QUOTE(laikinsoon @ Oct 22 2014, 05:10 PM)

Hi there, I want to ask the income tax relief receipt must be original or photostat copy enough already. Thank you very much.

Photocopy also canIncome Tax Issues v3, Anything related to Personal Income Tax

|

|

Oct 22 2014, 08:40 PM Oct 22 2014, 08:40 PM

|

Senior Member

6,620 posts Joined: Jun 2009 |

|

|

|

|

|

|

Oct 22 2014, 08:52 PM Oct 22 2014, 08:52 PM

|

Newbie

3 posts Joined: Sep 2011 |

QUOTE Original QUOTE Photocopy also can Only original copy or photocopy??? |

|

|

Oct 22 2014, 09:12 PM Oct 22 2014, 09:12 PM

|

Senior Member

6,620 posts Joined: Jun 2009 |

last time, was called in to show them evidence, photocopy no prob

|

|

|

Oct 22 2014, 09:17 PM Oct 22 2014, 09:17 PM

|

Newbie

3 posts Joined: Sep 2011 |

QUOTE last time, was called in to show them evidence, photocopy no prob I see. Thank you very much. This post has been edited by laikinsoon: Oct 22 2014, 09:17 PM |

|

|

Oct 30 2014, 07:50 PM Oct 30 2014, 07:50 PM

|

Junior Member

169 posts Joined: Mar 2008 |

Hi i moved this from another thread to here, deleted ori. Need advise from sifus here. Sorry in advance for noob questions.

I register new enterprise/sole proprietor 9 months ago- deposited rm2K to start Maybank account and checkbook. The thing is i set this up for non-profit, So over the 9 mths i have received over rm150k from various ppl and companies. But i have paid out my friends who helped me (as consultants, contractors, etc) leaving my bank acct balance around rm8k (incl the rm2k i deposited). Can someone advise me how do i go abt with income tax? I've read in other threads to pay IRB no matter what and to pay income tax since being new business set up bla bla. Ok its good advise but in my case do i only declare the rm6K as profit or how much? And do I need to show IRB the proof I've paid out to my friends, purchase stationery, travel, etc? TQVM |

|

|

Nov 4 2014, 05:53 PM Nov 4 2014, 05:53 PM

|

|

Staff

2,797 posts Joined: Nov 2007 From: On the beach |

QUOTE(bendover @ Oct 30 2014, 07:50 PM) Hi i moved this from another thread to here, deleted ori. Need advise from sifus here. Sorry in advance for noob questions. You might want to pay/consult an accountant to help you with this. I register new enterprise/sole proprietor 9 months ago- deposited rm2K to start Maybank account and checkbook. The thing is i set this up for non-profit, So over the 9 mths i have received over rm150k from various ppl and companies. But i have paid out my friends who helped me (as consultants, contractors, etc) leaving my bank acct balance around rm8k (incl the rm2k i deposited). Can someone advise me how do i go abt with income tax? I've read in other threads to pay IRB no matter what and to pay income tax since being new business set up bla bla. Ok its good advise but in my case do i only declare the rm6K as profit or how much? And do I need to show IRB the proof I've paid out to my friends, purchase stationery, travel, etc? TQVM Yes, you will need proof if IRB checks you. Proof for the expenses paid. And also not everything you paid out are deductible from your profit. |

|

|

|

|

|

Nov 5 2014, 01:27 PM Nov 5 2014, 01:27 PM

|

Senior Member

2,065 posts Joined: Oct 2014 From: Ipoh,Perak |

QUOTE(bendover @ Oct 30 2014, 07:50 PM) Hi i moved this from another thread to here, deleted ori. Need advise from sifus here. Sorry in advance for noob questions. You only have to declare your business income and any other gains/employment income for 2014 in next year - eFiling Form B before 30 June 2015.I register new enterprise/sole proprietor 9 months ago- deposited rm2K to start Maybank account and checkbook. The thing is i set this up for non-profit, So over the 9 mths i have received over rm150k from various ppl and companies. But i have paid out my friends who helped me (as consultants, contractors, etc) leaving my bank acct balance around rm8k (incl the rm2k i deposited). Can someone advise me how do i go abt with income tax? I've read in other threads to pay IRB no matter what and to pay income tax since being new business set up bla bla. Ok its good advise but in my case do i only declare the rm6K as profit or how much? And do I need to show IRB the proof I've paid out to my friends, purchase stationery, travel, etc? TQVM You only need to show them the receipts/invoices/bills/bank statements & etc related to this business, when they come and check you. At this moment, you doesn't need to show them anything but just keep all this document for future if IRB really comes after you. This post has been edited by rapple: Nov 5 2014, 01:38 PM |

|

|

Nov 6 2014, 10:05 PM Nov 6 2014, 10:05 PM

|

Senior Member

645 posts Joined: Apr 2007 |

QUOTE(KOHTT @ Oct 22 2014, 03:55 PM) http://www.nst.com.my/red/which-expenses-t...income-1.199281 Hi,ALLOWABLE: There is no ‘standard list’ of deductible expenses but there are common expenses that can be deducted The biggest grouse that a property owner has come tax submission season will be the amount of taxes that he has to pay on his property rental income. He will then naturally start to rummage through all the property expenses he had incurred to determine what is tax-deductible and what is not. In situations of doubt, I have known of property owners turning to other property owners asking, “Do you claim such-and-such expenses in your income tax return?“ Well, my sincere hope is that the person he is asking has a good understanding of the tax laws, otherwise it will be a case of the blind leading the blind and both will end up having to face unnecessary tax penalties when it comes to a tax audit. This article hopes to shed some light on how to determine the tax-deductibility of those expenses. I have often been asked if there is list of standard expenses that a taxpayer can deduct against the rental income from letting of his investment properties. Quite honestly, there is no ‘‘standard‘ list of allowable tax deductions as the expenses that a taxpayer incurs may be unique to his/her own situation. Therefore, the taxpayer will have to fall back on the letter of the law to determine if an expense is tax-deductible against rental income. Essentially, the law states that an expense wholly and exclusively incurred in the production of income under subsection 33(1) of the Income Tax Act (ITA) 1967 and which is not prohibited under subsection 39(1) of the ITA, is allowed as a deduction from rental income. What this means in laymen‘s terms is, any expenses that you incur for the year to generate the rental income would generally be tax-deductible. This also means that no private or personal expenses are allowable as a deduction. Common deductible expenses Aside from the ‘standard‘ list of tax-deductible expenses that a lot of property owners is asking for, what I can provide you here is a list of common expenses that generally may be claimed as a deduction against rental income: • Advertising for tenants • Assessment • Insurance (e.g. fire, burglary) • Interest on loan(s) to finance the purchase of the property being rented out • Legal expenses (renewal of tenancy agreement, recovery of rental arrears) • Maintenance/service charges • Pest control • Property agent fees/commission • Quit rent • Rental collection fee • Repairs and maintenance • Replacement of rental assets It is important to note that the expenses are deductible in the year they were incurred, even though you have not made any payment for them during the year. Having said that, do ensure that your obligations as a landlord towards the expenses which are to be borne by you, are clearly spelt out in the tenancy agreement to avoid any disputes by the Inland Revenue Board (IRB) against your claims for the said expenses. Non-allowable expenses Having touched on the tax-deductible expenses, it is also important to know what expenses are not allowable. Typically, initial expenses are not allowed to be deducted from income of letting of real property assessed under paragraph 4(a) or paragraph 4(d) of the ITA since those expenses are incurred to create a source of rental income and not incurred in the production of rental income. Examples of such expenses include: • Costs of obtaining the first tenant for the property, such as: ° Advertisement; ° Introducer’s commission; ° Legal fees incurred for the preparation of tenancy agreement; • Other expenses incurred prior to the property being rented out; or • Renovation and improvement costs. In the case of expenses incurred prior to the property being rented out, particularly relating to annual property expenses such as quit rent, assessment or insurance costs, then the proportion of the expenses in respect of the period before the property is rented out is not deductible and have to be adjusted accordingly. However, a distinction (although in many situations, a difficult one) has to be drawn between what expense is deemed to be ‘repairs and maintenance‘ (which is tax-deductible) and what is ‘renovation or improvement‘ (which is NOT tax-deductible). Typically, an expense is deemed to be ’repairs and maintenance‘ if it is incurred on ordinary repair to maintain or restore the real property in its existing state. It will not materially add to the property‘s value nor substantially prolong its useful life, but merely to keep it in good and efficient operating condition. In the case of ‘renovation or improvement‘, the reverse would then apply, i.e. the expense incurred would: • materially add to the property’s value; • substantially prolong its useful life; • adapt the property to a new or different use; or • enhance the property’s income-generating ability. What happens during the period when the property is not rented out? As explained above, expenses incurred prior to the property being first rented out, are not allowable in calculating the adjusted income from the letting of that property. However, if the property which was previously rented out is left temporarily unoccupied while you are looking for the next tenant, the expenses incurred during the period of non-occupancy will still qualify for deduction. This is on the condition that the property is being consistently kept in a tenantable state and is ready to be let out at any time. How long then, can a property be ‘temporarily‘ left vacant and yet the property expenses qualify for a tax deduction? The IRB’s Public Ruling 4/2011 further explains under what circumstances where the expenses incurred for the period the property is temporarily not rented out will be allowable. The circumstances are: • repair or renovation of the building; • absence of tenants for a period of two years after termination of tenancy; • legal injunction or other official sanction; or • other circumstances beyond the control of the person who lets out the real property. Under the above circumstances, the expenses for the period the property is not let out are allowable, provided that the property is maintained in good condition and is ready to be let out. Of course, having explained the concept of tax-deductibility of expenses against rental income, one must never forget or ignore the underlying basis for claiming for a tax deduction, i.e. the need to keep proper records and documentation relating to the claim for those expenses. When it comes to a tax audit, the IRB‘s basis of allowing you a tax deduction for the expenses claimed would all be about the availability of evidence. Read more: Which expenses to deduct from rental income? - RED - New Straits Times http://www.nst.com.my/red/which-expenses-t...1#ixzz2qrDugMR1 This is very helpful, thanks. I have a new property, empty unit, VP for 6 mths now. I have a few questions, hopefully someone can help. 1. If I sign a rental agreement with someone, and he pays rental for 2 months and terminates the agreement, can I still claim my income tax deductible expenses like maintenance fees for 2 years from the date of rental agreement signed? 2. Can I rent to someone at a rental fee that is less than my expenses, e.g. maintenance fees, and incur loss every year and claim tax deductions? How low can I go? 3. Will IRB ever audit the physical property on site to make sure that the property is liveable? This is my first property for investment where I don't stay in. Thanks. |

|

|

Nov 7 2014, 12:05 PM Nov 7 2014, 12:05 PM

|

Senior Member

2,065 posts Joined: Oct 2014 From: Ipoh,Perak |

QUOTE(wjchay @ Nov 6 2014, 10:05 PM) Hi, 1. Yes you can, but pro-rate your maintenance fees to avoid if in future IRB come check and say you over claim your expenses for that year.This is very helpful, thanks. I have a new property, empty unit, VP for 6 mths now. I have a few questions, hopefully someone can help. 1. If I sign a rental agreement with someone, and he pays rental for 2 months and terminates the agreement, can I still claim my income tax deductible expenses like maintenance fees for 2 years from the date of rental agreement signed? 2. Can I rent to someone at a rental fee that is less than my expenses, e.g. maintenance fees, and incur loss every year and claim tax deductions? How low can I go? 3. Will IRB ever audit the physical property on site to make sure that the property is liveable? This is my first property for investment where I don't stay in. Thanks. 2. Yes. And why you wanna do that? Your rental income is your source of income to proof to banks for future investments. 3. Not sure. This post has been edited by rapple: Nov 7 2014, 01:40 PM |

|

|

Nov 9 2014, 07:11 PM Nov 9 2014, 07:11 PM

|

Senior Member

3,599 posts Joined: Jun 2009 From: MYBoleh.NET |

Recently purchased a phone casing from the US and using FedEx Courier services. The product cost roughly Rm 350 and I was surprised that when it reaches Malaysia Kastam, it has been then further taxes together with duty fees in the amount of RM 240.

So, i am here to ask is there any possible ways for me to get back the money through rebate? How about i declare it as personal use and then got the rebate from the LHDN later on? Any opinions and suggestions are welcome and appreciated. |

|

|

Nov 9 2014, 08:37 PM Nov 9 2014, 08:37 PM

|

Senior Member

11,554 posts Joined: Aug 2009 |

QUOTE(MasBoleh! @ Nov 9 2014, 07:11 PM) Recently purchased a phone casing from the US and using FedEx Courier services. The product cost roughly Rm 350 and I was surprised that when it reaches Malaysia Kastam, it has been then further taxes together with duty fees in the amount of RM 240. You can appeal. But that's almost 100% of tax. Something wrong already.So, i am here to ask is there any possible ways for me to get back the money through rebate? How about i declare it as personal use and then got the rebate from the LHDN later on? Any opinions and suggestions are welcome and appreciated. |

|

|

Nov 9 2014, 10:30 PM Nov 9 2014, 10:30 PM

|

Senior Member

3,599 posts Joined: Jun 2009 From: MYBoleh.NET |

QUOTE(supersound @ Nov 9 2014, 08:37 PM) Yea, It is actually an Element Case Solace for iPhone 6http://www.elementcase.com/Solace-for-iPho...t-0011-x000.htm Total including shipping is RM 390 to be exact. FedEx provided this statement FedEx: AWB#********** has been cleared with duty and tax RM235.68 + RM5.00 (FCZ CHARGES) = RM 240.68. For assistance on delivery and shipment movement status, kindly contact our customer service center at 1-800-88-6363. Thank you for shipping with FedEx. |

|

|

Nov 10 2014, 12:42 AM Nov 10 2014, 12:42 AM

|

Senior Member

11,554 posts Joined: Aug 2009 |

QUOTE(MasBoleh! @ Nov 9 2014, 10:30 PM) Yea, It is actually an Element Case Solace for iPhone 6 Just ask them why the tax so high.http://www.elementcase.com/Solace-for-iPho...t-0011-x000.htm Total including shipping is RM 390 to be exact. FedEx provided this statement FedEx: AWB#********** has been cleared with duty and tax RM235.68 + RM5.00 (FCZ CHARGES) = RM 240.68. For assistance on delivery and shipment movement status, kindly contact our customer service center at 1-800-88-6363. Thank you for shipping with FedEx. I think something wrong. |

|

|

|

|

|

Nov 10 2014, 02:04 AM Nov 10 2014, 02:04 AM

|

Senior Member

3,599 posts Joined: Jun 2009 From: MYBoleh.NET |

QUOTE(supersound @ Nov 10 2014, 12:42 AM) Gonna do that tomorrow. Hopefully everything can be fine soon. After checked with the Malaysia tax and duty fees, my product the most will only kena 10% sales tax which is RM 39.00. Clearly there was an error made by FedEx or Kastam |

|

|

Nov 10 2014, 09:39 AM Nov 10 2014, 09:39 AM

|

Senior Member

11,554 posts Joined: Aug 2009 |

QUOTE(MasBoleh! @ Nov 10 2014, 02:04 AM) Gonna do that tomorrow. Hopefully everything can be fine soon. Highest tax rate are about 30% from postage and item's price.After checked with the Malaysia tax and duty fees, my product the most will only kena 10% sales tax which is RM 39.00. Clearly there was an error made by FedEx or Kastam |

|

|

Nov 10 2014, 09:39 AM Nov 10 2014, 09:39 AM

|

Senior Member

11,554 posts Joined: Aug 2009 |

QUOTE(MasBoleh! @ Nov 10 2014, 02:04 AM) Gonna do that tomorrow. Hopefully everything can be fine soon. Highest tax rate are about 30% from postage and item's price.After checked with the Malaysia tax and duty fees, my product the most will only kena 10% sales tax which is RM 39.00. Clearly there was an error made by FedEx or Kastam |

|

|

Nov 10 2014, 11:05 AM Nov 10 2014, 11:05 AM

|

Junior Member

505 posts Joined: Sep 2008 From: https://goo.gl/96W8ru |

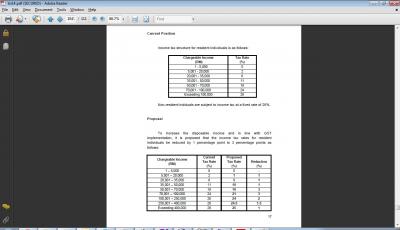

hi all sifu. Need u all advice very much, as i'm going to LHDN office in next few days. i received an official letter from LHDN sent to my HR, asking to start deduct extra more than rm 80++ of income tax from my pay roll next month onwards, however no any reason given WHY they instruct so. i was wondering if this has to do with me didn't file for eTax using the BE form during Apr 2014, this year, as i refer to attached details from our PM najib's 2014 Budget. (Previous few years i did declared for eTax) According to attached excerpt from the official document, income groups of certain salary range are exempted from tax in year 2014. But why LHDN now come and chase for the heft total 1K ++ ? Even my previous years tax declaration didn't amount to more than rm 100. - What are the complete set of documents i need to standby to bring to the local LHDN office, to appeal for this issue ? (mine is at the setapak one) i have only 1 day to settle this, and i hope things will be going smooth. any advice, comments appreciated. Attached thumbnail(s)

|

|

|

Nov 10 2014, 02:47 PM Nov 10 2014, 02:47 PM

|

Senior Member

3,599 posts Joined: Jun 2009 From: MYBoleh.NET |

QUOTE(supersound @ Nov 10 2014, 09:39 AM) QUOTE(supersound @ Nov 10 2014, 09:39 AM) I see. May I know how you deduced that highest tax rate are about 30%? hmm... This website stated that Malaysia only imply 10% service tax. http://www.dutycalculator.com/hs-code-duty...2.39.0090/7353/ While, in the kastam's website. Under the 420239900 of Old HLS (you can put the number into the search bar at the right to search) It also stated only got 10% sale tax. http://tariff.customs.gov.my/ |

|

|

Nov 10 2014, 03:26 PM Nov 10 2014, 03:26 PM

|

Senior Member

11,554 posts Joined: Aug 2009 |

QUOTE(MasBoleh! @ Nov 10 2014, 02:47 PM) I see. May I know how you deduced that highest tax rate are about 30%? hmm... That's for electronics. If yours are not electronics, then it shall not being charge for > 30%.This website stated that Malaysia only imply 10% service tax. http://www.dutycalculator.com/hs-code-duty...2.39.0090/7353/ While, in the kastam's website. Under the 420239900 of Old HLS (you can put the number into the search bar at the right to search) It also stated only got 10% sale tax. http://tariff.customs.gov.my/ |

|

|

Nov 10 2014, 03:41 PM Nov 10 2014, 03:41 PM

|

Junior Member

505 posts Joined: Sep 2008 From: https://goo.gl/96W8ru |

QUOTE(Life_House @ Nov 10 2014, 11:05 AM) hi all sifu. any advise for above ? thx.Need u all advice very much, as i'm going to LHDN office in next few days. i received an official letter from LHDN sent to my HR, asking to start deduct extra more than rm 80++ of income tax from my pay roll next month onwards, however no any reason given WHY they instruct so. i was wondering if this has to do with me didn't file for eTax using the BE form during Apr 2014, this year, as i refer to attached details from our PM najib's 2014 Budget. (Previous few years i did declared for eTax) According to attached excerpt from the official document, income groups of certain salary range are exempted from tax in year 2014. But why LHDN now come and chase for the heft total 1K ++ ? Even my previous years tax declaration didn't amount to more than rm 100. - What are the complete set of documents i need to standby to bring to the local LHDN office, to appeal for this issue ? (mine is at the setapak one) i have only 1 day to settle this, and i hope things will be going smooth. any advice, comments appreciated. |

|

Topic ClosedOptions

|

| Change to: |  0.0215sec 0.0215sec

0.23 0.23

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 07:49 PM |