QUOTE(backspace66 @ Jan 29 2021, 02:25 PM)

KOSPI down by almost 9% from peak in just 5 days. Going in for a short trade in addition to my medium term position in fund with heavy exposure to Korea.

China???Public Mutual Funds, version 0.0

|

|

Jan 29 2021, 02:26 PM Jan 29 2021, 02:26 PM

Return to original view | IPv6 | Post

#81

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

|

|

|

Jan 29 2021, 03:35 PM Jan 29 2021, 03:35 PM

Return to original view | Post

#82

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

Feb 8 2021, 02:25 PM Feb 8 2021, 02:25 PM

Return to original view | IPv6 | Post

#83

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

Feb 8 2021, 02:40 PM Feb 8 2021, 02:40 PM

Return to original view | IPv6 | Post

#84

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

Feb 8 2021, 02:48 PM Feb 8 2021, 02:48 PM

Return to original view | IPv6 | Post

#85

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

Feb 9 2021, 08:34 AM Feb 9 2021, 08:34 AM

Return to original view | IPv6 | Post

#86

|

Senior Member

2,437 posts Joined: Sep 2016 |

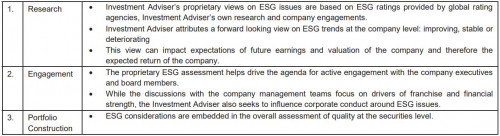

PUBLIC e-CARBON EFFICIENT FUND (PeCEF) Risk 5

The fund will invest in stocks of companies with efficient carbon footprint. Companies with efficient carbon footprint refer to companies that have lower levels of carbon emissions relative to peers within a particular industry. The fund will invest in stocks of companies with efficient carbon footprint which are component stocks of an Environmental, Social and Governance (ESG) index  e_12_PeCEF_PKF_ENG.pdf ( 117.52k )

Number of downloads: 72

e_12_PeCEF_PKF_ENG.pdf ( 117.52k )

Number of downloads: 72 PeCEF_Prospectus_ENG.pdf ( 532.64k )

Number of downloads: 47

PeCEF_Prospectus_ENG.pdf ( 532.64k )

Number of downloads: 47This post has been edited by ironman16: Feb 9 2021, 08:50 AM |

|

|

|

|

|

Feb 9 2021, 08:51 AM Feb 9 2021, 08:51 AM

Return to original view | IPv6 | Post

#87

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

Feb 9 2021, 08:53 AM Feb 9 2021, 08:53 AM

Return to original view | IPv6 | Post

#88

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(GrumpyNooby @ Feb 9 2021, 08:52 AM) globalbenchmark is 90% with Customised index by S&P Dow Jones Indices, LLC based on constituents with lower carbon footprint of the S&P Global 1200 ESG Index This post has been edited by ironman16: Feb 9 2021, 08:57 AM |

|

|

Feb 9 2021, 09:43 AM Feb 9 2021, 09:43 AM

Return to original view | IPv6 | Post

#89

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(GrumpyNooby @ Feb 9 2021, 09:07 AM) Looks like it'll be like: I haven't got this type of fund, so just open one to test. Affin Hwang World Series - Global Sustainability Fund - MYR Hedged -> Allianz Global Sustainability RHB i-Global Sustainable Disruptors Fund Funds investing into SRI or ESG scope. QUOTE(k3LLyCh3n @ Feb 9 2021, 09:29 AM) Wow, is this fund feeder fund? How come u know the geography allocation oledi? |

|

|

Feb 9 2021, 10:03 AM Feb 9 2021, 10:03 AM

Return to original view | IPv6 | Post

#90

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(GrumpyNooby @ Feb 9 2021, 09:07 AM) Looks like it'll be like: Bro, what is the difference between ESG and sustainability?Affin Hwang World Series - Global Sustainability Fund - MYR Hedged -> Allianz Global Sustainability RHB i-Global Sustainable Disruptors Fund Funds investing into SRI or ESG scope. Same? If same, mean public oso got one fund oledi, public e-islamic sustainability milenium (hope the name is right) but in shariah only. I go Google, makin baca makin pening. |

|

|

Feb 9 2021, 10:26 AM Feb 9 2021, 10:26 AM

Return to original view | IPv6 | Post

#91

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(GrumpyNooby @ Feb 9 2021, 10:08 AM) SRI is old term. ESG is new bombastic term. SRI A minimum of 70% of Fund assets are invested in global equity markets of developed countries with a focus on sustainable business practices (namely, business practices which are environmentally friendly and socially responsible) and which the Investment Manager believes may create longterm value. https://secure.fundsupermart.com/fsm/admin/...lightALZ344.pdf ESG As the Fund is a qualified Sustainable and Responsible Investment (SRI) fund, the investments of the Fund will be subject to the integration of Environmental, Social and Governance (ESG) methodology. This includes the screening, selection, monitoring and realization of the Fund’s investments.  https://www.fsmone.com.my/admin/buy/reports...nceMYRII007.pdf almost the same? seen like ESG high tech sikit This post has been edited by ironman16: Feb 9 2021, 10:26 AM |

|

|

Feb 9 2021, 11:07 AM Feb 9 2021, 11:07 AM

Return to original view | IPv6 | Post

#92

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(DragonReine @ Feb 9 2021, 10:49 AM) A more modern rebranding with focus on "environment" 👍 If like this I just focus this ESG la, not need sustainable liao. it also checks on the ethics and transparency of the companies involved, I think Currently only active 2 fund in public, AI n this ESG, others just let it n switching only This post has been edited by ironman16: Feb 9 2021, 11:08 AM DragonReine liked this post

|

|

|

Feb 9 2021, 03:00 PM Feb 9 2021, 03:00 PM

Return to original view | IPv6 | Post

#93

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(xander83 @ Feb 9 2021, 02:39 PM) SRI is more focus on environmental and climate change Thanks for the infoWhile ESG is more focus to social issues like modern slave trading, illegal labor’s practices and social justice Both terms are bombastic and fashionable only thing matters the end results from those terms as more funds jumping into bandwagon without understanding the whole implications Just like emperor getting out his slave trading cloak |

|

|

|

|

|

Feb 9 2021, 03:26 PM Feb 9 2021, 03:26 PM

Return to original view | IPv6 | Post

#94

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

Feb 9 2021, 03:30 PM Feb 9 2021, 03:30 PM

Return to original view | IPv6 | Post

#95

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(xander83 @ Feb 9 2021, 03:26 PM) Like most flashy products especially paper based are most bullshit with these names and most of it will be invested in Tesla and Apple through feeder funds hence the profits will not be so fantastic as investing into the direct ETFs or those shares 😂😂😂But the Sales Charge is crazy at 3% and the benchmark it is easy to see it won’t hit RM0.42 in 2021 to be profitable in it Nvm, i play small small only |

|

|

Feb 9 2021, 06:45 PM Feb 9 2021, 06:45 PM

Return to original view | IPv6 | Post

#96

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(frankzane @ Feb 9 2021, 05:52 PM) oledi can purchase in PMO https://forum.lowyat.net/topic/3580942/+2360# oledi discuss a few post b4... kasi u pic https://www.publicmutual.com.my/Menu/Campai...-Efficient-Fund

This post has been edited by ironman16: Feb 9 2021, 06:50 PM |

|

|

Feb 15 2021, 06:09 PM Feb 15 2021, 06:09 PM

Return to original view | IPv6 | Post

#97

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(wongmunkeong @ Feb 15 2021, 06:04 PM) ini kena kasi wongmunkeong liked this post

|

|

|

Mar 4 2021, 08:18 PM Mar 4 2021, 08:18 PM

Return to original view | Post

#98

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

Mar 4 2021, 08:19 PM Mar 4 2021, 08:19 PM

Return to original view | Post

#99

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(thecurious @ Mar 4 2021, 08:16 PM) I think he mean switching some unit fund to new fund thecurious liked this post

|

|

|

Mar 4 2021, 08:57 PM Mar 4 2021, 08:57 PM

Return to original view | Post

#100

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(wishmegood @ Mar 4 2021, 08:22 PM) Sorry, didn't reliase is bond fund. I think u have to pay the sales charge. Still the same question, PB can go P series? 😂 U gonna know ur fund is loaded or low loaded unit? Within 90 day or after 90 days switching? If u switch online, u will know after u complete ur switch 😁 At rm25 up to 3.75%, my predict only. Not sure. Ask ur agents la This post has been edited by ironman16: Mar 4 2021, 09:01 PM |

| Change to: |  0.1038sec 0.1038sec

0.94 0.94

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 17th December 2025 - 09:14 AM |