QUOTE(klsooo @ Apr 12 2017, 07:01 PM)

Dear1. loan is based on your borrowed amount, stipulated in the letter offer. if it's rm500k and less.

yes it can

Cheers

Mortgage Loan Package Inquiries, (Strictly NO Promotion Allowed)

|

|

Apr 12 2017, 06:15 PM Apr 12 2017, 06:15 PM

Return to original view | IPv6 | Post

#1061

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

|

|

|

|

|

|

Apr 13 2017, 03:26 PM Apr 13 2017, 03:26 PM

Return to original view | Post

#1062

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(Lvl 2 sword master @ Apr 13 2017, 12:39 PM) Hi, Dear Lvl 2 sword master,I am first home buyer, what kind of payment I need to pay to lawyer firm? (Stamp duty fees? Legal fees?) 1. Legal loan fees Professional Charges Facilities Agreement Charge Annexure Discharge of charge Entry and Withdrawal of Private Caveat Consent to charge Statutory Declaration Disbursement Stamp duty on the Facility Agreement (Original) Stamp duty on the Facility Agreement (Copies) Stamp duty on the Charge Annexure Stamp duty on the Discharge of charge Stamp duty on Letter of Offer Registration Fee on Charge Registration Fee on Entry and Withdrawal of Private Caveat Registration fees on Discharge of charge Registration fees on Caveator Consent Affirming Fee/Bankruptcy Search Stamping on Statutory Declaration (Owner Occupation/not a bankrupt) CTC Title Application and Registration fees for Consent to Charge Land Search Documentation Fee Transportation Telephone Calls, Facsmile, Printing charges and couriers and etc Miscellaneous GST 6% 2. Legal spa fees Professional Charges Sales and purchase agreement Deed of assignment CKHT 2A Disbursement Stamp duty on the deed of assignment (SUBJECT TO VALUATION) Stamp duty on the deed of assignment (COPY) Stamp duty on the Sales and Purchase Agreement Deed of Mutual convenants Affirming Fee/Bankruptcy Search Developer confirmation fees Land Search Transportation Telephone Calls, Facsmile, Printing charges and couriers and etc Miscellaneous GST 6% above is an example, it depends on your property type and land title etc and other factors. It will determined the charges differently. Cheers QUOTE(Lvl 2 sword master @ Apr 13 2017, 01:46 PM) Just inform the lawyer your first time house buying, they will know what to doCheers |

|

|

Apr 14 2017, 08:47 AM Apr 14 2017, 08:47 AM

Return to original view | IPv6 | Post

#1063

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(AmeiN @ Apr 13 2017, 06:34 PM) Hi, for lawyer fee, usually when they will request for the payment? lets say total 10K. do we need to pay lumpsum 10k during signing snp? Dear AmeiN,1. Yes but 2. Some lawyer allows you to defer the payment, but have to make sure pay else they won't proceed with the loan progress 3. SOme lawyer allows you to do in installment. Depends on the lawyer Cheers QUOTE(MyHeArtb3Ating @ Apr 13 2017, 08:15 PM) Hi, i got loan offered from below : DearUOB 3.75% + 0.5 = 4.25 % ( with MRTL 3+15 years = RM10,093) CIMB 3.9% + 0.45 = 4.35 % ( with MRTL 3+15 years = RM 7117) which 1 is best option for investment, no plan to hold long, probably less than 10 years. For me, if the ELR is the same, spread rate different isn't differ by alot, I will chose according to few criteria as below: A. Banks that are easily accessible to your vicinity, why take loan offer form bank when you need them, you need to drive 20-40km. B. Customer services, go with bank that offer tremendous value added service, try calling their hotline whether easily reached and are they responsive and helpful. In long term, this will lessen any unwanted hassle. C. Semi or Full flexi that suits your criteria. SOmetimes, different banks semi and full flexi mechanism is different D. Does the loan package has the right features that you need? Finance legal fees, semi/full/fixed/islamic loan ? lock in period or without? defaultment period ? loan account is it link to saving or current account? E. Does the consultant serves you well? etc all this that must put into consideration into long term perspectives instead of just interest rate. Effective interest rate right now is quite short term view. Cheers |

|

|

Apr 14 2017, 08:54 AM Apr 14 2017, 08:54 AM

Return to original view | IPv6 | Post

#1064

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(IM NEW @ Apr 14 2017, 01:07 AM) huh, cant believe if restructure will reflect into ccris? Dearanother question, my sis thinking to apply for houses as well, her credit is all clean, only one thing is owe telco for quite many years ago maybe 10 years. Telco overcharge her and sudden cut her line and demand payment of 500. lately found her name in ctos under the telco. Will this affect her loan consideration? she had applied few CC but without any issue she get the CC. 1. Yes it will reflect. will show a "T". on the debt facility 2. If she apply with CTOS problem, yes it will be rejected. Only one bank that doesn't check ctos, but the bank DSR isn't quite high. So it depends , have to look at her profile first nad calculate max loan on each bank. QUOTE(tcch @ Apr 14 2017, 02:23 AM) Hi all,can I check what is the max loan eligibility for a fix income earner who wish to purchase a 430k subsale property and whether need a joint borrower Dear tcch,Age:29 Position:Executive Salary:4,000 basic with no allowance Commitment: Two credit card,outstanding cleared monthly Mortgage:1320 monthly,still u/c so serving interest currently No car loan PTPTN-65.00 monthly 1. Based on the details given by you, Your max loan eligibility for each bank is as follow: Bank Rm A*BANK 180,476.00 H*NG LE*NG 356,531.83 M*YBANK 64,199.67 *CBC 133,674.00 R*B 270,667.50 U*B 168,411.17 C*MB 270,667.50 AFF*N - PB* 270,667.50 HSB* 133,674.00 Things to take note of based on my max loan calculation " -The best bank to get the highest loan would be HLBB . However, each bank has it's own ball game Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence, I would need to do a due diligence on your profile before suggesting the best bank to proceed with." 2. Max is RM356K 3. IF you have bonus income, FD, SHARES, ASB, or tenancy rental income. It would help Cheers  upload pic |

|

|

Apr 15 2017, 05:03 PM Apr 15 2017, 05:03 PM

Return to original view | Post

#1065

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(AskarPerang @ Apr 14 2017, 05:09 PM) Hi, this is supposed to be posted in the lawyer corner but the topic is closed and no new thread reopen. Need to post here instead. What will be the charges involve if I want to transfer a property from my wife to me? I read up there will be exemption on the stamp duty. RPGT is not in question as she bought the house more than 5 years ago. So the questions will be do I need to pay legal fees for: S&P Loan Agreement She will need to pay legal fees for lawyer to transfer the name? Seems like the charges all the same like selling a property? Like my wife is selling to me the house? QUOTE(lifebalance @ Apr 14 2017, 06:08 PM) Hi Dear AskarPenang,If you haven't bought a property before this, then yes you can be exempted for the first 300k Stamp Duty. The cost involved will be the S&P and Loan Agreement fee which is consider like a Buy & Sell from ur Wife to you. Seems like the charges all the same like selling a property? Like my wife is selling to me the house? Yes you're right. Any particular reason why your wife would like to transfer the property entirely to you ? 1. RPGT is over after 5 years spa signed. 2. Now the topic is about refinanceing via MOT. - If you refinance via spouse, the process going through MOT, there's a waiver based on transfer with love and affection method. With transfer with love and affection, you will be eligible for SPA stampduty full waiver. 3. Refinance and subsales waiver is totally a different issue here. SO do take note. 4. If you have anymore inquiries, do let me know Cheers mate! QUOTE(Syd G @ Apr 14 2017, 07:57 PM) I'm wondering what are the means of refinancing a property for someone who doesn't have a payslip, EPF or tax receipt. Dear Syd G,I have a property worth 250k with a balance of 40k that i would like to refinance cause the current interest rate is 6.5% (old mortgage) and wanna take my co-signer's name off the loan. It's a really small loan. My CTOS score is above 750. Property is currently rented with 5 year tenancy agreement. 1. If you wish to remove one of the spa owner in the land spa assigned. You must go through refinance, if you still owe bank the $$$$ 2. If you go through refinancing, you will be charged on valuation, legal loan and legal spa Method 1 -If you wish to go low cost with the removal of ownership, why don't ya pay off the loan 40k and then have a lawyer to help you draft the transfer without going through refinancing, which will save you alot of money Method 2 - Going through refinancing to remove on of the owner name Which cost will go around 10k++ and for a better rate, your loan of refinancing must be around 200k and above to secure a better rate loan, else if rm100k and below, the rate will range between 4.5%- 5% Cheers QUOTE(soolim88 @ Apr 14 2017, 08:15 PM) Hi all, Dear [soolim88],Lets say I have placed a booking of RM10k via instant bank transfer to the sales agent agency (e.g. XX Realty) and they have placed a booking for me to the developer and forms (Not S&P) have been filled. The forms I filled is some kind of booking form. Take note that S&P has not been filled and banks have not approach me for loans as the property I placed my booking for is in a pre-launch stage. During purchase, SA did not mention to me that if I decided not to buy after the booking fee has been placed, a RM1k admin fees will be charged. However, the SA did mention to me that if my loan application is rejected by bank twice, I will have my full refund back. Lets say I have decided not to purchase the property, can I request the any of 2 banks to reject my loan application when they approach me so that I can get my full refund back? Any professional advice is highly appreciated. 1. You need to know a nice banker that would draft you the letter of rejection else 2. You submit a subpar low income doc that doesn't qualify DSR requirement and get rejected. Which I don't encourage as will be time wasting for the banker though. Cheers QUOTE(soolim88 @ Apr 14 2017, 08:29 PM) Hi bro, You can try!Thanks for the quick reply. When the bankers approach me, can I let my wife to proceed with the loan application instead of myself? This is because she has high DSR which the bank will probably reject. Is this workable? |

|

|

Apr 15 2017, 05:03 PM Apr 15 2017, 05:03 PM

Return to original view | Post

#1066

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

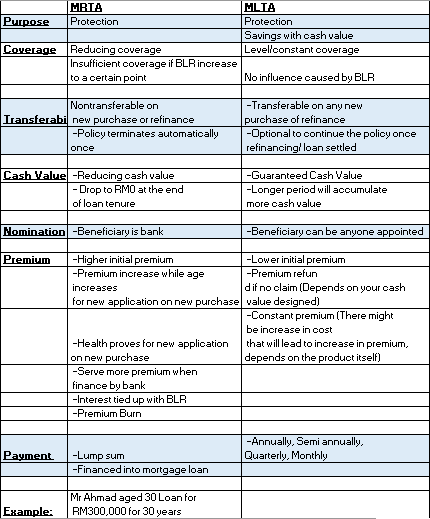

QUOTE(xasar @ Apr 15 2017, 02:02 AM) Me and my husband is around 28-30 yo Dear xasar,Net income is about 8600 Rental income 1500 FD 300,000 Amanah Saham 20,000 Lability Housing 2500 Car loan 500 Would like to know our max housing loan eligibility Your gross income would be around 11k 1. Based on the details given by you, Your max loan eligibility for each bank is as follow: Bank Rm A*BANK 815,198.89 H*NG LE*NG 1,187,745.83 M*YBANK 749,942.85 *CBC 993,770.67 R*B 1,180,199.02 U*B 790,212.33 C*MB 1,178,449.02 AFF*N - PB* 1,178,449.02 HSB* 993,770.67 Things to take note of based onmy max loan calculation " -The best bank to get the highest loan would be HLBB . However, each bank has it's own ball game Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence, I would need to do a due diligence on your profile before suggesting the best bank to proceed with." " - I would need to check you CCRIS, CTOS and income documentation before giving you any assurance. If everything goes fine, 90% shouldn't be a problem for you." 2. Let me know if you have anymore inquiries!  image hosting gif Cheers mate QUOTE(JET @ Apr 15 2017, 05:41 PM) Dear Forumers, DearPackages were offered by Bank with good interest rate and benefit. But one of the term is to purchase Insurance from the Bank. May I know it's a 'MUST' to purchase Insurance (MRTA or other type) from Bank? NO such this as a must to purchase of MRTA! no such thing only PBB! Cheers |

|

|

|

|

|

Apr 18 2017, 04:53 PM Apr 18 2017, 04:53 PM

Return to original view | Post

#1067

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(Lvl 2 sword master @ Apr 17 2017, 06:44 PM) I am getting a 90% loan offer with 4.55% interest rate. I have been told that this rate is not fixed where it will increase over the time for the next 35 years. My question is: 1. Can I know what is the mechanism behind this? why the rate will increase and when it will increase? 2. Is there any upper limit for the interest rate or bank can adjust it with any amount? 3. Normally it will increase up to how many % for the next 35 years? QUOTE(AmeiN @ Apr 17 2017, 07:10 PM) Dear Lvl 2 sword master,1. Base rate + spread rate = Effective lending rate Base rate will alter according to banks need from time to time, hence it will affect your EFL Spread rate will be fixed throughout the loan tenure. Hence, banker like to say lower spread rate will be better: Example: A) 4% + 0.5% = 4.5% effective lending rate B) 4.1% + 0.4%=4.5% effective lending rate Both ELR is the same, but the spread rate is different. Hence in common perspective sense, people will chose the lower spread rate as it is fixed throughout loan tenure. Thus will say B is better. But actual sense, there's no best solutions or answer for this. Because, lower spread rate doesn't secure the bank from increasing the base rate in the future and ELR is higher than A in the future. It's very subjective: 1. Base rate is different across different banks. 2. When OPR adjusted by BNM, Base rate wouldn’t bulge. Base rate would either stay neutral or increase, depends on bank owns decision. Base rate could even change without OPR altered. 3. SRR is the reserve requirement that bank needs to uphold, set by BNM. It’s a liquidity management. When BNM believes economy is prospering and lack of funds, it may reduce SRR requirement to keep less money as reserves in bank and have bank lend more fund out for economic activities. This lead to higher loan growth. The changes of Base rate can reflect the effectiveness of Government Monetary Policy. 4. Spread are defined according to the borrower risk profile, but spread rate are mainly fixed when display to public, as most of the borrower holds almost identical risk. 5. Base rate may be adjusted every 3 months, it’s following KLIBOR. Every 3 months we may or may not witness a changes in bank base rate, but it depends on the banks own internal decision. Hence it is subjective. 3 months stated are just an example usage. Example: Jan OCBC rate 4.02 April OCBC rate 3.92 6. Spread rate will not change and is fixed till the end of the loan tenure 7. even when base rate is superbly low, the effective lending rate in the end could be higher. Example: Maybank: Base rate 3.2% + Spread 1.5% =4.7% OCBC: Base rate 4.02%+ Spread 0.5%=4.52% It all boil's down on the spread given, hence do look at the effective lending rate instead!!! Shop around and ask your mortgage agent. Base rate Pro a) Greater competition between banks b) Higher transparency, as bank will display their profit margin and bank lending efficiency c) Bank loan rate changes will have a higher correlation with Malaysia market economy and OPR. d) Better indication in monetary policy changes. Cons a)Uncertainty. Rate may change accordingly to banks own internal desire. b) There’s a bottom line for how low our loan rate can drop. Example: BLR 6.85 6.85-2.5%=4.35% 6.85-2.6%=4.25% And so on Base rate 3.2%+ 1.35%= 4.55% 3.2%+2%= 5.2% BLR is negative in nature, it can go as low as the bank allows it to be. Base rate is positive in nature, it has a benchmark bottom line. 3.2% is the bottom line and won’t go any further down." For me, if the ELR is the same, spread rate different isn't differ by alot, I will chose according to few criteria as below: A. Banks that are easily accessible to your vicinity, why take loan offer form bank when you need them, you need to drive 20-40km. B. Customer services, go with bank that offer tremendous value added service, try calling their hotline whether easily reached and are they responsive and helpful. In long term, this will lessen any unwanted hassle. C. Semi or Full flexi that suits your criteria. SOmetimes, different banks semi and full flexi mechanism is different D. Does the loan package has the right features that you need? Finance legal fees, semi/full/fixed/islamic loan ? lock in period or without? defaultment period ? loan account is it link to saving or current account? E. Does the consultant serves you well? etc all this that must put into consideration into long term perspectives instead of just interest rate. Effective interest rate right now is quite short term view. 2. upper limit only limited to islamic loan, whereby they put ceiling of around 10% range 3. No one know. based on blr, the highest it goes is 12% before. 4. After this I think u can level up to lvl10 sword man.! hahaha Cheers QUOTE(akecema @ Apr 18 2017, 12:04 PM) anyone can answer? last week i contact 1 agent bank (staff) to make a home loan (after a year) so she ask me some basic document and email to her i already send all documents she want at friday, i ask again if got any problem my requirement to make a loan, she say should be no problem. all document show my loan can approve. so yesterday i message again , did i need to fill any loan document. she reply " LOAN APPROVED". she want meet me tomorrow. now no need fill loan document? what i need to bring to her tomorrow, im blur now today i call n message her, but no reply. QUOTE(akecema @ Apr 18 2017, 12:28 PM) i also dont know what she mean "loan approved" i just email document like normal 3 month payslip, EA form, Letter of Purchase, IC, KWSP QUOTE(akecema @ Apr 18 2017, 12:34 PM) i can confirm they check my CCRIS because she said got problem with my PTPTN but already solve last week Dear akecema,1.Just sign the letter offer will do 2. If she still need document, means loan in process, not yet approved .. she/he just saying that to comfort you... CHeers QUOTE(-Nos- @ Apr 18 2017, 03:38 PM) what is the minimum MRTA that we can take? Dear -Nos-,the banker offer me 25 years coverage for 35 years loan tenure. 1. Usually min is at range of 2% of the loan amount it differs by bank though Cheers |

|

|

Apr 20 2017, 08:17 AM Apr 20 2017, 08:17 AM

Return to original view | IPv6 | Post

#1068

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(EuPhoBoy @ Apr 19 2017, 04:58 PM) Hi all, I just met with a mortgage banker yesterday. I tried asking him to give me a copy of the offer letter (even in softcopy) but he said he's not allowed to share with me. Dear EuPhoBoy,I don't understand why I'm not even allowed to have a copy to have a closer look at the fine prints when I'm the one who's supposed to sign the offer letter. I'm a first-time homebuyer btw. Is this a normal practice in the industry? Have you guys come across such an issue before? What can I do? 1. Either he she havent had the loan approved 2. He does't want to give you the LO to compare with other banks to protect his advantage 3. It really depends how banker and you deal with each other. There do exist banker that are notorious in a way of not giving you the soft copy until you meet him her for actual signing. It depends Cheers QUOTE(T101 @ Apr 19 2017, 05:02 PM) Hi sifus, i would like to know what is the maximum amount of loan that I am able to have for my first house. Dear T101,Age:33 Rm5000 of basic salary No fixed allowance No commitment/loan at all Annual bonus of 2 months(non contractual) Having 9 credit cards with 10k credit limit each Monthly total outstanding credit card is around rm500 (statement balance is cleared every month) No ptptn repayment ASB saving RM50k + FD RM30K 1. Based on the details given by you, Your max loan eligibility for each bank is as follow: Bank Rm A*BANK 505,130.00 H*NG LE*NG 732,912.50 M*YBANK 648,118.33 *CBC 555,530.00 R*B 646,287.50 U*B 601,824.17 C*MB 646,287.50 AFF*N - PB* 646,287.50 HSB* 555,530.00 Things to take note of based onmy max loan calculation " -The best bank to get the highest loan would be HLBB . However, each bank has it's own ball game Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence, I would need to do a due diligence on your profile before suggesting the best bank to proceed with." " - I would need to check you CCRIS, CTOS and income documentation before giving you any assurance. If everything goes fine, 90% shouldn't be a problem for you."  how do you upload photos |

|

|

Apr 20 2017, 12:29 PM Apr 20 2017, 12:29 PM

Return to original view | Post

#1069

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(Lvl 2 sword master @ Apr 20 2017, 01:09 PM) Thanks! Another question here. Dear,What is the differences between full flexi and semi flexi? When I ask the banker (MBB) regarding flexi account, banker said I don't need to care what is full flexi. Just use the semi flexi will do. 1. Difference Full flexi: 1) current account tied to loan account 2) auto debit from current account at month end and interest is calculated based on outstanding balance minus amount in current account 3) maintenance charge of RM10 per month 4) setup/ processing fee of Rm200 (certain bank) 5)The liquidity comes in the form of an ATM card or a linked CASA account to the housing loan. Example: You have a shop that is opened Monday to Satuday, rest on Sunday. On Saturday, you deposit all your proceeds of the week into the flexi account, on Sunday, you would save [(your-HL-interest-rate)/365]*AmountDeposited worth of interest. On Monday, you withdraw the money to run your business 6) Withdrawal of money or crediting of money through ATM,CHEQUE,OVER THE COUNTER, or online Semi Flexi semi flexi package typically has these features: 1) requires you to phone in to indicate the extra payment as early settlement of advance payments 2) if you fail to indicate, you will be charged 1% (some banks do this afaik) 3) if you indicate advance payment, no additional interest is saved as "advance" payment will only be credited to your loan account when it reaches your cycle date, so it is plain advance payments. and must be in multiple of your monthly payment. 4) For redrawable prepayments, you need to indicate separately and Redraw charge of RM50 is imposed (M*B charge Rm25) 5) Withdrawal of money or crediting of money through Cheque or Over the counter 2. Well, because the MBB full flexi is due to the nature of the full flexi which tweak differently. The fluctuating installment in mbb is actually resulted from a principal plus interest payment set by mbb. A lot of people(including bankers) do not know that interest is calculated based on your previous month end balance and not charged upfront like car loan or personal loan. In maxihome flexi case, Maybank set a higher repayment on principal so your month end balance is lowered hence resulting a lower interest on the subsequent month. Say 500k loan, 35 years loan repayment, 4.5% interest rate: normal semi flexi package Repayment rm2367 Principal repayment rm492 Interest repayment rm1875 End balance 499,508 Maxihome flexi Repayment rm4000 (example only) Principal repayment rm2125 Interest repayment rm1875 End balance 497,875 ---------------------- 2nd month normal semi flexi package Repayment rm2367 Principal repayment rm493 Interest repayment rm1873 End balance 499,015 Maxihome flexi Repayment rm3992 (example only) Principal repayment rm2125 Interest repayment rm1867 End balance 495,750 (Interest,repayment amount and outstanding balance reduced, but each month have to fork out more) Cheers mate |

|

|

Apr 20 2017, 02:45 PM Apr 20 2017, 02:45 PM

Return to original view | Post

#1070

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(magnesium @ Apr 20 2017, 03:20 PM) i intends to refinance my house loan Dear,loan already 8 years paid from 30 years but ccris is not good am i able to get refinace? 1. It depends on your profile and dsr 2. It also depends on how bad is your ccris as your describe it is. what's with your ccris? let us know -is it with bad arrears 789? - or high credit card debts would need to look at the overall profile before giving you any advise : Cheers QUOTE(magnesium @ Apr 20 2017, 03:32 PM) it is from total commitments Deari thought to get refinace and the extra amount to clear all credit card in on shot some more im no longet working as doing small business 1. If it's from commitments problem, can be solved. 2. make sure your credit card utilization is not more than 75%, maintain that level. 3. There's more ways to deal with it. But have to make sure your cash out refinance can go through approval only you could get the cash to cover the commitments. Cheers This post has been edited by Madgeniusfigo: Apr 20 2017, 02:47 PM |

|

|

Apr 20 2017, 05:05 PM Apr 20 2017, 05:05 PM

Return to original view | IPv6 | Post

#1071

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(xin @ Apr 20 2017, 04:19 PM) Hi, need advise on this as my fren and her sister wants to joint name to take loan. Dear xin,Nett salary RM4080 commitment for both only is car loan RM660+RM500=RM1160 Will it be possible for them to get a house loan of 90% of RM300k ? any advise on how to boost the probability ? 1. Based on the details given by you, Your max loan eligibility for each bank is as follow: Bank Rm A*BANK 255,577.87 H*NG LE*NG 394,500.75 M*YBANK 370,266.96 *CBC 248,966.91 R*B 372,557.06 U*B 288,982.01 C*MB 368,657.06 AFF*N - PB* 368,657.06 HSB* 248,966.91 Things to take note of based onmy max loan calculation " -The best bank to get the highest loan would be HLBB . However, each bank has it's own ball game Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence, I would need to do a due diligence on your profile before suggesting the best bank to proceed with." " - I would need to check you CCRIS, CTOS and income documentation before giving you any assurance. If everything goes fine, 90% shouldn't be a problem for you." 2. If you need my help, do feel free to contact me. I will be all ears in guiding you towards this rough path.  Cheers mate QUOTE(xin @ Apr 20 2017, 04:34 PM) Looks like if they go for RM270k loan should be good to go ? As they were told that their nett salary is not enough by the SA for the condo which worries them if they should proceed to apply for the loan. Ur profile Possible to get.QUOTE(o0o0 @ Apr 20 2017, 04:42 PM) age 31 Dear o0o0,gross salary 7000 car loan repayment 800 (still owe 13k) ptptn repayment 200 (still owe 30k) ccriss & ctos all clean record may i know roughly how much is the maximum of mortgage loan that bank can approve to me? 1. Based on the details given by you, Your max loan eligibility for each bank is as follow: Bank Rm A*BANK 647,193.33 H*NG LE*NG 782,997.02 M*YBANK 690,097.22 *CBC 658,351.19 R*B 766,222.22 U*B 658,351.19 C*MB 706,701.39 AFF*N - PB* 706,701.39 HSB* 658,351.19 Things to take note of based on my max loan calculation " -The best bank to get the highest loan would be HLBB . However, each bank has it's own ball game Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence, I would need to do a due diligence on your profile before suggesting the best bank to proceed with." " - I would need to check you CCRIS, CTOS and income documentation before giving you any assurance. If everything goes fine, 90% shouldn't be a problem for you." 2. If you need my help, do feel free to contact me. I will be all ears in guiding you towards this rough path.  Cheers mate QUOTE(o0o0 @ Apr 20 2017, 05:09 PM) Different bank have different DSR.range 50-90% QUOTE(tiestoycc @ Apr 20 2017, 05:24 PM) Dear  Cheers |

|

|

Apr 23 2017, 07:27 PM Apr 23 2017, 07:27 PM

Return to original view | Post

#1072

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(superdev @ Apr 21 2017, 01:42 PM) Hello guys, I receive a house loan offer from one of the banks I applied. However, the agent told me the offer is only valid for one week. I did not even receive an offer letter, it was all through text and phone conversation. Dear superdev,Is this normal? I was thinking to wait for the other banks to reply and compare the loan package before any decision is made. One week expiration is too short IMO. 1. usually the letter offer can last quite long, but best to sign it quick before any alteration from bank side and need to come up with a sub LO... still ok. usually 2 weeks 2. Banker would be reluctant to provide you the letter offer, to avoid you comparing with other banks or use the letter offer upper hand to negotiate better loan with other bank. 3. For me, I am a transparent consultant, will deinitely send you the letter offer for you to read through.. not an issue.. As I always ask client on their needs and objectives before applying the right suited taylor made package to clients, hence I won't have this issues 4. based on banker method of dealing with clients though Cheers mate! QUOTE(MrBlackie33 @ Apr 21 2017, 02:49 PM) Dear all sifus Im looking to buy my 1st property with a partner as joint name. Our details as follow Dear MrBlackie33,My age : 24 My income : Rm 3.2k (include 430 fixed allowance), nett 2550 Loan ; only ptptn repayment rm250 (still owe 59k), no other loan Bonus : rm800 in 2016 (started working on dec 2016 after grad) Savings : 27k + asm 15k Partner age : 25 Partner income ; Sgd 2.4k + allowance avg sgd600 Loan : no Bonus : no Savings : 22k sgd How much is the max mortgage loan we can get? Thanks alot 1. Based on the details given by you, Your max loan eligibility for each bank is as follow: Bank Rm A*BANK 977,249.22 H*NG LE*NG 1,017,441.20 M*YBANK 831,430.40 *CBC 910,338.40 R*B 940,913.41 U*B 910,338.40 C*MB 1,152,295.20 AFF*N - PB* 1,152,295.20 HSB* 910,338.40 Things to take note of based onmy max loan calculation " -The best bank to get the highest loan would be HLBB . However, each bank has it's own ball game Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence, I would need to do a due diligence on your profile before suggesting the best bank to proceed with." " - I would need to check you CCRIS, CTOS and income documentation before giving you any assurance. If everything goes fine, 90% shouldn't be a problem for you." 2. Can get high loan amount, due to joint income is very strong. and LOW debt 3. any more inquiries, let me know! Cheers mate!  QUOTE(Lorenzo Von Matterhorn @ Apr 21 2017, 03:40 PM) Hi all, my bro is looking to buy property himself now, would like to find out the MAX housing loan he is eligible for, before considering me as joint purchaser/borrower... Dear Lorenzo Von Matterhorn,Age: 30 Income: RM4K before EPF contribution Loan: Car loan settled. Currently having housing loan of RM500K, paying RM3,700 per month, now in 2nd year. *It's a joint loan: My bro, our mother and I borrowed. Basically My mum and I are paying the loan. Cos that time I am not eligible to get the loan by myself. But anyway, my bro also will be considered as taking 2nd loan, right? or no? Bonus: 1 month Savings: RM15K in FD; and less than RM5K in savings Thanks all 1. Based on the details given by you, Your max loan eligibility for each bank is as follow: Bank Rm A*BANK 284,661.00 H*NG LE*NG 487,823.50 M*YBANK 310,315.67 *CBC 256,366.00 R*B 399,322.50 U*B 294,444.83 C*MB 399,322.50 AFF*N - PB* 399,322.50 HSB* 256,366.00 Things to take note of based onmy max loan calculation " -The best bank to get the highest loan would be HLBB . However, each bank has it's own ball game Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence, I would need to do a due diligence on your profile before suggesting the best bank to proceed with." " - I would need to check you CCRIS, CTOS and income documentation before giving you any assurance. If everything goes fine, 90% shouldn't be a problem for you." 2. The housing loan debt is divided by 3 person, do provide letter offer to show that it's joint by 3 person, bank will divide it accordingly for this debt 3. YOu are still eligible for 90%, as this will be ur second housing loan only 4. above calculation assume your bonus RM4000 is contractual bonus. 5. any inquiries, do let me know! Cheers mate!  QUOTE(yao_mou_gao_cho @ Apr 22 2017, 10:49 AM) Hi sifus, i would like to know what is the maximum amount of loan that I am able to have for my second house. Dear yao_mou_gao_cho,Age:30 Rm4700 of nett salary inclusive of fixed allowance Currently serving my first house loan RM1314/month Currently serving my hire purchase of RM520/month (1 more year to go) Annual bonus of 3 months(non contractual) Having 4 credit cards (fully paid for each statement) No ptptn repayment FD RM20K To get more accurate calculation, do answer below questions 1. what's your gross income and fixed allowance 2. 2 years bonus breakdown is how much each? 3. last month creditcard usage is how much? CHeers mate! |

|

|

Apr 24 2017, 02:34 PM Apr 24 2017, 02:34 PM

Return to original view | Post

#1073

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(lightonokira @ Apr 23 2017, 10:13 PM) Hello Sifus, Dear lightonokira,Age: 25 RM 8000 of nett salary inclusive of allowance Currently serving my first hire purchase of RM650 monthly Have 1 credit card paid for each statement I am currently working with a foreign company that is operating outside of Malaysia. Started ~5 months ago. I would like to know what is the maximum loan I can apply 1. Based on the details given by you, Your max loan eligibility for each bank is as follow: Bank Rm A*BANK 999,043.33 H*NG LE*NG 1,211,802.98 M*YBANK 998,225.00 *CBC 974,415.48 R*B 1,241,612.50 U*B 974,415.48 C*MB 1,239,362.50 AFF*N - PB* 1,239,362.50 HSB* 974,415.48 2. working at foreign company won't be a ocmpany but better as it's a MNC company, higher scoring. 3. Things to take note of based on my max loan calculation " -The best bank to get the highest loan would be HLBB . However, each bank has it's own ball game Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence, I would need to do a due diligence on your profile before suggesting the best bank to proceed with." " - I would need to check you CCRIS, CTOS and income documentation before giving you any assurance. If everything goes fine, 90% shouldn't be a problem for you." Cheers mate  QUOTE(Astotti @ Apr 24 2017, 01:11 AM) Dear wild_card_my, brief answer.I just signed the offer letter with PBB recently. Detail as below: Housing Loan RM 387,000 Premium MRPA RM 800 Total loan amt RM 387,800 MRPA=Mortgage Reducing Personal Accident. (My agent said is a must, can't waived) For this case, do I still need to purchase MRTA or MLTA. Because my agent keep recommend me to sign up for MLTA, i not decide yet. You can buy it if you see the needs YOu can opt not to buy it if it doesnt meet your need or you are out of budget. Cheers |

|

|

|

|

|

Apr 29 2017, 03:24 PM Apr 29 2017, 03:24 PM

Return to original view | IPv6 | Post

#1074

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(raul88 @ Apr 29 2017, 09:35 AM) Dear forumer Dear raul88,I am a first time home buyer Recently I booked a house The agent said he already apply from a few banks for loan Developers gave 10% discount so I don't have to pay deposit However so far only one bank contacted me Is there a time period to take the loan offer before my booking expired? I'm concern as agent said the discount was circumferential meaning if I don't settle everything within stipulated time, I won't get the discount Many thanks 1. Usually they will put a time period on the rebate, to force buyer to rush to loan approval. some developer allows extension.. etc loan approval usually takes around 7 days less or more working days to be completed. 2. It's best if you are in touch with the banker, so that you are in the loop and able to know the status. Cheers QUOTE(raul88 @ Apr 29 2017, 12:00 PM) Ty for ur swift reply We all know most of them only submit loan to their Friend at the expense of getting the best deal to customer QUOTE(AskarPerang @ Apr 29 2017, 02:42 PM) Sales Agent help you to submit your loan application. Must be a very good agent. normally they will just list down which is the panel bank and you can own deal with any bankers from those bank. Nah, usually they will submit to their own preferred banker. some they trust, some give them kickbacks.. etc.but in the end, agent want the approval to be hasten so that they can close the case and receive their payout confirmed! Cheers |

|

|

May 1 2017, 05:07 PM May 1 2017, 05:07 PM

Return to original view | Post

#1075

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(ObeLIsK @ May 1 2017, 01:51 PM) Hi Guys, I'd like to inquire for your expertise and opinions as I recently booked for a low cost sub-sale property and was considering to finance it in cash but the banks instead offered loan which is similar to cash buying, where there's 0% interest, as long as I can maintain a positive deposit against the loan outstanding. So my question is that is - is such a deal for real and worth it? - is there no hidden catch for the deal or certain aspect of it that I may not be aware of? - such deal would allow for liquidity to a certain extend as I need only maintain a positive amount against the outstanding? - possible to re-negotiate with the seller & agent for a lower price since such deal is akin to cash buying? - is it considered conventional home loan with payment to principal kind of concept? Appreciate all the advises and opinions all the pros here have to share. QUOTE(ObeLIsK @ May 1 2017, 03:04 PM) Thanks Keith & Azmi for the kind input. Dear ObeLIsK,If such is the case, is it important or even worth it to have a good credit rating/record by engaging a bank for loan because I've not had any real commitment apart from credit card (No outstanding since it's cleared monthly & driving an inherited old waja). or Cash buy is the way to go for possibly better negotiation terms & pricing? Also possibly saving some legal fees too but would there be any issues/trouble from the tax dept or anything? 1. If you cash rich and could purchase with own cash, why take their offer and pay interest? QUOTE(propusers @ May 1 2017, 05:12 PM) May I know whether share margin quota approve from share investment bank like Maybank / Hong Leong will be counted as commitment? Dear propusers,Let assume this case. I have get approval of 100,000 margin from hong leong investment bank. And I have already used 30,000 from the margin to buy shares. Q1. Will this appear in CCRIS? Q2. How do banks evaluate this borrowing? Use 100k or 30k as commitment? Or certain percentage of 100k/30k? Q3. Is it different bank has different method to calculate? If yes, can explain the bank method that you most experience with? 1. Share margin is called revolving debt if u utilized the amount, that amount will be considered as your debt 2. It will appear in ccris 3. 30k of certain %, depends on bank Cheers |

|

|

May 3 2017, 03:53 PM May 3 2017, 03:53 PM

Return to original view | Post

#1076

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(bapakaka @ May 3 2017, 11:26 AM) Hi All DearJust want to know, how bad PTPTN will impacting the loan application. Early of this year, i have paid all my outstanding and changed it to Ujrah But recently there is misunderstanding on "payment from salary deduction scheme" where it lead to one month outstanding. But i have paid that off. How do you rate my chance to get a housing loan? Im looking for my first house. Does this will give a significant impact to my application? Im planning to buy a house with price tag 700k Below is my details of salary and appreciate if someone can give some insight Me Net salary 4500 Bonus 9000 Ot average 700 My wife Net salary 4100 Commitment both Car 700 Cc 9000 Ptptn 150 PL 950 1. ptptn will cause rejection on loan. however it can be solved. To settle PTPTN issues, there's 3 ways: 1. If you couldn't afford to pay for the outstanding, as it is too much to bear with, do Visit a PTPTN centre and ask for PTPTN debt restructuring, they will help you restructure your payment for the debt. However, you would need to pay off a certain amount of the outstanding loan, before they allow restructuring to take place. After that, they will provide you a letter of restructuring, 4 pages. Bank will calculate your installment based on the payment stated in the letter. 2. If you could bear with he outstanding amount, do Visit PTPTN centre, and settle the outstanding amount to remove the arrears. After that please do remember to pay your debt promptly! 3. Fully settled your PTPTN. Then the loan will removed from the ccris, After that, they will provide you a letter of settlement. With above methods, will enable your loan to approved, given that PTPTN is the only obstacles. Cheers --------------------------------------------------------- 2. Based on the details given by you, Your max loan eligibility for each bank is as follow: Bank Rm A*BANK 974,480.04 H*NG LE*NG 1,107,641.95 M*YBANK 846,215.78 *CBC 961,351.32 R*B 1,128,688.78 U*B 785,734.66 C*MB 1,214,442.78 AFF*N - PB* 1,214,442.78 HSB* 961,351.32 Things to take note of based onmy max loan calculation " -The best bank to get the highest loan would be HLBB . However, each bank has it's own ball game Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence, I would need to do a due diligence on your profile before suggesting the best bank to proceed with." " - I would need to check you CCRIS, CTOS and income documentation before giving you any assurance. If everything goes fine, 90% shouldn't be a problem for you." . If you need my help, do feel free to contact me. I will be all ears in guiding you towards this rough path.  Cheers mate |

|

|

May 11 2017, 02:58 PM May 11 2017, 02:58 PM

Return to original view | Post

#1077

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(Win Win Inspiration @ May 11 2017, 01:28 PM) What are the factors that affect the BR and SR? Base rate + spread rate = Effective lending rateAre them fluctuating throughout the Loan Repayment Period or Fixed? Base rate will alter according to banks need from time to time, hence it will affect your EFL Spread rate will be fixed throughout the loan tenure. Hence, banker like to say lower spread rate will be better: Example: A) 4% + 0.5% = 4.5% effective lending rate B) 4.1% + 0.4%=4.5% effective lending rate Both ELR is the same, but the spread rate is different. Hence in common perspective sense, people will chose the lower spread rate as it is fixed throughout loan tenure. Thus will say B is better. But actual sense, there's no best solutions or answer for this. Because, lower spread rate doesn't secure the bank from increasing the base rate in the future and ELR is higher than A in the future. It's very subjective: 1. Base rate is different across different banks. 2. When OPR adjusted by BNM, Base rate wouldn’t bulge. Base rate would either stay neutral or increase, depends on bank owns decision. Base rate could even change without OPR altered. 3. SRR is the reserve requirement that bank needs to uphold, set by BNM. It’s a liquidity management. When BNM believes economy is prospering and lack of funds, it may reduce SRR requirement to keep less money as reserves in bank and have bank lend more fund out for economic activities. This lead to higher loan growth. The changes of Base rate can reflect the effectiveness of Government Monetary Policy. 4. Spread are defined according to the borrower risk profile, but spread rate are mainly fixed when display to public, as most of the borrower holds almost identical risk. 5. Base rate may be adjusted every 3 months, it’s following KLIBOR. Every 3 months we may or may not witness a changes in bank base rate, but it depends on the banks own internal decision. Hence it is subjective. 3 months stated are just an example usage. Example: Jan OCBC rate 4.02 April OCBC rate 3.92 6. Spread rate will not change and is fixed till the end of the loan tenure 7. even when base rate is superbly low, the effective lending rate in the end could be higher. Example: Maybank: Base rate 3.2% + Spread 1.5% =4.7% OCBC: Base rate 4.02%+ Spread 0.5%=4.52% It all boil's down on the spread given, hence do look at the effective lending rate instead!!! Shop around and ask your mortgage agent. Base rate Pro a) Greater competition between banks b) Higher transparency, as bank will display their profit margin and bank lending efficiency c) Bank loan rate changes will have a higher correlation with Malaysia market economy and OPR. d) Better indication in monetary policy changes. Cons a)Uncertainty. Rate may change accordingly to banks own internal desire. b) There’s a bottom line for how low our loan rate can drop. Example: BLR 6.85 6.85-2.5%=4.35% 6.85-2.6%=4.25% And so on Base rate 3.2%+ 1.35%= 4.55% 3.2%+2%= 5.2% BLR is negative in nature, it can go as low as the bank allows it to be. Base rate is positive in nature, it has a benchmark bottom line. 3.2% is the bottom line and won’t go any further down." For me, if the ELR is the same, spread rate different isn't differ by alot, I will chose according to few criteria as below: A. Banks that are easily accessible to your vicinity, why take loan offer form bank when you need them, you need to drive 20-40km. B. Customer services, go with bank that offer tremendous value added service, try calling their hotline whether easily reached and are they responsive and helpful. In long term, this will lessen any unwanted hassle. C. Semi or Full flexi that suits your criteria. SOmetimes, different banks semi and full flexi mechanism is different D. Does the loan package has the right features that you need? Finance legal fees, semi/full/fixed/islamic loan ? lock in period or without? defaultment period ? loan account is it link to saving or current account? E. Does the consultant serves you well? etc all this that must put into consideration into long term perspectives instead of just interest rate. Effective interest rate right now is quite short term view. CHEERS QUOTE(Win Win Inspiration @ May 11 2017, 02:50 PM) Heard from many others saying that, the monthly repayment that we make from the period of Loan Approved, to, Project Completed, is the pure payment for Interest instead of Principal, is that true? Yes, correct. it's called progressive interest!Cheers QUOTE(Win Win Inspiration @ May 11 2017, 03:15 PM) Would it be fair to say that the payment for Project Loan is not as worthy to go for, in view of the scenario that we are paying only for interest but not any portion of the principal during the construction period? WEll, it's a must to pay and price to pay to owned a project unitPlease correct me if I am wrong. It really depends on your objectives in invesetment! |

|

|

Sep 8 2017, 06:31 PM Sep 8 2017, 06:31 PM

Return to original view | IPv6 | Post

#1078

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(llthim @ Sep 8 2017, 01:37 PM) Hi, Dear llthim,Could you check for me how much i can loan from bank please. And want to ask is it possible to joint name with friend to purchase a property? Age: 28 Nett pay: 5800 Commitment House: 2500 Car: 737 PTPTN: 265 Thanks  1. Based on the details given by you, Your max loan eligibility for each bank is as follow: Bank Loan amount A*BANK 222,148.89 H*NG LE*NG 359,839.88 M*YBANK 73,304.41 *CBC 104,329.38 R*B 307,790.74 U*B 104,329.38 C*MB 250,169.91 AFF*N - PB* 250,169.91 HSB* 104,329.38 Things to take note of based onmy max loan calculation " -The best bank to get the highest loan would be HLBB . However, each bank has it's own ball game Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence, I would need to do a due diligence on your profile before suggesting the best bank to proceed with." " - I would need to check you CCRIS, CTOS and income documentation before giving you any assurance. If everything goes fine, 90% shouldn't be a problem for you." 4. Just in case, make sure your PTPTN is paid on time, else I would need your PTPTN to be settled or restructured in order to proceed with loan approval Cheers QUOTE(scubamy @ Sep 8 2017, 02:57 PM) Hi, Dear scubamyCould you check for me how much i can loan from bank please. Age: 37 Nett pay: 6400 Commitment House: 2000 (joint name,so divide 2?) Car: 772 Credit card: 9000 Thanks  1. Based on the details given by you, Your max loan eligibility for each bank is as follow: Bank Loan amount A*BANK 473,921.11 H*NG LE*NG 630,319.64 M*YBANK 502,151.37 *CBC 408,154.14 R*B 590,709.70 U*B 408,154.14 C*MB 526,347.20 AFF*N - PB* 526,347.20 HSB* 408,154.14 Things to take note of based on my max loan calculation " -The best bank to get the highest loan would be HLBB . However, each bank has it's own ball game Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence, I would need to do a due diligence on your profile before suggesting the best bank to proceed with." " - I would need to check you CCRIS, CTOS and income documentation before giving you any assurance. If everything goes fine, 90% shouldn't be a problem for you." 4. However, I need to check on your credit card usage, if the utilization is more than 90% meaning, credit balance/ credit limit =>90% Your scoring would be low, as bank sees you as a high credit usage and low liquidity in cash flow Cheers This post has been edited by Madgeniusfigo: Sep 9 2017, 10:00 AM |

|

|

Sep 10 2017, 12:02 AM Sep 10 2017, 12:02 AM

Return to original view | IPv6 | Post

#1079

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(hiroshi87 @ Sep 9 2017, 10:31 PM) Hi, Dear hiroshi87,I am looking for a 2nd unit housing. Will be glad if anyone can help to check my maximum loan amount. Age: 30 Nett pay: 11000 + fixed allowance 3k. Commitment House: 3000 Car: None PTPTN: None 1. Given your info above  Based on the details given by you, Your max loan eligibility for each bank is as follow: Rm A*BANK - H*NG LE*NG 1,264,645.83 M*YBANK 1,275,479.33 *CBC 1,545,762.67 R*B 1,189,521.83 U*B 1,275,479.33 C*MB 1,189,521.83 AFF*N 1,583,162.67 "2. The best bank to get the highest loan would be HLBB . However, each bank has it's own ball game Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence, I would need to do a due diligence on your profile before suggesting the best bank to proceed with." "3. I would need to check you CCRIS, CTOS and income documentation before giving you any assurance. If everything goes fine, 90% shouldn't be a problem for you." 4. However, I need DO due diligence before any concrete answer. 5. Your lawyer fees will be around here FOR RM1MIL property Legal spa CODE [img]https://pictr.com/images/2017/09/10/cb7c949d39249614fed3b03ed17e03fc.png[/img] Legal loan CODE [img]https://pictr.com/images/2017/09/09/dead19a10bcc26f260bc9857f4fee18c.png[/img] Cheers , any more inquiries, let me know. This post has been edited by Madgeniusfigo: Sep 10 2017, 08:00 AM |

|

|

Sep 11 2017, 11:41 AM Sep 11 2017, 11:41 AM

Return to original view | IPv6 | Post

#1080

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(eastwest @ Sep 11 2017, 10:06 AM) Yes it isQUOTE(ronron @ Sep 11 2017, 12:17 PM) Hi all masters, Dear ronron,I have a question here: currently, I have a house loan balance of RM250k. The monthly repayment RM1235, the loan agreement is signed on 2012 and tenure 30 years. I now have cash RM100k and I would like to put this RM100k into the loan balance so the loan balance left will become 150K. however, I have a question: 1) Can I just refinance within the same bank, remortgage 150K with lesser tenure (eg. 15 years)??? 2) Or just continue the monthly installment and slowly pay off loan balance 150K ???? 1. it is called top up, yes you can. But worthy will depends whether the market value of the property is good for cash out. If the property market value is higher than the O/S balance , hence,you can top up the property price. A o/s Blance Rm250,000 Market value of property A is RM650,000 In contract selling Rm500,000 to you, but borrowing RM650,000 from bank 90% of RM650,000 = RM585,000 RM585,000 - RM250,000 =RM335,000 extra cash out and u can gauge the loan tenure lessser at 15 years TOO. HOWEVER, Your DSR income debt comes into calculation, income has to be sufficient to cash out such huge amount, and your ccris payment record comes into scrutiny too. - *You will still have to bear the cost of legal loan* For top up 2. 1. When you pay extra for monthly installment, which it will reduce your total interest charges. Example: 2016 Housing loan Rm500,000 / 4.5% interest rate / 35 years loan tenure Monthly installment is RM2,366 (Rm1,875 Interest + Rm491.28 Principal = Rm2,366) As you can see, your installment payment are actually paying more towards your interest than your principal. If you decided to start paying extra RM500 every month. Your Monthly payment will be RM2,866 (RM1,875 Interest +RM991.28 Principal = RM2,866) You will be paying more towards your Principal with the extra RM500. Hence, if you continue paying extra RM500/month consistently. Your total interest saved would be RM180,759 Your Loan tenure will be shorten by 136months. -This will help reduce your interest charges and reduce the loan tenure. Paying extra to Capital account/advanced account 2. If you have a sudden influx of cash into your pocket, lets say inheritance of RM100,000, and you decided to put it into your housing loan capital account/advanced account, because you have max out ASB and other financial options. Example: 2016 - Housing loan Rm500,000 / 4.5% interest rate / 35 years loan tenure Monthly installment is RM2,366 (Rm1,875 Interest + Rm491.28 Principal = Rm2,366) Total interest charge: RM493,837.28 - If you credit in Rm100,000 into the account, housing loan outstanding would be RM400,000 (RM500,000 -RM100,000), and paying the same installment amount, this will reduce your total interest charge to Rm395,072. Because the interest you are paying right now is 4.5% on Rm400,000 instead 4.5% on Rm500,000. Hence, you save interest and reduce the loan tenure likewise. --------------------------------------------------------------------------------------------------------------------------- MOst importantly, what's your goal? To pay less interest, follow NO.2 , to get more cash out No.1 Cheers |

| Change to: |  0.0490sec 0.0490sec

0.50 0.50

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 07:38 PM |