Outline ·

[ Standard ] ·

Linear+

Income Tax Issues v4, Scope: e-BE and eB only

|

BacktoBasics

|

Mar 3 2020, 11:33 PM Mar 3 2020, 11:33 PM

|

|

guys,

My offer letter has a breakdown as such:

Basic Salary: 3,000

Car Allowance: 600

Road Tax: 75

My monthly salary is 3,675 as per the payslip with no breakdown.

So my EA form, they didnt put under section pelepasan cukai(F) category.

Cinaman company want to make my basic lower so if got bonus or increment it will be based on basic only.

So my question is, can I still alter my declaration by manually adjust to section F? because got tax relief of 6k per year which is a lot.

Please advise.

|

|

|

|

|

|

BacktoBasics

|

Mar 4 2020, 12:10 AM Mar 4 2020, 12:10 AM

|

|

QUOTE(GrumpyNooby @ Mar 3 2020, 11:35 PM) Follow EA form as it serves as a guide for filing. A copy of the EA form should be funneled to inland revenue. But it is rather unfair isn't it if part of my basic salary consists of car allowance elements in it? |

|

|

|

|

|

BacktoBasics

|

Mar 4 2020, 12:55 AM Mar 4 2020, 12:55 AM

|

|

QUOTE(MUM @ Mar 4 2020, 12:16 AM) unless you can ask your company to amend the EA form... the company make the EA form to looks like they are paying your more.....so as to make them pay less taxes? is that possible?  wondering how they gonna tally the employer EPF amount with the payslip amount.... your payslip show salary 3675....did the employer EPF contribution amount tally with that? Payslip shows total 3675. Yes the EPF contribution is on the full amount which is correct But the only difference is that they don't split out the car allowance which was mentioned in the offer letter in detail. And the bonus or increment is % of the basic stated in the offer letter not the gross amount in payslip which is the total. |

|

|

|

|

|

BacktoBasics

|

Mar 4 2020, 08:12 AM Mar 4 2020, 08:12 AM

|

|

QUOTE(MUM @ Mar 4 2020, 01:50 AM) since even the EPF contribution % is correct, then as mentioned by GrumpyNooby....follow the EA form. the LHDN will refer to the EA form if and when you are being audited. the non compliance of offer letter is between you, your employer and labour office (if it end there) alright. noted with thanks. |

|

|

|

|

|

BacktoBasics

|

Mar 4 2020, 09:29 AM Mar 4 2020, 09:29 AM

|

|

QUOTE(ronnie @ Mar 4 2020, 09:25 AM) Your company's HR is doing the EA form wrongly making you pay more tax  thats the thing. I dont think it is accidental mistake but intentional mistake. like i told you, they will award bonus & increments based on your BASIC which is 3k as per offer letter,however, the basic as per payslip is 3,675. so there is a lost for me there already. |

|

|

|

|

|

BacktoBasics

|

Mar 4 2020, 09:36 AM Mar 4 2020, 09:36 AM

|

|

QUOTE(rapple @ Mar 4 2020, 09:32 AM) Allowance is taxable unless every petrol and tol receipts you submit back to the company then only it becomes not taxable as this becomes reimbursements to you. Usually allowance is paid to reduce the company epf and socso contribution for employees. yes agreed. but shouldnt the company allow the 500 out of 600 per month (Max RM6k per year) to be non-taxable allowance since it is stated it is for car allowance? since they are also using my BASIC RM 3k as a basis for bonus and increments? |

|

|

|

|

|

BacktoBasics

|

Mar 4 2020, 09:51 AM Mar 4 2020, 09:51 AM

|

|

QUOTE(yklooi @ Mar 4 2020, 09:47 AM) as you had mentioned that the 3675 on payslip has the correct EPF % . thus your company is paying EPF for your Car Allowance: 600 + Road Tax: 75 you mentioned you will lose out bcos your bonus and increment starts from 3000 calculation if your increment is 10%, you will get 300 instead of 367.50 you lose out 67.50 per year. BUT What is the extra you get in your EPF by your employer per year, when they pay EPF on your Car Allowance: 600 + Road Tax: 75? Yes, i just thought it the car allowance will be non-taxable because my friend who has RM 500 car allowance, his EA form shows RM 6k under Section F as non-taxable allowance. |

|

|

|

|

|

BacktoBasics

|

Mar 4 2020, 09:57 AM Mar 4 2020, 09:57 AM

|

|

QUOTE(yklooi @ Mar 4 2020, 09:54 AM) try to calculate which paying method "lebih untung" YOU more? oh you mean allowances not attributable to EPF contribution? now i see.  |

|

|

|

|

|

BacktoBasics

|

Mar 4 2020, 10:00 AM Mar 4 2020, 10:00 AM

|

|

QUOTE(rapple @ Mar 4 2020, 09:56 AM) Is irrelevant whether the company uses the basic as the yardstick for increment/bonus or his total pay.. This is up to the management level to decide. Increment / bonus is not mandatory. Did you ask your friend, whether he submitted any claim to the company? It's either your friend did submit travelling claim or the HR is just incompetent. I thought all the while the basis used must be basic salary, thats what all the people say right, 1 month of my salary as bonus, or 10% of my basic salary as increment. I thought the company doing some fishy shxt. not sure about the second question though. i neeed to ask. |

|

|

|

|

|

BacktoBasics

|

Mar 4 2020, 10:07 AM Mar 4 2020, 10:07 AM

|

|

QUOTE(rapple @ Mar 4 2020, 10:07 AM) They can give increment in RMxxx or by %. It's not carve in stone. Most Company will use this term "ALLOWANCE" so that the company pay less EPF & Socso. i.e. Company pay 1.2k as basic and 1k allowance = total 2.2k but company only pay EPF 13% on 1.2k while the 1k is not entitled. alright noted with thanks. |

|

|

|

|

|

BacktoBasics

|

Mar 4 2020, 11:42 AM Mar 4 2020, 11:42 AM

|

|

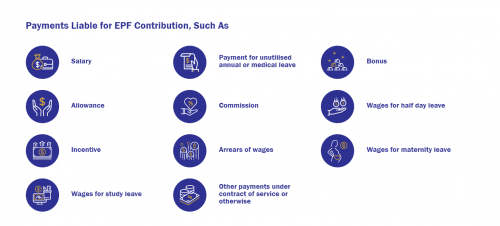

QUOTE(ronnie @ Mar 4 2020, 10:51 AM) so basically allowance also must contribute EPF? hmmm |

|

|

|

|

|

BacktoBasics

|

Apr 14 2020, 03:27 PM Apr 14 2020, 03:27 PM

|

|

guys, does purchasing second hand laptop or PC entitled for the tax relief?

|

|

|

|

|

|

BacktoBasics

|

Apr 14 2020, 03:30 PM Apr 14 2020, 03:30 PM

|

|

QUOTE(GrumpyNooby @ Apr 14 2020, 03:28 PM) Do you have receipt attention to your name (not original owner)? If yes, then you can claim. No, i was thinking to ask the seller to write me up a receipt... for instance, buying from carousell |

|

|

|

|

|

BacktoBasics

|

Apr 14 2020, 03:32 PM Apr 14 2020, 03:32 PM

|

|

QUOTE(GrumpyNooby @ Apr 14 2020, 03:30 PM) As long as you have receipt and in the event audit, you can provide the evidence as per request. Anything can be claimed for. I am just worried because i am asking for a receipt but he doesnt have it.... so maybe I plan to get a simple receipt book from popular and ask him to draft and sign on it.... |

|

|

|

|

|

BacktoBasics

|

Apr 14 2020, 03:38 PM Apr 14 2020, 03:38 PM

|

|

QUOTE(MUM @ Apr 14 2020, 03:35 PM) can he be contacted again when required by LHDN for receipt transaction verification?  not sure about that....if lets say 3 years later, he changed number or profile no longer in carousell then how? what if i ask him to sign and put his IC at the bottom of the receipt? |

|

|

|

|

|

BacktoBasics

|

Apr 14 2020, 03:42 PM Apr 14 2020, 03:42 PM

|

|

QUOTE(GrumpyNooby @ Apr 14 2020, 03:39 PM) Bear in mind that receipt needs to keep for min 7 years! yes, i am aware of the 7 years rule... but not sure if those receipts by second hand item sellers will qualify or not.... want to buy a PC but dont want to pay too much. so thought of getting a 2nd hand |

|

|

|

|

|

BacktoBasics

|

Apr 14 2020, 04:00 PM Apr 14 2020, 04:00 PM

|

|

QUOTE(MUM @ Apr 14 2020, 03:44 PM) if I am the auditor, in the eye of the LHDN,...I would seek for additional info like....  ..... do you have the email, communication records, screenshot of the transaction too ?  ...the IC number and name written on the receipt, could be from some none existing person or none involved person too  if the seller had already used that PC serial number for tax claiming purposes......   so it is hard to prove so your advise is dont claim? This post has been edited by BacktoBasics: Apr 14 2020, 04:01 PM |

|

|

|

|

|

BacktoBasics

|

Apr 14 2020, 04:07 PM Apr 14 2020, 04:07 PM

|

|

QUOTE(MUM @ Apr 14 2020, 04:02 PM) how much is that laptop, how much tax relief can you claim under yr tax bracket? on rough calculation is about RM200 - RM 300 for tax relief |

|

|

|

|

|

BacktoBasics

|

Apr 14 2020, 04:20 PM Apr 14 2020, 04:20 PM

|

|

QUOTE(MUM @ Apr 14 2020, 04:10 PM) wow, that is a lot to quickly and simply decide not to claim.... try contact LHDN for some advise before making this decision? alright. will do. =) thanks for sharing |

|

|

|

|

|

BacktoBasics

|

Apr 16 2020, 11:52 AM Apr 16 2020, 11:52 AM

|

|

QUOTE(ckdenion @ Apr 16 2020, 10:08 AM) » Click to show Spoiler - click again to hide... «

it is advisable to have to original receipt.

try not to use write up receipt, afraid LHDN will deem that as a receipt that everyone can provide.

hi BacktoBasics, for 2nd hand laptop that you bought directly for users themselves, i advise not to claim. unless you bought it from a PC shop with official receipt issued by the shop. noted with thanks. |

|

|

|

|

Mar 3 2020, 11:33 PM

Mar 3 2020, 11:33 PM

Quote

Quote

0.0282sec

0.0282sec

0.41

0.41

7 queries

7 queries

GZIP Disabled

GZIP Disabled