QUOTE(cybermaster98 @ Dec 10 2013, 01:08 PM)

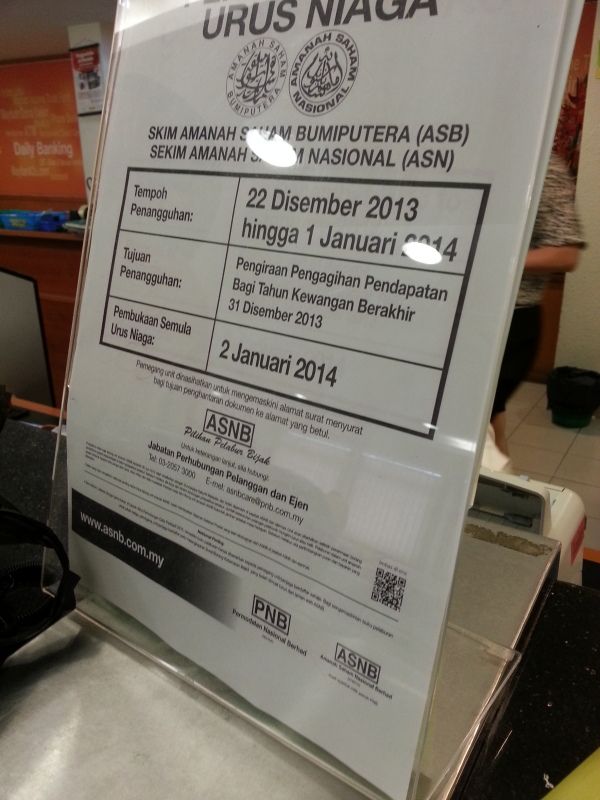

that's the day ASNB decided to suspend all ASB / ASN transactions

ASN, ASN2, ASN3, ASG, ASB, ASW2020, ASM, ASD, AS1M, AMANAH SAHAM NASIONAL BERHAD V4

|

|

Dec 10 2013, 01:46 PM Dec 10 2013, 01:46 PM

Return to original view | Post

#141

|

|

Staff

7,948 posts Joined: Jan 2005 From: Soviet Sarawak |

|

|

|

|

|

|

Dec 13 2013, 08:52 AM Dec 13 2013, 08:52 AM

Return to original view | Post

#142

|

|

Staff

7,948 posts Joined: Jan 2005 From: Soviet Sarawak |

QUOTE(richygirl88 @ Dec 11 2013, 02:23 PM) non-bumi. why lucky? if u noticed i am reluctant to put some calculations for you since your case is quite rare. would you mind taking a snap of your pass book before i help you calculate the dividend?lucifah Today manage to put another RM50k .. Total is RM60k So if i withdraw all by 01 DEC 2014.. the interest will be count from JAN to NOV 2014 (11 months) ? Let say the interest is 6.7% again So the dividend will be 3685 + Rm60,000 Total = RM63685 Sifu my calculation correct? and i lose interest for DECEMBER 2013 whole month? |

|

|

Dec 13 2013, 03:09 PM Dec 13 2013, 03:09 PM

Return to original view | Post

#143

|

|

Staff

7,948 posts Joined: Jan 2005 From: Soviet Sarawak |

QUOTE(Leo the Lion @ Dec 13 2013, 03:06 PM) Finally invest RM640(1 year savings from tabung). Btw guys, do bank like maybank accept coins? Can exchange for paper money or not? floats will be imposedi.e. they take their sweet time to count the coins and then after a few days then credit it into your account just go to my shop and exchange with me or if my shop is too far, just go to any supermarket / mini market. the towkay will be happy to exchange the coins with you, provided you pack the coins properly for easy recounting |

|

|

Dec 14 2013, 09:01 AM Dec 14 2013, 09:01 AM

Return to original view | Post

#144

|

|

Staff

7,948 posts Joined: Jan 2005 From: Soviet Sarawak |

QUOTE(plumberly @ Dec 13 2013, 08:19 PM) Wah, did not know that there are more than 1700 branches. they include all MBB, CIMB and RHB banks throughout the country. my small hometown has at least 10 agents + 1 PNB branch if you include the Post OfficeSo I am competing with some 1700 potential buyers when I try my luck. Interesting. Cheerio. |

|

|

Dec 14 2013, 09:02 AM Dec 14 2013, 09:02 AM

Return to original view | Post

#145

|

|

Staff

7,948 posts Joined: Jan 2005 From: Soviet Sarawak |

|

|

|

Dec 14 2013, 10:50 AM Dec 14 2013, 10:50 AM

Return to original view | Post

#146

|

|

Staff

7,948 posts Joined: Jan 2005 From: Soviet Sarawak |

QUOTE(aeiou228 @ Dec 14 2013, 10:45 AM) It is still possible though as she has her mum's friend working at the bank's counter to immediately place a deposit when a customer just made a withdrawal. The technical question here is that how her mum's friend can have access to her account for CASH withdrawal without proper authorization and biometric thumb print scan and IC verification ? that's the easy part. he can leave a large amount of cash to the tellerI hope richygirl88 can share with us how it was done. the harder part is getting 20 - 40k deposits in a day. many people have shared difficulties in doing so, thus the doubts |

|

|

|

|

|

Dec 14 2013, 11:40 AM Dec 14 2013, 11:40 AM

Return to original view | Post

#147

|

|

Staff

7,948 posts Joined: Jan 2005 From: Soviet Sarawak |

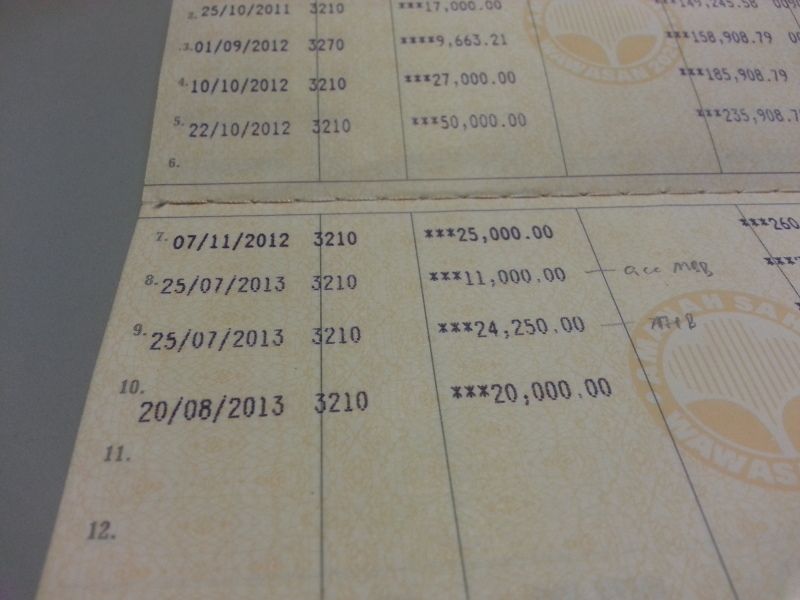

QUOTE(richygirl88 @ Dec 14 2013, 11:09 AM) As you can see in my previous post, i did mention i put my passbook with her + money/cheque. I didn't go through like you guys to Bank's counter, i do at their amanah saham branch. it's not funny. it's just intriguing especially you are non-bumi.ALL my transactions done had been printed in my passbook. It tooks 3 pages for RM60k to be done for last few days. why should need thumb print scan and IC verification when i didnt do any withdrawal? I guess i dont have to please everyone here by capturing images of my passbook. Thus if you guys believe it's not true then it is. The interest i have confirm with my mum's friend and its confirm 8 months interest dividend till 1/9/2014. The funny part is afterall this thread had been created for years.... i can't believe forumers here cant put rm50k-rm100k with combination of rm4.5k, rm3k, rm5k on one day. Funny... funny....  it's good that all transactions are printed properly on a passbook with your name on it (not a borrowed bumi account). just don't want you to be a victim of scam where they reprint other people's transactions on your book. it happened before. CBT among bank tellers. just be careful. you're right. you don't have to please everyone here. but this is FBIH. we need proof before we talk. |

|

|

Dec 14 2013, 12:50 PM Dec 14 2013, 12:50 PM

Return to original view | Post

#148

|

|

Staff

7,948 posts Joined: Jan 2005 From: Soviet Sarawak |

QUOTE(aeiou228 @ Dec 14 2013, 12:41 PM) Well, I never doubted you. It is indeed possible if you have some one in the PNB branch monitor for you. 1. it has to be a house chequeYou have PNB staff to assist you in getting the ASNW, so it is not funny that others (without any internal assistance) can't achieve the same as you. BTW, you mentioned cheque. Can you share with us how do you make a cheque good for an instant purchase of ASNW ?? 2. you have to cancel the "a/c payee only" and initial on it 3. the check is pre-signed |

|

|

Dec 14 2013, 03:18 PM Dec 14 2013, 03:18 PM

Return to original view | Post

#149

|

|

Staff

7,948 posts Joined: Jan 2005 From: Soviet Sarawak |

QUOTE(richygirl88 @ Dec 14 2013, 01:58 PM) But with the passbook shown.. one of the forumer can buy rm50k unit one shot.. impressive to me too.. bumputra quote is still available, thus you can top up as much as you wantmine only one time 4.5k, 5k, 3.5k, 3k like that then total up till now only 60k. QUOTE(plumberly @ Dec 14 2013, 12:17 PM) I assume this is your passbook. IMPRESSIVE! So many 00000! the account belongs to my client. Getting 100 is already difficult for me. But will persist and one day sikit sikit lama lama jadi bukit for me. Ha. Cheerio. This post has been edited by lucifah: Dec 14 2013, 03:19 PM |

|

|

Dec 14 2013, 04:01 PM Dec 14 2013, 04:01 PM

Return to original view | Post

#150

|

|

Staff

7,948 posts Joined: Jan 2005 From: Soviet Sarawak |

QUOTE(plumberly @ Dec 14 2013, 03:38 PM) Ya, "my client" is a diplomatic way of saying "myself" lah. Ha. as long you have the fund, there is no limitIs there a maximum limit for non bumi in ASM, AS1M & ASW? One thread mentioned about a max where the amount above that max will not get any dividend. Scary if true. Thanks. but you have to try your luck. sometimes you can top up "only" 20k in one transaction |

|

|

Dec 14 2013, 04:02 PM Dec 14 2013, 04:02 PM

Return to original view | Post

#151

|

|

Staff

7,948 posts Joined: Jan 2005 From: Soviet Sarawak |

QUOTE(plumberly @ Dec 14 2013, 03:58 PM) modal = principalASB has initial principal investment limit of 200k which can grow every year, depending on the dividend. it's like a container. your container limit is 200k. but after a yr, the container will expand a bit to accomodate the dividend. if you take out the dividend, your container size remains at 200k + dividend. if you leave it like that, the container will eventually expand very very big |

|

|

Dec 14 2013, 04:16 PM Dec 14 2013, 04:16 PM

Return to original view | Post

#152

|

|

Staff

7,948 posts Joined: Jan 2005 From: Soviet Sarawak |

QUOTE(plumberly @ Dec 14 2013, 04:10 PM) I see. If I understand this correctly, there is a limit on "fresh" fund top up once 200K is reached. No limit for add-on dividend. Right? yes. but there's also another case - ASB balance inheritance. if you inherit the ASB account from, let's say your parents, you will automatically have whatever in their account + the initial investment limit of 200kThanks. |

|

|

Dec 15 2013, 10:42 PM Dec 15 2013, 10:42 PM

Return to original view | Post

#153

|

|

Staff

7,948 posts Joined: Jan 2005 From: Soviet Sarawak |

QUOTE(Ancient-XinG- @ Dec 15 2013, 08:50 PM) Well, funny part is u are non bumi, and yet getting huge amount, even for 1 year time impossible to got it, in term of normal people. pls try to avoid sarcasm. he/she must have reasons why he doesn't want to upload any photo. we respect that.Well, I can tell also, I deposited 1K daily. but, no snap shoot provided. LOL if you have doubt, ask for clarifications, rather than replying sarcastically. after all, this is a FBIH forum. cheers |

|

|

|

|

|

Dec 18 2013, 10:54 PM Dec 18 2013, 10:54 PM

Return to original view | Post

#154

|

|

Staff

7,948 posts Joined: Jan 2005 From: Soviet Sarawak |

|

|

|

Dec 18 2013, 11:24 PM Dec 18 2013, 11:24 PM

Return to original view | Post

#155

|

|

Staff

7,948 posts Joined: Jan 2005 From: Soviet Sarawak |

QUOTE(HJebat @ Dec 18 2013, 11:20 PM) It's just me. I'm not comfortable with: yes, it's more to individual approach. i myself don't fancy ASB financing1. the possibilty of BNM increases the BLR rate 2. bank keeping my ASB cert but just to answer your q: 1. historically proven, any BLR increment will also see the increase of ASB dividend 2. they keep your cert as a chargor against your loan, but the dividends are credited into your passbook |

|

|

Dec 19 2013, 05:06 PM Dec 19 2013, 05:06 PM

Return to original view | Post

#156

|

|

Staff

7,948 posts Joined: Jan 2005 From: Soviet Sarawak |

QUOTE(MysteriousBabe @ Dec 19 2013, 04:29 PM) ASB's historical dividend + bonus payout: don't factor in the bonus portion. you will be dissapointed.2007 - 8.00 + 2008 - 7.00 + 2009 - 7.30 + 2010 - 7.50 + 2011 - 7.65 + 2012 - 7.75 + 2013 - 7.70 + |

|

|

Dec 19 2013, 05:07 PM Dec 19 2013, 05:07 PM

Return to original view | Post

#157

|

|

Staff

7,948 posts Joined: Jan 2005 From: Soviet Sarawak |

QUOTE(acexii @ Dec 19 2013, 03:47 PM) Under ASB loan, after 3 consecutive failed installment the bank will liquefy (sold back) your ASB cert to PNB. Example : Let says after 4 years your cannot / do not continue the ASB loan, bank sell back the cert and reimbursed back if have any balance (principal) to you (loan amount minus your 4 year installment = principal) depends on your financing termshad a case where they didn't sell back the ASB cert, but revoked the BLR -1.65% advantage on the delinquent account |

|

|

Dec 19 2013, 05:20 PM Dec 19 2013, 05:20 PM

Return to original view | Post

#158

|

|

Staff

7,948 posts Joined: Jan 2005 From: Soviet Sarawak |

|

|

|

Dec 19 2013, 11:53 PM Dec 19 2013, 11:53 PM

Return to original view | Post

#159

|

|

Staff

7,948 posts Joined: Jan 2005 From: Soviet Sarawak |

QUOTE(guy3288 @ Dec 19 2013, 11:47 PM) my books are left with the bank clerk. I never withdraw before, so just wanna ask. yes. u need to thumbprint twice, sign 3 times, front and back, of the w/drawal slipDo they need our IC, or thumbprint to make withdrawal from the ASM,AS1M or ASW2020 book? i think they sure need signature on withdrawal form, but not sure about the above 2 extra... PS: I wonder if that guy who said he left his book with the bank clerk, i wonder how much he managed to top up so far... |

|

|

Dec 20 2013, 07:20 AM Dec 20 2013, 07:20 AM

Return to original view | Post

#160

|

|

Staff

7,948 posts Joined: Jan 2005 From: Soviet Sarawak |

|

|

Topic ClosedOptions

|

| Change to: |  0.0522sec 0.0522sec

0.29 0.29

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 10:46 PM |