1) I want to refinance my house, which bank now offering the best rates?

2) The legal fees absorb by bank or me?

Thank you very much.

Refinancing, Need help from sifu

Refinancing, Need help from sifu

|

|

Dec 12 2014, 12:35 PM, updated 11y ago Dec 12 2014, 12:35 PM, updated 11y ago

Show posts by this member only | Post

#1

|

Junior Member

276 posts Joined: Oct 2011 From: Penang Island |

1) I want to refinance my house, which bank now offering the best rates?

2) The legal fees absorb by bank or me? Thank you very much. |

|

|

|

|

|

Dec 12 2014, 12:58 PM Dec 12 2014, 12:58 PM

Show posts by this member only | Post

#2

|

Senior Member

4,828 posts Joined: Jan 2012 |

Calling wild_card_my to advice

|

|

|

Dec 12 2014, 01:10 PM Dec 12 2014, 01:10 PM

Show posts by this member only | Post

#3

|

Senior Member

6,562 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(MadKat @ Dec 12 2014, 12:35 PM) 1) I want to refinance my house, which bank now offering the best rates? Thanks CFA28 for the summon2) The legal fees absorb by bank or me? Thank you very much. 1. The rates depend on the loan amount, generally, and I said this without guarantee, HLB and AMBANK are giving more competitive rates. In the end of the day though, the rates depend heavily on these 3 factors: a) The bank you are applying for b) The loan amount you are applying for c) Your credit rating (good paymaster vs bad paymaster vs having no loans at all) 2. As for the legal fees, only HSBC that I know of can absorb the legal fees in its entirety, but the rates CAN (not necessarily) be worse than the other banks by about 0.2 to 0.3%. On the other hand, other banks do offer to include the legal fees into the loan amount, so your refinancing would be at a margin of 90% + 2~%. - Faiz Azmi (+6 013 369 3993) edit: You can also post your questions in this thread sanctioned by our STAFF Lucifah linked below ya. No questions are too stupid, you can ask about ANYTHING related to mortgage there, dont be afraid: Mortgage Loan Package Inquiries This post has been edited by wild_card_my: Dec 12 2014, 01:25 PM |

|

|

Dec 12 2014, 01:28 PM Dec 12 2014, 01:28 PM

Show posts by this member only | Post

#4

|

Junior Member

276 posts Joined: Oct 2011 From: Penang Island |

QUOTE(wild_card_my @ Dec 12 2014, 01:10 PM) Thanks CFA28 for the summon Thanks CFA28 for facilitate the summoning1. The rates depend on the loan amount, generally, and I said this without guarantee, HLB and AMBANK are giving more competitive rates. In the end of the day though, the rates depend heavily on these 3 factors: a) The bank you are applying for b) The loan amount you are applying for c) Your credit rating (good paymaster vs bad paymaster vs having no loans at all) 2. As for the legal fees, only HSBC that I know of can absorb the legal fees in its entirety, but the rates CAN (not necessarily) be worse than the other banks by about 0.2 to 0.3%. On the other hand, other banks do offer to include the legal fees into the loan amount, so your refinancing would be at a margin of 90% + 2~%. - Faiz Azmi (+6 013 369 3993) a) The bank you are applying for I guessing MBB, HLB and AMBANK for comparison b) The loan amount you are applying for Loan amount is equivalent to the valuation amount right? c) Your credit rating (good paymaster vs bad paymaster vs having no loans at all) Should be ok I guess... 2. As for the legal fees, only HSBC that I know of can absorb the legal fees in its entirety, but the rates CAN (not necessarily) be worse than the other banks by about 0.2 to 0.3%. On the other hand, other banks do offer to include the legal fees into the loan amount, so your refinancing would be at a margin of 90% + 2~%. Is 0.2-0.3% consider a lot? I really got no clue. I don't even know how their interest is calculated...All I know is darn high. |

|

|

Dec 12 2014, 01:47 PM Dec 12 2014, 01:47 PM

Show posts by this member only | Post

#5

|

Senior Member

6,562 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(MadKat @ Dec 12 2014, 01:28 PM) Thanks CFA28 for facilitate the summoning 1. HLB would probably give the better rates, but all offers are only final when the LO is issued by the respective banks, and I really cannot speak for them although my firm empannel all 3 (we have 5 banks under us); I cannot guarantee that HLB would give the best offers. I usually apply up to 3 banks for each customer, any more than this is a waste and it may affect the customers future applications since these applications (whether they are approved or rejected by the bank, accepted or rejected by the customer) will be recorded in the CCRISa) The bank you are applying for I guessing MBB, HLB and AMBANK for comparison b) The loan amount you are applying for Loan amount is equivalent to the valuation amount right? c) Your credit rating (good paymaster vs bad paymaster vs having no loans at all) Should be ok I guess... 2. As for the legal fees, only HSBC that I know of can absorb the legal fees in its entirety, but the rates CAN (not necessarily) be worse than the other banks by about 0.2 to 0.3%. On the other hand, other banks do offer to include the legal fees into the loan amount, so your refinancing would be at a margin of 90% + 2~%. Is 0.2-0.3% consider a lot? I really got no clue. I don't even know how their interest is calculated...All I know is darn high. 2. The loan is equivalent to 90% (plus 2~3% for legal fees that can be financed into the bank) of the MV. Provided that these are your 1st and 2nd house. But if it is your 3rd house, your refinancing would be capped at just 70% 3. Typically, to calculate the difference without a calculator.... 0.1% in interest charge for RM100k loan amount is RM100 a year. So if the difference is 0.3%, for a loan amount of say, RM500k, the nominal difference is 3 x 100 x 5 = RM1,500 a year that you overpay (or save, depending on which bank you take la) Typically the Legal fees is about 2% of the loan amount only. So at 0.3% difference in interest rate, in 6.66 years you would already have covered the legal fees, and if you go beyond the 6 years, you would be over paying the bank that initially covered your legal fees. The legal fee absorption is good if you are planning to sell or refinance the house within 6 years of purchasing/refinancing. Sorry late reply, went for Friday Prayers |

|

|

Dec 12 2014, 02:29 PM Dec 12 2014, 02:29 PM

Show posts by this member only | Post

#6

|

Junior Member

276 posts Joined: Oct 2011 From: Penang Island |

QUOTE(wild_card_my @ Dec 12 2014, 01:47 PM) 1. HLB would probably give the better rates, but all offers are only final when the LO is issued by the respective banks, and I really cannot speak for them although my firm empannel all 3 (we have 5 banks under us); I cannot guarantee that HLB would give the best offers. I usually apply up to 3 banks for each customer, any more than this is a waste and it may affect the customers future applications since these applications (whether they are approved or rejected by the bank, accepted or rejected by the customer) will be recorded in the CCRIS So it is better to get 3 banks proposal/quotation then.2. The loan is equivalent to 90% (plus 2~3% for legal fees that can be financed into the bank) of the MV. Provided that these are your 1st and 2nd house. But if it is your 3rd house, your refinancing would be capped at just 70% 3. Typically, to calculate the difference without a calculator.... 0.1% in interest charge for RM100k loan amount is RM100 a year. So if the difference is 0.3%, for a loan amount of say, RM500k, the nominal difference is 3 x 100 x 5 = RM1,500 a year that you overpay (or save, depending on which bank you take la) Typically the Legal fees is about 2% of the loan amount only. So at 0.3% difference in interest rate, in 6.66 years you would already have covered the legal fees, and if you go beyond the 6 years, you would be over paying the bank that initially covered your legal fees. The legal fee absorption is good if you are planning to sell or refinance the house within 6 years of purchasing/refinancing. Sorry late reply, went for Friday Prayers One more question, how is the interest being calculated monthly? Example, Loan Amt 200k, required minimum payment monthly RM1k, when receive the statement, RM7xx paying interest, RM2xx credit to principal and sometimes the figure doesn't add up to RM1k also. |

|

|

|

|

|

Dec 12 2014, 02:34 PM Dec 12 2014, 02:34 PM

Show posts by this member only | Post

#7

|

Senior Member

4,828 posts Joined: Jan 2012 |

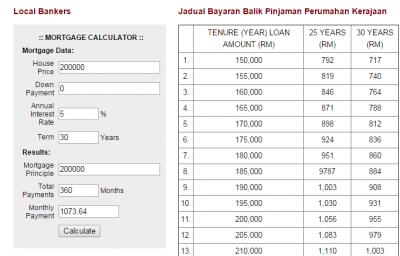

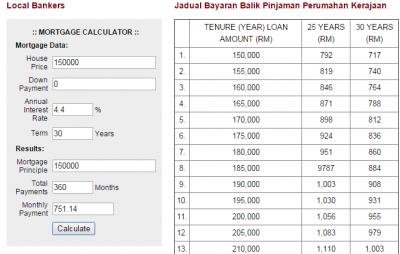

QUOTE(MadKat @ Dec 12 2014, 02:29 PM) So it is better to get 3 banks proposal/quotation then. Refer to the table belowOne more question, how is the interest being calculated monthly? Example, Loan Amt 200k, required minimum payment monthly RM1k, when receive the statement, RM7xx paying interest, RM2xx credit to principal and sometimes the figure doesn't add up to RM1k also. RHB has a good HL Calculator which is very transparent The monthly installment is used to repay Interest first and the balance to principal Just to add, in actual situation, the monthly interest will be based on the actual number of days but the RHB calculator is just based on annual interest / 12-mths for simplicity cos its difficult to calculate if follow actual number of days. This post has been edited by cfa28: Dec 12 2014, 02:49 PM Attached File(s)  HL_Repayment_Schedule.pdf ( 72.21k )

Number of downloads: 29

HL_Repayment_Schedule.pdf ( 72.21k )

Number of downloads: 29 |

|

|

Dec 12 2014, 02:36 PM Dec 12 2014, 02:36 PM

Show posts by this member only | Post

#8

|

Senior Member

11,554 posts Joined: Aug 2009 |

Under what reason you want to refinance?

If you take the current loan from past 5 years, it is not worth at all to refinance as you are delaying the time(if you are still young) and losing out on the interest. Just do your self a calculation and see what is your principle is. |

|

|

Dec 12 2014, 02:44 PM Dec 12 2014, 02:44 PM

Show posts by this member only | Post

#9

|

Junior Member

276 posts Joined: Oct 2011 From: Penang Island |

QUOTE(cfa28 @ Dec 12 2014, 02:34 PM) Refer to the table below Thank you, that explain a lot.RHB has a good HL Calculator which is very transparent The monthly installment is used to repay Interest first and the balance to principal QUOTE(supersound @ Dec 12 2014, 02:36 PM) Under what reason you want to refinance? I thought people do refinancing, get the money and buy prop or pay other debt.If you take the current loan from past 5 years, it is not worth at all to refinance as you are delaying the time(if you are still young) and losing out on the interest. Just do your self a calculation and see what is your principle is. It is a bad time to do refinance as the cuckoo of the economy situation? Next year the service will kena GST if wanna do refinance... Or is it possible to negotiate with current bank to reduce the interest or etc...? |

|

|

Dec 12 2014, 02:55 PM Dec 12 2014, 02:55 PM

|

Senior Member

11,554 posts Joined: Aug 2009 |

QUOTE(MadKat @ Dec 12 2014, 02:44 PM) Thank you, that explain a lot. I only consider refinance if the interest rate between 2 loans are > 5%, 10-15 years back, housing loan are freaking high at 9-11%.I thought people do refinancing, get the money and buy prop or pay other debt. It is a bad time to do refinance as the cuckoo of the economy situation? Next year the service will kena GST if wanna do refinance... Or is it possible to negotiate with current bank to reduce the interest or etc...? Else just continue to pay the current loan. Unless you have too much money to waste, then just take it. If you feel under pressure with current situation, consider use credit card to make money. |

|

|

Dec 12 2014, 03:04 PM Dec 12 2014, 03:04 PM

|

Junior Member

276 posts Joined: Oct 2011 From: Penang Island |

QUOTE(supersound @ Dec 12 2014, 02:55 PM) I only consider refinance if the interest rate between 2 loans are > 5%, 10-15 years back, housing loan are freaking high at 9-11%. I need to get quote then only can compare between 2 contract then. Existing one is signed at 2005.Else just continue to pay the current loan. Unless you have too much money to waste, then just take it. If you feel under pressure with current situation, consider use credit card to make money. I don't have money to waste, as just recently only starts to concern about money. Yah, I'm seeellloooowwww learner... So anything now concerning dollar and cent need to consider, cost cutting, SCM myself. Btw, how to make money using CC? |

|

|

Dec 12 2014, 03:19 PM Dec 12 2014, 03:19 PM

|

Senior Member

11,554 posts Joined: Aug 2009 |

QUOTE(MadKat @ Dec 12 2014, 03:04 PM) I need to get quote then only can compare between 2 contract then. Existing one is signed at 2005. Just say you are taking your loan in 2005 for 25 years, which you will settle it by 2030. BLR at that time should be about 6% - 0.5-1%, so 5% I guess? Hope you can state clearly on all this.I don't have money to waste, as just recently only starts to concern about money. Yah, I'm seeellloooowwww learner... So anything now concerning dollar and cent need to consider, cost cutting, SCM myself. Btw, how to make money using CC? You already paying the loan for 9 years, which should be paying quite a sum of interest. Use cash back credit cards to make money, buy groceries and sell it back, each month you can make about rm30-100. And you no need to get any quotation, since refinance is still a "new loan". At the end of refinance period, you will know that you paid extra interest and only can settle it after 2030. This post has been edited by supersound: Dec 12 2014, 03:21 PM |

|

|

Dec 12 2014, 03:32 PM Dec 12 2014, 03:32 PM

|

Junior Member

276 posts Joined: Oct 2011 From: Penang Island |

QUOTE(supersound @ Dec 12 2014, 03:19 PM) Just say you are taking your loan in 2005 for 25 years, which you will settle it by 2030. BLR at that time should be about 6% - 0.5-1%, so 5% I guess? Hope you can state clearly on all this. I think is BLR -1%, need to double check it though.You already paying the loan for 9 years, which should be paying quite a sum of interest. Use cash back credit cards to make money, buy groceries and sell it back, each month you can make about rm30-100. And you no need to get any quotation, since refinance is still a "new loan". At the end of refinance period, you will know that you paid extra interest and only can settle it after 2030. What is the current interest rate? |

|

|

|

|

|

Dec 12 2014, 03:39 PM Dec 12 2014, 03:39 PM

|

Senior Member

4,828 posts Joined: Jan 2012 |

QUOTE(MadKat @ Dec 12 2014, 03:32 PM) Current is between BLR less 2.2% to 2.4%, depending on loan amount and credit profileYou can request for your Bank to revise the rate bit they will probably go as low as between 1.8% to 2.0% |

|

|

Dec 12 2014, 03:42 PM Dec 12 2014, 03:42 PM

|

Junior Member

276 posts Joined: Oct 2011 From: Penang Island |

|

|

|

Dec 12 2014, 03:57 PM Dec 12 2014, 03:57 PM

|

Senior Member

4,828 posts Joined: Jan 2012 |

|

|

|

Dec 12 2014, 04:01 PM Dec 12 2014, 04:01 PM

|

Junior Member

276 posts Joined: Oct 2011 From: Penang Island |

|

|

|

Dec 12 2014, 04:06 PM Dec 12 2014, 04:06 PM

|

Senior Member

11,554 posts Joined: Aug 2009 |

QUOTE(MadKat @ Dec 12 2014, 03:32 PM) Do provide me your loan repayment period, interest rate and each month's cost.But without looking at it also I can tell you the answer : you are wasting your money. Just follow what I'm doing, quite effective to gain money without taking too much risk : I have MBB's dual card with 5% cash back + 5 X TPs(which I convert it back to cash vouchers), that used for paying my TM, TNB bills that only cost me rm250 and some once a blue moon online shopping(now with USD so strong, I can forget about it). I need to spend at least rm1000 to get rm50 of cash back, so balance of the rm750 I use it to pay my wife's kindi TM and TNB bills, rm400, so I give less money to my wife. The balance rm350 is used to pay my uncle's TNB bill, so rm50 every month sure on hand. Then for my groceries, petrol and Maxis are settled by HLB's STUPID card. My own spending on groceries are about rm200 a month, petrol about rm400(2 cars), so again I got extra rm400 that I can use it to make money. With rm400, I can buy 13 bags of Milo 2KG soft packs for rm30(during promotion I sure take few)and then sell it for rm30.5-31. As I'm getting 8.25% of cash back, the actual price of the Milo is rm27.52, so I gain rm3 per pack or rm39. But found a better deal, Libresse pads for rm2(original price rm8), already bought 20 packs and wait till the offer finishes then sell it back at rm8, so rm120 once sold out. With both the cash back cards, I only pay rm1867.5 for rm2000 spending, which partly are my spending and others are used to make money. With rm132.50, you can use this money to offset your interest. So this is how I free up my money. |

|

|

Dec 12 2014, 04:27 PM Dec 12 2014, 04:27 PM

|

Junior Member

276 posts Joined: Oct 2011 From: Penang Island |

QUOTE(supersound @ Dec 12 2014, 04:06 PM) Do provide me your loan repayment period, interest rate and each month's cost. That is a very smart way of you managing your money. I have the MBB 2 card also But without looking at it also I can tell you the answer : you are wasting your money. Just follow what I'm doing, quite effective to gain money without taking too much risk : I have MBB's dual card with 5% cash back + 5 X TPs(which I convert it back to cash vouchers), that used for paying my TM, TNB bills that only cost me rm250 and some once a blue moon online shopping(now with USD so strong, I can forget about it). I need to spend at least rm1000 to get rm50 of cash back, so balance of the rm750 I use it to pay my wife's kindi TM and TNB bills, rm400, so I give less money to my wife. The balance rm350 is used to pay my uncle's TNB bill, so rm50 every month sure on hand. Then for my groceries, petrol and Maxis are settled by HLB's STUPID card. My own spending on groceries are about rm200 a month, petrol about rm400(2 cars), so again I got extra rm400 that I can use it to make money. With rm400, I can buy 13 bags of Milo 2KG soft packs for rm30(during promotion I sure take few)and then sell it for rm30.5-31. As I'm getting 8.25% of cash back, the actual price of the Milo is rm27.52, so I gain rm3 per pack or rm39. But found a better deal, Libresse pads for rm2(original price rm8), already bought 20 packs and wait till the offer finishes then sell it back at rm8, so rm120 once sold out. With both the cash back cards, I only pay rm1867.5 for rm2000 spending, which partly are my spending and others are used to make money. With rm132.50, you can use this money to offset your interest. So this is how I free up my money. Who you sell your goods to? Mini mart? |

|

|

Dec 12 2014, 04:31 PM Dec 12 2014, 04:31 PM

|

Senior Member

11,554 posts Joined: Aug 2009 |

QUOTE(MadKat @ Dec 12 2014, 04:27 PM) That is a very smart way of you managing your money. I have the MBB 2 card also Nope, to neighbors and traditional coffee shops.Who you sell your goods to? Mini mart? Just go to Tesco, Giant, AeonBig and see whatever are cheap, just sapu them, then no more offer sell it back. Let bank work for you, don't work for bank. That's why I never encourage people do refinance unless really in deep trouble. As your loan's interest rate and current loan offer's difference are about 1%, so just forget about it. |

|

|

Dec 12 2014, 04:41 PM Dec 12 2014, 04:41 PM

|

Junior Member

276 posts Joined: Oct 2011 From: Penang Island |

QUOTE(supersound @ Dec 12 2014, 04:31 PM) Nope, to neighbors and traditional coffee shops. Yeah, just gonna contact banker request for revision of interest rate.Just go to Tesco, Giant, AeonBig and see whatever are cheap, just sapu them, then no more offer sell it back. Let bank work for you, don't work for bank. That's why I never encourage people do refinance unless really in deep trouble. As your loan's interest rate and current loan offer's difference are about 1%, so just forget about it. Well, anyway I just check the MBB 2 card T&C, apparently the cash back only on weekends and cap at RM50 per principal card holder per month. So... Still |

|

|

Dec 12 2014, 06:07 PM Dec 12 2014, 06:07 PM

|

Senior Member

11,554 posts Joined: Aug 2009 |

QUOTE(MadKat @ Dec 12 2014, 04:41 PM) Yeah, just gonna contact banker request for revision of interest rate. MBB most of the bills can be paid using M2U, so I'll pay on weekends Well, anyway I just check the MBB 2 card T&C, apparently the cash back only on weekends and cap at RM50 per principal card holder per month. So... Still This post has been edited by supersound: Dec 12 2014, 06:07 PM |

|

|

Dec 12 2014, 08:23 PM Dec 12 2014, 08:23 PM

|

Senior Member

6,562 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(MadKat @ Dec 12 2014, 02:29 PM) So it is better to get 3 banks proposal/quotation then. Noted, and sure, I can help you with that if you want to proceed with the refinancing: I have 5 banks One more question, how is the interest being calculated monthly? Example, Loan Amt 200k, required minimum payment monthly RM1k, when receive the statement, RM7xx paying interest, RM2xx credit to principal and sometimes the figure doesn't add up to RM1k also. --- I got in a little late replying to this thread as I was meeting a client later in the evening. But CFA28 has pretty much covered things up. You can use the table and see how the money is divided up. But keep in mind that the table would be off if you miss a single repayment, or made an advance payment on your installments. Amortization table, you should use it to get a more thorough understanding of the reducing balance loan... ask about it here if you need more explanation:  --- The differences between the interest add up over the years. A typical difference of 0.1% for every RM100k loan equals to RM100 a year. So if your loan balance is RM200k, and your current rate is BLR - 1.0%, by refinancing to a -2.4% you could save about 14 * 100 * 2 = RM2800 a year (interest payable) and this adds up going forward. Of course, the loan balance would be reduced as you go along. And by refinancing you would incur costs such as the legal, valuation, and stamp duty that is rated at about 2% of the financing amount. This post has been edited by wild_card_my: Dec 12 2014, 09:39 PM |

|

|

Dec 12 2014, 09:51 PM Dec 12 2014, 09:51 PM

|

Senior Member

11,554 posts Joined: Aug 2009 |

QUOTE(wild_card_my @ Dec 12 2014, 08:23 PM) Noted, and sure, I can help you with that if you want to proceed with the refinancing: I have 5 banks http://mega3.com.my/site/index.php?cat=67--- I got in a little late replying to this thread as I was meeting a client later in the evening. But CFA28 has pretty much covered things up. You can use the table and see how the money is divided up. But keep in mind that the table would be off if you miss a single repayment, or made an advance payment on your installments. Amortization table, you should use it to get a more thorough understanding of the reducing balance loan... ask about it here if you need more explanation:  --- The differences between the interest add up over the years. A typical difference of 0.1% for every RM100k loan equals to RM100 a year. So if your loan balance is RM200k, and your current rate is BLR - 1.0%, by refinancing to a -2.4% you could save about 14 * 100 * 2 = RM2800 a year (interest payable) and this adds up going forward. Of course, the loan balance would be reduced as you go along. And by refinancing you would incur costs such as the legal, valuation, and stamp duty that is rated at about 2% of the financing amount. Sorry if I getting a little long-winded with my replies. I don't know where your table comes from, but I prefer use back Malaysia's calculation to prevent any confusion.

Assuming TS's taking rm200k loan with 5% interest for 30 years, starting from 2005, by now he already paid rm115953.12. Now I assuming 60% from the total amount paid are interest, so rm69571. Principle only settled rm46382. And TS shall able to settle his loan on 2035. To round it up for refinance, rm150000.

According to above table, no doubt TS do pay lesser at rm751.14, but bare in mind that he only able to settle the loan on 2044, which is 9 years later from his original plan. Now to calculate total amount paid for both loans(assuming BLR never change), 1st loan, rm386510.4 where rm186510.4 is the interest paid to bank. On the refinance of rm150000, total 270410.4 where rm120410.4. But wait, TS already paid 9 years on his first loan and ~rm70000 of interest paid, so the total interest paid is rm190410.4. For nothing TS wasted rm3900 and extra 9 years. Aiyah, forgot that settling the first loan have some extra charges and refinance another charge, how much is that? Just say the total is rm5000, so TS in actual have to fork out rm8900 extra and have to run up and down banks and lawyer firm. |

|

|

Dec 12 2014, 09:58 PM Dec 12 2014, 09:58 PM

|

Senior Member

6,562 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(supersound @ Dec 12 2014, 09:51 PM) http://mega3.com.my/site/index.php?cat=67 Im way too tired to go through your numbers, but if you had used the same amortization table that I posted, and inputting the same figures as you did, you would get the same results anyway. Amortization calculations are the same across the world, the only differences are if the interests are calculated based on a daily, monthly, bi-monthly, yearly rests etc. I am surprised that someone as experienced as you actually thought that there was a difference between using the malaysian based or foreign based amortization table. It's just a simple formula applied to the principal (outstanding) with interests and tenure as the variables. I don't know where your table comes from, but I prefer use back Malaysia's calculation to prevent any confusion. Assuming TS's taking rm200k loan with 5% interest for 30 years, starting from 2005, by now he already paid rm115953.12. Now I assuming 60% from the total amount paid are interest, so rm69571. Principle only settled rm46382. And TS shall able to settle his loan on 2035. To round it up for refinance, rm150000. According to above table, no doubt TS do pay lesser at rm751.14, but bare in mind that he only able to settle the loan on 2044, which is 9 years later from his original plan. Now to calculate total amount paid for both loans(assuming BLR never change), 1st loan, rm386510.4 where rm186510.4 is the interest paid to bank. On the refinance of rm150000, total 270410.4 where rm120410.4. But wait, TS already paid 9 years on his first loan and ~rm70000 of interest paid, so the total interest paid is rm190410.4. For nothing TS wasted rm3900 and extra 9 years. Aiyah, forgot that settling the first loan have some extra charges and refinance another charge, how much is that? Just say the total is rm5000, so TS in actual have to fork out rm8900 extra and have to run up and down banks and lawyer firm.  Can someone take care of the guy on for me for the time being? I'll be back in the morning to reply his misleading numbers. I'll put it out here as a hint to help those who bother to calculate and present the results here, that there are definitely benefits in reducing the interest by 1.4% even if you need to pay the legal fees, as well keeping the remaining tenure the same as a new refinancing scheme. Good night everyone. This post has been edited by wild_card_my: Dec 12 2014, 10:06 PM |

|

|

Dec 12 2014, 10:52 PM Dec 12 2014, 10:52 PM

|

Senior Member

11,554 posts Joined: Aug 2009 |

QUOTE(wild_card_my @ Dec 12 2014, 09:58 PM) Im way too tired to go through your numbers, but if you had used the same amortization table that I posted, and inputting the same figures as you did, you would get the same results anyway. Amortization calculations are the same across the world, the only differences are if the interests are calculated based on a daily, monthly, bi-monthly, yearly rests etc. I am surprised that someone as experienced as you actually thought that there was a difference between using the malaysian based or foreign based amortization table. It's just a simple formula applied to the principal (outstanding) with interests and tenure as the variables. Well, even the table you provided are the same, but you never mention to TS that he have to pay extra money to bank and wasting another 9 years. Can someone take care of the guy on for me for the time being? I'll be back in the morning to reply his misleading numbers. I'll put it out here as a hint to help those who bother to calculate and present the results here, that there are definitely benefits in reducing the interest by 1.4% even if you need to pay the legal fees, as well keeping the remaining tenure the same as a new refinancing scheme. Good night everyone. By looking at your reply, you only trying your best to insult me on my "incompetency" on providing the table but can't prove my facts that extra money and time being wasted were flaw, following your logic. Is not you tired with me, is your myth being busted nicely. Refinance only work when the first loan was at >9% which happen on past 20 years. I hope you can come out with another table stating refinance can save money and time And by using your link that you provided, you just slapped your face, the refinance value are not rm150000 as I said, it is rm162000. So TS will have to pay extra again despite wasting time. This post has been edited by supersound: Dec 12 2014, 11:00 PM |

|

|

Dec 13 2014, 10:47 AM Dec 13 2014, 10:47 AM

|

Senior Member

6,562 posts Joined: Jan 2003 From: Kuala Lumpur |

Uncle, after I post this I hope you can stand down and accept that you have the wrong idea about refinancing. Im in the middle of filming for my personal financial-management youtube series, but I spent some time in this nice morning (morning sun is good for lighting) just to show you what you missed.

Refinancing is a financial move with a lot of flexibility: a) you can reduce the installment amount payable by extending the tenure and/or locking-in better interest rates b) you can borrow from the bank for the cash-out portion at the lowest interest rate possible, no other loans that are available to the general public have lower interest rates than a mortgage. Many people use this money for other business and investments that are yielding higher returns than what the banks are charging as interests. This is called leveraging on your assets instead of sitting on them. Whether or not to do it depends on you, but there shouldn't be 1 true way to go about it. c. You can shorten the tenure, but still pay the same installment amount d. You can maintain the tenure while lowering the installment if you could lock-in a better rate (like what I am going to show below) Keep this in your head: refinancing is flexible, and depending on your situation and the economic conditions, you should take the move (or not) as you see fit. Only a stubborn person would think that there is only 1 true way of doing things without considering the situation of others. My job is to listen to my clients and give them options based on what I know and what is available to them. Your job... apparently is to chatter like a [redacted] about the first thing that appeared in your head without contributing anything to solve these people's financial problems. My job entails me to provide solutions to my clients and prospects: I get PMs, emails, whatsap, and phone calls everyday asking for my financial consultancy services. I can attribute those to the way I answer the questions posted in this forum to the best of my abilities; for example, when someone is asking for a refinance just like the TS did, just look at the details of my answer - you wont get that from a normal consultant. I refrain from giving unsolicited advice like how you seem to enjoy doing (again, signs of old age, no offense to other lovely elderlies). These forummers don't need over the top loud mouthing by someone who thinks he knows it all because he is either old, or thinks he is smarter than anyone in the room. Sorry for making this rather personal but you never bothered to hide your misguided hatred towards financial consultants either, which in my opinion, is very childish. Don't dish it out if you can't take it. --- --- --- I will start with these numbers: Initial loan RM200k 30 years tenure Interest at BLR - 1% as per what TS mentioned *Do note that I work with my clients closely and I would ask them for their loan statements, without which would be difficult for me to know the total installments paid over the years due to the changes in BLR. But for the purpose of our education session today, the BLR in 2005 was 6.00% but increased to 6.75% in 2007, and hovered around that number and ended up as 6.85% today. As such, whatever outstanding balance stated below cannot be accurate altogether. But that is why you need a consultant to go through these numbers for you and present it in the way that you would understand.   Now, let's refinance based on the remaining balance + cost of refinancing   Results, comments, and conclusion: a. The tenure (in this case, to please the uncle) has not been changed. The loan remains to end after 360months (30 years) on December 2034. b. The installment has changed from RM1179.88 to RM1086.10 (including the cost of refinancing) from the 121st month onwards till the end of the loan tenure. This move lowers your installment by about RM100 a month, without extending the tenure. Why would you want to pay RM100 a month to the bank? Because uncle said "no need to refinance"? c. Here is the calculation for total savings: CODE Total installment paid by refinancing midway in the end of the 10th year, calculated by adding all the installments from the 1st month till 360th month: = [Total installments paid from 1st to 120th month] + [total installments paid from 121st to 360th month, that is after the refinancing] = [RM1179.88 x 120] + [RM1086.10 x 240] = RM141,585.60 + RM260,664 = RM402,249.60 CODE Differences in total installments paid between refinancing midway VS maintaining the old loan: RM424,756.80 - RM402,249.60 = RM22,507.20 Or in simple terms, because the client needs to pay off the outstanding balance anyway, ALL you need to do is to SIMPLY differentiate the difference going forward between maintaining the status quu by paying RM1179.88 x 240 months VS refinancing midway and paying RM1086.10x240 months: CODE [RM1179.88x240] - [RM1086.10x240] = RM283171.2 - RM260664 = RM22,507.20 The client would save RM22,507.20 in this particular case. Of course, every person would face a number of different situations. To refinance or not depends on their needs, situation, economic climate, and ambition (do they want to be extremely, moderately, or lowly leveraged?). And I work with my clients to find a solution to their needs or problems. In addition, there are many other things that you could do with refinancing: to get a loan from the bank at low interest rate for the purpose of investing in other, better opportunities; to extend the tenure and reduce the installments for better cash flow (who are you to judge whether they should do it or not?), to shorten the tenure but pay same amount (like I have explained above), or to take the advantage of the periodical lower interest rates offered by the banks. Uncle, maybe due to your age you have become risk aversed and afraid of taking risks, whether or not it is reasonable is debatable because a number of my older clients are still able to stomach some risks due to the fact that they have their retirement nests ready (planned by myself, of course); but just because you are near the end of your line (of career, you know, because of the age) doesn't mean you should stop others from exploring their options and opportunities. You are quite the poison in this subforum as far as I can tell. Other people have opinions and talk about them openly, occasionally arguing by providing citations and or numbers. But you? You chide other people's efforts because you think it's either your way or the highway. I hope this has served as a good lesson to you in terms of sharing opinions and ideas online. Have a good day. Don't forget the medicine. This post has been edited by wild_card_my: Dec 13 2014, 04:20 PM |

|

|

Dec 13 2014, 12:42 PM Dec 13 2014, 12:42 PM

|

Senior Member

1,178 posts Joined: May 2007 |

QUOTE(wild_card_my @ Dec 13 2014, 10:47 AM) Uncle, after I post this I hope you can stand down and accept that you have the wrong idea about refinancing. Im in the middle of filming for my personal financial-management youtube series, but I spent some time in this nice morning (morning sun is good for lighting) just to prove you wrong. Good job nice effort.thx very much.The fact of the matter is refinancing is a financial move with a lot of flexibility: a) you can reduce the installments paid by extending the tenure b) you can borrow from the bank for the cash-out portion at the lowest interest rate possible, no other loans that are available to the general public have lower interest rates than a mortgage. Many people use this money for other business and investments that are yielding higher returns than what the bank charge as interests. This is called leveraging on your assets instead of sitting on it. Whether or not to do it depends on you, but there shouldn't be 1 true way to go about it. c. You can shorten the tenure, but paying the same installment amount if you can lock in a good interest rate d. You can maintain the tenure and pay lowered installments (like what I am going to show below) The idea is that refinancing is flexible, and depending on your situation and the economic conditions, you should take the move (or not) as you see fit. Only a stubborn person would think that there is only 1 true way of doing things without considering the situation of others. My job is to listen to my clients and give them options based on what I know and what is available to them. Your job... apparently is to chatter like a [redacted] about the first thing that appeared in your head without contributing anything to solve these people's financial problems. I work with solutions, those are what the world needs, not needless loud mouthing. Sorry for being rather personal but someone here never bothered to hide his (or her?) hatred towards financial consultant either. Don't dish it out if you can't take it. --- --- --- I will start with these numbers: Initial loan RM200k 30 years tenure Interest at BLR - 1% as per what TS mentioned *Do note that I work with my clients closely and I would ask them for their loan statements, without which would be difficult for me to know the total installments paid over the years due to the changes in BLR. But for the purpose of our education session today, the BLR in 2005 was 6.00% but increased to 6.75% in 2007, and hovered around that number and ended up as 6.85% today. As such, whatever outstanding balance stated below cannot be accurate altogether. But that is why you need a consultant to go through these numbers for you and present it in the way that you would understand.   Now, let's refinance based on the remaining balance + cost of refinancing   Results, comments, and conclusion: a. The tenure (in this case, to please the uncle) has not been changed. The loan remains to end after 360months (30 years) on December 2034. b. The installment has changed from RM1179.88 to RM1086.10 (including the cost of refinancing) from the 121st month onwards till the end of the loan tenure. This move lowers your installment by about RM100 a month, without extending the tenure. Why would you want to pay RM100 a month to the bank? Because uncle said "no need to refinance"? c. Here is the total savings: CODE Total installment paid by refinancing from the 1st month till 360th month: = [Total installments paid from 1st to 120th month] + [total installments paid from 121st month to 360th month that is after the refinancing] = [RM1179.88 x 120 months = RM141,585.6] + [RM260,663.21 (as per the calculation poster above)] = 141585.6 + 260663.21 = RM402,248.81 CODE Differences in total installments paid between refinancing midway or maintaining the old loan: RM424757.47 - RM402248.81 = RM22,508.66 You would save RM22,508.66 in this particular case. Of course, every person would face a number of different situations. To refinance or not depends on your needs, situation, and ambition. And I work with my clients in finding a solution to your needs or problems. Have a good day. Between just leave the sakai alone..dun need feed it as it appear in every thread promoting sakainess expertise. |

|

|

Dec 13 2014, 05:50 PM Dec 13 2014, 05:50 PM

|

Senior Member

11,554 posts Joined: Aug 2009 |

QUOTE(wild_card_my @ Dec 13 2014, 10:47 AM) Uncle, after I post this I hope you can stand down and accept that you have the wrong idea about refinancing. Im in the middle of filming for my personal financial-management youtube series, but I spent some time in this nice morning (morning sun is good for lighting) just to show you what you missed. I know you want to insult me using uncle. But then you are still cheating TS.Refinancing is a financial move with a lot of flexibility: a) you can reduce the installment amount payable by extending the tenure and/or locking-in better interest rates b) you can borrow from the bank for the cash-out portion at the lowest interest rate possible, no other loans that are available to the general public have lower interest rates than a mortgage. Many people use this money for other business and investments that are yielding higher returns than what the banks are charging as interests. This is called leveraging on your assets instead of sitting on them. Whether or not to do it depends on you, but there shouldn't be 1 true way to go about it. c. You can shorten the tenure, but still pay the same installment amount d. You can maintain the tenure while lowering the installment if you could lock-in a better rate (like what I am going to show below) Keep this in your head: refinancing is flexible, and depending on your situation and the economic conditions, you should take the move (or not) as you see fit. Only a stubborn person would think that there is only 1 true way of doing things without considering the situation of others. My job is to listen to my clients and give them options based on what I know and what is available to them. Your job... apparently is to chatter like a [redacted] about the first thing that appeared in your head without contributing anything to solve these people's financial problems. My job entails me to provide solutions to my clients and prospects: I get PMs, emails, whatsap, and phone calls everyday asking for my financial consultancy services. I can attribute those to the way I answer the questions posted in this forum to the best of my abilities; for example, when someone is asking for a refinance just like the TS did, just look at the details of my answer - you wont get that from a normal consultant. I refrain from giving unsolicited advice like how you seem to enjoy doing (again, signs of old age, no offense to other lovely elderlies). These forummers don't need over the top loud mouthing by someone who thinks he knows it all because he is either old, or thinks he is smarter than anyone in the room. Sorry for making this rather personal but you never bothered to hide your misguided hatred towards financial consultants either, which in my opinion, is very childish. Don't dish it out if you can't take it. --- --- --- I will start with these numbers: Initial loan RM200k 30 years tenure Interest at BLR - 1% as per what TS mentioned *Do note that I work with my clients closely and I would ask them for their loan statements, without which would be difficult for me to know the total installments paid over the years due to the changes in BLR. But for the purpose of our education session today, the BLR in 2005 was 6.00% but increased to 6.75% in 2007, and hovered around that number and ended up as 6.85% today. As such, whatever outstanding balance stated below cannot be accurate altogether. But that is why you need a consultant to go through these numbers for you and present it in the way that you would understand.   Now, let's refinance based on the remaining balance + cost of refinancing   Results, comments, and conclusion: a. The tenure (in this case, to please the uncle) has not been changed. The loan remains to end after 360months (30 years) on December 2034. b. The installment has changed from RM1179.88 to RM1086.10 (including the cost of refinancing) from the 121st month onwards till the end of the loan tenure. This move lowers your installment by about RM100 a month, without extending the tenure. Why would you want to pay RM100 a month to the bank? Because uncle said "no need to refinance"? c. Here is the calculation for total savings: CODE Total installment paid by refinancing midway in the end of the 10th year, calculated by adding all the installments from the 1st month till 360th month: = [Total installments paid from 1st to 120th month] + [total installments paid from 121st to 360th month, that is after the refinancing] = [RM1179.88 x 120] + [RM1086.10 x 240] = RM141,585.60 + RM260,664 = RM402,249.60 CODE Differences in total installments paid between refinancing midway VS maintaining the old loan: RM424,756.80 - RM402,249.60 = RM22,507.20 Or in simple terms, because the client needs to pay off the outstanding balance anyway, ALL you need to do is to SIMPLY differentiate the difference going forward between maintaining the status quu by paying RM1179.88 x 240 months VS refinancing midway and paying RM1086.10x240 months: CODE [RM1179.88x240] - [RM1086.10x240] = RM283171.2 - RM260664 = RM22,507.20 The client would save RM22,507.20 in this particular case. Of course, every person would face a number of different situations. To refinance or not depends on their needs, situation, economic climate, and ambition (do they want to be extremely, moderately, or lowly leveraged?). And I work with my clients to find a solution to their needs or problems. In addition, there are many other things that you could do with refinancing: to get a loan from the bank at low interest rate for the purpose of investing in other, better opportunities; to extend the tenure and reduce the installments for better cash flow (who are you to judge whether they should do it or not?), to shorten the tenure but pay same amount (like I have explained above), or to take the advantage of the periodical lower interest rates offered by the banks. Uncle, maybe due to your age you have become risk aversed and afraid of taking risks, whether or not it is reasonable is debatable because a number of my older clients are still able to stomach some risks due to the fact that they have their retirement nests ready (planned by myself, of course); but just because you are near the end of your line (of career, you know, because of the age) doesn't mean you should stop others from exploring their options and opportunities. You are quite the poison in this subforum as far as I can tell. Other people have opinions and talk about them openly, occasionally arguing by providing citations and or numbers. But you? You chide other people's efforts because you think it's either your way or the highway. I hope this has served as a good lesson to you in terms of sharing opinions and ideas online. Have a good day. Don't forget the medicine. He already paid 9 years, and you never include the interest paid from the first loan. And you only use lesser time once you got kicked by me. Good strategy to use term "tired" to continue cheating people and avoid being held responsible if giving false info. Also, is good that you use 5.85% which I used 5%, another good way to cheat With your logic, sure it looks people taking refinance paying lesser interest. This post has been edited by supersound: Dec 13 2014, 05:51 PM |

|

|

Dec 13 2014, 08:19 PM Dec 13 2014, 08:19 PM

|

Senior Member

6,562 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(supersound @ Dec 13 2014, 05:50 PM) I know you want to insult me using uncle. But then you are still cheating TS. Uncle, I call you that with the utmost respect, I think your unsolicited advice may have helped some forummers in some unimaginable ways; but if you are so insecure about it maybe it is because you know that people loathe listening to you? I can't help those with insecurity issues, I am not a psychologist. He already paid 9 years, and you never include the interest paid from the first loan. And you only use lesser time once you got kicked by me. Good strategy to use term "tired" to continue cheating people and avoid being held responsible if giving false info. Also, is good that you use 5.85% which I used 5%, another good way to cheat With your logic, sure it looks people taking refinance paying lesser interest. But I think your issue can be attributed to your prejudice against the financial planners; perhaps you met the wrong ones, or perhaps you were too naive to differentiate between the honest and the dishonest ones: as such, since age has caught up to you, you are unable to change and it is clouding your decision making skills on top of being too stubborn to admit defeat. I tell you what, I will help you see this through. Going forward without refinancing, the client is poised to pay RM1,179.88x240month = RM283,171.20 in total By refinancing today, of the outstanding balance amount plus refinancing cost, the client will pay RM1,086.10x240month = RM260,664 in total So by refinancing, the client would save: RM283,171.20 - RM260,664.00 = RM22,507.2 --- --- --- Uncle can you see it now? By simply refinancing, the client would have saved RM22,507.20! What else do you want? Medicine? QUOTE(bee993 @ Dec 13 2014, 12:42 PM) Good job nice effort.thx very much. Thanks for the support. I noticed his behavior in other threads too. But I can't just leave him be especially when he quotes me.Between just leave the sakai alone..dun need feed it as it appear in every thread promoting sakainess expertise. This post has been edited by wild_card_my: Dec 13 2014, 08:46 PM |

|

|

Dec 13 2014, 09:44 PM Dec 13 2014, 09:44 PM

|

Senior Member

11,554 posts Joined: Aug 2009 |

QUOTE(wild_card_my @ Dec 13 2014, 08:19 PM) Uncle, I call you that with the utmost respect, I think your unsolicited advice may have helped some forummers in some unimaginable ways; but if you are so insecure about it maybe it is because you know that people loathe listening to you? I can't help those with insecurity issues, I am not a psychologist. Suggest you change the 5.85% to 5%, unless you are here to mislead people.But I think your issue can be attributed to your prejudice against the financial planners; perhaps you met the wrong ones, or perhaps you were too naive to differentiate between the honest and the dishonest ones: as such, since age has caught up to you, you are unable to change and it is clouding your decision making skills on top of being too stubborn to admit defeat. I tell you what, I will help you see this through. Going forward without refinancing, the client is poised to pay RM1,179.88x240month = RM283,171.20 in total By refinancing today, of the outstanding balance amount plus refinancing cost, the client will pay RM1,086.10x240month = RM260,664 in total So by refinancing, the client would save: RM283,171.20 - RM260,664.00 = RM22,507.2 --- --- --- Uncle can you see it now? By simply refinancing, the client would have saved RM22,507.20! What else do you want? Medicine? Thanks for the support. I noticed his behavior in other threads too. But I can't just leave him be especially when he quotes me. But since your job are to cheat and mislead, I doubt you will change. Calling a person that don't know the age are more on insulting, rather than respecting. And for your info, the wrong financial planner are a person that will advise people don't be greedy and to invest on something to make the rich become richer, poor become poorer, in this case, all the "investment" other than ASB, ASW, EPF and FD. I never meet with wrong financial planner, but right financial planner like you that always mislead people. You see, as a cheater, you still avoiding changing the calculation to 5% but keep on calling me uncle just to hide the fact behind. |

|

|

Dec 13 2014, 09:50 PM Dec 13 2014, 09:50 PM

|

Senior Member

6,562 posts Joined: Jan 2003 From: Kuala Lumpur |

Ill let the rest of us decide whether or not I am a cheater or you are just being childish. I presented numbers in its most basic form while you are just chattering like a monkey repeating the same things over and over again.

|

|

|

Dec 13 2014, 10:02 PM Dec 13 2014, 10:02 PM

|

Senior Member

4,258 posts Joined: Nov 2012 |

QUOTE(wild_card_my @ Dec 13 2014, 09:50 PM) Ill let the rest of us decide whether or not I am a cheater or you are just being childish. I presented numbers in its most basic form while you are just chattering like a monkey repeating the same things over and over again. Ya I agree with you. How come such an easy stuff need to talk so much ? I don't understand why supersound want to make it so complicatedIf the refinancing involve lower interest rate, and the total interest saved is less than the cost of refinancing, of course it is beneficial to refinance. Very simple logic. |

|

|

Dec 13 2014, 10:08 PM Dec 13 2014, 10:08 PM

|

Senior Member

4,258 posts Joined: Nov 2012 |

QUOTE(MadKat @ Dec 12 2014, 12:35 PM) 1) I want to refinance my house, which bank now offering the best rates? And if we read TS questions carefully, he is not asking whether it is beneficial to refinance. He has already made up his mind to refinance. What he is asking is which bank has the best package2) The legal fees absorb by bank or me? Thank you very much. |

|

|

Dec 13 2014, 10:50 PM Dec 13 2014, 10:50 PM

|

Senior Member

6,562 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(Showtime747 @ Dec 13 2014, 10:02 PM) Ya I agree with you. How come such an easy stuff need to talk so much ? I don't understand why supersound want to make it so complicated Thank you, I need all the support I can get to differentiate between truth and lies. If the refinancing involve lower interest rate, and the total interest saved is less than the cost of refinancing, of course it is beneficial to refinance. Very simple logic. QUOTE(supersound @ Dec 13 2014, 10:10 PM) Come on cheater, be a man to prove I'm wrong with your table. No need to call me uncle or childish and ask others to support you. Okay, this is where I have to call you stupid. You know that the TS's interest rate is based on BLR - 1% right (see his post above)? so if I were to put the interest rate as 5%, then that would be wrong because his interest rate from today onwards is already BLR (6.85%) - 1% = 5.85%.You can't already as by input 5% on the first loan, your lies are busted automatically. Sure, his interest rate in 2005 when he took the loan was BLR (6%) - 1 % = 5%, HOWEVER BLR has increased from 6% in 2005 to 6.75% in 2007, and now hovering at 6.85%. As such, today and going forward, his interest rate will be calculated at BLR (6.85%) - 1% = 5.85% as I posted above. Wait, unless you actually think that the rates that he took in 2005 would remain as in till today? Then I have an even low opinion of you since you speak as if you know things but couldn't even comprehend how the interest rates are calculated - based on the daily-or-monthly rest, on the outstanding balance of the loan, on a rate calculated as this: BLR (current BLR, not the BLR at the time the loan is taken) adjusted according to the loan agreement. As such, when the BLR changes, so will the effective interest rate. So why would I set the earlier calculation as 5% because that only occurred for the first 2 years and have increased significantly in 2007 till now? In addition, I have mentioned that when I meet my clients I would need to see their loan statement to know exactly the amount of their paid installments as you do realize that it is impossible to calculate it exactly due to the changes of the BLR over the years right? If you haven't realized this and insist on setting it at 5%, you really really really are dumb, especially for someone who talks so much  Also, the most important thing is going forward, how much the TS will pay in the next 20 years, and if he were to refinance, will the total repayments be lowered due to the lower interest rate? The answer is yes(!!!) as I have shown multiple times, but because you may have lost some marbles up there, I will show it again: » Click to show Spoiler - click again to hide... « I really don't like to call others stupid, or dumb, I am very open to opinions and discussions; but when they can't see the things that are right in front of them what else can I do? I respect many old people, I learn A LOT from all my clients especially the older ones, and they return that by fully respecting my opinions as a financial planner regardless if they agree with me or otherwise. But you? I don't know what kind of financial planners you have met, but if you got cheated by some of them previously you only have yourself to blame for being too stupid and naive, because the final decision always require your signature. You signed your stupidity by signing contracts with dishonest financial planners. |

|

|

Dec 13 2014, 10:59 PM Dec 13 2014, 10:59 PM

|

Senior Member

11,554 posts Joined: Aug 2009 |

QUOTE(wild_card_my @ Dec 13 2014, 10:50 PM) Thank you, I need all the support I can get to differentiate between truth and lies. If were to average out the 10 years interest, it is still lower than what you stated in that table that you used to cheat people.Okay, this is where I have to call you stupid. You know that the TS's interest rate is based on BLR - 1% right (see his post above)? so if I were to put the interest rate as 5%, then that would be wrong because his interest rate from today onwards is already BLR (6.85%) - 1% = 5.85%. Sure, his interest rate in 2005 when he took the loan was BLR (6%) - 1 % = 5%, HOWEVER BLR has increased from 6% in 2005 to 6.75% in 2007, and now hovering at 6.85%. As such, today and going forward, his interest rate will be calculated at BLR (6.85%) - 1% = 5.85% as I posted above. Wait, unless you actually think that the rates that he took in 2005 would remain as in till today? Then I have an even low opinion of you since you speak as if you know things but couldn't even comprehend how the interest rates are calculated - based on the daily-or-monthly rest, on the outstanding balance of the loan, on a rate calculated as this: BLR (current BLR, not the BLR at the time the loan is taken) adjusted according to the loan agreement. As such, when the BLR changes, so will the effective interest rate. So why would I set the earlier calculation as 5% because that only occurred for the first 2 years and have increased significantly in 2007 till now? In addition, I have mentioned that when I meet my clients I would need to see their loan statement to know exactly the amount of their paid installments as you do realize that it is impossible to calculate it exactly due to the changes of the BLR over the years right? If you haven't realized this and insist on setting it at 5%, you really really really are dumb, especially for someone who talks so much  Also, the most important thing is going forward, how much the TS will pay in the next 20 years, and if he were to refinance, will the total repayments be lowered due to the lower interest rate? The answer is yes(!!!) as I have shown multiple times, but because you may have lost some marbles up there, I will show it again: » Click to show Spoiler - click again to hide... « I really don't like to call others stupid, or dumb, I am very open to opinions and discussions; but when they can't see the things that are right in front of them what else can I do? I respect many old people, I learn A LOT from all my clients especially the older ones, and they return that by fully respecting my opinions as a financial planner regardless if they agree with me or otherwise. But you? I don't know what kind of financial planners you have met, but if you got cheated by some of them previously you only have yourself to blame for being too stupid and naive, because the final decision always require your signature. You signed your stupidity by signing contracts with dishonest financial planners. Average is 5.25% only but you use 2014's interest rate to calculate TS's 2005 interest rate. If this is not cheating then I don't know what is your excuse. I like to burst a cheater's lie and myth especially that cheater are still trying his very best to cheat. When a cheater wants to cheat or mislead, for sure he will use harsh words to insult and attack another when he run out of excuse. As cheat is cheat, can be busted at any 1 time. |

|

|

Dec 13 2014, 11:02 PM Dec 13 2014, 11:02 PM

|

Senior Member

4,258 posts Joined: Nov 2012 |

QUOTE(supersound @ Dec 13 2014, 10:59 PM) If were to average out the 10 years interest, it is still lower than what you stated in that table that you used to cheat people. Bro, why do you refuse to understand what wild_card_my presented ?Average is 5.25% only but you use 2014's interest rate to calculate TS's 2005 interest rate. If this is not cheating then I don't know what is your excuse. I like to burst a cheater's lie and myth especially that cheater are still trying his very best to cheat. When a cheater wants to cheat or mislead, for sure he will use harsh words to insult and attack another when he run out of excuse. As cheat is cheat, can be busted at any 1 time. Read again what he wrote. It is long, but he is just being patient to explain to you some very simple stuff |

|

|

Dec 13 2014, 11:07 PM Dec 13 2014, 11:07 PM

|

Senior Member

11,554 posts Joined: Aug 2009 |

QUOTE(Showtime747 @ Dec 13 2014, 11:02 PM) Bro, why do you refuse to understand what wild_card_my presented ? Nope, by input 5%, the total interest paid are lower than refinance(as you need to add loan 1's interest rate paid and loan 2's interest). I already read and understand. Read again what he wrote. It is long, but he is just being patient to explain to you some very simple stuff But with interest rate are moving up and down almost every year, none of the table works 100%. It will be a guide only. |

|

|

Dec 14 2014, 01:32 AM Dec 14 2014, 01:32 AM

|

Senior Member

4,828 posts Joined: Jan 2012 |

Ignoring what was paid in the past.

Just compare, existing principal outstanding at BLR less 1% for remaining tenures. Then refinancing the same principal outstanding with same tenure at say BLR less 2.4%. What is the interest savings less the refinancing cost. Of course, we can have secondary argument as to whether you need to present value back the interest savings. It should be that simple right. Past is past. Just focus on remaining loan amount. |

|

|

Dec 14 2014, 08:13 AM Dec 14 2014, 08:13 AM

|

Senior Member

11,554 posts Joined: Aug 2009 |

QUOTE(cfa28 @ Dec 14 2014, 01:32 AM) Ignoring what was paid in the past. With current 6.85%-2.2(or 2.4%) compare to last time's 6%, the difference after adding legal fees are not much.Just compare, existing principal outstanding at BLR less 1% for remaining tenures. Then refinancing the same principal outstanding with same tenure at say BLR less 2.4%. What is the interest savings less the refinancing cost. Of course, we can have secondary argument as to whether you need to present value back the interest savings. It should be that simple right. Past is past. Just focus on remaining loan amount. And to make it more sour, BNM may increase OPR after April Fool next year to strengthen rm against USD/SGD. Still remember my friend took a housing loan from insurance company(the agent have business with his family) that with interest rate of 12%(fixed) and he do refinance as the difference are big. BTW, why want to ignore the paid interest? Because it seems like only I'm the only person adding both interest while others only uses current to compare. |

|

|

Dec 14 2014, 08:34 AM Dec 14 2014, 08:34 AM

|

Senior Member

6,562 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(supersound @ Dec 14 2014, 08:13 AM) BTW, why want to ignore the paid interest? Because it seems like only I'm the only person adding both interest while others only uses current to compare. Because a mortgage has its interest calculated based on reducing balance. Given whatever the outstanding balance is, going forward would you want to pay the outstanding balance based on BLR - 1% OR BLR - 2.4%? At that big a difference between the old offer than the new offer, it is easy to tell that the client would benefit in paying their remaining outstanding balance by first refinancing it to lock-in the lower rates of BLR-2.4%. I'll show you again just for kicks ya: Going forward without refinancing, the client is poised to pay » Click to show Spoiler - click again to hide... « By refinancing today, of the outstanding balance amount plus refinancing cost, the client will pay » Click to show Spoiler - click again to hide... « So by refinancing, the client would save: » Click to show Spoiler - click again to hide... « |

|

|

Dec 14 2014, 09:02 AM Dec 14 2014, 09:02 AM

|

Senior Member

4,258 posts Joined: Nov 2012 |

QUOTE(supersound @ Dec 13 2014, 11:07 PM) Nope, by input 5%, the total interest paid are lower than refinance(as you need to add loan 1's interest rate paid and loan 2's interest). I already read and understand. Past interest paid is "sunk cost". It has been paid. You can't recoup no matter how. Like cf28 said "past is past". We should only look forwardBut with interest rate are moving up and down almost every year, none of the table works 100%. It will be a guide only. Since it is a Sunday, I will use supersound's example to illustrate to TS the simple calculation (not trying to convince supersound because he feels he is never wrong Original loan = RM200k Interest = BLR -1% Year = 2005, tenure = 30 years finish paying in 2034 After 10 years on 31/12/2014 = principal paid down to RM150k. Interest paid RM70k (as assumed by supersound) Now TS wants to refinance RM150k Refinancing interest = BLR - 2.4% Tenure = 20 years. Same finish paying in 2034 Scenario 1 - Don't refinance. Continue existing loan Interest already paid = RM70k (cannot change because already paid) Loan amount = RM150k, Interest rate = BLR-1% = 6.85% - 1% = 5.85% What is the total interest payable from 2015 - 2034 ? Based on loan calculator = ~RM105k. Monthly instalment = RM1,062 Scenario 2 - Refinance. Interest already paid = RM70k (cannot change because already paid) Loan amount = RM150k, interest rate = BLR-2.4% = 6.85% - 2.4% = 4.45% What is the total interest payable form 2015 - 2034 ? Based on loan calculator = ~RM77k. Monthly instalment = RM945 Conclusion : By comparing the 2 scenario, the monthly instalment is reduced to RM945. The interest saved will be RM105k - RM77k = RM28k. It should be more than able to cover the refinancing cost. What I calculated above is the same as what wide_card_my presented. Simple calculation which any people with SPM maths passed can calculate This post has been edited by Showtime747: Dec 14 2014, 09:05 AM |

|

|

Dec 14 2014, 09:06 AM Dec 14 2014, 09:06 AM

|

Senior Member

11,554 posts Joined: Aug 2009 |

QUOTE(Showtime747 @ Dec 14 2014, 09:02 AM) Past interest paid is "sunk cost". It has been paid. You can't recoup no matter how. Like cf28 said "past is past". We should only look forward No wonder banks are making more and more money and people are getting poorer. Because interest paid are considered never paid before on the first loan when flip to second loan Since it is a Sunday, I will use supersound's example to illustrate to TS the simple calculation (not trying to convince supersound because he feels he is never wrong Original loan = RM200k Interest = BLR -1% Year = 2005, tenure = 30 years finish paying in 2034 After 10 years on 31/12/2014 = principal paid down to RM150k. Interest paid RM70k (as assumed by supersound) Now TS wants to refinance RM150k Refinancing interest = BLR - 2.4% Tenure = 20 years. Same finish paying in 2034 Scenario 1 - Don't refinance. Continue existing loan Interest already paid = RM70k (cannot change because already paid) Loan amount = RM150k, Interest rate = BLR-1% = 6.85% - 1% = 5.85% What is the total interest payable from 2015 - 2034 ? Based on loan calculator = ~RM105k. Monthly instalment = RM1,062 Scenario 2 - Refinance. Interest already paid = RM70k (cannot change because already paid) Loan amount = RM150k, interest rate = BLR-2.4% = 6.85% - 2.4% = 4.45% What is the total interest payable form 2015 - 2034 ? Based on loan calculator = ~RM77k. Monthly instalment = RM945 Conclusion : By comparing the 2 scenario, the monthly instalment is reduced to RM945. The interest saved will be RM105k - RM77k = RM28k. It should be more than able to cover the refinancing cost. What I calculated above is the same as what wide_card_my presented. Simple calculation which any people with SPM maths passed can calculate |

|

|

Dec 14 2014, 09:13 AM Dec 14 2014, 09:13 AM

|

Senior Member

4,258 posts Joined: Nov 2012 |

QUOTE(supersound @ Dec 14 2014, 09:06 AM) No wonder banks are making more and more money and people are getting poorer. Because interest paid are considered never paid before on the first loan when flip to second loan If TS don't refinance, banks will be making RM28k more from 2015-2034 As I said, I am not here to convince some non-finance-sensible person. I think my calculation will be enough to help TS decide whether to refinance or not |

|

|

Dec 14 2014, 09:14 AM Dec 14 2014, 09:14 AM

|

Senior Member

11,554 posts Joined: Aug 2009 |

QUOTE(Showtime747 @ Dec 14 2014, 09:08 AM) Bro, if it is in real life, you are actually defaming/slandering wide_card_my Nope, that's a fact. Because in 2005 BLR only 6%, so after -1(or 1.2%), it is only at 5% and it do go lower in the mean time. But you will get away in cyberworld. Unless you stand by your opinion and give your actual name, I/C, contact address etc He run out of excuse, that's why he is seeking help and using childish and other harsh words to insult me. I never really against refinance as long as the difference are big enough after including all(first loan's interest paid which all over here say that's not interest, legal fess), like my friend's, it is worth for him to refinance as he took fixed rate loan. |

|

|

Dec 14 2014, 09:15 AM Dec 14 2014, 09:15 AM

|

Senior Member

6,562 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(supersound @ Dec 14 2014, 08:38 AM) You do know that when BLR increases, and if you want to maintain tenure, your instalment needs to increase too right?My company develops our own calculators for our consultants to use with our clients, and one of the most basic formula is the calculation for the PMT (installment) of FV (future value) for a reducing balance loan. There are 3 variables when it comes to calculating the FV [future value](remaining outstanding balance of the future, which you would like to be 0, that is when you would have finished paying for the loan). Do yourself a favor, open up excel and type this: CODE =FV(.......... You will notice that it would be asking for at minimum 3 variables:- A: Payment [pmt](installment amount) B: Rate [rate](Interest ate) C: Number of payments in a set of tenure [nper](number of months, since the installment is set to be payable every month) *The items in the squared brackets are the same items you put in your excel if you need to see it for yourself* So if you would like to maintain the tenure (240 months), but the interest rate has increased (from 5.00 to 5.85%), you would then need to increase the installment accordingly. But here you are yelling about 5% 5% 5%, without realizing that as the interest rate for the client climbed to 5.85%, so will the installment as long as he intends to maintain the tenure (which mean he does not prolonging it). --- Everyone else reading this thread... You guys can decide for yourself who is right and who is a monkey. I don't know why uncle is acting the way he does, but I've presented my arguments in the best way possible. On the other hand all he ever does is to call me a cheater, and all his replies are without any substance. Well it is his right to make himself look stupid. But I implore that everyone read all the posts carefully to decide which side is talking about facts, and which side is filled with unreasonable hatred towards an array of entities; and if you have any doubts, do post your questions here. If you have decided that he is a poison to our little community, please do your part and link this thread whenever he swoops in to give his unsolicited advice. This will give him a piece of his own medicine. I hate doing a witch hunt, and it would sadden me to continue putting people down, but I also believe that no bad deed can go unexposed, especially if he insist on continuing with his denials... the best way to make it stop is to let the masses decide. Have a good Sunday, people. This post has been edited by wild_card_my: Dec 14 2014, 09:17 AM |

|

|

Dec 14 2014, 09:21 AM Dec 14 2014, 09:21 AM

|

Senior Member

11,554 posts Joined: Aug 2009 |

QUOTE(wild_card_my @ Dec 14 2014, 09:15 AM) You do know that when BLR increases, and if you want to maintain tenure, your instalment needs to increase too right? I think I got put there average later on at 5.25%, but you ignored it. My company develops our own calculators four our consultants to use with our clients, and one of the most basic formula is the calculation for the PMT (installment) for a reducing balance loan. There are 3 variables when it comes to calculating the FV [future value](remaining outstanding balance of the future, which you would like to be 0, that is when you would have finished paying for the loan). Do yourself a favor, open up excel and type this: CODE =FV(.......... You will notice that it would be asking for at minimum 3 variables:- A: Payment [pmt](installment amount) B: Rate [rate](Interest ate) C: Number of payments in a set of tenure [nper](number of months, since the installment is set to be payable every month) *The items in the squared brackets are the same items you put in your excel if you need to see it for yourself* So if you would like to maintain the tenure (240 months), but the interest rate has increased (from 5.00 to 5.85%), you would then need to increase the installment accordingly. But here you are yelling about 5% 5% 5%, without realizing that as the interest rate for the client climbed to 5.85%, so will the installment as long as he intends to maintain the tenure (which mean he does not prolonging it). --- Everyone else reading this thread... You guys can decide for yourself who is right and who is a monkey. I don't know why uncle is acting the way he does, but I've presented my arguments in the best way possible. On the other hand all he ever does is to call me a cheater, and all his replies are without any substance. Well it is his right to make himself look stupid. But I implore that everyone read all the posts carefully to decide which side is talking about facts, and which side is filled with unreasonable hatred towards an array of entities; and if you have any doubts, do post your questions here. If you have decided that he is a poison to our little community, please do your part and link this thread whenever he swoops in to give his unsolicited advice. This will give him a piece of his own medicine. I hate doing a witch hunt, and it would sadden me to continue putting people down, but I also believe that no bad deed can go unexposed, especially if he insist on continuing with his denials... the best way to make it stop is to let the masses decide. Have a good Sunday, people. Again, as long as you refuse to change it to 5% and redo the calculation, I'll treat you as still want to cheat. To make cheat successful on this matter, a person just need to choose the highest interest rate to show how bad it was on the first loan and use the lowest to show how good it is by doing refinance. So no need to bring up other rubbish, only a cheater that have agenda will keep on bring up other rubbish to continue cheat and mislead. |

|

|

Dec 14 2014, 09:35 AM Dec 14 2014, 09:35 AM

|

Senior Member

4,258 posts Joined: Nov 2012 |

QUOTE(supersound @ Dec 14 2014, 09:14 AM) Nope, that's a fact. Because in 2005 BLR only 6%, so after -1(or 1.2%), it is only at 5% and it do go lower in the mean time. He insulted you ? His real name is there. His telephone number is there. You can always ask your lawyer to contact him if his comment is falseHe run out of excuse, that's why he is seeking help and using childish and other harsh words to insult me. I never really against refinance as long as the difference are big enough after including all(first loan's interest paid which all over here say that's not interest, legal fess), like my friend's, it is worth for him to refinance as he took fixed rate loan. On the other hand, you are hiding behind the computer using a fake name to call him a cheater. Unless you stand by your words and pm him your real name and real details |

|

|

Dec 14 2014, 09:39 AM Dec 14 2014, 09:39 AM

|

All Stars

24,329 posts Joined: Feb 2011 |