Outline ·

[ Standard ] ·

Linear+

EPF DIVIDEND, EPF

|

prophetjul

|

Mar 15 2022, 02:08 PM Mar 15 2022, 02:08 PM

|

|

QUOTE(Wedchar2912 @ Mar 15 2022, 02:02 PM) wah... nice man.... still have gratuity from your firm? I thought those almost no longer exists anymore... What an envious position to be in... Some more right timing to retire: we are about to open up and can choose to travel around already. Consider taking first class/biz class for safety purposes?  Yes. Written into my contract.  And i still have travel passage from the company. Biz class it it!  Not retiring just yet. So will be on contract. This post has been edited by prophetjul: Mar 15 2022, 02:08 PM |

|

|

|

|

|

prophetjul

|

Mar 15 2022, 05:15 PM Mar 15 2022, 05:15 PM

|

|

QUOTE(magika @ Mar 15 2022, 04:55 PM) Talk to your company on the possibilty of moving the gratuity direct into epf. It will circumvent the 60k limit. Use to be able but policy could change. IS THAT possible?  |

|

|

|

|

|

prophetjul

|

Mar 15 2022, 06:17 PM Mar 15 2022, 06:17 PM

|

|

QUOTE(magika @ Mar 15 2022, 06:13 PM) I retire early a number of years ago. My company give me option either receive in cash or transfer to epf. I chose epf of course. But need to talk with your company. I think if EPF allows it, my company has no issue with this. I will get my accountant to contact EPF tmoro to find out! Thanks in advance for the heads up!  |

|

|

|

|

|

prophetjul

|

Mar 15 2022, 06:24 PM Mar 15 2022, 06:24 PM

|

|

QUOTE(magika @ Mar 15 2022, 06:22 PM) Glad to be of help. Just dont encourage others as epf will have problems handling too much funds. Ha ha Haha! Problem is company giving gratuities is getting rarer nowadays.  |

|

|

|

|

|

prophetjul

|

Mar 15 2022, 09:07 PM Mar 15 2022, 09:07 PM

|

|

QUOTE(Wedchar2912 @ Mar 15 2022, 07:30 PM) Very rare... Giving equities/stock options still have, but gratuities. Plus you still get EPF contributions from employer? Past 60? Yeah. I am askng for 8% employer's contribution. |

|

|

|

|

|

prophetjul

|

Mar 15 2022, 09:31 PM Mar 15 2022, 09:31 PM

|

|

QUOTE(Wedchar2912 @ Mar 15 2022, 09:12 PM) gratuity and EPF contribution by employer... wow... you really got a sweet deal... Gratuity after 30 years of service  . |

|

|

|

|

|

prophetjul

|

Mar 16 2022, 02:19 PM Mar 16 2022, 02:19 PM

|

|

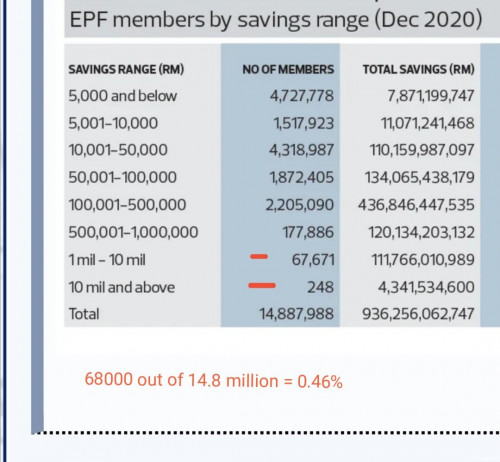

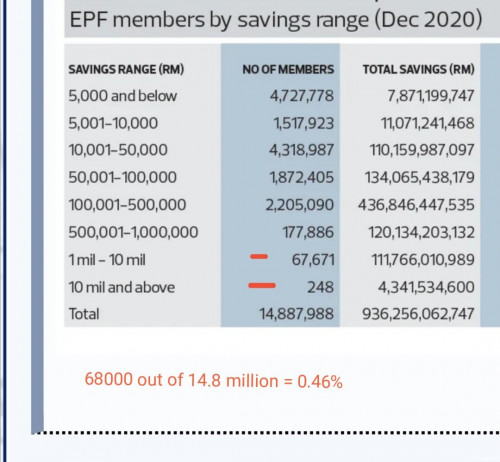

QUOTE(Wedchar2912 @ Mar 16 2022, 12:22 PM) I believe the 248 persons refers to all EPF members, both active and passive, as 14 million persons referred in this table from theedge attached by other forumers is the full members. Hence why I always said these are the likes of CEOs and ex-CEOs and the C suites members...  So we may end up with 5 million people with a big fat 0 in their account? |

|

|

|

|

|

prophetjul

|

Mar 16 2022, 02:48 PM Mar 16 2022, 02:48 PM

|

|

QUOTE(Wedchar2912 @ Mar 16 2022, 02:46 PM) Most definitely... Plus there will be more new members due to the fact that we as a country still churn out fresh grads or school leavers. And older folks like us would need to subsidize these poor and/or young members just by virtue that their balance is low; if the tiering is to happen. How does 10% sound to them? nice rite? until they realize that 10% on 5K rm is just 500rm. So the really poor person who really needed help now can eat a few more meals and go back to being poor because EPF is the wrong indicator of poverty. What I am interested to see is how many new 248 members there will be..... another 50 to 100 extra?   Going past Rm10mil in EPF is a very difficult target. Rm1 to 5 mil is still achievable. |

|

|

|

|

|

prophetjul

|

Mar 17 2022, 09:00 AM Mar 17 2022, 09:00 AM

|

|

QUOTE(NF2M @ Mar 17 2022, 08:56 AM) Agree. 10 is a bit too hard to achieve for most. 1-5 is more achievable. Rm1mil for a professional nowadays should be highly achievable. Especially with the retirement age at 60. MY guess is a normal professional should be able to accumulate around Rm2 mil easy over a 35 year working life span. Anything more depends on your career luck. |

|

|

|

|

|

prophetjul

|

Mar 17 2022, 10:09 AM Mar 17 2022, 10:09 AM

|

|

QUOTE(statikinetic @ Mar 17 2022, 09:46 AM) Depends on how you define "professional" I guess. If it generally just means working adult, then the vast majority of working Malaysians based on the wage data would find the RM1 mil mark way out of reach. Now if you gate "professional" as having to come from a certain industry and working at a specific level, for example a Department Head in a large Bank then yes that RM 1 mil mark is much more achievable. But that also means that this categorization of "professionals" are a tiny minority in the larger population pool. Perhaps we are splitting hairs here. Psychological studies already show that a large percentage of humans will always favour short term immediate gains over long term goals which seem distant. Not many B40 will say no to an immediate infusion of RM10k to their bank account. The government is merely trading short term popularity with a longer term problem of social welfare when all these people hit retirement. Professional in my thinking should earn: a) Starting pay Rm2,500 at 25 years old b) 5% increment c) work life 35 years i did a fast simulation and got RM1.67mil in EPF at a yield of 6% pa. i believe 5% increment may be conservative. So yeah, RM2 mil is easily achievable nowadays. |

|

|

|

|

|

prophetjul

|

Mar 17 2022, 10:29 AM Mar 17 2022, 10:29 AM

|

|

QUOTE(DragonReine @ Mar 17 2022, 10:23 AM) The problem here is that the working adults who ironically stand to benefit from EPF the most, B40, will never get that number because starting pay low, no increment etc, and a vast number nowadays also rely on gig/informal work that doesn't pay EPF unless they self contribute they'll be hard pressed to see the benefits of EPF when many live from paycheck to paycheck proverty is a spiral So my assumptions for the future professional earners is not realistic?  I am an engineer BTW. |

|

|

|

|

|

prophetjul

|

Mar 17 2022, 10:46 AM Mar 17 2022, 10:46 AM

|

|

QUOTE(MUM @ Mar 17 2022, 10:32 AM) End value can be mathematically computed Current kwsp basic saving sum target is 240k.... In another 35 years it may also had risen Yes. Did that. If our professionals are paid fairly, they should achieve Rm2mil by the time they retire. But then Rm2mil in 35 years is only worth Rm506k in present value.  |

|

|

|

|

|

prophetjul

|

Mar 17 2022, 11:03 AM Mar 17 2022, 11:03 AM

|

|

QUOTE(yklooi @ Mar 17 2022, 10:51 AM) Per Nov 2021 article.. Only 27 per cent of Employees Provident Fund (EPF) members, aged between 18 and 55, are estimated to have sufficient savings in account 1 based on its basic savings quantum, the Dewan Rakyat was told today. https://www.nst.com.my/news/nation/2021/11/...antum-thresholdThus if everything remained the same,... The % of members not able to met the basic sum target set 35 yrs later would roughly the same too?? 😎😉 Present 240k should project to 940k in 35 years at 4% inflation rate.  i did a fast check on my model with Rm1200 starting pay at 4% increment . End result is 690k at year 35. |

|

|

|

|

|

prophetjul

|

Mar 17 2022, 11:57 AM Mar 17 2022, 11:57 AM

|

|

QUOTE(Wedchar2912 @ Mar 17 2022, 11:53 AM) thats why I don't get the poor B40 group of people.... EPF is already there to help everywhere get out of the poverty trap. Covid19 and the economic slowdown are bad... understand. But Epf is not the solution. Ask for direct help from the Gov. The government is here to help, not here to ask you to help yourself. But the cynical side of me... the politician minded side, if you will.... would say pls... go ahead and drawdown the 10K rm and spend spend spend. I have exposure in Malaysia equities and this must be good for the stock market.... TQ BN gov for helping everyone, but the richer ones will benefit more. The main problem IMO is theB40 spends lots on material goods which they cannot afford to, by means of DEBT. Especially CC. Many of them do NOT understand the compounded interest rates! All these borrowings eat away their potential to save. |

|

|

|

|

|

prophetjul

|

Mar 21 2022, 09:59 AM Mar 21 2022, 09:59 AM

|

|

QUOTE(Chrono-Trigger @ Mar 21 2022, 09:26 AM) wah, SNES chrono-trigger my era worrr.. secret of the silver blades, ultima  The thought of withdrawing from EPF and not receiving a salary every month is kind of unsettling to me. But yes 47 is about right age, not too old to enjoy. After certain age, the body degraded too much and health issue will start to prop up 47 years old is pretty young to stop work. As for body degrading, i am 60 years old. I can still dead lift 80 kg. I do calesthenics at home 4 days in a week to keep fit. Before this i was in the gym 5 days of the week. Unfortunately Covid has put paid to that. Diet is also important. So one could carry out some preventive measures to ensure the body and mind do not degrade too fast.  |

|

|

|

|

|

prophetjul

|

Mar 21 2022, 10:35 AM Mar 21 2022, 10:35 AM

|

|

QUOTE(familyfirst3 @ Mar 21 2022, 10:32 AM) These days 47 is too young. Many are still strong at 60 like you mentioned. Unless God has different plans. Yeah. I am 60 years old and just given a new contract to continue working. Maybe 62 or 63 will be good to call it a day. Hopefully we can travel freely by then  |

|

|

|

|

|

prophetjul

|

Mar 21 2022, 11:11 AM Mar 21 2022, 11:11 AM

|

|

QUOTE(Kelangketerusa @ Mar 21 2022, 11:08 AM) 60 is still young la boss. I see some of my Board members 70 dah still enjoying their work life  Board members do not work. They get pampered!  Some people get married to their work. Not me. |

|

|

|

|

|

prophetjul

|

Mar 21 2022, 01:31 PM Mar 21 2022, 01:31 PM

|

|

QUOTE(Chrono-Trigger @ Mar 21 2022, 01:01 PM) why not just put everything in EPF to get 5-6% compounded return? I leave very minimal in my bank account, but in some ways, I feel a bit poor. Call it negative wealth effect.  QUOTE(TheEquatorian @ Mar 21 2022, 01:05 PM) I think many retirees do this, that’s why they are dependent on no change to the structure since it is their main cashflow. i will getting my retirement gratuity soon. I will plunk the whole lot into the EPF.  5 to 6% savings account is rather fantastic in the present environment! AND i will request my monthly salary to be injected into EPF too.  |

|

|

|

|

|

prophetjul

|

Mar 21 2022, 01:54 PM Mar 21 2022, 01:54 PM

|

|

QUOTE(Wedchar2912 @ Mar 21 2022, 01:50 PM) glad and envious at your deal.... seriously rare and damn nice...  but hopefully you will not do any actual work anymore for your "new" contract work, but pass on your experience, knowledge and work ethnics to the younger ones in your firm. We don't have enough people with right skill set, and many of the older folks are retiring. I am still doing actual work. Reason being i have just set up a new division in the company. So its a incubator with skeleton staff at the moment. Working on implementing our first project. And the same time, negotiating new ones.  However, my few subordinates have followed me for the last 20 years, so i will be able to hand over to them when the right time comes.  |

|

|

|

|

|

prophetjul

|

Mar 21 2022, 04:08 PM Mar 21 2022, 04:08 PM

|

|

QUOTE(magika @ Mar 21 2022, 03:30 PM) So are you sucessful in diverting your gratuity into epf ? Hopefully can as mine was done sometime ago. Just sent me a starbucks voucher will do..  No. Mine is only coming in next month. But i have enquire of EPF, which they have affirmed that they will accept gratuity payments. |

|

|

|

|

Mar 15 2022, 02:08 PM

Mar 15 2022, 02:08 PM

Quote

Quote

0.0430sec

0.0430sec

0.83

0.83

7 queries

7 queries

GZIP Disabled

GZIP Disabled