Outline ·

[ Standard ] ·

Linear+

Income Tax Issues v4, Scope: e-BE and eB only

|

T231H

|

Apr 4 2016, 02:12 PM Apr 4 2016, 02:12 PM

|

|

QUOTE(uglyduckling422 @ Apr 4 2016, 12:54 PM) For perbelanjaan rawatan perubatan ibu bapa - is this mean if i pay the medical fees for my parents i can claim for deduction? (normal parents see doctor for fever etc) Thank you if you mean as per "F2" in page 11 of this guide book, then the defination is there too..... http://www.hasil.gov.my/pdf/pdfam/Nota_Pen...an_BE2015_1.pdf |

|

|

|

|

|

T231H

|

Apr 18 2016, 01:19 AM Apr 18 2016, 01:19 AM

|

|

QUOTE(yisien @ Apr 18 2016, 12:18 AM) Hi all, I have a question regarding income tax. As I know, we can get tax relief from buying books right? If we buy e-books from online such as google play store, can we get income tax relief from the purchase? from the guidebook see F8, page 12 http://www.hasil.gov.my/pdf/pdfam/Nota_Pen...an_BE2015_1.pdf |

|

|

|

|

|

T231H

|

Apr 18 2016, 11:07 AM Apr 18 2016, 11:07 AM

|

|

QUOTE(HoNgZ @ Apr 18 2016, 09:45 AM) Hi Sifus, 2 more questions here 1. Is the dental treatments (filling, washing) are only applicable the relief of medical treatment for parents, but not medical treatment for tax payer? 2. Is knee supports applicable to relief of medical treatments for parents or supporting equipments? I bought it for my parents to ease their knee's pain while walking. It is elastic, not for sport. Something like this from the guidebook F2 page 11 http://www.hasil.gov.my/pdf/pdfam/Nota_Pen...an_BE2015_1.pdf |

|

|

|

|

|

T231H

|

Apr 25 2016, 08:52 AM Apr 25 2016, 08:52 AM

|

|

QUOTE(ChrisWeiYuan @ Apr 23 2016, 12:03 PM) Guys. Anyone receive an email for lhdn stating that they overpaid the cukai bayar balik? I've just received it this morning. Wtf Wei. My payback amount is 577 only. They want to audit it. QUOTE(ChrisWeiYuan @ Apr 24 2016, 11:46 PM) any kind soul that can answer my quest here? Not sure if tis story is relevant......... Few yrars ago. I was asked to go present receipts to lhdn before they can approve stated overpaid amount ..while there, the officer ask me to go do efilling instead of manuall submission. He said for efiiling, lhdn will do refund 1st before audit. While for manual filling, is audit b4 refund...... |

|

|

|

|

|

T231H

|

Apr 26 2016, 08:14 AM Apr 26 2016, 08:14 AM

|

|

QUOTE(emment85 @ Apr 26 2016, 01:10 AM) Hi all, If during 2015 i work till november and i start anoher job in november, should i file 2 of the income tax? sorry for the noob question as this is my 1st time.. =P  almost similar question/situation and answer as in page 46, post 917 |

|

|

|

|

|

T231H

|

Apr 26 2016, 11:33 AM Apr 26 2016, 11:33 AM

|

|

QUOTE(Belphegor @ Apr 26 2016, 11:27 AM) I have my EA form missing. Do you guys know where can I reprint it? Thank you in advance. EA form?..get from the originator (your company)? if BE form.... http://www.hasil.gov.my/bt_goindex.php?bt_...i=1&Submit=Cari |

|

|

|

|

|

T231H

|

Apr 27 2016, 07:29 AM Apr 27 2016, 07:29 AM

|

|

QUOTE(mamamia @ Apr 27 2016, 07:18 AM) For care taker, is it also claim up to RM5000? As I heard from the radio station last week, the tax expert mentioned care taker expense is up to RM500 only. But I search the guidebook, can't find.. "Perbelanjaan rawatan perubatan, keperluan khas dan penjaga ibu bapa dibenarkan sebagai potongan terhad kepada RM5,000". F2, page 11 http://www.hasil.gov.my/pdf/pdfam/Nota_Pen...an_BE2015_1.pdffrom the word "dan",  it must be either single type or combined RM 5000, not "also" whereby RM 5000 + RM 5000  This post has been edited by T231H: Apr 27 2016, 07:41 AM This post has been edited by T231H: Apr 27 2016, 07:41 AM |

|

|

|

|

|

T231H

|

Apr 27 2016, 07:53 AM Apr 27 2016, 07:53 AM

|

|

QUOTE(mamamia @ Apr 27 2016, 07:47 AM) Ya, I mean can claim up to RM5000 (total medical + care taker).. I'm confuse from wat the tax expert mentioned in the radio station where only RM500 maximum to claim for care taker. Mean, my care taker expenses is RM1000, I can only claim RM500, balance RM4500 is for medical expenses.. to be on the sure side...try contact them to find out....?? http://www.hasil.gov.my/bt_goindex.php?bt_...nit=3&bt_sequ=1then pls tell us.... |

|

|

|

|

|

T231H

|

Apr 29 2016, 09:25 PM Apr 29 2016, 09:25 PM

|

|

QUOTE(lowyat101 @ Apr 29 2016, 08:40 PM) Hi, I'm about to submit my e-filling but today my insurance agent told me that I can claim tax relief for paying my mother's medical card insurance under the parents medical claim. But when I searched around, seems that most of the info I gather is the other way round. Therefore can some experts here advise if it's ok to file this for tax relief? Thanks why don't you do us a favor....sent this attached "Guidebook" to your insurance agent and ask him to point to you where in section F can he do that?...then tell us. thks.  http://www.hasil.gov.my/pdf/pdfam/Nota_Pen...an_BE2015_1.pdf http://www.hasil.gov.my/pdf/pdfam/Nota_Pen...an_BE2015_1.pdfbtw, this guidebook did spell some details and example on what can be claimed for relief.... This post has been edited by T231H: Apr 29 2016, 09:26 PM |

|

|

|

|

|

T231H

|

May 3 2016, 12:40 AM May 3 2016, 12:40 AM

|

|

QUOTE(hickups @ May 3 2016, 12:32 AM) Telah melupuskan syer dalam syarikat harta tanah dan/atau harta tanah di bawah Akta Cukai Keuntungan Harta Tanah 1976 <-----wat is this... tick ya atau tidak?

tick "YES" or "NO"?  it really depends on whether you had tis and had done that........ same question as per post 712, page 36 post 808, page 41 This post has been edited by T231H: May 3 2016, 12:57 AM Attached thumbnail(s)

|

|

|

|

|

|

T231H

|

May 4 2016, 01:49 PM May 4 2016, 01:49 PM

|

|

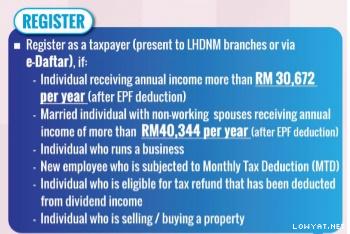

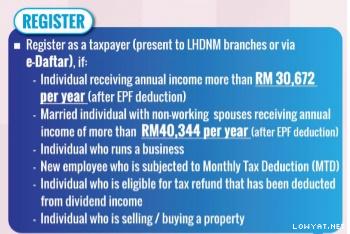

QUOTE(OldSchoolJoke @ May 4 2016, 01:34 PM) I'm working in Malaysia and my income is RM3k, which I checked is not within the taxable amount. How about it? Still need to file it? see this,..hope it can provide some added info http://www.hasil.gov.my/bt_goindex.php?bt_...nit=1&bt_sequ=1http://www.hasil.gov.my/pdf/pdfam/RISALAH_R1_BI_15.pdf Attached image(s) |

|

|

|

|

|

T231H

|

May 5 2016, 10:17 PM May 5 2016, 10:17 PM

|

|

QUOTE(mamamia @ May 5 2016, 09:51 PM) .....To be exact is if ur gross annual income less than 38k (3183 per month), no need to register tax file. Calculation : 3183 -11% EPF = 2832 home pay x 12 months = 34k  NO yearly bonus, monthly allowances or BIK stuffs, commission, etc ? if in borderline cases, it is best to go get a tax number and do e-filling...just 10 min and it is all done. till next yr. if it is way below the 34K then no need-lah This post has been edited by T231H: May 5 2016, 10:27 PM |

|

|

|

|

|

T231H

|

May 7 2016, 07:50 AM May 7 2016, 07:50 AM

|

|

QUOTE(garf @ May 6 2016, 12:29 PM) I'm a bit unlucky. Two months back i was informed by LHDN that I owe them few hundreds tax money. after clarify at LHDN counter (went there few times), the officer told me that they found I have additional RM30k income in year 2009. That's why I have outstanding tax amounting the few hundreds to be paid. Definitely I don't have the 30k additional income, and I have no idea how they found this additional income. The officer have no idea either..... LHDN promised me they will investigate and let me know what went wrong.... yesterday, i received letter from LHDN (cc to me) instructing my employer to deduct from my salary for the outstanding payment! no investigation result or whatever reason explaining my earlier doubt! spent so much time and efforts meeting them, at the end i still have to pay for the so call additional income! if they say i have additional 300k income then??

anyone have same experience?? how u resolve it? or we hv no choice but to pay and close case???

NOW,...what you gonna do? how you are you going to resolve it? or you have no choice but to pay and close the case? if next few years they say you have additional 300k income then? pls share..... wanna try this?.... http://maklumbalas.hasil.gov.my/borangaduan.phpor select the type of complaint from here then continue... http://maklumbalas.hasil.gov.my/index.php?ky=6a3This post has been edited by T231H: May 7 2016, 08:00 AM |

|

|

|

|

|

T231H

|

May 9 2016, 02:07 AM May 9 2016, 02:07 AM

|

|

QUOTE(JuneC @ May 8 2016, 11:44 PM) Is PCB/MTD compulsory from the employer? As the company does not do the monthly deduction from the employee's salary and then just pay the income tax yearly... may I suggest you read this link... http://www.hasil.gov.my/bt_goindex.php?bt_...=5100&bt_sequ=6Employer's Responsiblities Employer's responsibilities under the MTD Rules are as follows: a.Deduct the MTD from the remuneration of employee in each month or the relevant month in accordance with the Schedule of Monthly Tax Deductions or Computerised Calculation Method and pay to the Director General. |

|

|

|

|

|

T231H

|

May 14 2016, 02:10 PM May 14 2016, 02:10 PM

|

|

QUOTE(mobio.dev @ May 14 2016, 11:39 AM) my friend and his wife submit tax filing separately, last year his wife undergo surgery, is it possible my friend claim his wife medical fee under his submission ? thanks in advance refer to this guidebook... under what Section does he intent to do that? is it F6, page 11? http://www.hasil.gov.my/pdf/pdfam/Nota_Pen...an_BE2015_1.pdf |

|

|

|

|

|

T231H

|

May 24 2016, 09:36 PM May 24 2016, 09:36 PM

|

|

QUOTE(popice2u @ May 24 2016, 09:28 PM) what did they do with those resit? they will see the amount you claimed in borang submission year then compare it with the resit amount |

|

|

|

|

|

T231H

|

May 24 2016, 09:47 PM May 24 2016, 09:47 PM

|

|

QUOTE(popice2u @ May 24 2016, 09:44 PM) will they stamp/chop on the resit? are we allowed to bring back the resit after the audit? .....the front desk will go thru those resits and photocopy those resit and will pass it to their officer for review at their convinence...the original was returned to me unharmed. |

|

|

|

|

|

T231H

|

Jun 25 2016, 02:25 PM Jun 25 2016, 02:25 PM

|

|

QUOTE(dradormien @ Jun 25 2016, 11:56 AM) Can we claim medical insurance for parents, siblings and child? or only for self while waiting for value added responses...I googled and found this... hope it can helps provide some guide while you wait for responses... page 15.... http://www.hasil.gov.my/pdf/pdfam/Nota_Pen...an_BE2015_1.pdf |

|

|

|

|

|

T231H

|

Sep 17 2016, 09:55 AM Sep 17 2016, 09:55 AM

|

|

QUOTE(Skyfer @ Sep 17 2016, 09:23 AM) I don't know. There are several, please correct me: > Not US citizen, so not eligible to pay US tax. > Service done internationally, i.e. customer in US but service in Malaysia, so international tax? or tax to both countries? I have a lot more questions, but don't know the proper channel to ask.

try this channel? http://www.hasil.gov.my/bt_goindex.php?bt_...942355f2d8b63a3 |

|

|

|

|

|

T231H

|

Nov 17 2016, 07:47 AM Nov 17 2016, 07:47 AM

|

|

QUOTE(philipkyw @ Nov 17 2016, 07:18 AM) HI, May I know if this year I brought a new PC (ie:2800), during tax submission on next year, it should be still following previous guideline where we having tax relief of 3k for computers, or it changed to the new policy of 2.5 on sports+computer ? Thanks try this article.... I think the answer is there..... https://www.imoney.my/articles/lifestyle-ta...he-bad-the-uglyLifestyle Tax Relief: The Good, The Bad & The Ugly "If you are planning to purchase a computer, it will be best to make the purchase before the end of the year to still make use of the separated relief of up to RM3,000." |

|

|

|

|

Apr 4 2016, 02:12 PM

Apr 4 2016, 02:12 PM

Quote

Quote

0.0368sec

0.0368sec

0.43

0.43

7 queries

7 queries

GZIP Disabled

GZIP Disabled