QUOTE(moosset @ Apr 7 2019, 11:17 AM)

cherroyI've got a question:

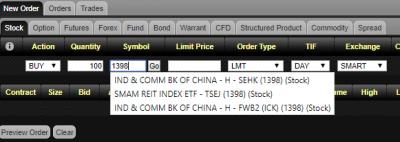

Say I'm interested in S&P500, so I'll find an ETF to track that.

Is it safe to say that we'll never make a loss in the long term??

For example, if you buy Apple, but Apple may go bankrupt. Maybe the stock price went down and I didn't exit in time, until it got delisted from the stock exchange.

In the case of ETF, if Apple got delisted from S&P500, another company will replace its position, right?? So this ETF will never go bankrupt??

So ETF is all to gain, nothing to lose in the long term??

If you hold an ETF, when the intrinsic companies change, it doesn't affect you in the long term, does it??

Sorry! I'm not sure if my question makes sense.

The ETF may suffer the loss if their holding share price plunged or delisted.

ETF is to track and mimick the targeted benchmark, so generally they do hold those benchmarking stocks.

ETF sometimes can deviated from its benchmark, aka not tracking well their benchmark.

When a stock is removed from the index (due to massive loss/share price plunging), the ETF may need to dispose the stock at a loss as well, and buy a new inclusion stock.

The comparison of Apple vs S&P500 is not right, as one is heavy on single stock, while another one technically invests in 500 stocks.

So S&P500 ETF gives you a better diversification, and risk spreading effect.

No such thing of never make loss in stock market, but generally good stocks do trend upward over the long time due to inflation effect.

Apr 6 2019, 11:54 PM

Apr 6 2019, 11:54 PM

Quote

Quote

0.0314sec

0.0314sec

0.82

0.82

6 queries

6 queries

GZIP Disabled

GZIP Disabled