QUOTE(effectz @ Dec 3 2020, 10:59 PM)

Ya.... Not so nice, bur at least now can using apps to top up n managing my fund..... Not need use computer..... Hope them can tweak the user interface so that beauty a bit.Public Mutual Funds, version 0.0

Public Mutual Funds, version 0.0

|

|

Dec 3 2020, 11:03 PM Dec 3 2020, 11:03 PM

Return to original view | IPv6 | Post

#41

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

|

|

|

Dec 4 2020, 09:51 AM Dec 4 2020, 09:51 AM

Return to original view | Post

#42

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(MUM @ Dec 3 2020, 11:05 PM) I only know android, u can try serach in apple version MUM liked this post

|

|

|

Dec 4 2020, 12:24 PM Dec 4 2020, 12:24 PM

Return to original view | IPv6 | Post

#43

|

Senior Member

2,437 posts Joined: Sep 2016 |

WaNaWe900 liked this post

|

|

|

Dec 22 2020, 11:54 AM Dec 22 2020, 11:54 AM

Return to original view | IPv6 | Post

#44

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(GrumpyNooby @ Dec 22 2020, 10:48 AM) not suit me......got sales charge Sales Charge: Up to 0.65% prefer 0% sales charge, eg Public e-Income Fund/Public e-Islamic Income Fund (up to 50% sukuk in msia only) VS Public e-sukuk Fund (75 to 98% in sukuk with 25% in foreign expose) got different these two This post has been edited by ironman16: Dec 22 2020, 11:55 AM |

|

|

Dec 22 2020, 12:06 PM Dec 22 2020, 12:06 PM

Return to original view | IPv6 | Post

#45

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(GrumpyNooby @ Dec 22 2020, 12:02 PM) i got PMO account.......know this PeSUKUK oledi......but seen got sales charge, i just skip it.......prefer 0%........ so far only 3 e -series fund with 0% sales charge (2 bond + 3 MM, if not mistaken), i got invest some...... This post has been edited by ironman16: Dec 22 2020, 12:08 PM |

|

|

Dec 22 2020, 12:10 PM Dec 22 2020, 12:10 PM

Return to original view | IPv6 | Post

#46

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(GrumpyNooby @ Dec 22 2020, 12:08 PM) just try log in aje/ go PM branch check lo.....i use it to accumulate emergency fund beside my old time investment (b4 i go in FSM)quite efficient, redeem today, tomorrow get it for MM, if Bond take almost 1 week my itchy hand cant have my emergency fund in bank/FD...... This post has been edited by ironman16: Dec 22 2020, 12:12 PM WaNaWe900 liked this post

|

|

|

|

|

|

Jan 10 2021, 07:57 PM Jan 10 2021, 07:57 PM

Return to original view | IPv6 | Post

#47

|

Senior Member

2,437 posts Joined: Sep 2016 |

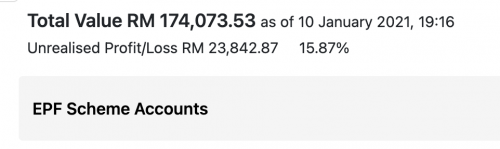

QUOTE(boldsouljah @ Jan 10 2021, 07:22 PM) Hey guys, just a quick to PM sifus here. https://ringgitplus.com/en/blog/personal-fi...dend-rates.htmlI have been investing my EPF $$ for about 5-7years now (some funds are 7 years old, some are 5). The agent is very much helpful and we did some switching last year due to low performing fund called Public Index Fund. Below is my return.  So basically I invested RM 150,231 and got back RM23,842 profit. My question is, would it have been better if I just left it in EPF? How can I calculate how much I would have gotten if I left it in EPF? pass year EPF dividend 2014 =6.75 2015 =6.4 2016 =5.7 2017 =6.9 2018 =6.15 2019 =5.45 i did a simple calculation , if u left in EPF, should b around RM215818 u get salah jgn tembak saya, saya bukan pro punya.....just simple mathematic aje.....should b more than this value..... i would said better just left in EPF....... This post has been edited by ironman16: Jan 10 2021, 07:58 PM WaNaWe900 liked this post

|

|

|

Jan 10 2021, 09:25 PM Jan 10 2021, 09:25 PM

Return to original view | IPv6 | Post

#48

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(boldsouljah @ Jan 10 2021, 08:47 PM) Thank you for the calculation. above master oledi teach u.....mine is just a simple calculationMay I know how you did the calculation. It's not like 1 day 7 years ago I deposited RN150k into PB. It was a gradual deposit according to how much EPF allows us. I remember when I started I was only depositing around 2 to 3k every 3 months. As time goes as my salary increases I deposit around 8k every 3 months (epf only allows certain amount of % to be moved to Unit trust every 3 months) master one is the more accurate but need time.... if wanna cut in short, ur investment not so good..... u just let ur agent decide for u which fund to go? at least u should study which fund to go ? if ur fund can't beat 6% per year, u better put in EPF...... what fund u invest? try regional or global fund , i think more safe..... This post has been edited by ironman16: Jan 10 2021, 09:30 PM boldsouljah liked this post

|

|

|

Jan 10 2021, 10:03 PM Jan 10 2021, 10:03 PM

Return to original view | IPv6 | Post

#49

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(j.passing.by @ Jan 10 2021, 09:53 PM) To beat EPF, you don't want it to be "more safe". 😁😁😁When money is taken out from EPF to purchase funds, you want it to be different from what EPF is doing... you put it into equity funds and into equity funds that are not inside Malaysia. EPF is the taikor in Malaysia stock market. Tough to beat EPF in the field it controls. Thats why i ask him choosing regional or global fund. Single country or sector fund can oso unless u know some info about timing the market 😁😁😁 |

|

|

Jan 10 2021, 10:17 PM Jan 10 2021, 10:17 PM

Return to original view | IPv6 | Post

#50

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(j.passing.by @ Jan 10 2021, 10:11 PM) my choice is PUBLIC e-ARTIFICIAL INTELLIGENCE TECHNOLOGY FUND PUBLIC GLOBAL SELECT FUND PUBLIC FAR-EAST ALPHA-30 FUND others no clue.... WaNaWe900 liked this post

|

|

|

Jan 11 2021, 03:47 PM Jan 11 2021, 03:47 PM

Return to original view | IPv6 | Post

#51

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(j.passing.by @ Jan 11 2021, 02:26 PM) Is it too late to join the bandwagon? For most Asia Pacific Funds, the rally continues last week; a good start to the new year. Last Friday's daily increments for some funds were not seen before... PUBLIC FAR-EAST CONSUMER THEMES FUND 3.81% PUBLIC ISLAMIC ASIA LEADERS EQUITY FUND 2.41% PB ASIA CONSUMER SECTOR FUND 3.95% PB ASIA PACIFIC ENTERPRISES FUND 3.16% PUBLIC SINGAPORE EQUITY FUND 2.49% STI is still below its 2020 Jan/Feb level, while other indices, Taiwan and S Korea have rally past its early 2020 levels. Hang Seng is about back to 2020 Feb level. My 2 cents: Some Asia Pacific funds, as like above funds, could possibly gain at 15% to 30% by year end. Just to give an indication on how strong was the rally last week (and after the sharp pullback last March); while bond funds were in the negative last week, but my port having less than 30% in equities had gained slightly above 1% last week. PUBLIC FAR-EAST CONSUMER THEMES FUND 8/1/2020-8/1/2021 (1-yr): 39.67% 31/12/2020-8/1/2021 (ytd): 8.11% not bad......my selected fund all kalah u.... but i seldom switch bcoz dun wanna pay the switching fee |

|

|

Jan 12 2021, 02:57 PM Jan 12 2021, 02:57 PM

Return to original view | IPv6 | Post

#52

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(j.passing.by @ Jan 12 2021, 02:54 PM) Switching is not same as "buy and sell". If you sell and buy back, you will be paying service charges again. Bukan Public got switching fee? Why u unlimited?I got unlimited free switching... I'm holding all the above 5 funds plus a few more. 2 of them, switched in last Friday. All the equity funds just several % of the port; wtih bigger % in Islamic Asia Leaders and Vietnam-Global. Had switched out of Islamic Global and Global Select; but still holding Lifestyle & Tech and PB Global Tech. Most of the funds are similar to each other, Asia Pacific region and large caps, so when I'm in dilemma in choosing the funds, I chose them all. |

|

|

Jan 12 2021, 03:30 PM Jan 12 2021, 03:30 PM

Return to original view | IPv6 | Post

#53

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(j.passing.by @ Jan 12 2021, 03:09 PM) Gold member. Ini baru taiko 👍👍👍As a beginner, better to stay with one fund house and not do to much switching... stay and accumulate and grow the port. Wait till you got gold member status. There is a good phrase which I recently came across... To grow wealth, concentrate. To preserve wealth, diversify. I just maintain at public, i go fsm n other's oledi |

|

|

|

|

|

Jan 16 2021, 01:46 AM Jan 16 2021, 01:46 AM

Return to original view | IPv6 | Post

#54

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(iChongYC @ Jan 16 2021, 01:07 AM) Another question, is there any different between I choose to place my Unit Trust over PMO without entering any consultant? will the sales charge be the same?? Public will get the commission. U still pay the same sales charge. If got ppl u know, that put they utc code. |

|

|

Jan 16 2021, 10:46 AM Jan 16 2021, 10:46 AM

Return to original view | IPv6 | Post

#55

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(YoungMan @ Jan 16 2021, 10:16 AM) PLTF has been giving good return, one of my best performing fund in PM. But do remember that past performance is not an indication of future performance. Got ppl easy la. As for the new US fund there is no track record yet. you have to look at similar funds from other houses. Haha this is the trick if investing directly with fund houses. Especially family member which you can nego sales charge. Mostly public investor is uncle aunty with big volume punya. I ikan bilis, so just swim for e series n go fsm lo |

|

|

Jan 16 2021, 11:22 AM Jan 16 2021, 11:22 AM

Return to original view | IPv6 | Post

#56

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(YoungMan @ Jan 16 2021, 11:14 AM) Me 2Global, Asia Pacific, e AI. Personally like the AI, but the sales charge not competitive to others, so just dca normally aje. Oso cant see the fund facsheet, didn’t know where it go. Just let it for a while until i find out. |

|

|

Jan 18 2021, 09:53 PM Jan 18 2021, 09:53 PM

Return to original view | Post

#57

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

Jan 18 2021, 10:18 PM Jan 18 2021, 10:18 PM

Return to original view | Post

#58

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

Jan 18 2021, 10:50 PM Jan 18 2021, 10:50 PM

Return to original view | Post

#59

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

Jan 18 2021, 10:54 PM Jan 18 2021, 10:54 PM

Return to original view | Post

#60

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

| Change to: |  0.0284sec 0.0284sec

0.31 0.31

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 07:10 AM |