QUOTE(Gen-X @ Jan 3 2015, 01:04 PM)

To ALL:

We are now in a similar position to that in 2008/2009 where we had a slow-down.

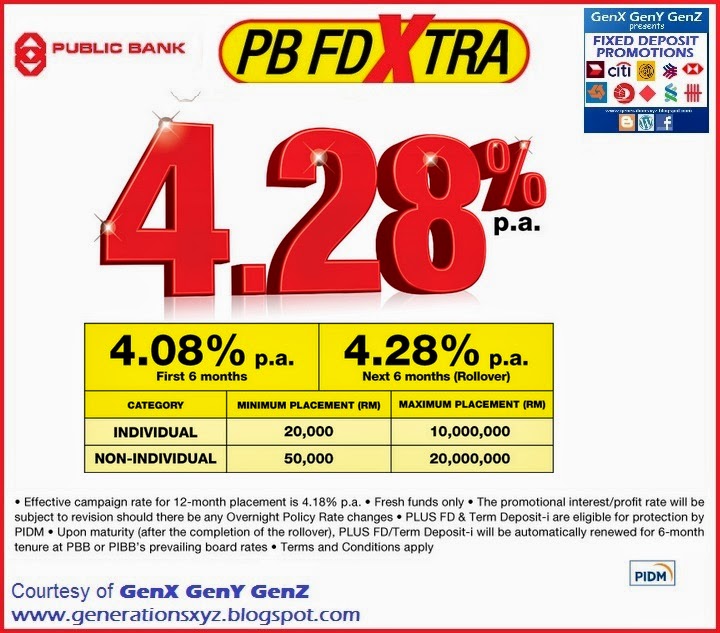

In mid 2008, banks were still offering FD about 4% interest rate (like what we have now). USD/MYR went above 3.5 (same thing now) and petrol went below USD60/barrel in 2009 (like what is happening now).

But by mid 2009, interest rates went below 2%!!!!

Below is what was posted by our President/CEO of FDMCGC MilesAndMore:

You can check FD interest rates between 2008 and 2011 at Original FD Thread.

this is very interesting. never considered that... but was thinking what else happened in 2008-2009...We are now in a similar position to that in 2008/2009 where we had a slow-down.

In mid 2008, banks were still offering FD about 4% interest rate (like what we have now). USD/MYR went above 3.5 (same thing now) and petrol went below USD60/barrel in 2009 (like what is happening now).

But by mid 2009, interest rates went below 2%!!!!

Below is what was posted by our President/CEO of FDMCGC MilesAndMore:

You can check FD interest rates between 2008 and 2011 at Original FD Thread.

with all those troubles in 2008, what did "they" do to get rates down to 2% by 2009 so that people continued to spend n consume?

i m not well not versed with the subject but i do think that has to do with a major change in policy in 2008/2009 - gates of debt opened, hence continued consumption/gdp growth while gomen n domestic debt started to climb dramatically since 2009.

question is... is there capacity now for same debt recipe to get us thru this time? if no, what will happen to int rates, bond rates and rm exchange rates?

QUOTE

The federal government’s borrowing shifted into higher gear from 2008, the year the Barisan National coalition lost its two-thirds parliamentary majority.

http://www.freemalaysiatoday.com/category/...illion-by-2020/

http://www.consumer.org.my/index.php/perso...-it-sustainable

http://www.freemalaysiatoday.com/category/...illion-by-2020/

http://www.consumer.org.my/index.php/perso...-it-sustainable

Jan 3 2015, 02:45 PM

Jan 3 2015, 02:45 PM

Quote

Quote

0.0727sec

0.0727sec

0.48

0.48

7 queries

7 queries

GZIP Disabled

GZIP Disabled