I would prefer that EPF effect any voluntary withdrawal and contribution on same day basis, rather than need T+1 to T+2 to effect.

If banks can do so with duitnow, EPF can do so also.

EPF DIVIDEND, EPF

EPF DIVIDEND, EPF

|

|

Nov 8 2023, 11:17 AM Nov 8 2023, 11:17 AM

Return to original view | Post

#701

|

Senior Member

3,692 posts Joined: Apr 2019 |

I would prefer that EPF effect any voluntary withdrawal and contribution on same day basis, rather than need T+1 to T+2 to effect.

If banks can do so with duitnow, EPF can do so also. |

|

|

|

|

|

Nov 8 2023, 11:31 AM Nov 8 2023, 11:31 AM

Return to original view | Post

#702

|

Senior Member

3,692 posts Joined: Apr 2019 |

QUOTE(virtualgay @ Nov 8 2023, 11:23 AM) not necessarily.... for normal days, they almost never had to liquidate anything if they did their job properly.There is always floating cash they keep to meet daily liquidity requirement (that's why funds always say they can keep up to like 5% in cash). 1% alone for ETF is 10 billion ringgit. EPF always roll funds overnight with banks. |

|

|

Nov 8 2023, 12:28 PM Nov 8 2023, 12:28 PM

Return to original view | Post

#703

|

Senior Member

3,692 posts Joined: Apr 2019 |

|

|

|

Nov 8 2023, 12:30 PM Nov 8 2023, 12:30 PM

Return to original view | Post

#704

|

Senior Member

3,692 posts Joined: Apr 2019 |

QUOTE(Rinth @ Nov 8 2023, 12:27 PM) its basically similar to Tax invoice during GST era.....if the buyer need invoice (albeit Tax invoice or E-invoice) for business tax deduction(GST input tax claim during GST era), they'll need the E-invoice...No E-invoice means no tax deduction..... have to remove cash transactions also.... else not effective.Thats why wee (if not mistaken) in parliament say might as well introduced back GST since we're already heading toward E-invoicing,which i think now most of the malaysian agreed that GST still the best, especially business owner.. Back to nasi lemak roadside, literally yes they need to issue E-invoice, but they can do bulk/consolidate E-invoice everyday as a record. but no need give to their customer.....but in reality, they dun even have business license or business registration, how to issue E-invoice lol. if u insist want it, i bet they say u dun kacau here rather dun want sell to you, or he desperate then discount RM1 for u to not issue E-invoice to you lol...in the end see they desperate to sell to you or u desperate to buy to eat the nasi lemak |

|

|

Nov 8 2023, 12:42 PM Nov 8 2023, 12:42 PM

Return to original view | Post

#705

|

Senior Member

3,692 posts Joined: Apr 2019 |

QUOTE(Rinth @ Nov 8 2023, 12:36 PM) We're doing good in moving forward to cashless societies edi....but i think mostly are urban area and youngster...need more time for rural and old ppl to adapt......govt expect 2030 for malaysia to be cashless society ... I prefer the cash option to still be around, ie not all move to cashless. Just cos tech is not 100% of the time reliable. https://www.thestar.com.my/news/nation/2023...nts-in-malaysia 2 incidents came to mind: a) one time I tried to pay via e-wallet, but for some reason reception was horrendous at where the shop was. ended up paying cash as it was easier (cashier said many customers just paid cash... faster) b) some news about a major carpark jam because some bank's credit card was not accessible for a few hours... cannot remember which bank already. then again, if no more cash transactions, should be easier to catch crooks rite? Then again, no also... scammers can still take money from victims even via banking system. |

|

|

Nov 8 2023, 12:46 PM Nov 8 2023, 12:46 PM

Return to original view | Post

#706

|

Senior Member

3,692 posts Joined: Apr 2019 |

QUOTE(xander2k8 @ Nov 8 2023, 12:38 PM) ... 10% seems way too big... its around 100 billion, but if you include short term govies, sure... very possible. EPF is quite liquid 🤦♀️ as you think 10% allocated to MMF and cash while local bonds are easily liquidated because that is biggest holding hence liquidity is not an issue unless you are talking about billions of liquidations like what happened to special withdrawals where they having headaches to liquidate back then About close to 10% with combination of cash and MMF no wonder div yield is not great.... 10% of aum in cash, earning like 3% type return.... |

|

|

|

|

|

Nov 8 2023, 01:55 PM Nov 8 2023, 01:55 PM

Return to original view | Post

#707

|

Senior Member

3,692 posts Joined: Apr 2019 |

QUOTE(Rinth @ Nov 8 2023, 01:01 PM) 10k a week net profit exaggerated abit la, revenue maybe for very popular 1 lol...E-invoices for business transaction only, EPF depositing and interest etc etc no e-invoicing involved. A lot of things can be "done" in china.... as its big brother gov has the willpower to do many things. toward cashless societies in future is unavoidable, how fast to adapt it only...With technologies such as Alipay, travellers also start to no need use cash edi.....in china if u use cash they see u as dinosaur...... So our infrastructure need to cope with the technologies lo....got starlink now edi mah can cover most of the part edi haha... Malaysia gov, somemore under this PMX, I don't know lar... i don't have much faith in our government, regardless of which gov. Politicians still like to hide cash at home, for example. somemore this is tech related... my confidence level drops further. Better to have cash option around really, dinosaur or not. HolyCooler and Rinth liked this post

|

|

|

Nov 8 2023, 01:58 PM Nov 8 2023, 01:58 PM

Return to original view | Post

#708

|

Senior Member

3,692 posts Joined: Apr 2019 |

QUOTE(coyouth @ Nov 8 2023, 01:28 PM) i said "i wonder who's that staff that key in 1 by 1 key for millions of employee data". how in the world do you interpret it as someone disagreeing. back in 1950s, what does people key into? was there not a famous quote in the 1940s by IBM that the whole world only needed 5 computers? So i really doubt in 1950s, Malaya even has a single computer around. lol. This post has been edited by Wedchar2912: Nov 8 2023, 02:03 PM |

|

|

Nov 8 2023, 02:17 PM Nov 8 2023, 02:17 PM

Return to original view | Post

#709

|

Senior Member

3,692 posts Joined: Apr 2019 |

QUOTE(Rinth @ Nov 8 2023, 02:06 PM) haha dunno maybe i intepret wrongly, my english not that good. yeah, I know.... was just joining the fun about digitalization... cos some of us here are either too young, or too old (ie forgetful already)...50s-60s was exaggerated too loh..Digitalisation starts within this 10 years when 2G/3G and internet starts........10 years ++ ago i still submit manually those contribution every month lol.. i still remember I was one of the earliest in my ex-firm to have online access in late 2000 I think (if memory serves me) to kwsp website... cos many didn't realize kwsp allowed account to be viewed online. Heck, even now, many didn't realize can withdraw EPF (those who qualify) via online. tech has improved a lot, but it took time nonetheless. Rinth liked this post

|

|

|

Nov 8 2023, 06:45 PM Nov 8 2023, 06:45 PM

Return to original view | Post

#710

|

Senior Member

3,692 posts Joined: Apr 2019 |

QUOTE(kevyeoh @ Nov 8 2023, 03:07 PM) others most probably answered already also... based on my personal experience, min I have withdrawn online is a few hundred ringgit (forgot the exact amount). max is 30K rm per day (ie per time for that day). anything more have to go to a EPF office, a good feature to have. edit: magika has tried 50rm previously. QUOTE(magika @ Nov 8 2023, 05:06 PM) This post has been edited by Wedchar2912: Nov 8 2023, 06:46 PM kevyeoh liked this post

|

|

|

Nov 8 2023, 08:30 PM Nov 8 2023, 08:30 PM

Return to original view | Post

#711

|

Senior Member

3,692 posts Joined: Apr 2019 |

|

|

|

Nov 8 2023, 08:51 PM Nov 8 2023, 08:51 PM

Return to original view | Post

#712

|

Senior Member

3,692 posts Joined: Apr 2019 |

QUOTE(nexona88 @ Nov 8 2023, 08:34 PM) Ahhh... yeah, in terms of settlement, no difference. It still goes to bank account. Same like online... Then 😁 The process is same like how we do in banks right... Verify our thumbprint with IC etc. For OTC EPF withdrawal... But I guess the 30K rm limit is there to provide some comfort that if say someone managed to hack/gain access to our EPF accounts, they cannot simply say empty out (leaving behind 1 million ringgit) everything one short. That would need the member's physical presence at a EPF office. A counter argument maybe is if the hacker wanted to take out say 200K rm, he/she needs 7 days to do so. Problem is if I am already compromised, how would I know 30K been withdrawn everyday? |

|

|

Nov 9 2023, 01:34 PM Nov 9 2023, 01:34 PM

Return to original view | Post

#713

|

Senior Member

3,692 posts Joined: Apr 2019 |

|

|

|

|

|

|

Nov 9 2023, 01:36 PM Nov 9 2023, 01:36 PM

Return to original view | Post

#714

|

Senior Member

3,692 posts Joined: Apr 2019 |

QUOTE(batman1172 @ Nov 9 2023, 12:53 PM) They should tell people to withdraw the dividends after re-investing the difference between EPF rate less Inflatation rate. Basically withdraw 2% value of capital assuming EPF pays 5% and inflation is 3%. Very comfortable amount. but that also means EPF sucks because the dividends per unit doesn't grow. Not so easy for many to spend 2% or lesser of one's wealth at retirement. Say if have 10 million ringgit, would you be ok to spend just 200K rm per year? that's like 16K rm only.... (why I choose 10 million? cos stupid media has brainwashed me that one must have 10 million to retire.... lol) eitherway, keeping the principal intact and somemore grow (or at least keep up with inflation rate) should not be the aim of most retirees.... that is truly reserved for the select few who wishes to leave a large inheritance behind. This post has been edited by Wedchar2912: Nov 9 2023, 01:39 PM HolyCooler and magika liked this post

|

|

|

Nov 9 2023, 08:20 PM Nov 9 2023, 08:20 PM

Return to original view | Post

#715

|

Senior Member

3,692 posts Joined: Apr 2019 |

QUOTE(CommodoreAmiga @ Nov 9 2023, 07:52 PM) Got a few a here...you know who you are... what to do.... UBI is still better than no ubi... Wah lau...RM100 UBI...eat Ubi Kentang jer....No wonder it's called UBI. was surprised the amt is so low.... if intro GST and remove fuel subsidies and increase tax on the higher income tax payers, should be able to give more right? already 10 million not enough to retire... 100rm per month may not do much... magika liked this post

|

|

|

Nov 13 2023, 01:42 PM Nov 13 2023, 01:42 PM

Return to original view | Post

#716

|

Senior Member

3,692 posts Joined: Apr 2019 |

QUOTE(maxxng12 @ Nov 13 2023, 10:59 AM) hi, for epf member passed away : just sharing what i think i know, but best you go to EPF and ask them directly. 1. can the epf fund continue to grow inside? and pay monthly to the family member ? 2. can we directly transfer to the kids name under epf account, and continue to grow the epf fund? 3. use epf as a tool of living trust fund? 4. EPF wiill close the account once they know the member is passed away? or the fund can continue to grow inside for next 10 years? thank you this is what i think I remember reading somewhere and some "info" from ex-colleagues (about a colleague who passed away leaving a young kid and wife). I may recall some info wrong also. 1. short answer is no. all will be credited to the bene (if no nomination, then follow some processes. some claim follow will, but i am not sure). if bene is underage, then the funds can be kept in a special account until kid reach 18 years old 2. no, except the abv underage scenario. but i believe must take out upon reaching 18. 3. no. 4. they will try to find the bene, and no idea if the funds will continue to enjoy div. the story about the colleague who passed away: if not mistaken, the wife takes out her portion, while the kid's remain in epf. |

|

|

Nov 13 2023, 02:50 PM Nov 13 2023, 02:50 PM

Return to original view | Post

#717

|

Senior Member

3,692 posts Joined: Apr 2019 |

QUOTE(CommodoreAmiga @ Nov 13 2023, 02:44 PM) Bro. I can confirmed that is incorrect. The money keeps getting dividend as usual as long as inside epf. No special account needed. You don't need to take out upon reach 18 either. ah ok. but then won't this mean that one can technically let one's child(ren) inherent everything in EPF and this is no longer fully just for retirement? It can be used in estate planning. imagine using this method to pass generational wealth... also, i have the impression that the bene cannot request the funds to be transferred into the bene's own EPF account. Say for example a young couple, wife has 500K rm and only put husband as sole bene. Wife passed away. I have the impression that the hubby must take all 500K rm out into his own bank account. This post has been edited by Wedchar2912: Nov 13 2023, 02:59 PM |

|

|

Nov 13 2023, 03:28 PM Nov 13 2023, 03:28 PM

Return to original view | Post

#718

|

Senior Member

3,692 posts Joined: Apr 2019 |

QUOTE(CommodoreAmiga @ Nov 13 2023, 03:00 PM) Npt sure what you mean here, but as long you have nominee, it will goes to your nominee. Don't even need a will, i believe the EPF nominee will overwrite the Will as well. Ex: if will says goes to ABC, but nominee is XYZ. regarding the nomination in EPF superceeding whatever written in the deceased's will, we are in agreement. Some info i dug up: https://www.gavinjayapal.com/post/can-a-wil...on%20Act%201958. That i don't know. I don't think it's possible. You can either take out the money to your bank account or leave it there. I don't think you can suka suka transfer from EPF Account to EPF account. AFAIK. I also have the impression that once EPF knows the member is deceased, they will try to distribute the funds. ie cannot just leave it there. (then again, so many 100 years old accounts rite?) The point I was trying to say is that EPF's function is to help one for retirement, and not really to be used in estate planning. Which i continue below: QUOTE(maxxng12 @ Nov 13 2023, 03:10 PM) ya thats what i mean, so can i use epf as estate planning? Maybe an example would put all of us on the same page: meaning that member pass away, however do not take out the money and let the money to keep roll inside till they grow up , is it possible? Say there is a chap (45) who has 3 million in EPF and he put the following nomination: a) wife (45) : 33.3333...% b) kid 1 (22) : 33.3333...% c) kid 2 (12) : 33.3333...% My understanding is wife and kid 1 must take out their respective 1 million ringgit into their respective bank accounts. no such thing as put into own EPF accounts and continue. However, i have the impression that for kid 2, EPF will create a special account for kid 2 which will earn div. upon reaching legal age 18, kid 2 will also have the take out the funds. This is like EPF taking the role of trustee. hence the estate planning part is really limited to minors only. This post has been edited by Wedchar2912: Nov 13 2023, 03:31 PM |

|

|

Nov 13 2023, 06:15 PM Nov 13 2023, 06:15 PM

Return to original view | Post

#719

|

Senior Member

3,692 posts Joined: Apr 2019 |

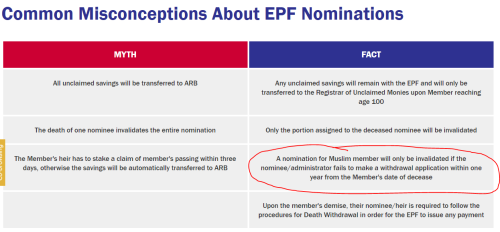

QUOTE(CommodoreAmiga @ Nov 13 2023, 04:00 PM) Ah, i see what you are trying to say. But i am thinking...what if (a) and (b), just leave it there and not take until a later date? Because for © is possible, so logically should be same for (a) and (b). I would think if ( a ) and ( b ) are allowed, then ( c ) can automatically be allowed. ( c ) case is special because kid 2 is a minor. nontheless, I do believe if any of the bene went to EPF and inform them of the member's demise, then EPF will try to disburse all the funds. Similar to how banks will freeze all the accounts of the deceased once they know about it. I went to kwsp site and saw this: https://www.kwsp.gov.my/member/nomination  scary... Lembu Goreng liked this post

|

|

|

Nov 13 2023, 07:34 PM Nov 13 2023, 07:34 PM

Return to original view | Post

#720

|

Senior Member

3,692 posts Joined: Apr 2019 |

|

| Change to: |  0.0470sec 0.0470sec

0.80 0.80

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 22nd December 2025 - 10:03 AM |