Outline ·

[ Standard ] ·

Linear+

Income Tax Issues v4, Scope: e-BE and eB only

|

GrumpyNooby

|

Mar 28 2020, 10:02 PM Mar 28 2020, 10:02 PM

|

|

QUOTE(MasterConfucion @ Mar 28 2020, 10:00 PM) is income tax also close? i have filed before mco but haven’t receive my claim Selaras dengan Perutusan Khas yang telah dibuat oleh YAB Perdana Menteri pada 25 Mac 2020 berkaitan pelanjutan tempoh Perintah Kawalan Pergerakan (PKP) ke 14 April 2020, Lembaga Hasil Dalam Negeri Malaysia (LHDNM) ingin memaklumkan bahawa semua premis LHDNM di seluruh negara akan ditutup sehingga tempoh PKP tamat. http://www.hasil.gov.my/bt_goindex.php?bt_...t=1&bt_sequ=523Berikutan dengan situasi terkini, pusat panggilan LHDNM iaitu Hasil Care Line (HCL) akan ditutup mulai 26 Mac 2020 sehingga tempoh Perintah Kawalan Pergerakan (PKP) tamat. Details: http://lampiran1.hasil.gov.my/pdf/pdfam/Ke..._PERGERAKAN.pdfhttp://www.hasil.gov.my/bt_goindex.php?bt_...equ=521&cpage=0This post has been edited by GrumpyNooby: Mar 28 2020, 10:05 PM |

|

|

|

|

|

GrumpyNooby

|

Mar 28 2020, 10:55 PM Mar 28 2020, 10:55 PM

|

|

QUOTE(christ14 @ Mar 28 2020, 10:53 PM) What do you guys claim until can get refund? Max a few stuff also still need to pay eh.. sad af Get a spouse and get a child. If you're single, nothing much you can get back. This post has been edited by GrumpyNooby: Mar 28 2020, 11:03 PM |

|

|

|

|

|

GrumpyNooby

|

Mar 29 2020, 05:35 PM Mar 29 2020, 05:35 PM

|

|

QUOTE(blackjoker08 @ Mar 29 2020, 05:26 PM) Hi. For my case, it’s ACCA membership fees, in which I can claim back the amount I have previously paid to ACCA from my employer. Can I still deduct from gross income then? Thanks in advance. If there's reimbursement from your employer, I don't think you should claim that amount as your employer would have done the same for their company tax reduction. Moreover, you need to supply a receipt in the event of audit. If reimbursement by your employer, shouldn't the original receipt be submitted to your company HR/payroll. This post has been edited by GrumpyNooby: Mar 29 2020, 05:35 PM |

|

|

|

|

|

GrumpyNooby

|

Mar 29 2020, 11:18 PM Mar 29 2020, 11:18 PM

|

|

QUOTE(ronnie @ Mar 29 2020, 11:15 PM) Part F is not required in the tax submission He wants to claim that and he has receipt as proof of payment, let him claim for it. It's his right to claim the relief even though proper advice has been given. Professional membership fee can be directly deducted from gross income. There's no right or wrong for doing so as he insisted. Same concept to the MCO, government has been repeatedly said don't go out unless necessary but to-date, how many have been arrested? This post has been edited by GrumpyNooby: Mar 29 2020, 11:23 PM |

|

|

|

|

|

GrumpyNooby

|

Apr 2 2020, 12:48 PM Apr 2 2020, 12:48 PM

|

|

QUOTE(langstrasse @ Apr 2 2020, 12:47 PM) Anyone else having difficulty loading the LHDN website today ? Also, how do you guys check the status of your refunds ? Just looking for which tab on the website has the information.  Monitor your e-Lejar statement. |

|

|

|

|

|

GrumpyNooby

|

Apr 4 2020, 01:23 PM Apr 4 2020, 01:23 PM

|

|

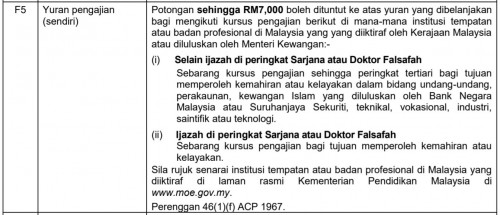

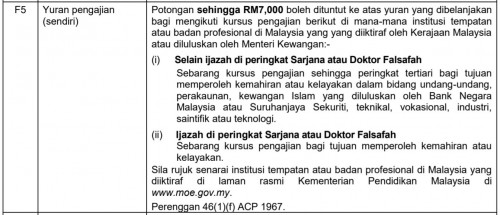

QUOTE(lau521 @ Apr 4 2020, 01:14 PM) How about acca exemption fee? is it deductable under 'education'? anyone help please  |

|

|

|

|

|

GrumpyNooby

|

Apr 5 2020, 04:25 PM Apr 5 2020, 04:25 PM

|

|

QUOTE(heliosi_hou @ Apr 5 2020, 04:21 PM) Hi guys, regarding Private Retirement Scheme (RM3000) - I bought into the PRS in Dec 2018 with RM1000 investment. I have already claimed for tax relief for year 2018 assessment. Can I still claim it every year thereafter? Make new contribution and then you can claim for it. Capped at RM 3k per year till 2021. |

|

|

|

|

|

GrumpyNooby

|

Apr 6 2020, 12:27 AM Apr 6 2020, 12:27 AM

|

|

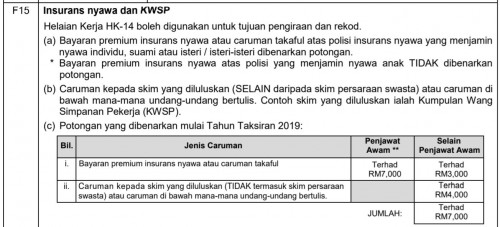

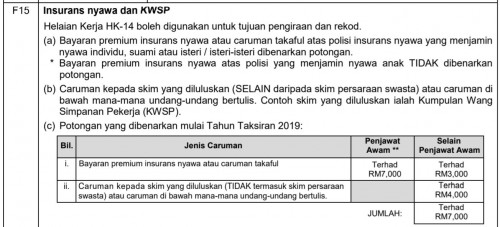

QUOTE(Jack&Guild @ Apr 6 2020, 12:25 AM) Inland revenue board is really stingy for 2019. Not allowed exemptions for government servant to save money in epf. I thought up to RM 7k for government servants?  This post has been edited by GrumpyNooby: Apr 6 2020, 12:29 AM This post has been edited by GrumpyNooby: Apr 6 2020, 12:29 AM |

|

|

|

|

|

GrumpyNooby

|

Apr 6 2020, 08:45 AM Apr 6 2020, 08:45 AM

|

|

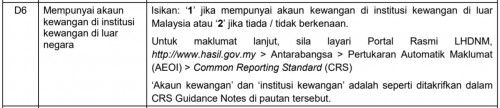

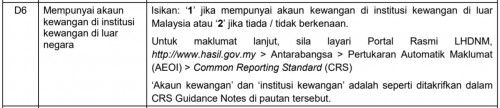

QUOTE(MUM @ Apr 6 2020, 08:42 AM) my wild guess are,... it will be an offence of "NOT' telling the truth when asked by LHDN. it is not illegal to have a banking facilities overseas but IRB knows how much you have in that offshore bank account... https://www.stanleyco.com.my/single-post/20...man’s-terms-1so on this, will IRB query why I have overseas account? I think no, unless BNM tell them to ask first  And last year during the special voluntary disclosure, I don't need to disclose it right? since it is voluntary,.....then no need to disclose voluntary then, but now since they asked you, .....do you still want to not telling the truth by ticking "NO"?  How about overseas brokerage account? The CRS notes are so lengthy.  |

|

|

|

|

|

GrumpyNooby

|

Apr 6 2020, 09:11 AM Apr 6 2020, 09:11 AM

|

|

QUOTE(MUM @ Apr 6 2020, 09:10 AM) isn't that already taxed at source? like withholding taxes? unless there is not double taxation agreement with Malaysia, then   i also don't know WHT by brokerage in US. |

|

|

|

|

|

GrumpyNooby

|

Apr 6 2020, 09:14 AM Apr 6 2020, 09:14 AM

|

|

QUOTE(MUM @ Apr 6 2020, 09:13 AM) I think Singapore has not taxes for gains from trading ...is that right? I don't know about Singapore. My brokerage account is opened by my company for ESPP programme. If dividend received, WHT applied. This post has been edited by GrumpyNooby: Apr 6 2020, 09:15 AM |

|

|

|

|

|

GrumpyNooby

|

Apr 6 2020, 09:25 AM Apr 6 2020, 09:25 AM

|

|

QUOTE(MUM @ Apr 6 2020, 09:24 AM) btw, where is this brokerage a/c?  Based in US. Very limited trading activity for company shares only. |

|

|

|

|

|

GrumpyNooby

|

Apr 6 2020, 09:33 AM Apr 6 2020, 09:33 AM

|

|

QUOTE(MUM @ Apr 6 2020, 09:32 AM) so for the below post,....does he need to tick "yes" too? btw, what is CRS? Common Reporting Standard (CRS) The CRS was developed by the Organisation for Economic Development and Cooperation (OECD) to put a global model of automatic exchange of information into practice. It sets out the financial account information to be exchanged, the Financial Institutions (FIs) required to report, the different types of accounts and taxpayers covered, as well as due diligence procedures to be followed by FIs. |

|

|

|

|

|

GrumpyNooby

|

Apr 6 2020, 09:45 AM Apr 6 2020, 09:45 AM

|

|

QUOTE(cherroy @ Apr 6 2020, 09:44 AM) CRS - When you have an bank or depository account in any countries that participate in CRS eg like Sg, (most countries nowadays one can google the countries already joined), the bank or FI will send your account info to your tax resident country authorities every year. It depends on the broker whether it is considered as FI. FI- an entity accept depository money. If the brokerage firm accepts money for trading in general account but my account is limited in functionality, do I still need to put Y? Limited functionality: 1. No trading for other shares in the NYSE 2. No direct deposit of USD 3. No direct purchase of company shares in open market poll 4. Can only sell purchased shares at discounted price This post has been edited by GrumpyNooby: Apr 6 2020, 09:54 AM |

|

|

|

|

|

GrumpyNooby

|

Apr 7 2020, 10:45 PM Apr 7 2020, 10:45 PM

|

|

QUOTE(hakkai0810 @ Apr 7 2020, 10:43 PM) hi sifu, got a question regarding the gaya hidup section, if i claim the handphone purchase for YA 2018, can i claim again in YA2019 if i buy another new phone? I remember there is some restriction which is the handphone purchase can only claim once in 3 or 5 years but when i check the form itself this year, the clause is not there anymore. That clause was meant for computer (including laptops and tablets) only but excluding smartphones. To claim for YA2019, you had to buy a new smartphone in 2019. This post has been edited by GrumpyNooby: Apr 7 2020, 10:46 PM |

|

|

|

|

|

GrumpyNooby

|

Apr 9 2020, 10:59 AM Apr 9 2020, 10:59 AM

|

|

QUOTE(hakkai0810 @ Apr 9 2020, 10:59 AM) oo noted thx vm. No wonder i cant c the restriction already  Because the restriction is no longer valid. |

|

|

|

|

|

GrumpyNooby

|

Apr 10 2020, 10:51 AM Apr 10 2020, 10:51 AM

|

|

QUOTE(anonymous_3693 @ Apr 10 2020, 10:49 AM) Hi thanks for your reply. But how do I check my e-lejar? |

|

|

|

|

|

GrumpyNooby

|

Apr 11 2020, 12:11 PM Apr 11 2020, 12:11 PM

|

|

QUOTE(Kerry1136 @ Apr 11 2020, 12:10 PM) Hi Can anyone advice where to check the status on whether they have filed / processed or paid because I have filed myself and my wife on the 23rd March. I got paid on 3rd April but my wife no status yet. Please advice. Please monitor your filing status using e-Lejar especially if you're expecting an excess refund. This post has been edited by GrumpyNooby: Apr 11 2020, 12:11 PM |

|

|

|

|

|

GrumpyNooby

|

Apr 11 2020, 12:24 PM Apr 11 2020, 12:24 PM

|

|

QUOTE(Kerry1136 @ Apr 11 2020, 12:21 PM) I went to e lejar and all I see is the balance to be given back and that’s it. If your ledger has below two lines, then your filing has been processed: | XX/0X/2020 | XX/0X/2020 | Taksiran Disifarkan | | XX/0X/2020 | XX/0X/2020 | Bayaran Balik |

This post has been edited by GrumpyNooby: Apr 11 2020, 12:25 PM |

|

|

|

|

|

GrumpyNooby

|

Apr 11 2020, 02:09 PM Apr 11 2020, 02:09 PM

|

|

QUOTE(Kerry1136 @ Apr 11 2020, 02:08 PM) I don't see those that u mentioned in e-lejar. I only see Baki Cukai Bayaran Belum Boleh Guna Baki Lejar And the amount. Did you click into specific year like 2019? Example:  This post has been edited by GrumpyNooby: Apr 11 2020, 02:10 PM This post has been edited by GrumpyNooby: Apr 11 2020, 02:10 PM |

|

|

|

|

Mar 28 2020, 10:02 PM

Mar 28 2020, 10:02 PM

Quote

Quote

0.0375sec

0.0375sec

0.38

0.38

7 queries

7 queries

GZIP Disabled

GZIP Disabled