QUOTE(bearbear @ Dec 3 2014, 10:43 PM)

question; is the miles worth paying 2.5% for it?

say RM 10k equivalent to RM250 extra for 11k miles.

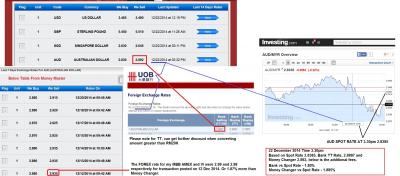

Bro, just for the heck of it, I did some comparison between Credit Cards versus Bank TT versus Money Changer (Mid Valley) vs Spot Rate

From the attached image:

AUD/MYR Spot Rate on 22 December 3.30pm - 2.8385

AUD/MYR Bank TT on 22 December 3.35pm - 2.8897. Diff between Spot Rate 1.8%!

AUD/MYR Money Changer on 22 December 3.32pm - 2.892. Diff between Spot Rate 1.885%!

Right now AUD/MYR Spot Rate - 2.8342, down from 3.30pm

From above example, better to TT because we get discount off the bank's official rate when converting more than RM20K.,

What about Credit Card? From Money Master website, i.e. Money Changer at Mid Valley, on 12 December, AUD/MYR 2.935

Well, I did 2 transactions on 10 Dec and both posted on 12 December.

AMEX RESERVE AUD/MYR - 2.99. Diff versus Money Master - 1.87%

MBB VI AUD/MYR - 2.98. Diff versus Money Market - 1.53%

So from the above, using MBB VI or MBB AR credit cards we are still paying more BUT not necessarily 2.5% extra for AUD/MYR case (for USD may be a complete different story as Money Changer Rate very close to Spot Rate) because no way we can get Spot Rate.

This post has been edited by Gen-X: Dec 22 2014, 06:52 PM Attached thumbnail(s)

Dec 22 2014, 02:24 PM

Dec 22 2014, 02:24 PM

Quote

Quote

0.0259sec

0.0259sec

0.33

0.33

6 queries

6 queries

GZIP Disabled

GZIP Disabled