QUOTE(Syd G @ Aug 4 2015, 12:53 AM)

Any suggestions for shariah compliant funds? EI ex Japan looks promising but return a bit like too high dy

Have u read all the FAQs on Post #1? It will debunk your myth above Fundsupermart.com v11, Grexit or not, Europe will sail on...

|

|

Aug 4 2015, 09:49 AM Aug 4 2015, 09:49 AM

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

|

|

|

|

Aug 4 2015, 10:02 AM Aug 4 2015, 10:02 AM

|

|

VIP

8,023 posts Joined: Jan 2003 From: :: Cheras :: |

|

|

|

Aug 4 2015, 10:02 AM Aug 4 2015, 10:02 AM

|

||||||||||||

Junior Member

381 posts Joined: Jan 2003 |

QUOTE(Syd G @ Aug 4 2015, 12:53 AM) Any suggestions for shariah compliant funds? EI ex Japan looks promising but return a bit like too high dy hi, my shariah compliant fund but return is so-so only.haha Held Eastspring Investments Asia Pacific Shariah Equity Fund before. But cashed out for profit after sudden 15% rise in 1 day. Not sure want to re-enter to this fund or not.

|

||||||||||||

|

|

Aug 4 2015, 11:20 AM Aug 4 2015, 11:20 AM

|

||||||||||||

|

VIP

8,023 posts Joined: Jan 2003 From: :: Cheras :: |

QUOTE(dirtinacan @ Aug 4 2015, 10:02 AM) hi, Thanks for sharing.my shariah compliant fund but return is so-so only.haha Held Eastspring Investments Asia Pacific Shariah Equity Fund before. But cashed out for profit after sudden 15% rise in 1 day. Not sure want to re-enter to this fund or not.

Ya return usually so-so only. But what to do. Am looking at 3-5y investment window. Else I just put in ASB. |

||||||||||||

|

|

Aug 4 2015, 11:22 AM Aug 4 2015, 11:22 AM

|

||||||||||||

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(dirtinacan @ Aug 4 2015, 10:02 AM) hi, Try Kenanga Syariah or Affin Hwang Aiiman insteadmy shariah compliant fund but return is so-so only.haha Held Eastspring Investments Asia Pacific Shariah Equity Fund before. But cashed out for profit after sudden 15% rise in 1 day. Not sure want to re-enter to this fund or not.

|

||||||||||||

|

|

Aug 4 2015, 11:29 AM Aug 4 2015, 11:29 AM

|

Junior Member

381 posts Joined: Jan 2003 |

|

|

|

|

|

|

Aug 4 2015, 08:28 PM Aug 4 2015, 08:28 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

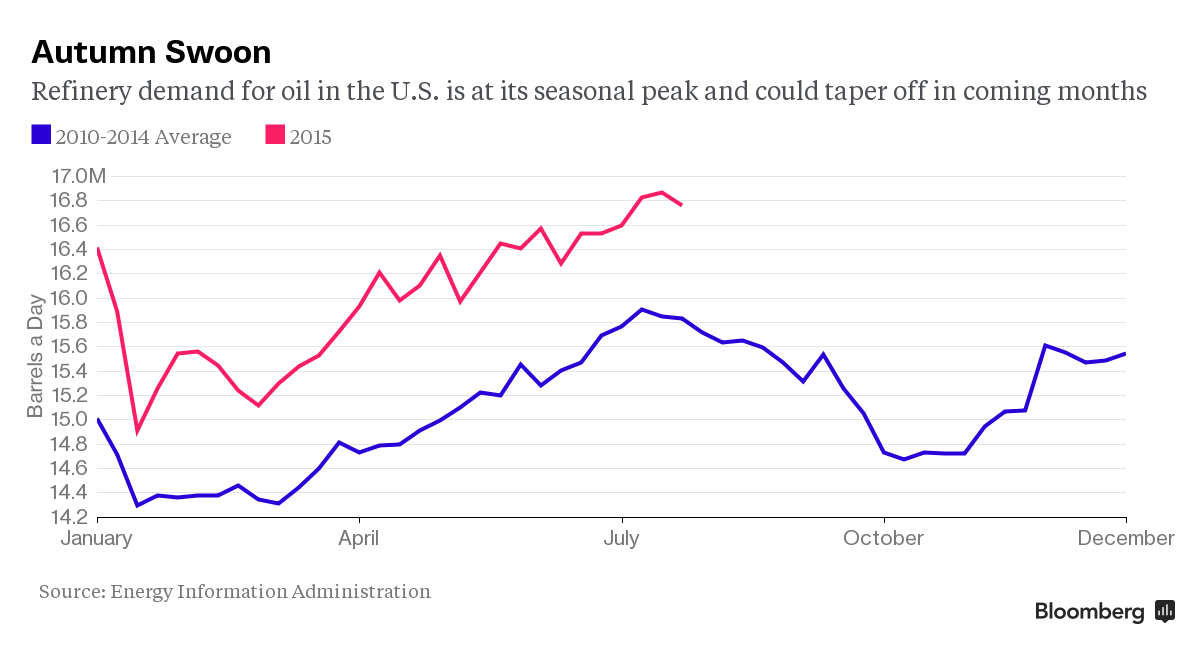

Oil’s Below $50 and About to Get Worse

Oil has fallen to a six-month low, and hopes of a quick rebound are fading as demand heads into an autumn swoon. Brent crude tumbled below $50 on Monday for the first time since January. Gasoline fell the most in almost three years. The slump may have further to go. U.S. refineries, which turned a record amount of crude into gasoline during July, typically slow down from August through October for maintenance.  URL: http://www.bloomberg.com/news/articles/201...s-demand-swoons |

|

|

Aug 4 2015, 08:28 PM Aug 4 2015, 08:28 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

China Dethroned as World’s Most Liquid Stock Market After Curbs

China has lost its title as the world’s most liquid stock market as trading halts and regulatory efforts to curb bearish transactions drive away investors. Daily turnover on mainland exchanges has averaged the equivalent of $202 billion over the past 30 days, down from $288 billion at the start of July. After exceeding turnover on U.S. bourses for about a month through July 8, the value of shares traded in China is now $72 billion lower than in America. Volume in Shanghai on Tuesday was 36 percent below the 30-day average. URL: http://www.bloomberg.com/news/articles/201...ket-after-curbs |

|

|

Aug 4 2015, 08:29 PM Aug 4 2015, 08:29 PM

|

Senior Member

2,429 posts Joined: Jul 2007 |

anyone invested in Affin Hwang Select SGD Income fund? MYR or SGD fund is better?

|

|

|

Aug 4 2015, 08:45 PM Aug 4 2015, 08:45 PM

|

Senior Member

908 posts Joined: Feb 2011 From: Kerteh - KL - Ipoh - KB |

QUOTE(Syd G @ Aug 4 2015, 11:20 AM) Thanks for sharing. PMB Syariah Aggressive Fund is good for the said time. Good time to buy now also since the NAV has just been adjusted after SAF financial year ended. Ya return usually so-so only. But what to do. Am looking at 3-5y investment window. Else I just put in ASB.

This post has been edited by screwedpeep: Aug 4 2015, 08:59 PM |

|

|

Aug 4 2015, 09:08 PM Aug 4 2015, 09:08 PM

|

Senior Member

2,392 posts Joined: Dec 2009 |

|

|

|

Aug 4 2015, 09:14 PM Aug 4 2015, 09:14 PM

|

Senior Member

908 posts Joined: Feb 2011 From: Kerteh - KL - Ipoh - KB |

QUOTE(brotan @ Aug 4 2015, 09:08 PM) For me, the good time to top up is when NAV goes lower than average NAV for say one or two weeks time. YMMV. It's subjetive. Small or huge top up amount, it still makes difference. Every 0.01% change must be considered. Heheh.This post has been edited by screwedpeep: Aug 4 2015, 09:14 PM |

|

|

Aug 4 2015, 09:15 PM Aug 4 2015, 09:15 PM

|

Senior Member

2,392 posts Joined: Dec 2009 |

QUOTE(screwedpeep @ Aug 4 2015, 09:14 PM) For me, the good time to top up is when NAV goes lower than average NAV for say one or two weeks time. YMMV. It's subjetive. Small or huge top up amount, it still makes difference. Every 0.01% change must be considered. Heheh. i thought NAV has no impact on fund performance?i mean buying a fund with very high NAV or very low NAV shouldn't matter right? as long as their ROI in % is good This post has been edited by brotan: Aug 4 2015, 09:17 PM |

|

|

|

|

|

Aug 4 2015, 09:18 PM Aug 4 2015, 09:18 PM

|

Senior Member

908 posts Joined: Feb 2011 From: Kerteh - KL - Ipoh - KB |

|

|

|

Aug 4 2015, 09:21 PM Aug 4 2015, 09:21 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(brotan @ Aug 4 2015, 09:15 PM) i thought NAV has no impact on fund performance? i mean buying a fund with very high NAV or very low NAV shouldn't matter right? as long as their ROI in % is good Eric Wong, Head of Research at Lipper, a Thomson Reuters Company, in Hong Kong, reminds investors not to overly emphasize on “returns” and neglect other aspects of fund performance. “Investors tend to focus on the return of funds in their selection process. They should also consider how funds manage their risk or volatility and preserve their capital. Also, if investors plan to invest for a longer time horizon, fund expense should be under their consideration. Assuming all other factors constant, high fund expense can erode the returns of funds over time.” http://www.fundsupermart.com.my/main/resea...l?articleNo=627 This post has been edited by T231H: Aug 4 2015, 09:30 PM Attached image(s)  |

|

|

Aug 4 2015, 09:28 PM Aug 4 2015, 09:28 PM

|

Senior Member

1,338 posts Joined: Sep 2012 |

|

|

|

Aug 4 2015, 09:29 PM Aug 4 2015, 09:29 PM

|

Senior Member

2,392 posts Joined: Dec 2009 |

|

|

|

Aug 4 2015, 09:31 PM Aug 4 2015, 09:31 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(ohcipala @ Aug 4 2015, 09:28 PM) try this?https://www.google.com.my/#q=annualized+vol...lity+definition |

|

|

Aug 4 2015, 09:32 PM Aug 4 2015, 09:32 PM

|

Senior Member

1,338 posts Joined: Sep 2012 |

QUOTE(T231H @ Aug 4 2015, 09:31 PM) OK thanks. :wink: |

|

|

Aug 4 2015, 09:33 PM Aug 4 2015, 09:33 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

Topic ClosedOptions

|

| Change to: |  0.0188sec 0.0188sec

0.35 0.35

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 04:32 AM |