QUOTE(alexanderclz @ Sep 24 2017, 07:47 PM)

hi sifu all,

i will be paying my 1st loan installment soon. and as far as i can remember, i signed a standing instruction form for pbb to deduct the loan amount every month. my question is:

1. is it compulsory for the SI or i may cancel it?

2. is there any charges for that service? (some banks i heard will charge rm2 to 5 for that)

just want to clarify all these before going to the bank tmr to settle all these. thanks

Dear alexanderclz,i will be paying my 1st loan installment soon. and as far as i can remember, i signed a standing instruction form for pbb to deduct the loan amount every month. my question is:

1. is it compulsory for the SI or i may cancel it?

2. is there any charges for that service? (some banks i heard will charge rm2 to 5 for that)

just want to clarify all these before going to the bank tmr to settle all these. thanks

1. Not conmpulsory, yes you can do it manually, but why?

2. Yes for certain bank

Best is you call PBB service hotline and check for the cost, always the best to get info from them for double confirmation and also you can test out how efficient is their service

Cheers

QUOTE(alexanderclz @ Sep 24 2017, 08:51 PM)

yup. will do.

another question regarding how advance payment works. say my monthly instalment is 2k, and this month i decide to pay 4k. 2k will be used to offset this month's instalment, the other 2k will be floating somewhere not doing anything until i forget to pay the next instalment?

Yes dearanother question regarding how advance payment works. say my monthly instalment is 2k, and this month i decide to pay 4k. 2k will be used to offset this month's instalment, the other 2k will be floating somewhere not doing anything until i forget to pay the next instalment?

1. You cal always put your cash either to advance payment or capital, you just have to inform the bank if you are semi flexi packages

Cheers

QUOTE(Vinzcent @ Sep 24 2017, 09:10 PM)

Hi,

i'm planning to purchase my 1st property.

May i know how much loan can i get for property price at 400k and 450k

Does 30k cash enough to pay all the miscellaneous fees (Such as Down payment 1-3% ,Booking 1-5k ,Lawyer and etc...)

Prefer loan Tenure 30 yrs

Age : 38

Gross pay: 4367

Nett pay : 3912

Rental Income: N/A

Bonus 2017 : 9.5K

Commitment: 1000

ASNB: 500

House: N/A

Car: N/A

Credit card outstanding: N/A

Thank You.

Dear Vinzcent,i'm planning to purchase my 1st property.

May i know how much loan can i get for property price at 400k and 450k

Does 30k cash enough to pay all the miscellaneous fees (Such as Down payment 1-3% ,Booking 1-5k ,Lawyer and etc...)

Prefer loan Tenure 30 yrs

Age : 38

Gross pay: 4367

Nett pay : 3912

Rental Income: N/A

Bonus 2017 : 9.5K

Commitment: 1000

ASNB: 500

House: N/A

Car: N/A

Credit card outstanding: N/A

Thank You.

1. I assume your 1000 debt is car loan aite, since you didn't specify it

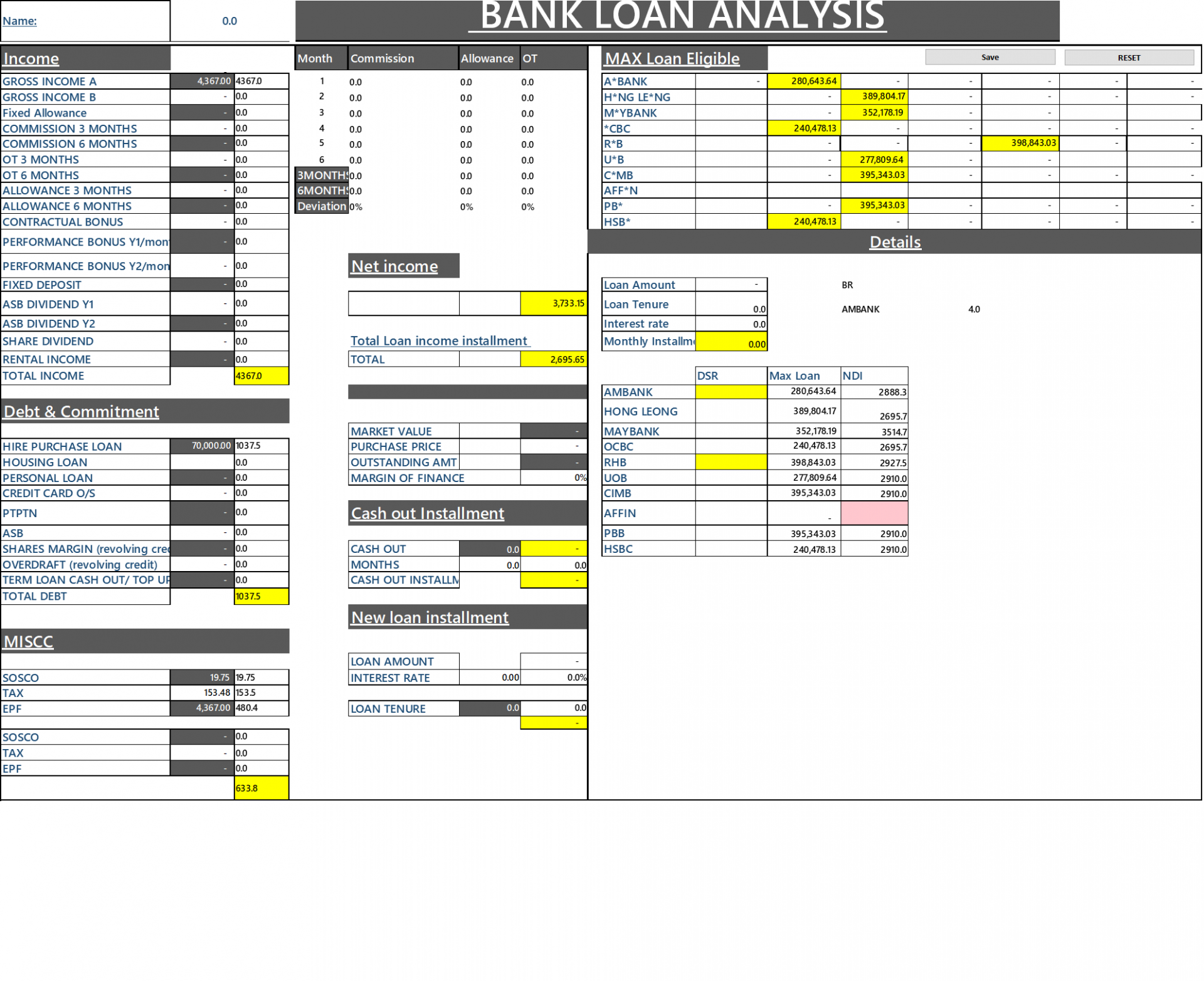

1. Based on the details given by you, Your max loan eligibility for each bank is as follow:

CODE

Bank Loan amount

A*BANK 280,643.64

H*NG LE*NG 389,804.17

M*YBANK 352,178.19

*CBC 240,478.13

R*B 398,843.03

U*B 277,809.64

C*MB 395,343.03

AFF*N -

PB* 395,343.03

HSB* 240,478.13

A*BANK 280,643.64

H*NG LE*NG 389,804.17

M*YBANK 352,178.19

*CBC 240,478.13

R*B 398,843.03

U*B 277,809.64

C*MB 395,343.03

AFF*N -

PB* 395,343.03

HSB* 240,478.13

Things to take note of based onmy max loan calculation

" -The best bank to get the highest loan would be HLBB . However, each bank has it's own ball game

Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence,

I would need to do a due diligence on your profile before suggesting the best bank to proceed with."

" - I would need to check you CCRIS, CTOS and income documentation before giving you any assurance.

If everything goes fine, 90% shouldn't be a problem for you."

Cheers

QUOTE(alexanderclz @ Sep 24 2017, 11:41 PM)

what about early payment? if the due date is 1st and i pay on the 28th the month before, will the payment be 'valid' only on 1st or already deduct from the interest and principle on 28th?

It will be advanced cash payment to settle any future installment due paymentCheers

Sep 25 2017, 12:50 AM

Sep 25 2017, 12:50 AM

Quote

Quote

0.0468sec

0.0468sec

0.32

0.32

7 queries

7 queries

GZIP Disabled

GZIP Disabled