QUOTE(pull007 @ Oct 26 2017, 08:18 AM)

Dear sifus,

I have housing loan full flexi with CIMB with outstanding amount of RM520k for 20 years tenure. Currently, I'm paying RM3.5k/month for the loan.

I would like to prolong my loan tenure to 30-35 years so that I can reduce my monthly payment.

My question is:

1. Is it better to do with the same bank or change to other bank?

2. What are the costs involved?

3. Can the costs be absorbed into the new loan?

Please comment on my situation.

Thank you.

Dear,

1. Reasonn to lengthen? to reduce installment payment? You can visit them and request them to reduce your installment, can try

2. Not cheap if you want lengthen, you have to pay legal loan fees which will surmount to 10k...

Cheers

QUOTE(FuNks @ Oct 26 2017, 11:17 AM)

Dear Sifus, wanna ask about BR base rate. when u sign offer letter, there got state something like if BR goes up 1 or 2%. in future will the base rate goes up?

Dear

Base rate + spread rate = Effective lending rate

Base rate will alter according to banks need from time to time, hence it will affect your EFL

Spread rate will be fixed throughout the loan tenure.

Hence, banker like to say lower spread rate will be better:

Example:

A) 4% + 0.5% = 4.5% effective lending rate

B) 4.1% + 0.4%=4.5% effective lending rate

Both ELR is the same, but the spread rate is different.

Hence in common perspective sense, people will chose the lower spread rate as it is fixed throughout loan tenure. Thus will say B is better.

But actual sense, there's no best solutions or answer for this. Because, lower spread rate doesn't secure the bank from increasing the base rate in the future and ELR is higher than A in the future.

It's very subjective:

1. Base rate is different across different banks.

2. When OPR adjusted by BNM, Base rate wouldn’t bulge.

Base rate would either stay neutral or increase, depends on bank owns decision. Base rate could even change without OPR altered.

3. SRR is the reserve requirement that bank needs to uphold, set by BNM. It’s a liquidity management. When BNM believes economy is prospering and lack of funds, it may reduce SRR requirement to keep less money as reserves in bank and have bank lend more fund out for economic activities. This lead to higher loan growth. The changes of Base rate can reflect the effectiveness of Government Monetary Policy.

4. Spread are defined according to the borrower risk profile, but spread rate are mainly fixed when display to public, as most of the borrower holds almost identical risk.

5. Base rate may be adjusted every 3 months, it’s following KLIBOR. Every 3 months we may or may not witness a changes in bank base rate, but it depends on the banks own internal decision. Hence it is subjective. 3 months stated are just an example usage.

Example:

Jan OCBC rate 4.02

April OCBC rate 3.92

6. Spread rate will not change and is fixed till the end of the loan tenure

7. even when base rate is superbly low, the effective lending rate in the end could be higher.

Example:

Maybank: Base rate 3.2% + Spread 1.5% =4.7%

OCBC: Base rate 4.02%+ Spread 0.5%=4.52%

It all boil's down on the spread given, hence do look at the effective lending rate instead!!! Shop around and ask your mortgage agent.

Base rate

Pro

a) Greater competition between banks

b) Higher transparency, as bank will display their profit margin and bank lending efficiency

c) Bank loan rate changes will have a higher correlation with Malaysia market economy and OPR.

d) Better indication in monetary policy changes.

Cons

a)Uncertainty. Rate may change accordingly to banks own internal desire.

b) There’s a bottom line for how low our loan rate can drop.

Example:

BLR 6.85

6.85-2.5%=4.35%

6.85-2.6%=4.25%

And so on

Base rate

3.2%+ 1.35%= 4.55%

3.2%+2%= 5.2%

BLR is negative in nature, it can go as low as the bank allows it to be.

Base rate is positive in nature, it has a benchmark bottom line. 3.2% is the bottom line and won’t go any further down."

For me, if the ELR is the same, spread rate different isn't differ by alot, I will chose according to few criteria as below:

A. Banks that are easily accessible to your vicinity, why take loan offer form bank when you need them, you need to drive 20-40km.

B. Customer services, go with bank that offer tremendous value added service, try calling their hotline whether easily reached and are they responsive and helpful. In long term, this will lessen any unwanted hassle.

C. Semi or Full flexi that suits your criteria. SOmetimes, different banks semi and full flexi mechanism is different

D. Does the loan package has the right features that you need? Finance legal fees, semi/full/fixed/islamic loan ? lock in period or without? defaultment period ? loan account is it link to saving or current account?

E. Does the consultant serves you well?

etc all this that must put into consideration into long term perspectives instead of just interest rate. Effective interest rate right now is quite short term view.

Cheers

QUOTE(FuNks @ Oct 26 2017, 11:28 AM)

means BR will increase normally? if increase 1% will be like extra 500 bucks.

not too sure coz first time taking loan.

QUOTE(FuNks @ Oct 26 2017, 11:40 AM)

alright got it.

currently i have 630k loan, 3k monthly.

lets say if i have extra 100k cash, can i one shot pay off 100k or only can park into current account to decrease interest?

*if can* , will it decrease monthly installment, or loan tenure?

Yes it will

However, if it's semi flexi loan account, you have to call the service center that you are gonna put this xxxx amount to reduce capital, else it will become advance payment.

Cheers

QUOTE(stevenX @ Oct 26 2017, 08:19 PM)

Hi all sifu.

I come across an app which do loan calculation.

And there an option to keyin extra payment per month.

How does it work and did it actually work this way in mortgage loan ?

Simply pay extra, doesnt need to write in letter or pump an amount into principal also can save a lot of interest.

Dear

Extra payment1. When you pay extra for monthly installment, which it will reduce your total interest charges.

Example:

2016

Housing loan Rm500,000 / 4.5% interest rate / 35 years loan tenure

Monthly installment is RM2,366 (Rm1,875 Interest + Rm491.28 Principal = Rm2,366)

As you can see, your installment payment are actually paying more towards your interest than your principal.

If you decided to start paying extra RM500 every month. Your Monthly payment will be RM2,866 (RM1,875 Interest +RM991.28 Principal = RM2,866)

You will be paying more towards your Principal with the extra RM500. Hence, if you continue paying extra RM500/month consistently.

Your total interest saved would be RM180,759

Your Loan tenure will be shorten by 136months.

-This will help reduce your interest charges and reduce the loan tenure.

Paying extra to Capital account/advanced account2. If you have a sudden influx of cash into your pocket, lets say inheritance of RM100,000, and you decided to put it into your housing loan capital account/advanced account, because you have max out ASB and other financial options.

Example:

2016

- Housing loan Rm500,000 / 4.5% interest rate / 35 years loan tenure

Monthly installment is RM2,366 (Rm1,875 Interest + Rm491.28 Principal = Rm2,366)

Total interest charge: RM493,837.28

- If you credit in Rm100,000 into the account, housing loan outstanding would be RM400,000 (RM500,000 -RM100,000), and paying the same installment amount, this will reduce your total interest charge to Rm395,072.

Because the interest you are paying right now is 4.5% on Rm400,000 instead 4.5% on Rm500,000.

Hence, you save interest and reduce the loan tenure likewise.

QUOTE(GGSC27 @ Oct 27 2017, 11:04 PM)

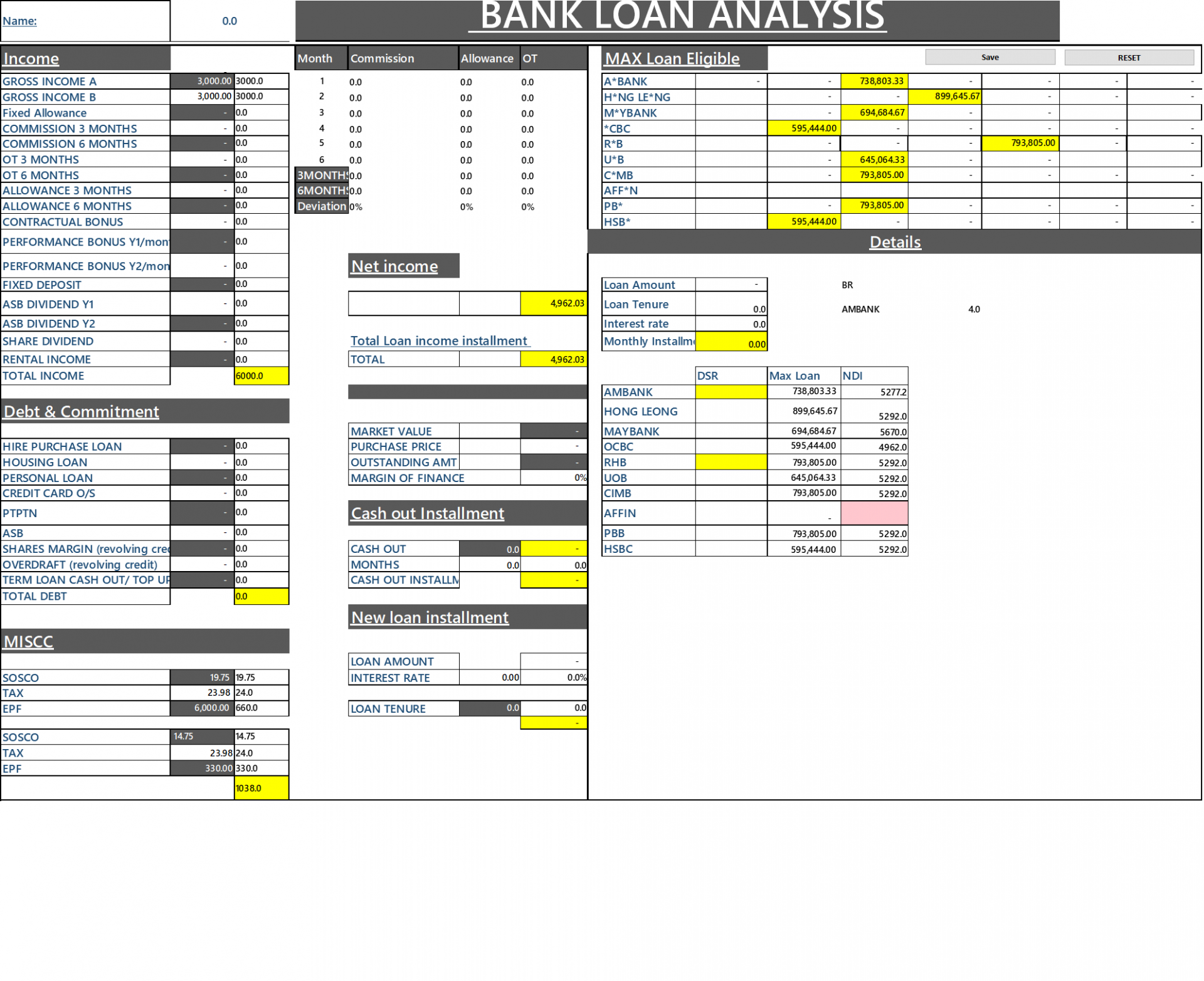

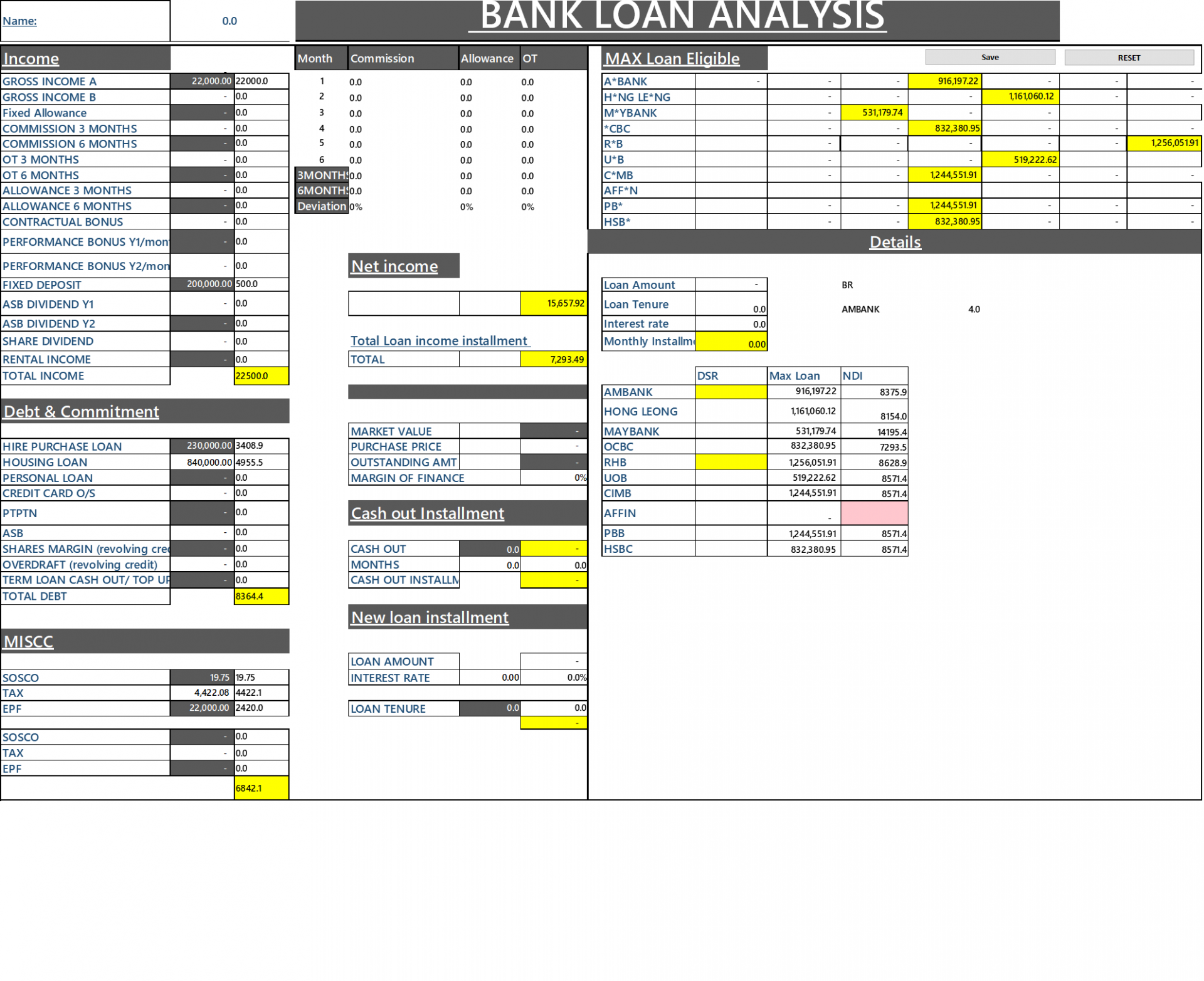

can any sifu advise the formula or calculation for max monthly installment for housing loan?

Just use this calculator

https://www.drcalculator.com/mortgage/

Oct 13 2017, 12:04 AM

Oct 13 2017, 12:04 AM

Quote

Quote

0.5504sec

0.5504sec

0.50

0.50

7 queries

7 queries

GZIP Disabled

GZIP Disabled