QUOTE(wild_card_my @ Dec 30 2014, 03:49 PM)

Thanks for sharing. No news form my side of banks yet.

But I dont quite get what you said, it means for the same loan amount you need to pay RM140/month more when we start using BR? That's... not very nice :|

i myself are not banker , so i concern only the final amount i pay , But I dont quite get what you said, it means for the same loan amount you need to pay RM140/month more when we start using BR? That's... not very nice :|

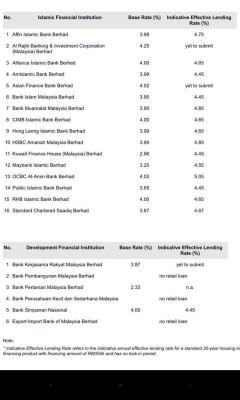

this UOB bank agent he do calculation for me , upon a RM500k loan amount . and monthly will be around RM2320/month for now .

so after BR implement , it could be around RM2460/month

for those who sign SnP before BR implement , they'll still follow BLR while not BR .

so for new buyer on 2015 , you're ready to xxx up now . sigh , GST + BR

Dec 30 2014, 03:53 PM

Dec 30 2014, 03:53 PM

Quote

Quote

0.0263sec

0.0263sec

0.43

0.43

6 queries

6 queries

GZIP Disabled

GZIP Disabled