QUOTE(fullframe17 @ Nov 21 2016, 07:33 AM)

see F7, Page 12hope the answer is there....

http://lampiran.hasil.gov.my/pdf/pdfam/Not...an_BE2013_1.pdf

Income Tax Issues v4, Scope: e-BE and eB only

|

|

Nov 21 2016, 08:48 AM Nov 21 2016, 08:48 AM

Return to original view | Post

#41

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(fullframe17 @ Nov 21 2016, 07:33 AM) see F7, Page 12hope the answer is there.... http://lampiran.hasil.gov.my/pdf/pdfam/Not...an_BE2013_1.pdf |

|

|

|

|

|

Jan 7 2017, 01:32 AM Jan 7 2017, 01:32 AM

Return to original view | Post

#42

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(David83 @ Jan 7 2017, 12:34 AM) Lifestyle Tax Relief: The Good, The Bad & The Ugly https://www.imoney.my/articles/lifestyle-ta...he-bad-the-ugly https://home.kpmg.com/xx/en/home/insights/2...t-2016-132.html http://www.stuff.tv/my/news/whats-good-and...tyle-tax-relief |

|

|

Jan 10 2017, 09:53 PM Jan 10 2017, 09:53 PM

Return to original view | Post

#43

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(heavensea @ Jan 10 2017, 09:31 PM) Hi All, I am seeking advise regarding partnership income tax. I am not expert in tax......was just wondering about what you mentioned....For instance, I joined a sole partnership company. The tax rate per year for company income tax is 20% of it's net profit? I issue payment voucher to myself (do I still need declare my individual tax?) or company itself would be enough? if the company has 10% profits.....which like you mentioned are subjected to tax.... so instead of tax, the company issue payment voucher of the 10% to you.... so now the company has no profits, but you have that money.... so on your questions ...."(do I still need declare my individual tax?) or company itself would be enough? |

|

|

Jan 10 2017, 11:50 PM Jan 10 2017, 11:50 PM

Return to original view | Post

#44

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(heavensea @ Jan 10 2017, 10:21 PM) ....... Eventually.. paying company taxable income tax is 2k cheaper than "tricky payments voucher" of personal taxable income tax? Am I right or totally wrong? was again pondering over your poser.... if the company did not "transfer" the profit to the individual.......how is that individual gonna get loan to buy a car/house for personal use? |

|

|

Mar 1 2017, 07:10 AM Mar 1 2017, 07:10 AM

Return to original view | Post

#45

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(eluna @ Mar 1 2017, 01:02 AM) hi guy... may i ask how to fill this 3 section? while waiting for a more direct and value added responses....A: Statutory income from employment B: Statutory income from rents C: Statutory income from interest, discounts, royalties, premiums, pensions, annuities, other periodical payments and other gains or profits if i have salary, bonus, incentive, and housing allowance ... does it mean combine all $$$$ then put in A section? I found this "Old" guidebook....hope it can helps to clear some terms and terminology http://lampiran2.hasil.gov.my/pdf/pdfam/BE...Guidebook_2.pdf |

|

|

Mar 1 2017, 10:42 PM Mar 1 2017, 10:42 PM

Return to original view | Post

#46

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(bennyt @ Mar 1 2017, 10:32 PM) I can't find this for Year 2016: Pelepasan Khas dibenarkan sebanyak RM2,000 jika Pendapatan Agregat (Ruangan B4) tidak melebihi RM96,000. This relief is applicable for Year Assessment 2015 only. http://www.hasil.org.my/bt_goindex.php?bt_...sequ=1&bt_lgv=2 |

|

|

|

|

|

Mar 6 2017, 08:33 PM Mar 6 2017, 08:33 PM

Return to original view | Post

#47

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(freestyler87 @ Mar 6 2017, 08:21 PM) Hi All , found this while googlingDo PTPTN repayment is entitled for tax relief in the category of Personal Education. my wife graduate degree in nursing, now she paying back the PTPTN monthly is this repayment can put in the Personal Education column? for Year 2016 filing... Thank you in advance, need to judge the authencity and validity of this articles Malaysia income tax: Tax Relief for PTPTN? http://www.mymidfield.com/malaysia-income-...lief-for-ptptn/ Post Graduate Education https://kclau.com/money-saving-tips/persona...tion-education/ |

|

|

Mar 6 2017, 09:22 PM Mar 6 2017, 09:22 PM

Return to original view | Post

#48

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Mar 6 2017, 10:39 PM Mar 6 2017, 10:39 PM

Return to original view | Post

#49

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(David83 @ Mar 6 2017, 10:25 PM) My humble 2 cents is no.Why? Because you're servicing a loan that has paid for the education fee back dated years ago. LHDN will seek for documents/receipts of payment addressed to you (directly or indirectly through some proxy account) made by you (direct or indirectly) under the current year of assessment. Unless, you're servicing an education loan that is paying for the education fee for the year under assessment. But for this, if you're pursuing for tertiary education (approved courses) while working, you can claim as long as you have receipts. Don't flame me. |

|

|

Mar 6 2017, 11:06 PM Mar 6 2017, 11:06 PM

Return to original view | Post

#50

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(freestyler87 @ Mar 6 2017, 08:21 PM) Hi All , I hope you do take the below 2 posts for consideration....Do PTPTN repayment is entitled for tax relief in the category of Personal Education. my wife graduate degree in nursing, now she paying back the PTPTN monthly is this repayment can put in the Personal Education column? for Year 2016 filing... Thank you in advance, QUOTE(David83 @ Mar 6 2017, 10:25 PM) My humble 2 cents is no.Why? Because you're servicing a loan that has paid for the education fee back dated years ago. LHDN will seek for documents/receipts of payment addressed to you (directly or indirectly through some proxy account) made by you (direct or indirectly) under the current year of assessment. Unless, you're servicing an education loan that is paying for the education fee for the year under assessment. But for this, if you're pursuing for tertiary education (approved courses) while working, you can claim as long as you have receipts. Don't flame me. QUOTE(David83 @ Mar 6 2017, 10:44 PM) |

|

|

Mar 8 2017, 10:00 PM Mar 8 2017, 10:00 PM

Return to original view | Post

#51

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(CANONPIXMA @ Mar 8 2017, 09:55 PM) Anyone knows what is the definition for 'Medical expenses for parent'. Can prescription glasses be claimed under this section? while waiting for responses, you may want to try read this....I hope Section D got the answer.... btw,...this is 2010 guide.... http://lampiran.hasil.gov.my/pdf/pdfam/BE2...Guidebook_2.pdf |

|

|

Mar 9 2017, 07:52 AM Mar 9 2017, 07:52 AM

Return to original view | Post

#52

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Mar 9 2017, 09:24 AM Mar 9 2017, 09:24 AM

Return to original view | Post

#53

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

|

|

|

Mar 9 2017, 09:37 AM Mar 9 2017, 09:37 AM

Return to original view | Post

#54

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(Kaka23 @ Mar 9 2017, 09:29 AM) found this while googling...http://www.panduanmalaysia.com/2015/02/tar...-2015-lhdn.html |

|

|

Mar 20 2017, 04:22 PM Mar 20 2017, 04:22 PM

Return to original view | Post

#55

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(babyphie @ Mar 20 2017, 04:16 PM) If husband n wife file separate ( not living together). Can claim 1k for wife n 1k for husband under claim for children under 18? Plz note 1 child involve here. read D 16 & 16a, 16b and 16c ..hope the answer is there...Thanks. http://lampiran2.hasil.gov.my/pdf/pdfam/BE...Guidebook_2.pdf |

|

|

Apr 1 2017, 04:40 PM Apr 1 2017, 04:40 PM

Return to original view | Post

#56

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(hirano @ Apr 1 2017, 03:59 PM) Im still confused on 1 part. By internet subscription, does it include my monthly telco mobile data (umobile, celcom, etc)? read the end of the article...? there is a 'comment' section....the answer to your question may be there.....else if you want contact the author while you wait for responses here..... |

|

|

Apr 6 2017, 08:26 PM Apr 6 2017, 08:26 PM

Return to original view | Post

#57

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(timetolaugh @ Apr 6 2017, 06:47 PM) googled and found this.hope it is still relevant and can helps. NOTA PENERANGAN BORANG TP http://lampiran2.hasil.gov.my/pdf/pdfam/No...n_TP_2004_1.pdf |

|

|

Apr 23 2017, 08:18 AM Apr 23 2017, 08:18 AM

Return to original view | Post

#58

|

Senior Member

5,143 posts Joined: Jan 2015 |

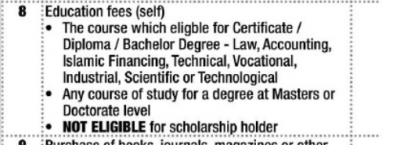

QUOTE(RickJames09 @ Apr 23 2017, 08:02 AM) found this on google....hope it is still applicable and valid Post Graduate Education To promote a culture of lifelong learning among Malaysians, the Government proposes tax relief of up to RM5,000 on education fees be extended to all post-graduate studies (Masters and Doctorate leve), effective from Year of Assessment 2008. Every individual are eligible to claim a RM5,000 relief each in respective tax returns provided that the post-graduate studies are at institutions or professional bodies in Malaysia that are recognised by the Government or approved by the Minister undertaken for the purpose of acquiring law, accounting, Islamic financing, technical, vocational, industrial, scientific or technological skills or qualifications. Please note that this deduction is effective only from YA 2008 onwards. https://kclau.com/money-saving-tips/persona...tion-education/ attachment is from... http://malaysiandigest.com/features/600423...s-for-2016.html This post has been edited by T231H: Apr 23 2017, 08:29 AM Attached thumbnail(s)

|

|

|

Apr 23 2017, 12:12 PM Apr 23 2017, 12:12 PM

Return to original view | Post

#59

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(littlecomel @ Apr 23 2017, 11:46 AM) I saw tax relief for faedah pinjaman perumahan . However the criteria says snp 2009 to 2010? I googled and found this....hope tis is what you looked for?Wonder is that a mistake or it is really for 2009 to 2010 houses? Tq in advance Housing loan interest tax deduction of RM10,000 per year for 3 years of assessment http://www.nbc.com.my/blog/loan-interest-t...00-for-3-years/ This post has been edited by T231H: Apr 23 2017, 12:19 PM |

|

|

Apr 23 2017, 12:25 PM Apr 23 2017, 12:25 PM

Return to original view | Post

#60

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(littlecomel @ Apr 23 2017, 12:20 PM) I googled and found this too....Tax Relief for Resident Individual (see the applicable year......) http://www.hasil.org.my/bt_goindex.php?bt_...sequ=1&bt_lgv=2 the TnC abt the SnP is there.... what do you think? Houses bought after 2010 can still claim? This post has been edited by T231H: Apr 23 2017, 12:27 PM |

| Change to: |  0.0335sec 0.0335sec

0.38 0.38

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 06:45 PM |