After a decade with P-Mutual (PM), I decided to quit invest in PM.

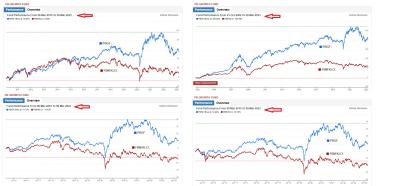

With zero knowledge on investment, I chosen to invest in PM since 2010 as a fresh grad. I invested in an equity fund with adequate growth rate at that point of time (roughly 5-8% per annum). However, the overall return (distribution + capital gain) was unsatisfactory since 2016 for an Equity Fund.

Despite unsatisfactory result, PM still charging 5.5% sales commission and ton of other management fee & cost.

TO ALL OF YOU, if you decide to invest in PM, here is my LESSONS to you before you dump your money into PM:

1) Past performance of the fund tell you what result to expect (high rish high return), but please KNOW YOUR FUND MANAGER as well. My equity fund was managed by competence fund manager at past (roughly 5-8% per annum), maybe headhunted by other firm so the competence fund manager resigned. Based on the return in 2016, I supposed the fund is managed by a new DONKEY fund manager / LOUSY fund manager. Hence, THE OVERALL RETURN BECOME UNSATISFACTORY (roughly 2-4% per annum).

2) An equity mutual fund requires active management to outperform the market, that why we pay expensive fee (5.5% sales commission + other fees) to the fund management team. However, most of the mutual funds in Malaysia failed to deliver satisfactory return to it's mutual fund unit holders. The fund management team STILL EARNING MANAGEMENT FEE OF X% DESPITE THE FUND PERFORMANCE GOOD OR BAD.

3) 5.5% sales commission is fxcking expensive fee, this money can be used to grow into bigger investment sum in long-term. What I hate is, the fund management team STILL EARNING MANAGEMENT FEE OF X% from you DESPITE THE FUND PERFORMANCE GOOD OR BAD. Why should you pay an expensive fee when the management team perform poorly / or incompetency?

4) If you have invested in PM, learn how to detect DONKEY fund manager / LOUSY fund manager and prepare to redeem / quit the fund. The equity fund I invested has low return from 2016 to 2019 despite Malaysia economy is doing well. THESE ARE THE RED FLAG, if you find that the return is low for an equity fund for 2-3 years, QUIT the fund, it is a sign of DONKEY fund manager.

5) Mutual fund is good choice for beginner investor, but you need to learn to invest and managed your own money in long-term. If you dont manage your own money, mutual fund will charge you expensive fee (5.5% sales commission + x% fee) first before help you manage your money. Your CAPITAL WILL BE IMMEDIATE LOSS BEFORE THE MUTUAL FUND HELP YOU EARN ANY MONEY AND DONKEY FUND MANAGER WILL USE YOUR MONEY IN BURSA PLAYGROUND.

6) Most of the PRS mutual funds return so-so only, and PRS lock your fund until 55 years old. If you putting RM3000 for 15% tax relief (M40 benchmark) , around RM450 tax relief. I suggest you use RM3000 to buy some REIT / share, to get better return and no need to wait until 55 years old.

7) When you give all the carrot (5.5% sales commission) to a Donkey first, it will eat the carrot first without doing any job. However, if you put the carrot in front of the Donkey, then Donkey will move in order to eat the carrot. Malaysia mutual fund industry is the former, eat the carrot first, so the Donkey wont bother to work properly. If the mutual fund industry is not practicing performance based reward to the mutual fund management team, I dont see any reason why the consumer should invest on mutual fund in Malaysia.

This post has been edited by hong999: Mar 8 2023, 11:56 AM

Public Mutual Funds, version 0.0

Mar 8 2023, 11:39 AM

Mar 8 2023, 11:39 AM

Quote

Quote

0.0308sec

0.0308sec

0.39

0.39

6 queries

6 queries

GZIP Disabled

GZIP Disabled