QUOTE(prophetjul @ Oct 27 2024, 08:10 AM)

herein lies the question of the decade!

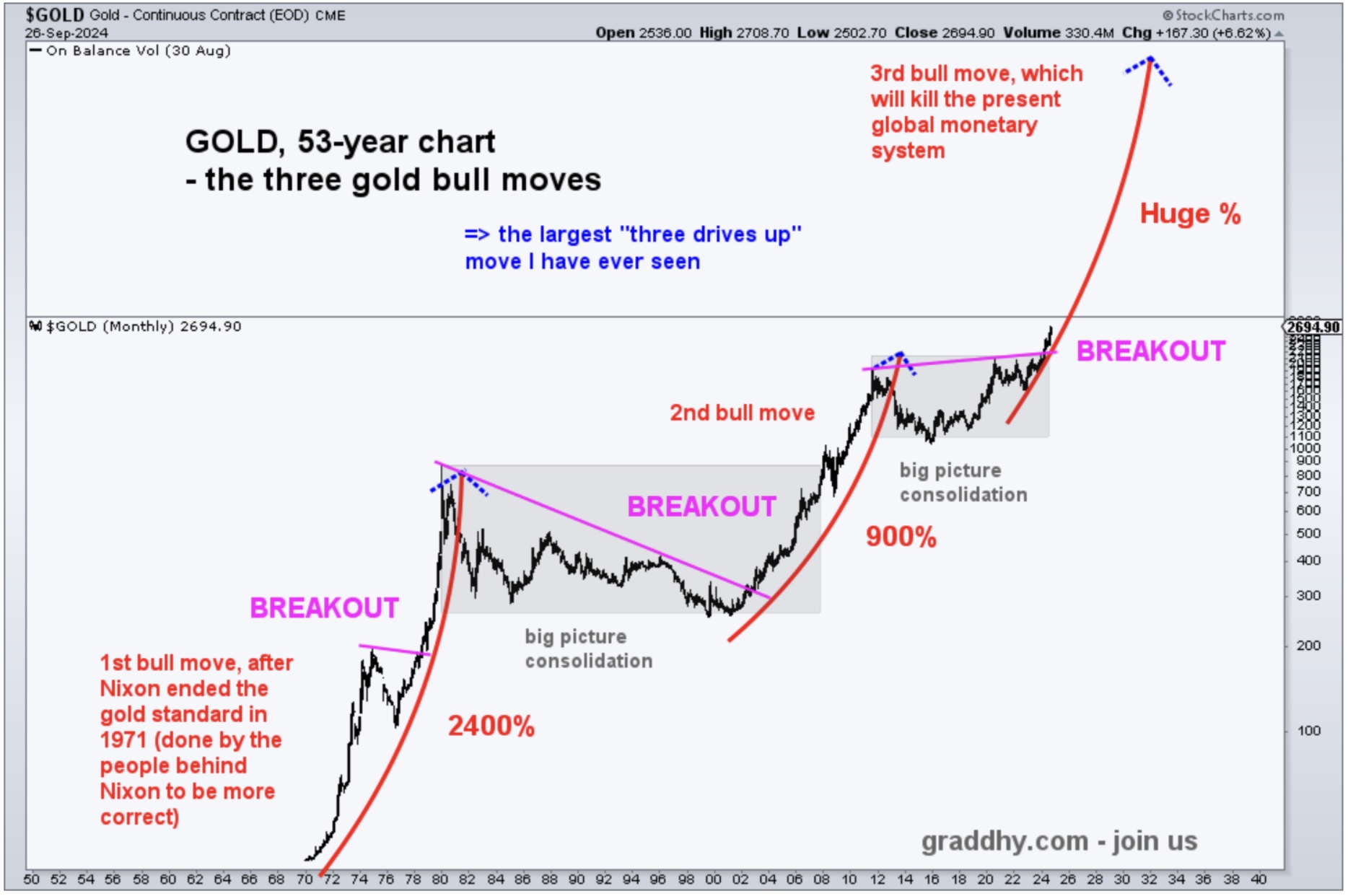

i m not sure if this fits the elliot 5 wave theory but i think does more than not.

waves1-2-3-4 have occurred, pretty much satisfied the conditions.

now, wave 5 looks to hv begun in 2022.

wave 3 started in 2015 at $1050/oz, ended around 2020 at $2000/oz, over 5 years.

by elliot's theory, wave 5 cannot be longer than wave 3.

wave 5 started in 2022; it shud be reasonable to predict this bull will not run longer than 5 years.

max 5 years from 2022 implies latest by 2027, the momentum divergence will be seen and the real decline will begin.

so, if i believe in the above, it will make sense to hold or add gold holdings between now and 2026?

of course be ready to sell when the time comes.

how does it sound?

Oct 23 2024, 12:50 PM

Oct 23 2024, 12:50 PM

Quote

Quote

0.0238sec

0.0238sec

1.22

1.22

6 queries

6 queries

GZIP Disabled

GZIP Disabled