Looking at the posted nav prices today on the main Public Mutual webpage, PIOf, has the highest daily increment.

PUBLIC ISLAMIC OPPORTUNITIES FUND 0.72%

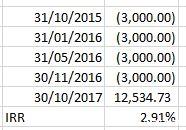

I have been holding this small-cap fund since 2014, all of them in several switches just before it closed in late Sept and it was near its annual peak then. And was gradually making the switches on its uptrend to the peak before it closed.

Its performance then went yo-yo, up and down; so there some high periods and some negative periods. Over the course of the next 3 years, in 2016, the returns were pretty flat giving very low effective returns of less than what you can get from FD.

But I hold on... maybe because of the fact that it is closed, if I switched out, I cannot get it back.

Starting this year, its performance started to climb... and climb... and climb. Turning from the worst performing fund in 2016, to be the best local fund of the year (so far this year).

At the moment, the IRR of the switches is 8.5%, with ROI of each switch ranging from 28% to 37%.

Should I take profit and switch out?

No. It has become one of my core funds. I have faith in it, that it will continue its ups and downs over the next several years, but it will eventually be among the better funds that I have invested in.

Maybe it will be reduced (from its current size of about 10% of the entire portfolio) when the portfolio is eventually restructure in its 3rd and final stage when I need to withdraw or cash-out the distributions for retirement income.

Cheers.

============

Today, when I update my portfolio's prices, PIOF +0.72% while the other funds in Greater China and Asia Pacific has sharp falls of about 1%. Overall, in the red... but still up for the month - way, way up from last month.

Today's closing:

KLCI -0.19%

Emas -0.11%

Small Cap +0.31%

HSI +1.17%

HSCEI +1.77%

=============

Most of the small cap funds are closed. The best alternative, currently - for local funds, would be those small-and-mid-cap funds:

Public Emerging Opportunities Fund

Public Islamic Ermerging Opportunities Fund

Oct 19 2017, 08:42 AM

Oct 19 2017, 08:42 AM

Quote

Quote

0.0302sec

0.0302sec

0.34

0.34

6 queries

6 queries

GZIP Disabled

GZIP Disabled