QUOTE(ameli7a @ Apr 15 2020, 08:25 PM)

Hello. I need some advice about this unit trust. I have invested in equity fund 3 years ago. However, the fund’s performance is just average. I have a few questions:

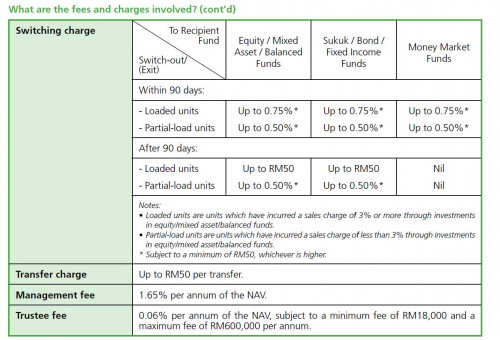

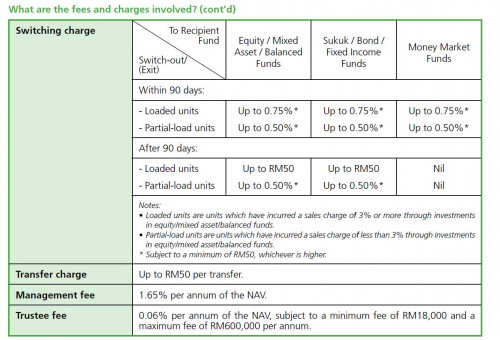

1.What are the difference between these two charges Switching Charge and Transfer Charge?

2. I wish to open a new fund. At the same time, can I transfer just certain units from the old fund to this new fund? If yes, what are the charges and the total charges? Thank you

1. Switching charge is the fee paid in switching from one fund to another.

Transfer charge, if not mistaken, is when you transfer the fund to another person, say your spouse when you truly wants to retire and allow another person to take over the portfoilo.

2. You can either open a new fund by purchasing or switching. Meaning you can do either first, wait 2 working days for the fund to appear in the system, then add more units (by purchasing or switching).

The switching charge you have copied and pasted were from investments done via I-Invest? The switching charges of 0.5% and 0.75% is very low. The usual sales charges for cash purchases is 5.5% for equity funds and 1.0% for bond funds. Bond fund is known as partial loaded, and when a bond fund is switched to an equity fund, the difference between 5.5% and 1.0% will be charged.

Below is the latest advice on the screen when you do switcing online.

Sales/Switching Charge (As a guide)

i. Switching of zero-load/low-load/1%-load units into equity/mixed asset/balanced funds will be subject to sales charge of up to 5.50% whilst switching of zero-load/low-load units into bond funds will be subject to sales charge of up to 1.00%.

ii. Switching of partial-load units (including E2 accounts opened through i-Invest) will be subject to a sales/switching charge of up to 0.50% or minimum RM50.

iii. For switching made within 90 days from date of purchase, switching of units from equity/mixed asset/balanced funds will be subject to switching charge of up to 0.75% or minimum RM50, whilst switching of units from bond funds (apart from that covered in item (i) and (ii) above) will be subject to switching charge of up to 0.25% or minimum RM50.

iv. For all other switching, you will be subject to switching charge of up to RM50.

Do you wish to proceed?

Please take note of (ii). I-Invest is from EPF I-Invest. It seems that if switching is done on funds bought via I-Invest, it will incur a switching fee of 0.5%. The sales charge in I-Invest is also 0.5%.

If the units is worth RM3000, then the switching fee is 3000 x 0.5% = RM15. The minimal fee of RM50 will be charged.

Apr 16 2020, 03:04 PM

Apr 16 2020, 03:04 PM

Quote

Quote

0.0294sec

0.0294sec

0.43

0.43

6 queries

6 queries

GZIP Disabled

GZIP Disabled