Got to endure almost 2 hours to open this and the associated saving account for half yearly interest crediting. AmBank is probably one of the least efficient bank..

Fixed Deposit Rates In Malaysia V. No.8, Please Read Post#1 and #2

Fixed Deposit Rates In Malaysia V. No.8, Please Read Post#1 and #2

|

|

Jan 12 2015, 07:06 PM Jan 12 2015, 07:06 PM

|

Junior Member

637 posts Joined: Jul 2012 |

Just opened AmBank 36-mth islamic FD promo at 4.5%, no more lucky dip mentioned by bbgoat (last day 28-12)..

Got to endure almost 2 hours to open this and the associated saving account for half yearly interest crediting. AmBank is probably one of the least efficient bank.. |

|

|

|

|

|

Jan 12 2015, 07:20 PM Jan 12 2015, 07:20 PM

|

All Stars

65,278 posts Joined: Jan 2003 |

|

|

|

Jan 12 2015, 07:56 PM Jan 12 2015, 07:56 PM

|

Senior Member

6,614 posts Joined: Mar 2011 |

QUOTE(harmonics3 @ Jan 12 2015, 07:06 PM) Just opened AmBank 36-mth islamic FD promo at 4.5%, no more lucky dip mentioned by bbgoat (last day 28-12).. I got Barbeque set and RM20 lucky dip on 7/1, Penang branch. Not sure if your location has all the lucky dip taken up. Got to endure almost 2 hours to open this and the associated saving account for half yearly interest crediting. AmBank is probably one of the least efficient bank.. In terms of efficiency, agreed with you that AmBank system is SLOW ! This post has been edited by bbgoat: Jan 12 2015, 08:09 PM |

|

|

Jan 12 2015, 08:41 PM Jan 12 2015, 08:41 PM

|

Senior Member

28,187 posts Joined: Mar 2007 From: Underworld |

QUOTE(cybpsych @ Jan 12 2015, 07:20 PM) Hong Leong Bank Priority Banking Fixed Deposit Promotion I know more and more interesting offer will be slowly creeping out one..12 January 2015 - 8 February 2015 6-month @ 4.35% p.a. 80% FD : 20% CASA (earmark for 4-month, 120 days) Min RM250k new funds @ RM200k FD : RM50k CASA More info: HLB PB | T&Cs That is why am not choosing to lock a long term until the best offer emerge Best will be at the last |

|

|

Jan 12 2015, 09:16 PM Jan 12 2015, 09:16 PM

|

Junior Member

637 posts Joined: Jul 2012 |

QUOTE(bbgoat @ Jan 12 2015, 07:56 PM) I got Barbeque set and RM20 lucky dip on 7/1, Penang branch. Not sure if your location has all the lucky dip taken up. ya.. 1hr each for waiting (2 customers before me) and processing.. the officer said have to manually key in the account numbers twice.. their flow is definitely slow compared to other banks such as OCBC... seeing so many people waiting and stressful expression on the counter staff's faces. i didn't ask for any free gifts.. In terms of efficiency, agreed with you that AmBank system is SLOW ! |

|

|

Jan 12 2015, 09:30 PM Jan 12 2015, 09:30 PM

|

Senior Member

1,624 posts Joined: Apr 2011 |

QUOTE(bbgoat @ Jan 12 2015, 07:56 PM) I got Barbeque set and RM20 lucky dip on 7/1, Penang branch. Not sure if your location has all the lucky dip taken up. May I know which branch gave the gifts...no harm to have some kept long term...In terms of efficiency, agreed with you that AmBank system is SLOW ! |

|

|

|

|

|

Jan 13 2015, 07:10 AM Jan 13 2015, 07:10 AM

|

Senior Member

4,821 posts Joined: Mar 2009 |

QUOTE(harmonics3 @ Jan 12 2015, 07:06 PM) Just opened AmBank 36-mth islamic FD promo at 4.5%, no more lucky dip mentioned by bbgoat (last day 28-12).. any idea what is the penalty clause if close lets say after 6 months, how much interest would you still get if any?Got to endure almost 2 hours to open this and the associated saving account for half yearly interest crediting. AmBank is probably one of the least efficient bank.. reasons: step up would be a better consumer choice to avoid lock up. |

|

|

Jan 13 2015, 07:11 AM Jan 13 2015, 07:11 AM

|

Senior Member

4,821 posts Joined: Mar 2009 |

QUOTE(harmonics3 @ Jan 12 2015, 07:06 PM) Just opened AmBank 36-mth islamic FD promo at 4.5%, no more lucky dip mentioned by bbgoat (last day 28-12).. that is why even with this rate I will think twice, you want your hard earn money to be in the right bank also, not just the rate.Got to endure almost 2 hours to open this and the associated saving account for half yearly interest crediting. AmBank is probably one of the least efficient bank.. |

|

|

Jan 13 2015, 09:12 AM Jan 13 2015, 09:12 AM

|

All Stars

18,406 posts Joined: Oct 2010 |

|

|

|

Jan 13 2015, 09:24 AM Jan 13 2015, 09:24 AM

|

Senior Member

28,187 posts Joined: Mar 2007 From: Underworld |

|

|

|

Jan 13 2015, 09:26 AM Jan 13 2015, 09:26 AM

|

All Stars

18,406 posts Joined: Oct 2010 |

|

|

|

Jan 13 2015, 09:28 AM Jan 13 2015, 09:28 AM

|

Senior Member

28,187 posts Joined: Mar 2007 From: Underworld |

QUOTE(MGM @ Jan 13 2015, 09:26 AM) Yea.. is good choice, but going to the branch (kuchai lama) and wait 1hr+ for processing, is real bad choice.It is a understaffed and overcrowded branch... This post has been edited by Bonescythe: Jan 13 2015, 09:29 AM |

|

|

Jan 13 2015, 09:48 AM Jan 13 2015, 09:48 AM

|

Senior Member

4,897 posts Joined: Aug 2005 |

Going to OCBC for the 6 months promo

This post has been edited by feralee: Jan 13 2015, 10:09 AM |

|

|

|

|

|

Jan 13 2015, 11:35 AM Jan 13 2015, 11:35 AM

|

Junior Member

637 posts Joined: Jul 2012 |

QUOTE(lowya @ Jan 13 2015, 07:10 AM) any idea what is the penalty clause if close lets say after 6 months, how much interest would you still get if any? Uplifting within 3 months no interest paid, between 3 ~ 36 months I quote the brochure below:reasons: step up would be a better consumer choice to avoid lock up. "the profit payable will be half (50%) of the contracted rate based on completed months" promotion ends on 31-Jan-2015. |

|

|

Jan 13 2015, 11:40 AM Jan 13 2015, 11:40 AM

|

Junior Member

637 posts Joined: Jul 2012 |

In view of the depreciating ringgit, any ideas to place foreign currency "FD" such as australian or chinese rmb?

|

|

|

Jan 13 2015, 03:06 PM Jan 13 2015, 03:06 PM

|

Senior Member

2,353 posts Joined: Apr 2009 |

|

|

|

Jan 13 2015, 03:11 PM Jan 13 2015, 03:11 PM

Show posts by this member only | IPv6 | Post

#237

|

All Stars

26,524 posts Joined: Jan 2003 |

QUOTE(ragk @ Jan 13 2015, 03:06 PM) a simple FD calculator to help youhttp://www.miniwebtool.com/fixed-deposit-calculator/ |

|

|

Jan 13 2015, 03:20 PM Jan 13 2015, 03:20 PM

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(harmonics3 @ Jan 13 2015, 11:40 AM) In view of the depreciating ringgit, any ideas to place foreign currency "FD" such as australian or chinese rmb? Many commercial banks offer Foreign Currency Deposits. Go to UOB, OCBC, Citibank, CIMB, etc websites to see currency being offered. You will note that the interest rates varies and the one offering higher rate may have higher conversion from RM to currency of interest. For example, OCBC 12 months interest rate for AUD may be lower than RHB BUT RHB conversion rate may be higher. QUOTE(MGM @ Jan 13 2015, 09:26 AM) True, the best for commercial banks 3, 6 and 9 months interest rates. However, the second and final 3 months interest rates quoted are not guaranteed (can go up which everybody will love and may go down). For 3 months yes we definitely will get 3.88%Latest on FD Promos, for more FD Promos please visit My Fixed Deposit Page at my blog. HLB offering 4.15% and 3.8% for 12 months and 6 months FD respectively. Minimum Fresh Fund RM50. Valid until end of Jan 2015. UOB 4.2% 12 months extended again. Not surprising since OCBC offering the same. These two banks kind of compete for the same customers who wants their money being parked among the safest banks on earth. This post has been edited by Gen-X: Jan 13 2015, 03:32 PM |

|

|

Jan 13 2015, 04:14 PM Jan 13 2015, 04:14 PM

|

Senior Member

2,353 posts Joined: Apr 2009 |

QUOTE(Human Nature @ Jan 13 2015, 03:11 PM) oh!!! now i understand, thanks! |

|

|

Jan 13 2015, 04:51 PM Jan 13 2015, 04:51 PM

|

All Stars

24,454 posts Joined: Nov 2010 |

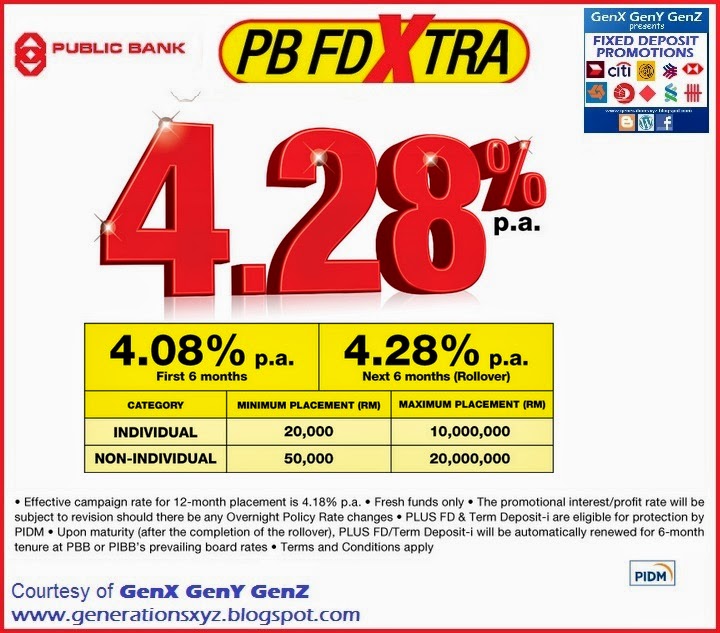

QUOTE(ragk @ Jan 13 2015, 03:06 PM) u definitely need to learn how to read ads with fine prints better...the big numbers in red says 4.28% with small print p.a.= per annum = per year. below, 4.08% p.a. first 6 months, 4.28% p.a. next 6 mths. now, go further below and read small print: effective campaign rate for 12 months placement is 4.18%. it means this promotion is ONLY for 12 months, cannot do 1 or 3 or 6 or 9 months. months 1-6, it is 4.08% p.a., so u get 6/12x4.08% = 2.04%. months 7-12, it is 4.28% p.a., u get 6/12x4.28%=2.14. add the 2 periods, you get 2.04+2.14=4.18% which is what is stated too. that's the way it is done. ads with big and small prints are meant to attract attention but qualified in case they get sued for misleading public. if u ever read any ad and think it is 4 or 5% for 6 months or 10% for a year, u know it is wrong. no bank is offering that much at this time.  This post has been edited by AVFAN: Jan 13 2015, 04:52 PM |

|

Topic ClosedOptions

|

| Change to: |  0.0308sec 0.0308sec

0.54 0.54

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 11:10 PM |