QUOTE(Human Nature @ Mar 4 2020, 07:24 PM)

Ignore it if you don't have.That's meant for education saving fund/insurance.

Just put for medical card/insurance portion.

This post has been edited by GrumpyNooby: Mar 4 2020, 07:26 PM

Income Tax Issues v4, Scope: e-BE and eB only

|

|

Mar 4 2020, 07:25 PM Mar 4 2020, 07:25 PM

Return to original view | IPv6 | Post

#41

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Mar 5 2020, 04:28 PM Mar 5 2020, 04:28 PM

Return to original view | Post

#42

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Mar 5 2020, 04:43 PM Mar 5 2020, 04:43 PM

Return to original view | Post

#43

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(juvaan @ Mar 5 2020, 04:38 PM) i'm sure this has been asked before, and i'm only able to trace one message. Grey area.For my DIgi mobile internet bill, deductible? Some say only the "internet portion" is deductible, but my plan is free calls unlimited and the rest is fixed quota data. Is this deductible for personal tax? Reply 1 from LHDN: (old info) Berhubung pelepasan cukai gaya hidup mengenai langganan internet, berikut dikemukakan pengesahan daripada pihak Kementerian Kewangan : 1. Bagi bayaran pakej internet yang tiada pecahan untuk amaun panggilan dan juga bayaran lain, amaun yang tertera di bil adalah terpakai untuk pakej internet dan layak bagi tujuan pelepasan cukai; 2. Bagi bayaran bil yang mengasingkan caj internet dan panggilan/SMS , maka amaun bayaran untuk internet sahaja yang layak menuntut pelepasan cukai. 3. Pelepasan adalah tidak termasuk dengan Cukai Barangan dan Perkhidmatan (GST). Setiap tuntutan di atas hendaklah disokong dengan resit |

|

|

Mar 6 2020, 10:54 AM Mar 6 2020, 10:54 AM

Return to original view | Post

#44

|

All Stars

12,387 posts Joined: Feb 2020 |

So are we getting the fund by end of next week?

2 weeks from 1/3/2020 This post has been edited by GrumpyNooby: Mar 6 2020, 10:55 AM |

|

|

Mar 6 2020, 10:57 AM Mar 6 2020, 10:57 AM

Return to original view | Post

#45

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(ronnie @ Mar 6 2020, 10:56 AM) Waiting anxiously is the trend in the forum.From SSPN dividend > EPF dividend > SSPN tax relief annual statement > Start of income tax filing > Income tax refund Occasionally we'll have why SSPN top up via Boost not appearing in the SSPN statement. This post has been edited by GrumpyNooby: Mar 6 2020, 10:58 AM |

|

|

Mar 6 2020, 11:30 AM Mar 6 2020, 11:30 AM

Return to original view | Post

#46

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Mar 7 2020, 12:58 PM Mar 7 2020, 12:58 PM

Return to original view | IPv6 | Post

#47

|

All Stars

12,387 posts Joined: Feb 2020 |

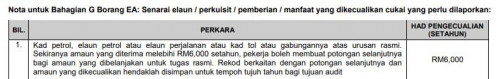

QUOTE(Jesse0916 @ Mar 7 2020, 12:55 PM) Just a sharing from my tax knowledge/ experience here. How to justify when it is put under Section B of the EA form instead of Section F?Car/ Traveling allowance is liable for EPF Contribution. Screen shot below for your reference (Source: EPF website)  For expense/ allowance related to traveling for business purpose, is subject for tax exemption. As long as you can justify the "car allowance" is for business purpose, you can get the exemption. Screen shot below is the note from LHDN.  Hope this is clarified your question. This should be rectified by the company HR/payroll/accounting right? |

|

|

Mar 7 2020, 10:56 PM Mar 7 2020, 10:56 PM

Return to original view | IPv6 | Post

#48

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(sjteh @ Mar 7 2020, 10:53 PM) Hi all, https://www.hasilnet.org.my/tax-on-reit-investment/Would like to know if want to claim back the reits 10% withholding tax, is it claim under "penggajian lain" or "faedah"? Thanking in advance. If a unit holder has income from sources other than REITs, an Income Tax Return Form (ITRF) has to be filed (e.g. Form BE, B or M for individuals or Form C for companies), income from REITs is not required to be included in the ITRF form as the Withholding Tax is a final tax. |

|

|

Mar 8 2020, 11:38 AM Mar 8 2020, 11:38 AM

Return to original view | IPv6 | Post

#49

|

All Stars

12,387 posts Joined: Feb 2020 |

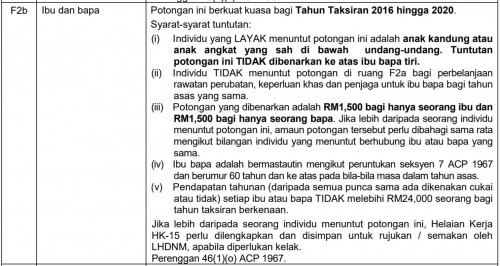

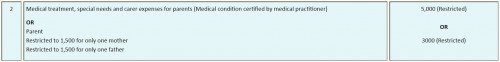

QUOTE(TeeKanne @ Mar 8 2020, 11:34 AM) Parent No requirement as long as you didn't claim for the medical expenses.Restricted to 1,500 for only one mother Restricted to 1,500 for only one father For the above items, are there any requirements? Search LHDN website and can't find any. Thanks.  This post has been edited by GrumpyNooby: Mar 8 2020, 11:40 AM |

|

|

Mar 8 2020, 11:47 AM Mar 8 2020, 11:47 AM

Return to original view | IPv6 | Post

#50

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(MUM @ Mar 8 2020, 11:43 AM) Those are basic eligibility of the parents of the taxpayer which has been there since years back. One is liable to validate for eligibility without submitting for the tax relief blindly. This post has been edited by GrumpyNooby: Mar 8 2020, 11:49 AM |

|

|

Mar 8 2020, 11:51 AM Mar 8 2020, 11:51 AM

Return to original view | IPv6 | Post

#51

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(MUM @ Mar 8 2020, 11:50 AM) thus more to it then meet the eyes on this "No requirement as long as you didn't claim for the medical expenses." No requirement from the taxpayer perspective. Deeper details do read Nota Penerangan BE; otherwise what the document/guide for. Even LHDN website also put it in such simple manner:  http://www.hasil.gov.my/bt_goindex.php?bt_...nit=1&bt_sequ=1 This post has been edited by GrumpyNooby: Mar 8 2020, 11:54 AM |

|

|

Mar 8 2020, 12:09 PM Mar 8 2020, 12:09 PM

Return to original view | IPv6 | Post

#52

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Mar 9 2020, 09:57 AM Mar 9 2020, 09:57 AM

Return to original view | Post

#53

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Mar 9 2020, 10:15 AM Mar 9 2020, 10:15 AM

Return to original view | Post

#54

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Mar 10 2020, 10:01 AM Mar 10 2020, 10:01 AM

Return to original view | Post

#55

|

All Stars

12,387 posts Joined: Feb 2020 |

It just 1 week passed and you guys are talking about refund.

Got so efficient? |

|

|

Mar 10 2020, 10:59 AM Mar 10 2020, 10:59 AM

Return to original view | Post

#56

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Mar 10 2020, 11:03 AM Mar 10 2020, 11:03 AM

Return to original view | Post

#57

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Mar 10 2020, 11:16 AM Mar 10 2020, 11:16 AM

Return to original view | Post

#58

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Mar 10 2020, 09:49 PM Mar 10 2020, 09:49 PM

Return to original view | IPv6 | Post

#59

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Mar 11 2020, 08:36 AM Mar 11 2020, 08:36 AM

Return to original view | Post

#60

|

All Stars

12,387 posts Joined: Feb 2020 |

|

| Change to: |  0.2183sec 0.2183sec

0.63 0.63

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 05:22 AM |