I'm right.

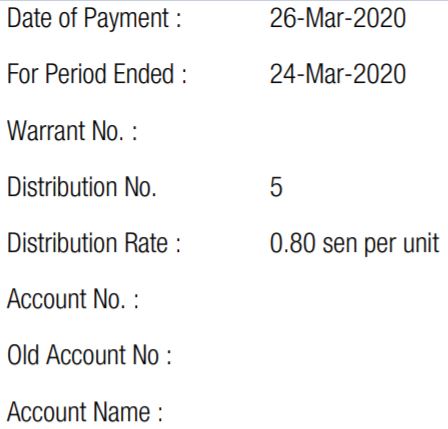

You'll get RM 8.80 and NOT RM 880.

I'm using an example from Opus IPF with latest distribution of 0.8 sen per unit

This post has been edited by GrumpyNooby: Apr 19 2020, 11:10 PM

Public Mutual Funds, version 0.0

|

|

Apr 19 2020, 11:07 PM Apr 19 2020, 11:07 PM

Show posts by this member only | IPv6 | Post

#1941

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Apr 24 2020, 04:17 PM Apr 24 2020, 04:17 PM

|

Senior Member

981 posts Joined: Jan 2008 From: Taiping / Sungai Petani / Butterworth |

Greetings anyone can recommend a fund to buy ... during this covid Crisis ?

|

|

|

Apr 26 2020, 12:40 PM Apr 26 2020, 12:40 PM

|

Senior Member

1,056 posts Joined: Apr 2016 |

|

|

|

Apr 26 2020, 02:02 PM Apr 26 2020, 02:02 PM

|

Senior Member

1,936 posts Joined: Oct 2011 From: KL |

|

|

|

Apr 26 2020, 02:10 PM Apr 26 2020, 02:10 PM

|

Senior Member

6,801 posts Joined: Oct 2008 From: Kuala Lumpur |

|

|

|

Apr 26 2020, 09:59 PM Apr 26 2020, 09:59 PM

Show posts by this member only | IPv6 | Post

#1946

|

Senior Member

1,936 posts Joined: Oct 2011 From: KL |

|

|

|

|

|

|

Apr 30 2020, 06:18 PM Apr 30 2020, 06:18 PM

Show posts by this member only | IPv6 | Post

#1947

|

All Stars

12,387 posts Joined: Feb 2020 |

Public Mutual declares RM64m in distributions for seven funds

A distribution of 8.5 sen per unit has been declared for PB Dynamic Allocation Fund, Public Mutual said in a statement today. The unit trust firm has declared a one sen per unit distribution for Public Select Mixed Asset Conservative Fund, and 0.5 sen per unit for Public Far-East Balanced Fund. Elsewhere, it has declared 0.25 sen per unit for four funds, namely Public Ehsan Mixed Asset Conservative Fund, Public Ehsan Mixed Asset Growth Fund, Public Islamic Dividend Fund and the Public Islamic Asia Dividend Fund. https://www.theedgemarkets.com/article/publ...ons-seven-funds |

|

|

May 4 2020, 03:34 PM May 4 2020, 03:34 PM

Show posts by this member only | IPv6 | Post

#1948

|

Junior Member

52 posts Joined: Oct 2013 |

1. After reading all the threads regarding investment in Unit Trust particularly with Public Mutual, can anyone here shed some light with empirical evidence that suggests investing in Unit Trust is far more profitable than leaving our money in EPF account?

2. As we understand it correctly, EPF will pay dividend every year which Gov guarantees of not less than 2.50% and as a matter of fact over the last 11 years, EPF never declared dividend lower than 4.50% (with the lowest registered in 2008 at 4.50%). 3. With this compounding interest (dividend) over long term in EPF account and bearing in mind that our principal at any point in time shall not be subjected to diminution in value plus we don't have to monitor our account for switching requirements and what not. 4. Assuming if we invested one-off amount (lump sum) in 2008, by right until 2019 the amount would already double in value ie. with 100% total return if we remained the same invested amount in EPF (calculation: 1.045 x 1.0565 X 1.058 X 1.06 X 1.0615 X 1.0635 X 1.0675 X 1.064 X 1.057 X 1.069 X 1.0615 X 1.0545 = 2.00 = 100% return). 5. Is there any fund under Public Mutual or any other UT companies can top that without making any switching every now and then??? 6. My point is UT companies and UT consultants are all suckers to confuse investors with terms like dollar averaging, long term horizon, switching here and there while without fail they will be collecting fees every year regardless of the return be it negative or positive.... 7. At the time when our investment registers positive returns, no consultants will advise us to realize our profits!!!! Unless we monitor ourselves on our portfolios!!! But what the heck if we were to do it when we can rest assured without doing anything in EPF account, our money will surely grow..... 8. OPEN UP our eyes (including mine) wide open and assess it objectively, figures don't lie!!!!! - Frustrated Investor in PM Unit Trust - |

|

|

May 4 2020, 04:54 PM May 4 2020, 04:54 PM

|

Senior Member

1,639 posts Joined: Nov 2010 |

QUOTE(Adam77 @ May 4 2020, 03:34 PM) 4. Assuming if we invested one-off amount (lump sum) in 2008, by right until 2019 the amount would already double in value ie. with 100% total return if we remained the same invested amount in EPF (calculation: 1.045 x 1.0565 X 1.058 X 1.06 X 1.0615 X 1.0635 X 1.0675 X 1.064 X 1.057 X 1.069 X 1.0615 X 1.0545 = 2.00 = 100% return). 5. Is there any fund under Public Mutual or any other UT companies can top that without making any switching every now and then??? - Frustrated Investor in PM Unit Trust - 2. Go to the Morningstar Malaysia website, select all funds, click on the longer term 10-year annualised, and rank it downwards. There would be about 30 funds beating the above figure. 3. The 10-year annualised EPF percentage from 2010 to 2019 is 6.16%. Even with a very bad year-to-date returns this year, there are not less than 30 funds having 10-year annualised returns higher than 6.16%. 4. Public Mutual has high service charge on its equity funds. This is one of the reasons that investors buying Public Mutual equity funds will encountered more difficulties in getting better returns for their invested money. |

|

|

May 4 2020, 05:10 PM May 4 2020, 05:10 PM

|

Senior Member

1,639 posts Joined: Nov 2010 |

BNM maybe cutting the OPR rates again.

In the past week, I have make several switches from money-market funds back to bond funds. Paying the switching fee, RM25 each time. If the amount swtiched is high enough, it is worth paying the fee. |

|

|

May 4 2020, 05:50 PM May 4 2020, 05:50 PM

Show posts by this member only | IPv6 | Post

#1951

|

Junior Member

52 posts Joined: Oct 2013 |

QUOTE(j.passing.by @ May 4 2020, 05:10 PM) BNM maybe cutting the OPR rates again. Then might as well as you become a fund manager if you needed to constantly monitor the market and make switching every now and then. Besides, how can we make comparable analysis on our portfolios return if we switched from one fund to the other, what I mean we cannot single out all funds that have higher annualized return then compare with EPF annualized return. Comparable analysis is by calculating our portfolios annualized return versus EPF annualized return.In the past week, I have make several switches from money-market funds back to bond funds. Paying the switching fee, RM25 each time. If the amount swtiched is high enough, it is worth paying the fee. |

|

|

May 4 2020, 06:47 PM May 4 2020, 06:47 PM

|

Senior Member

1,639 posts Joined: Nov 2010 |

QUOTE(Adam77 @ May 4 2020, 05:50 PM) Then might as well as you become a fund manager if you needed to constantly monitor the market and make switching every now and then. Besides, how can we make comparable analysis on our portfolios return if we switched from one fund to the other, what I mean we cannot single out all funds that have higher annualized return then compare with EPF annualized return. Comparable analysis is by calculating our portfolios annualized return versus EPF annualized return. Noted you are a first time poster in this thread. FYI, the above 2 postings are unrelated. If you care to read back the past pages in this thread, I have also posted several comments on the type of funds that can beat the returns in EPF.This thread is for self help in monitoring our portfolios as well as sharing other relevant information and opinions. What's your point of slurring me that I am monitoring my porfolio constantly? In your first post, you asked whether there are funds, with returns that are bought lump sum and without any switches, that can better EPF returns, and I shown you where to look. Now you want to discuss regarding comparable analysis of our portfolios' returns. After slurring me of becoming a fund manager when I make switches in my portfolio? My, my... |

|

|

May 14 2020, 11:55 AM May 14 2020, 11:55 AM

|

Senior Member

2,106 posts Joined: Jul 2018 |

https://www.publicmutual.com.my/Non-Face-to-Face

now you can open public mutual account online and transac online |

|

|

|

|

|

May 15 2020, 04:51 AM May 15 2020, 04:51 AM

Show posts by this member only | IPv6 | Post

#1954

|

Junior Member

590 posts Joined: Dec 2015 |

QUOTE(tadashi987 @ May 14 2020, 11:55 AM) https://www.publicmutual.com.my/Non-Face-to-Face Is the sales charge cheaper? Or remain the same? now you can open public mutual account online and transac online |

|

|

May 15 2020, 07:00 AM May 15 2020, 07:00 AM

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

May 15 2020, 09:19 AM May 15 2020, 09:19 AM

|

Senior Member

741 posts Joined: Apr 2016 |

sales charge has gone down from 5.5% to 5% now

This post has been edited by zubayr: May 15 2020, 09:19 AM |

|

|

May 15 2020, 01:09 PM May 15 2020, 01:09 PM

Show posts by this member only | IPv6 | Post

#1957

|

Junior Member

590 posts Joined: Dec 2015 |

QUOTE(zubayr @ May 15 2020, 09:19 AM) QUOTE(tadashi987 @ May 15 2020, 07:00 AM) Not sure if it is cheaper than purchasing through agent, but it is still high, equity up to 5.5% Fixed income up to 1% Yup, kind of expensive. Fundsupermart 1.75%.If the agent is doing his job, help to analyse market, rebalance, advise when to sell - buy, still OK to pay 5%. Most agent do not do it despite get high commission. |

|

|

Jun 11 2020, 08:58 PM Jun 11 2020, 08:58 PM

|

Newbie

29 posts Joined: Oct 2017 |

Hello, I want to know whether it is possible for me to discard my Unit Trust Consultant. If yes, what are the steps?

|

|

|

Jun 11 2020, 08:59 PM Jun 11 2020, 08:59 PM

Show posts by this member only | IPv6 | Post

#1959

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jun 11 2020, 09:11 PM Jun 11 2020, 09:11 PM

|

Newbie

29 posts Joined: Oct 2017 |

I want to remove my consultant. My consultant doesn't bother to update me. When i tried to call or even whatsapp, call was not answered, messages were not replied. I rather have no consultant or if I could manage to find a good consultant then i would take one.

|

| Change to: |  0.0207sec 0.0207sec

0.36 0.36

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 04:35 PM |