Uncle, after I post this I hope you can stand down and accept that you have the wrong idea about refinancing. Im in the middle of filming for my personal financial-management youtube series, but I spent some time in this nice morning (morning sun is good for lighting) just to show you what you missed.

Refinancing is a financial move with a lot of flexibility:

a) you can

reduce the installment amount payable by extending the tenure and/or locking-in better interest rates

b) you can

borrow from the bank for the cash-out portion at the lowest interest rate possible, no other loans that are available to the general public have lower interest rates than a mortgage. Many people use this money for other business and investments that are yielding higher returns than what the banks are charging as interests. This is called leveraging on your assets instead of sitting on them. Whether or not to do it depends on you, but there shouldn't be 1 true way to go about it.

c. You can

shorten the tenure, but still pay the same installment amount d. You can

maintain the tenure while lowering the installment if you could lock-in a better rate (like what I am going to show below)

Keep this in your head: refinancing is

flexible, and depending on your situation and the economic conditions, you should take the move (or not) as you see fit. Only a stubborn person would think that there is only 1 true way of doing things without considering the situation of others.

My job is to listen to my clients and give them options based on what I know and what is available to them. Your job... apparently is to chatter like a [redacted] about the first thing that appeared in your head without contributing anything to solve these people's financial problems.

My job entails me to provide solutions to my clients and prospects: I get PMs, emails, whatsap, and phone calls everyday asking for my financial consultancy services. I can attribute those to the way I answer the questions posted in this forum to the best of my abilities; for example, when someone is asking for a refinance just like the TS did, just look at the details of my answer - you wont get that from a normal consultant. I refrain from

giving unsolicited advice like how you seem to enjoy doing (again, signs of old age, no offense to other lovely elderlies). These forummers don't need over the top loud mouthing by someone who thinks he knows it all because he is either old, or thinks he is smarter than anyone in the room. Sorry for making this rather personal but you never bothered to hide your misguided hatred towards financial consultants either, which in my opinion, is very childish. Don't dish it out if you can't take it.

--- --- ---

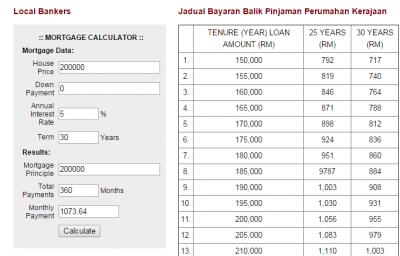

I will start with these numbers:

Initial loan RM200k

30 years tenure

Interest at BLR - 1% as per what TS mentioned

*Do note that I work with my clients closely and

I would ask them for their loan statements, without which would be difficult for me to know the total installments paid over the years due to the changes in BLR. But for the purpose of our education session today, the BLR in 2005 was 6.00% but increased to 6.75% in 2007, and hovered around that number and ended up as 6.85% today. As such, whatever outstanding balance stated below cannot be accurate altogether. But that is why you need a consultant to go through these numbers for you and present it in the way that you would understand.

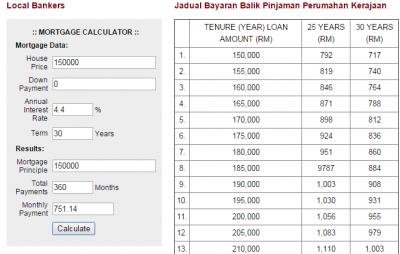

Now, let's refinance based on the remaining balance + cost of refinancing

Results, comments, and conclusion:

Results, comments, and conclusion: a. The tenure (in this case, to please the uncle) has not been changed. The loan remains to end after 360months (30 years) on December 2034.

b. The installment has changed from RM1179.88 to RM1086.10 (including the cost of refinancing) from the 121st month onwards till the end of the loan tenure. This move

lowers your installment by about RM100 a month, without extending the tenure. Why would you want to pay RM100 a month to the bank? Because uncle said "no need to refinance"?

c. Here is the calculation for total savings:

CODE

Total installment paid by refinancing midway in the end of the 10th year, calculated by adding all the installments from the 1st month till 360th month:

= [Total installments paid from 1st to 120th month] + [total installments paid from 121st to 360th month, that is after the refinancing]

= [RM1179.88 x 120] + [RM1086.10 x 240]

= RM141,585.60 + RM260,664 = RM402,249.60

CODE

Differences in total installments paid between refinancing midway VS maintaining the old loan: RM424,756.80 - RM402,249.60 = RM22,507.20

Or in simple terms, because the client needs to pay off the outstanding balance anyway, ALL you need to do is to

SIMPLY differentiate the difference going forward between maintaining the status quu by paying RM1179.88 x 240 months

VS refinancing midway and paying RM1086.10x240 months:

CODE

[RM1179.88x240] - [RM1086.10x240]

= RM283171.2 - RM260664

= RM22,507.20

The client

would save RM22,507.20 in this particular case. Of course, every person would face a number of different situations. To refinance or not depends on their needs, situation, economic climate, and ambition (do they want to be extremely, moderately, or lowly leveraged?). And I work with my clients to find a solution to their needs or problems. In addition, there are many other things that you could do with refinancing: to get a loan from the bank at low interest rate for the purpose of investing in other, better opportunities; to extend the tenure and reduce the installments for better cash flow (who are you to judge whether they should do it or not?), to shorten the tenure but pay same amount (like I have explained above), or to take the advantage of the periodical lower interest rates offered by the banks.

Uncle, maybe due to your age you have become risk aversed and afraid of taking risks, whether or not it is reasonable is debatable because a number of my older clients are still able to stomach some risks due to the fact that they have their retirement nests ready (planned by myself, of course); but just because you are near the end of your line (of career, you know, because of the age) doesn't mean you should stop others from exploring their options and opportunities. You are quite the poison in this subforum as far as I can tell. Other people have opinions and talk about them openly, occasionally arguing by providing citations and or numbers. But you? You chide other people's efforts because you think it's either your way or the highway. I hope this has served as a good lesson to you in terms of sharing opinions and ideas online.

Have a good day. Don't forget the medicine.

I know you want to insult me using uncle. But then you are still cheating TS.

He already paid 9 years, and you never include the interest paid from the first loan.

And you only use lesser time once you got kicked by me. Good strategy to use term "tired" to continue cheating people and avoid being held responsible if giving false info.

With your logic, sure it looks people taking refinance paying lesser interest.

Dec 12 2014, 02:36 PM

Dec 12 2014, 02:36 PM

Quote

Quote

0.0368sec

0.0368sec

0.43

0.43

7 queries

7 queries

GZIP Disabled

GZIP Disabled