QUOTE(Gen-X @ Sep 10 2013, 02:25 PM)

If you go open a savings account with RHB, still need to pay for the ATM card - need it to register for OTP for online banking.

Next year onwards we'll be imposed by all banks another RM0.50 for cheque processing fee

----------------------------------------------

A message from UOB website:

Cheque Processing Fee of RM0.50

Effective 1 April 2014, all banks in Malaysia will charge a processing fee of RM0.50 and stamp duty of RM0.15

for every cheque issued.

We therefore encourage you to take advantage of our Internet Banking services to perform your transaction.

You pay only RM0.10 per Interbank GIRO (IBG) transaction.

----------------------------------------------

I was told by Bank Rakyat if to transfer fund online via Giro from Bank Rakyat saving account to other

banks, this process will take 2 working days, so this means that we will lose 2 days interest..?

Luckily, other banks can receive fund on the same day if we use Bank Rakyat ATM machine to transfer fund, but this will cost service fee RM 1.00. I was wondering if other bank ATM machines can transfer fund on the same day just like Bank Rakyat?

QUOTE(gsc @ Sep 10 2013, 08:03 PM)

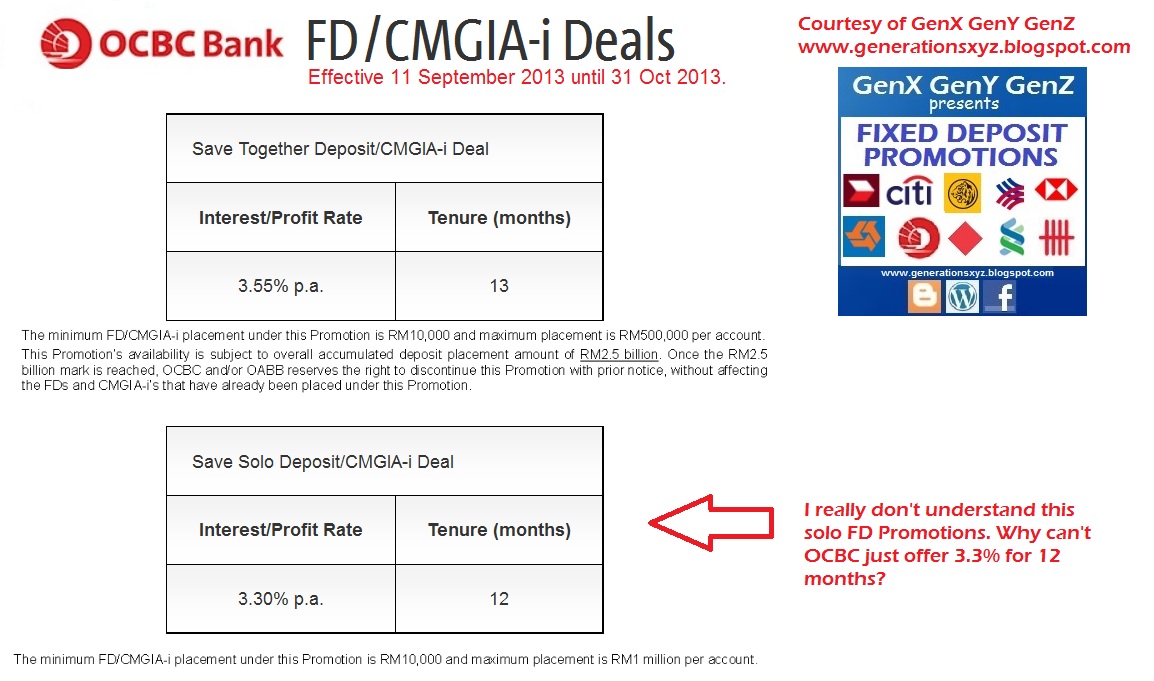

Effective 11 sept ocbc promo

Fresh fund same as before

Mega saver interest drop from 4.5% to 4.2%, previous 2:1 ratio remain. A quick estimate shown the effective rate is 3.55%.

Fresh fund same as before

13 months joint account drop from 3.7% to 3.55%

No Fresh fund required

3.33% for 12 months. This one I wasnt sure as the rate is low and I dont want to waste my memory cell..

Thanks for the update

QUOTE(gsc @ Sep 11 2013, 09:18 PM)

It seems that the bank strategy is throwing the net initially to attract customers with high short term (3 months) and now it is the time to tighten the net to lock the fish for 13 months...

Banks become more cunning lately..

This is a FD battle in between banks & Musical Chair members..

This post has been edited by BoomChaCha: Sep 12 2013, 02:11 AM

This post has been edited by BoomChaCha: Sep 12 2013, 02:11 AM

Sep 11 2013, 12:07 AM

Sep 11 2013, 12:07 AM

Quote

Quote

0.0202sec

0.0202sec

0.50

0.50

6 queries

6 queries

GZIP Disabled

GZIP Disabled