my public mutual agent sent me :X

Public Mutual Funds, version 0.0

Public Mutual Funds, version 0.0

|

|

Feb 8 2021, 02:44 PM Feb 8 2021, 02:44 PM

Show posts by this member only | IPv6 | Post

#2361

|

Probation

7 posts Joined: Jan 2021 |

my public mutual agent sent me :X

|

|

|

|

|

|

Feb 8 2021, 02:47 PM Feb 8 2021, 02:47 PM

Show posts by this member only | IPv6 | Post

#2362

|

Probation

7 posts Joined: Jan 2021 |

|

|

|

Feb 8 2021, 02:48 PM Feb 8 2021, 02:48 PM

Show posts by this member only | IPv6 | Post

#2363

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

Feb 8 2021, 02:48 PM Feb 8 2021, 02:48 PM

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Feb 8 2021, 04:17 PM Feb 8 2021, 04:17 PM

|

Junior Member

195 posts Joined: Sep 2020 |

still got prospect if join PBMutual unit trust consultant nowadays? as part time

|

|

|

Feb 9 2021, 07:47 AM Feb 9 2021, 07:47 AM

|

Junior Member

351 posts Joined: Nov 2010 |

QUOTE(JimK @ Feb 8 2021, 04:17 PM) First of all, Public Mutual Berhad is no longer a performing fund management company. It performed poorly since 2012. There are so many other fund management companies who did a much better job like Kenanga, East Spring and etc These companies also offer an easier way to invest via online with little to no service charge whereas PMB still requires agents to sell their products with high front loading. Realising that their company is facing stiff competition, PMB started with online sales as well with high front loading to existing client (with servicing agents) but the sales goes to the company directly, leaving the agents in the dirt. I would recommend you to look for a job on a part time basis, but do give it a good long thought if you intend to join PMB as a UTC. |

|

|

|

|

|

Feb 9 2021, 08:34 AM Feb 9 2021, 08:34 AM

Show posts by this member only | IPv6 | Post

#2367

|

Senior Member

2,437 posts Joined: Sep 2016 |

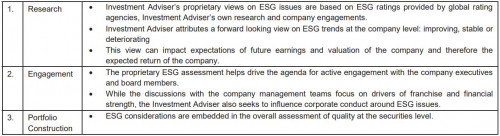

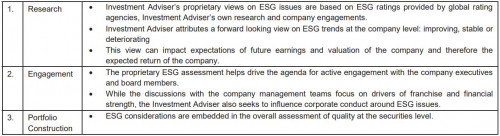

PUBLIC e-CARBON EFFICIENT FUND (PeCEF) Risk 5

The fund will invest in stocks of companies with efficient carbon footprint. Companies with efficient carbon footprint refer to companies that have lower levels of carbon emissions relative to peers within a particular industry. The fund will invest in stocks of companies with efficient carbon footprint which are component stocks of an Environmental, Social and Governance (ESG) index  e_12_PeCEF_PKF_ENG.pdf ( 117.52k )

Number of downloads: 72

e_12_PeCEF_PKF_ENG.pdf ( 117.52k )

Number of downloads: 72 PeCEF_Prospectus_ENG.pdf ( 532.64k )

Number of downloads: 47

PeCEF_Prospectus_ENG.pdf ( 532.64k )

Number of downloads: 47This post has been edited by ironman16: Feb 9 2021, 08:50 AM |

|

|

Feb 9 2021, 08:38 AM Feb 9 2021, 08:38 AM

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(ironman16 @ Feb 9 2021, 08:34 AM) PUBLIC e-CARBON EFFICIENT FUND (PeCEF) Risk 5 The link is dead from my office networkThe fund will invest in stocks of companies with efficient carbon footprint. Companies with efficient carbon footprint refer to companies that have lower levels of carbon emissions relative to peers within a particular industry. The fund will invest in stocks of companies with efficient carbon footprint which are component stocks of an Environmental, Social and Governance (ESG) index PUBLIC e-CARBON EFFICIENT QUOTE This fund is temporarily not available for investment via this service. Please call our Customer Service at 03-2022 5000 for further assistance. |

|

|

Feb 9 2021, 08:51 AM Feb 9 2021, 08:51 AM

Show posts by this member only | IPv6 | Post

#2369

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

Feb 9 2021, 08:52 AM Feb 9 2021, 08:52 AM

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(ironman16 @ Feb 9 2021, 08:51 AM) im just update the previous post. I just want to see region mandate.but i can see this fund in PMO oledi. i oso did open the account with this fund, now in floating trasaction oledi Locally, regionally or globally? This post has been edited by GrumpyNooby: Feb 9 2021, 08:52 AM |

|

|

Feb 9 2021, 08:53 AM Feb 9 2021, 08:53 AM

Show posts by this member only | IPv6 | Post

#2371

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(GrumpyNooby @ Feb 9 2021, 08:52 AM) globalbenchmark is 90% with Customised index by S&P Dow Jones Indices, LLC based on constituents with lower carbon footprint of the S&P Global 1200 ESG Index This post has been edited by ironman16: Feb 9 2021, 08:57 AM |

|

|

Feb 9 2021, 09:07 AM Feb 9 2021, 09:07 AM

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(ironman16 @ Feb 9 2021, 08:53 AM) global Looks like it'll be like:benchmark is 90% with Customised index by S&P Dow Jones Indices, LLC based on constituents with lower carbon footprint of the S&P Global 1200 ESG Index Affin Hwang World Series - Global Sustainability Fund - MYR Hedged -> Allianz Global Sustainability RHB i-Global Sustainable Disruptors Fund Funds investing into SRI or ESG scope. This post has been edited by GrumpyNooby: Feb 9 2021, 09:09 AM |

|

|

Feb 9 2021, 09:21 AM Feb 9 2021, 09:21 AM

|

Probation

7 posts Joined: Jan 2021 |

|

|

|

|

|

|

Feb 9 2021, 09:29 AM Feb 9 2021, 09:29 AM

|

Probation

7 posts Joined: Jan 2021 |

|

|

|

Feb 9 2021, 09:43 AM Feb 9 2021, 09:43 AM

Show posts by this member only | IPv6 | Post

#2375

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(GrumpyNooby @ Feb 9 2021, 09:07 AM) Looks like it'll be like: I haven't got this type of fund, so just open one to test. Affin Hwang World Series - Global Sustainability Fund - MYR Hedged -> Allianz Global Sustainability RHB i-Global Sustainable Disruptors Fund Funds investing into SRI or ESG scope. QUOTE(k3LLyCh3n @ Feb 9 2021, 09:29 AM) Wow, is this fund feeder fund? How come u know the geography allocation oledi? |

|

|

Feb 9 2021, 10:03 AM Feb 9 2021, 10:03 AM

Show posts by this member only | IPv6 | Post

#2376

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(GrumpyNooby @ Feb 9 2021, 09:07 AM) Looks like it'll be like: Bro, what is the difference between ESG and sustainability?Affin Hwang World Series - Global Sustainability Fund - MYR Hedged -> Allianz Global Sustainability RHB i-Global Sustainable Disruptors Fund Funds investing into SRI or ESG scope. Same? If same, mean public oso got one fund oledi, public e-islamic sustainability milenium (hope the name is right) but in shariah only. I go Google, makin baca makin pening. |

|

|

Feb 9 2021, 10:08 AM Feb 9 2021, 10:08 AM

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(ironman16 @ Feb 9 2021, 10:03 AM) Bro, what is the difference between ESG and sustainability? SRI is old term. ESG is new bombastic term. Same? If same, mean public oso got one fund oledi, public e-islamic sustainability milenium (hope the name is right) but in shariah only. I go Google, makin baca makin pening. SRI A minimum of 70% of Fund assets are invested in global equity markets of developed countries with a focus on sustainable business practices (namely, business practices which are environmentally friendly and socially responsible) and which the Investment Manager believes may create longterm value. https://secure.fundsupermart.com/fsm/admin/...lightALZ344.pdf ESG As the Fund is a qualified Sustainable and Responsible Investment (SRI) fund, the investments of the Fund will be subject to the integration of Environmental, Social and Governance (ESG) methodology. This includes the screening, selection, monitoring and realization of the Fund’s investments.  https://www.fsmone.com.my/admin/buy/reports...nceMYRII007.pdf This post has been edited by GrumpyNooby: Feb 9 2021, 10:09 AM |

|

|

Feb 9 2021, 10:26 AM Feb 9 2021, 10:26 AM

Show posts by this member only | IPv6 | Post

#2378

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(GrumpyNooby @ Feb 9 2021, 10:08 AM) SRI is old term. ESG is new bombastic term. SRI A minimum of 70% of Fund assets are invested in global equity markets of developed countries with a focus on sustainable business practices (namely, business practices which are environmentally friendly and socially responsible) and which the Investment Manager believes may create longterm value. https://secure.fundsupermart.com/fsm/admin/...lightALZ344.pdf ESG As the Fund is a qualified Sustainable and Responsible Investment (SRI) fund, the investments of the Fund will be subject to the integration of Environmental, Social and Governance (ESG) methodology. This includes the screening, selection, monitoring and realization of the Fund’s investments.  https://www.fsmone.com.my/admin/buy/reports...nceMYRII007.pdf almost the same? seen like ESG high tech sikit This post has been edited by ironman16: Feb 9 2021, 10:26 AM |

|

|

Feb 9 2021, 10:49 AM Feb 9 2021, 10:49 AM

Show posts by this member only | IPv6 | Post

#2379

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(ironman16 @ Feb 9 2021, 10:26 AM) A more modern rebranding with focus on "environment" it also checks on the ethics and transparency of the companies involved, I think This post has been edited by DragonReine: Feb 9 2021, 10:50 AM |

|

|

Feb 9 2021, 11:07 AM Feb 9 2021, 11:07 AM

Show posts by this member only | IPv6 | Post

#2380

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(DragonReine @ Feb 9 2021, 10:49 AM) A more modern rebranding with focus on "environment" 👍 If like this I just focus this ESG la, not need sustainable liao. it also checks on the ethics and transparency of the companies involved, I think Currently only active 2 fund in public, AI n this ESG, others just let it n switching only This post has been edited by ironman16: Feb 9 2021, 11:08 AM DragonReine liked this post

|

| Change to: |  0.0196sec 0.0196sec

0.52 0.52

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 03:03 PM |