Outline ·

[ Standard ] ·

Linear+

Income Tax Issues v4, Scope: e-BE and eB only

|

SUSDavid83

|

Mar 3 2019, 12:23 PM Mar 3 2019, 12:23 PM

|

|

QUOTE(anuj25 @ Mar 3 2019, 12:18 PM) The claim for Parent (RM1500)- Can I make this claim if: 1. My mother is still working and she files her taxes annually 2. Are there any terms and conditions to claim this relief? 3. She is of good health and I haven't spent anything on her medical. If her income is greater than the stipulated threshold, you can't claim. |

|

|

|

|

|

SUSDavid83

|

Mar 3 2019, 01:57 PM Mar 3 2019, 01:57 PM

|

|

QUOTE(Humorboy @ Mar 3 2019, 01:54 PM) hi all i wanna ask a noob question, if every month my company got deduct epf and sosco... can i claim under life insurance and epf and contribution to socso? means key in total amount as per EA form under E? Yes, that is what you should do. |

|

|

|

|

|

SUSDavid83

|

Mar 3 2019, 02:06 PM Mar 3 2019, 02:06 PM

|

|

QUOTE(MUM @ Mar 3 2019, 02:03 PM) just a note.....there is a max limit claimable for each of the category EPF + life insurance police: RM 6k max SOCSO: RM 250 max For YA2019EPF: RM 4k max Life insurance: RM 3k max SOCSO: RM 250 max |

|

|

|

|

|

SUSDavid83

|

Mar 3 2019, 03:24 PM Mar 3 2019, 03:24 PM

|

|

QUOTE(w3sley @ Mar 3 2019, 03:11 PM) Hi guys, do we incurred tax from capital gain from unit trust investment? Capital gain is not taxable for the mean time |

|

|

|

|

|

SUSDavid83

|

Mar 3 2019, 03:37 PM Mar 3 2019, 03:37 PM

|

|

QUOTE(kellyisevil @ Mar 3 2019, 03:36 PM) Hi, i did not refer to my EA form and thought my sosco contribution would overshoot like my epf contribution and filed for RM250 max claim but it is actually ony about Rm23x. Should i go to LHDN to file for amendment or is there any way to make amendment? Amendment can be submitted online but not sure if the link is up. Could be next month. Login to e-filing system and find for "e-Permohonan Pindaan BE". Note: e-Permohonan Pindaan BE for 2018 is not ready yet. This post has been edited by David83: Mar 3 2019, 08:06 PM |

|

|

|

|

|

SUSDavid83

|

Mar 3 2019, 06:21 PM Mar 3 2019, 06:21 PM

|

|

QUOTE(MUM @ Mar 3 2019, 06:19 PM) You mentioned that you are a student......thus that means you are not working of have any income right? Maybe he's a part time Master student. |

|

|

|

|

|

SUSDavid83

|

Mar 3 2019, 07:24 PM Mar 3 2019, 07:24 PM

|

|

QUOTE(ltl170692 @ Mar 3 2019, 07:24 PM) Yes, the receipt had my name, intake, my student ID, payment date, cheque number (my parents') the issue is the money is not from my bank account... Receipt matters. |

|

|

|

|

|

SUSDavid83

|

Mar 4 2019, 10:04 AM Mar 4 2019, 10:04 AM

|

|

QUOTE(beLIEve @ Mar 4 2019, 10:00 AM) How? 19.75 is max each month. Sure kena tipu Download from their website. I think they stopped sending paper bill since September TM got provide annual summary statement like CC statement? This post has been edited by David83: Mar 4 2019, 10:07 AM |

|

|

|

|

|

SUSDavid83

|

Mar 4 2019, 10:27 AM Mar 4 2019, 10:27 AM

|

|

QUOTE(beLIEve @ Mar 4 2019, 10:26 AM) nope. actually that's not a bad idea, though it wont happen anytime soon. just download manually 3-4 times a year. zip all into 1 file and backup online loh. that's what i do. All telco companies should do that. |

|

|

|

|

|

SUSDavid83

|

Mar 4 2019, 03:41 PM Mar 4 2019, 03:41 PM

|

|

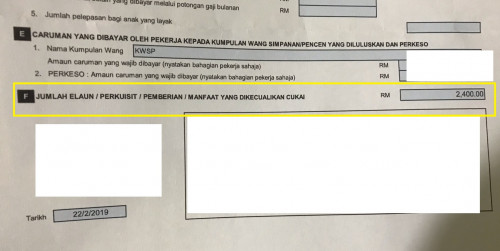

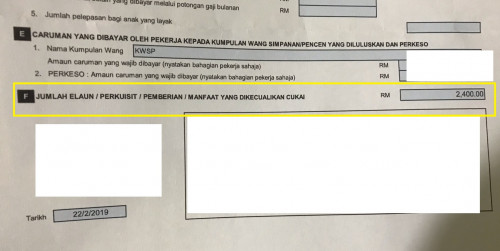

QUOTE(Ellizabeth @ Mar 4 2019, 03:25 PM) This is my EA form I got from my finance..I stucked at this section F. Do I need to insert this RM2400 in my efiling? Under which column where should I insert it OR not neccessary as this is entitled for tax exempt allowances ?  No action required. It's tax exempted. |

|

|

|

|

|

SUSDavid83

|

Mar 4 2019, 03:46 PM Mar 4 2019, 03:46 PM

|

|

QUOTE(Ellizabeth @ Mar 4 2019, 03:45 PM) Thanks for your information I heard frm my friend there is a limit for this right? If I remembered it's RM 6k but depends on category. Found this, please read from: http://lampiran2.hasil.gov.my/pdf/pdfam/Notes_PartF_2.pdfThis post has been edited by David83: Mar 4 2019, 03:47 PM |

|

|

|

|

|

SUSDavid83

|

Mar 4 2019, 05:37 PM Mar 4 2019, 05:37 PM

|

|

QUOTE(funlp @ Mar 4 2019, 05:33 PM) Can anyone confirm on this? I was reading the Explanatory Notes for BE2018 & it states there:- {Contribution to the Social Security Organization (SOCSO)} A relief not exceeding RM250 is allowed in respect of contribution to the Social Security Organization (SOCSO) made or suffered by the individual in basis year. What you want to confirm? Just put large sum SOSCO contribution into tax relief. I don't think SOSCO will generate annual statement which tells how much it goes to EIS. |

|

|

|

|

|

SUSDavid83

|

Mar 4 2019, 05:48 PM Mar 4 2019, 05:48 PM

|

|

QUOTE(funlp @ Mar 4 2019, 05:46 PM) Just wanted a confirmation on whether EIS is eligible for tax relief under SOCSO. What you've mentioned above is reasonable, so will claim max on SOCSO. The problem is that SOSCO doesn't send out annual itemized statement to its member like insurance company. So just put lump sum. This post has been edited by David83: Mar 4 2019, 05:48 PM |

|

|

|

|

|

SUSDavid83

|

Mar 4 2019, 07:42 PM Mar 4 2019, 07:42 PM

|

|

QUOTE(besiegetank @ Mar 4 2019, 07:41 PM) Dear all sifus, To claim for the medical checkup rm500, how to define the medical checkup is eligible for tax deduction? Have to go to hospital or can also be done by pathlab? I remembered it needs to be FULL medical checkup. I found an old thread: https://forum.lowyat.net/topic/557231/allThis post has been edited by David83: Mar 4 2019, 07:43 PM |

|

|

|

|

|

SUSDavid83

|

Mar 4 2019, 07:59 PM Mar 4 2019, 07:59 PM

|

|

QUOTE(besiegetank @ Mar 4 2019, 07:51 PM) So how to define full medical checkup? I can't find its definition anywhere... From The Star: QUOTE > What are the tests we need to do to be considered for tax relief under “full medical check-up”? A complete medical examination or full medical check-up is defined by the Malaysian Medical Council (MMC) as: 1. Physical examination: checking weight, blood pressure, eyes, ears, nose and throat, examining your neck for the size of the thyroid gland and any enlarged lymph nodes, listening to your chest and heart as well as breast and abdominal examination; 2. Laboratory tests: blood tests, urine analysis and pap smear. Blood test checking on your cholesterol level, thyroid hormones, complete blood count; and/or 3. Consultation by attending doctor Read more at https://www.thestar.com.my/news/nation/2012...ZB5l1lHSPTuA.99 |

|

|

|

|

|

SUSDavid83

|

Mar 5 2019, 06:12 AM Mar 5 2019, 06:12 AM

|

|

QUOTE(ilovefdmalaysia @ Mar 5 2019, 05:43 AM) Need some help and explanation, The budget 2019 stated that there is a (pegecualian cukai 50% ke atas pendapatan sewaan rumah) with certain conditions needed to be met. You can google this out. Now, my question is how to calculate this amount? let say my total rental income is rm65,000/year, based on the (jadual cukai) my tax shall be rm3900. now, with this new ruling, am i paying half tax of this rm3900 ie rm1950?? thank you in advance. Refer to this thread: https://forum.lowyat.net/topic/2970445/+60#entry91957293For 50% off, Post #58 For others related matters, Post #60 and a link from LHDN is also shared. |

|

|

|

|

|

SUSDavid83

|

Mar 6 2019, 09:57 AM Mar 6 2019, 09:57 AM

|

|

QUOTE(neooren @ Mar 6 2019, 09:56 AM) hi, if I want to claim tax relief for parent rm1500 each, but my father is a retiree with a government pension more than RM24K. Still eligible? No. |

|

|

|

|

|

SUSDavid83

|

Mar 6 2019, 01:07 PM Mar 6 2019, 01:07 PM

|

|

QUOTE(mroys@lyn @ Mar 6 2019, 12:54 PM) sorry hijack a bit, same question regarding tax relief for parents. can one sibling claim medical and another sibling claim parent support 2*1.5k? Technically no but I'm not sure if they're able to correlate and trace back. This post has been edited by David83: Mar 6 2019, 01:07 PM |

|

|

|

|

|

SUSDavid83

|

Mar 6 2019, 01:41 PM Mar 6 2019, 01:41 PM

|

|

QUOTE(donhue @ Mar 6 2019, 01:33 PM) Can. Checked with LHDN officer last year. Just same person cannot claim both. That is an obvious answer since it has mentioned "OR". But does that imply that Sibling 1 can claim 1.5k parents relief and Sibling 2 can claim medical expenses (up to RM 5k)? |

|

|

|

|

|

SUSDavid83

|

Mar 7 2019, 04:36 PM Mar 7 2019, 04:36 PM

|

|

QUOTE(one_cent @ Mar 7 2019, 04:35 PM) Guys, for "Life insurance dan EPF INCLUDING not through salary deduction" mean the EPF amount provided from employer? Your EPF contribution (not employer portion) + Your life insurance premium up to RM 6k max |

|

|

|

|

Mar 3 2019, 12:23 PM

Mar 3 2019, 12:23 PM

Quote

Quote

0.2246sec

0.2246sec

0.37

0.37

7 queries

7 queries

GZIP Disabled

GZIP Disabled