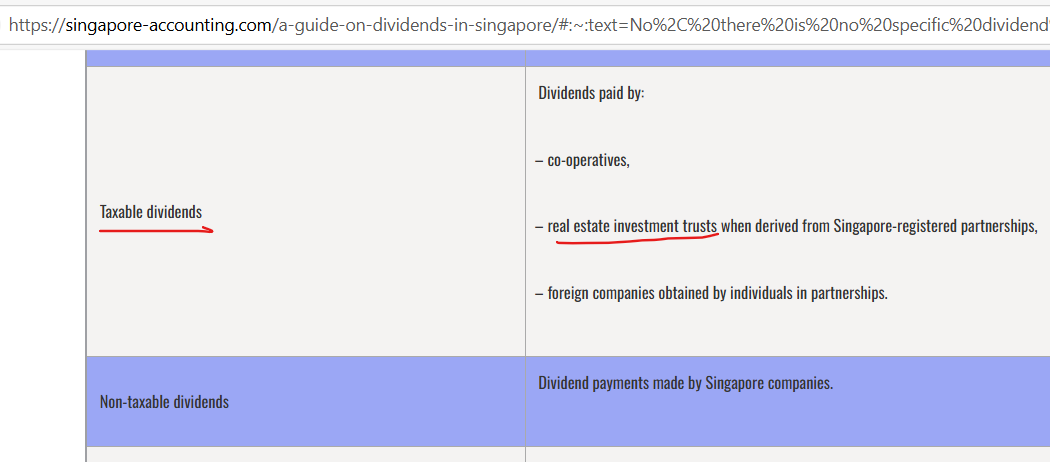

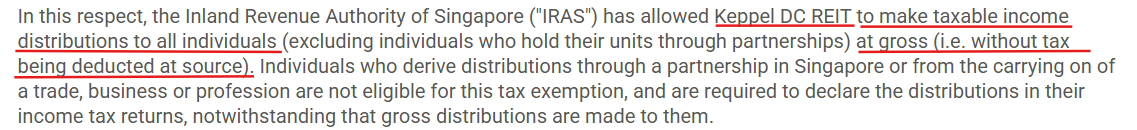

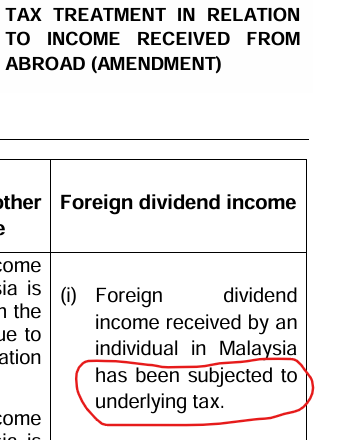

What is there to discuss ? To me, this FSI thing is plain and simple,... if we remit back, describe the funds being remitted back and decide if we shld include these into our net income or not. In fact, if we are certain the funds that we remit back are not taxable, we shld not even include these funds into our BE Form. However, I stand corrected in this thinking.

To your final statement in the above : I wonder if it is possible to discuss my case and potential taxation with LHDN before initiating the remittance and then decide to remit or not based on their response,......

You shld discuss this with your tax advisor. And secondly,... the moment you initiate this move, there are repercussions to it. Your file 'becomes visible'.

Awaiting your inputs, bros dwrk, prophet and jake,....

Jun 6 2025, 06:27 PM

Jun 6 2025, 06:27 PM

Quote

Quote

0.0345sec

0.0345sec

0.17

0.17

7 queries

7 queries

GZIP Disabled

GZIP Disabled