QUOTE(rachel_xxx @ Jul 27 2014, 06:28 PM)

More bones are out.. those group also dun dare buy di..developers getting greedyFinancial BLR Increase 2014?, Base Lending Rate.

Financial BLR Increase 2014?, Base Lending Rate.

|

|

Jul 27 2014, 10:31 PM Jul 27 2014, 10:31 PM

|

Senior Member

9,533 posts Joined: Jun 2013 |

|

|

|

|

|

|

Jul 31 2014, 01:02 PM Jul 31 2014, 01:02 PM

|

Senior Member

2,359 posts Joined: Apr 2006 |

RM300k.. buy old flat in city area?

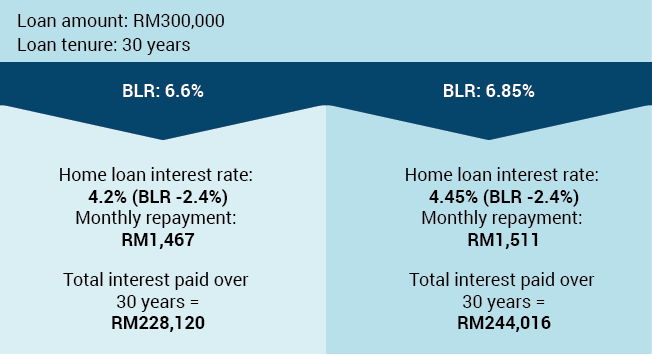

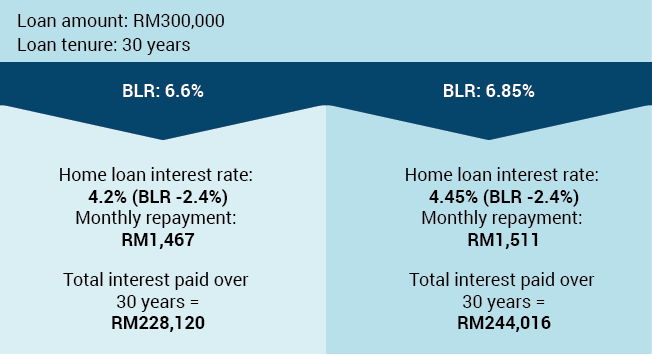

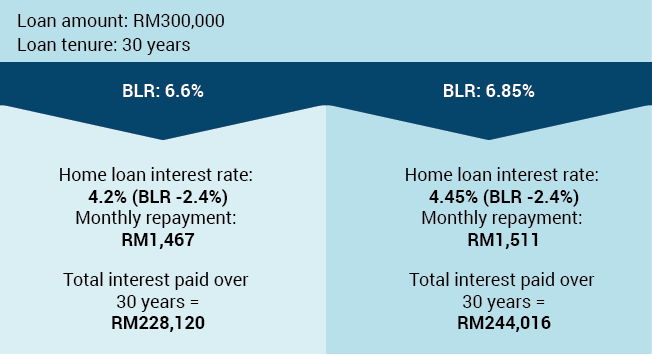

Nowdays.. most new property easily >500K - 700k++. 0.25% increased mean RM 250 extra per year for RM100k loan. If take loan: Rm500k - extra RM 1250 a year , mthly extra RM 104.16 RM600k - extra RM 1500 a year, mthly extra RM 125 RM700k - extra RM 1750 a year, mthly extra RM 145.83 Later if there another 0.25% interest raise,,, X 2 to the above amount.... QUOTE(andyyaosmurf @ Jul 31 2014, 12:12 PM) Look at Singapore? GST is 7%,which is 1% higher than us; Singapore_Power tariff is higher than TnB, No petrol subsidies, and many etc etc... so all Singaporean should consider to start coffins shop already? This post has been edited by viper88: Jul 31 2014, 01:04 PMOPR increase 25 basis point only. I don't know understand why people so panic... My suggestion to you is.. don't panic listen to me first.... Base on the table I downloaded from imoney, with RM300k loan with 30 year tenure. You only need to top up only RM44 interest rate every month after the BLR increased.  |

|

|

Jul 31 2014, 01:04 PM Jul 31 2014, 01:04 PM

|

Senior Member

9,533 posts Joined: Jun 2013 |

QUOTE(andyyaosmurf @ Jul 31 2014, 12:12 PM) Look at Singapore? GST is 7%,which is 1% higher than us; Singapore_Power tariff is higher than TnB, No petrol subsidies, and many etc etc... so all Singaporean should consider to start coffins shop already? i think you are noob, have you consider the Singapore salary?OPR increase 25 basis point only. I don't know understand why people so panic... My suggestion to you is.. don't panic listen to me first.... Base on the table I downloaded from imoney, with RM300k loan with 30 year tenure. You only need to top up only RM44 interest rate every month after the BLR increased.  and do you confirm the 25 points increase will only increase repayment solely? sure the owners wont increase rentals? the effect of this is multiple... you will get RM44 INCREASE from all angle of spending... dude, read my dialouge |

|

|

Jul 31 2014, 01:45 PM Jul 31 2014, 01:45 PM

|

Senior Member

2,359 posts Joined: Apr 2006 |

Well said..

QUOTE(bearbearwong @ Jul 31 2014, 01:04 PM) |

|

|

Aug 1 2014, 01:49 AM Aug 1 2014, 01:49 AM

|

Senior Member

1,170 posts Joined: Mar 2013 |

QUOTE(andyyaosmurf @ Jul 31 2014, 12:12 PM) Look at Singapore? GST is 7%,which is 1% higher than us; Singapore_Power tariff is higher than TnB, No petrol subsidies, and many etc etc... so all Singaporean should consider to start coffins shop already? Dude, you think Singaporeans are getting the same kind of salary you're getting arr? We see the BLR trend, not just the bloody 0.25%. And the trend now is upwards. Another guy reassuring himself.OPR increase 25 basis point only. I don't know understand why people so panic... My suggestion to you is.. don't panic listen to me first.... Base on the table I downloaded from imoney, with RM300k loan with 30 year tenure. You only need to top up only RM44 interest rate every month after the BLR increased.  |

|

|

Aug 1 2014, 08:13 AM Aug 1 2014, 08:13 AM

|

Junior Member

206 posts Joined: Jan 2011 |

Sien, don't compare MY with SG la.

SG has perfect transport system, higher % in CPF, lower rate of income tax. Just that, government just wanna to control their housing price by increasing the BLR due to their land is small.. MY ppl are not panic.. but very stress only |

|

|

|

|

|

Aug 1 2014, 08:19 AM Aug 1 2014, 08:19 AM

|

Junior Member

206 posts Joined: Jan 2011 |

QUOTE(viper88 @ Jul 31 2014, 01:02 PM) RM300k.. buy old flat in city area? RM1750 a year ! Nowdays.. most new property easily >500K - 700k++. 0.25% increased mean RM 250 extra per year for RM100k loan. If take loan: Rm500k - extra RM 1250 a year , mthly extra RM 104.16 RM600k - extra RM 1500 a year, mthly extra RM 125 RM700k - extra RM 1750 a year, mthly extra RM 145.83 Later if there another 0.25% interest raise,,, X 2 to the above amount.... |

|

|

Aug 1 2014, 02:33 PM Aug 1 2014, 02:33 PM

|

Senior Member

1,956 posts Joined: May 2010 |

|

|

|

Aug 1 2014, 02:34 PM Aug 1 2014, 02:34 PM

|

All Stars

18,672 posts Joined: Jan 2003 From: Penang |

QUOTE(beyond86 @ Aug 1 2014, 02:33 PM) Dun sked us. Please. |

|

|

Aug 1 2014, 02:37 PM Aug 1 2014, 02:37 PM

|

Senior Member

1,956 posts Joined: May 2010 |

|

|

|

Aug 1 2014, 03:31 PM Aug 1 2014, 03:31 PM

|

Junior Member

24 posts Joined: Jul 2014 |

Hope no more shite storm

|

|

|

Aug 1 2014, 05:23 PM Aug 1 2014, 05:23 PM

|

Senior Member

9,533 posts Joined: Jun 2013 |

QUOTE(beyond86 @ Aug 1 2014, 02:33 PM) yes yes hike more... it is about time...wake up calls |

|

|

Aug 1 2014, 06:14 PM Aug 1 2014, 06:14 PM

|

Senior Member

1,170 posts Joined: Mar 2013 |

|

|

|

|

|

|

Aug 1 2014, 06:27 PM Aug 1 2014, 06:27 PM

|

Senior Member

1,360 posts Joined: Mar 2010 |

QUOTE(bearbearwong @ Jul 27 2014, 10:13 AM) it has happened.. bancruptcy list and dafaulting loans NPL surge like hell.. forcing 3 banks popular with NPL to merge.. guess which 3? Hehe.. confidence is lost in property matket.. no matter how good the promotion by developers and how good interested party intends to potray property.. more info on this? |

|

|

Aug 1 2014, 07:12 PM Aug 1 2014, 07:12 PM

|

Senior Member

9,533 posts Joined: Jun 2013 |

|

|

|

Aug 1 2014, 07:17 PM Aug 1 2014, 07:17 PM

|

Senior Member

9,533 posts Joined: Jun 2013 |

QUOTE(cranx @ Aug 1 2014, 06:27 PM) rumors only.. that one also heard from bank officers... CIMB is famous with NPL loan in fact too.. MBSB is bank for ALL just give any loans you want like last time Eon bank when Hong Long bank wanted to take over.. Eon bank giving loans like mad.. why? more loans means stronger then bank and selling price of shares higher.. haizz that was Eon bank.. more banks trailing especially those approving before DSR... 2 years ago when CIMB came to market with Jib bro come in.. CIMB last time promo only do 500k above loans.. public bank terus lose face.. Public bank what loans also do provided the borrowers record is good and steady.. old man business This post has been edited by bearbearwong: Aug 1 2014, 09:43 PM |

|

|

Aug 2 2014, 09:10 AM Aug 2 2014, 09:10 AM

|

Senior Member

4,258 posts Joined: Nov 2012 |

Just to report all my 4 outstanding loans instalment from 3 banks did not increase in amount. Maybe because I did not take maximum tenure, so the banks want to earn more interest from me. Let's see if there are any changes later this month

|

|

|

Aug 4 2014, 03:31 PM Aug 4 2014, 03:31 PM

|

Senior Member

2,359 posts Joined: Apr 2006 |

If increase another 0.25% in Nov, total will be 0.5%

rm100k = rm 500 yrly, rm 41.66 mthly rm500k = rm 2500 yrly, rm208.33 mthly rm1million = rm5000 yrly, rm416.66 mthly QUOTE(andyyaosmurf @ Aug 4 2014, 12:50 PM) http://www.theedgemalaysia.com/business-ne...securities.html This post has been edited by viper88: Aug 4 2014, 03:32 PMsaying that November planning to increase another 0.50%, since there will have no increase on September... so it will how much monthly/yearly extra need to pay for interest? Anyway just would like to ask about KLIBOR? KLIBOR also increasing right? anyone expert manage to do a calculate to find out how much monthly extra $$ interest rate to be pay for KLIBOR home loan package,? |

|

|

Aug 5 2014, 10:52 AM Aug 5 2014, 10:52 AM

|

Senior Member

763 posts Joined: Sep 2007 |

Noob question.

My housing loan is auto deducted from my bank every month. I'm aware of the increase of BLR rate since last month which is supposed to take effect like immediately, but when I checked my loan amount deducted this month was still the same rates as per what I signed in the loan agreement BLR6.6- 2.4 I'm already taking a maximum tenure of 35years, kinda impossible that they still add on my years for the loan. As per maybank's announcement, they already follow Bank Negara's rules to increase BLR to 6.85 since mid July. Or I'm supposed to wait for a letter from the bank giving some instructions or something perhaps? Anyone kind enough to explain? Thanks a lot. |

|

|

Aug 5 2014, 11:03 AM Aug 5 2014, 11:03 AM

|

All Stars

12,528 posts Joined: Feb 2013 |

QUOTE(princessgalaria @ Aug 4 2014, 08:52 PM) Noob question. ask BBW our DDD korMy housing loan is auto deducted from my bank every month. I'm aware of the increase of BLR rate since last month which is supposed to take effect like immediately, but when I checked my loan amount deducted this month was still the same rates as per what I signed in the loan agreement BLR6.6- 2.4 I'm already taking a maximum tenure of 35years, kinda impossible that they still add on my years for the loan. As per maybank's announcement, they already follow Bank Negara's rules to increase BLR to 6.85 since mid July. Or I'm supposed to wait for a letter from the bank giving some instructions or something perhaps? Anyone kind enough to explain? Thanks a lot. |

| Change to: |  0.0345sec 0.0345sec

0.32 0.32

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 13th December 2025 - 11:40 PM |