QUOTE(bronkos @ May 7 2020, 08:51 AM)

Of course. I am pointing that out because there are many millionaires in KWSP.A million RM is not worth much nowadays due to its depreciating value.

And the rich will probably not need to contribute.

EPF DIVIDEND, EPF

|

|

May 7 2020, 09:17 AM May 7 2020, 09:17 AM

Return to original view | IPv6 | Post

#281

|

All Stars

12,268 posts Joined: Oct 2010 |

|

|

|

|

|

|

May 7 2020, 11:10 AM May 7 2020, 11:10 AM

Return to original view | IPv6 | Post

#282

|

All Stars

12,268 posts Joined: Oct 2010 |

QUOTE(bronkos @ May 7 2020, 10:41 AM) Statistics show less than 18% contributors have min. savings target of $228k. 39,610 out of 7,360,248 Where did you get the assumption there are many millionaires in EPF? https://www.thestar.com.my/business/busines...fford-to-retire  https://www.kwsp.gov.my/documents/20126/974...t=1564377639583 Thought there would be more than that. Was quite easy for me to pass Rm1mil Maybe i am the odd one out. |

|

|

May 7 2020, 11:25 AM May 7 2020, 11:25 AM

Return to original view | IPv6 | Post

#283

|

All Stars

12,268 posts Joined: Oct 2010 |

|

|

|

May 7 2020, 11:31 AM May 7 2020, 11:31 AM

Return to original view | IPv6 | Post

#284

|

All Stars

12,268 posts Joined: Oct 2010 |

|

|

|

May 7 2020, 12:07 PM May 7 2020, 12:07 PM

Return to original view | IPv6 | Post

#285

|

All Stars

12,268 posts Joined: Oct 2010 |

|

|

|

May 7 2020, 05:26 PM May 7 2020, 05:26 PM

Return to original view | IPv6 | Post

#286

|

All Stars

12,268 posts Joined: Oct 2010 |

QUOTE(guy3288 @ May 7 2020, 04:25 PM) looking down on people called average for a reason I thought with the present salaries compared to what I started with, there would be quite s few millionaires in the EPF.even if have RM10M in EPF also should not say that Knowing full well than 99% of people do not have it, to say is easy to have RM1 Million in EPF and 1M in EPF is nothing is to make many many others feel bad. Yes dont simply say it is easy when more than 99% people cant achieve it. IF I made you feel bad. I apologise. My bad. Bear in mind, I started work in 1983 with Rm1k. Peace. |

|

|

|

|

|

May 7 2020, 05:27 PM May 7 2020, 05:27 PM

Return to original view | IPv6 | Post

#287

|

All Stars

12,268 posts Joined: Oct 2010 |

QUOTE(bronkos @ May 7 2020, 05:17 PM) There is a saying that wealth does not pass three generations is a good reminder to ppl like him, what he boasts of now will eventually be done towards his descendants, or better straight at his face. Wished I had that much!I am a salaried person. I don't have THAT much. |

|

|

May 7 2020, 05:57 PM May 7 2020, 05:57 PM

Return to original view | IPv6 | Post

#288

|

All Stars

12,268 posts Joined: Oct 2010 |

|

|

|

May 7 2020, 06:01 PM May 7 2020, 06:01 PM

Return to original view | IPv6 | Post

#289

|

All Stars

12,268 posts Joined: Oct 2010 |

|

|

|

May 28 2020, 03:00 PM May 28 2020, 03:00 PM

Return to original view | IPv6 | Post

#290

|

All Stars

12,268 posts Joined: Oct 2010 |

Can one just dump in Rm60k at a go?

|

|

|

May 28 2020, 03:05 PM May 28 2020, 03:05 PM

Return to original view | IPv6 | Post

#291

|

All Stars

12,268 posts Joined: Oct 2010 |

|

|

|

May 28 2020, 04:15 PM May 28 2020, 04:15 PM

Return to original view | IPv6 | Post

#292

|

All Stars

12,268 posts Joined: Oct 2010 |

|

|

|

May 30 2020, 02:36 PM May 30 2020, 02:36 PM

Return to original view | IPv6 | Post

#293

|

All Stars

12,268 posts Joined: Oct 2010 |

QUOTE(KIP21 @ May 30 2020, 10:06 AM) If you have say RM1.5mil in your EPF, you can even transfer RM400k direct to your wife EPF account from yours instead of RM60k yearly. If both already more than rm1mil category then nothing much to figure out. Was thinking that EPF should be better than FD in the near future. So just dump it into wife's account. |

|

|

|

|

|

May 31 2020, 08:06 PM May 31 2020, 08:06 PM

Return to original view | IPv6 | Post

#294

|

All Stars

12,268 posts Joined: Oct 2010 |

QUOTE(waghyu @ May 31 2020, 04:53 PM) Always better right? Tradeoff is cant withdraw now, unless already at 1 million cap. Good place to keep money. Make own company and declare huge salary to pump huge money into EPF. Owh contribution got limit and late become rich. She's already 56 years young. So withdrawal is not a problem. |

|

|

Jun 14 2020, 02:06 PM Jun 14 2020, 02:06 PM

Return to original view | IPv6 | Post

#295

|

All Stars

12,268 posts Joined: Oct 2010 |

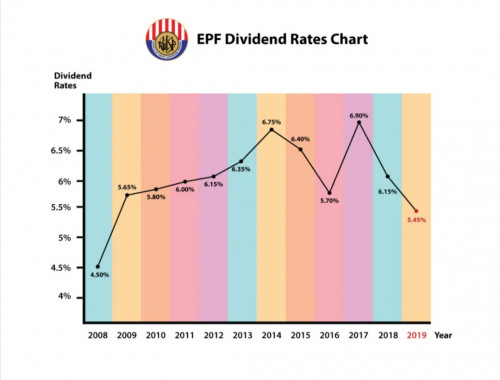

QUOTE(Unkerpanjang @ Jun 14 2020, 10:52 AM) Kwsp, seeking forumers opinion... Q1,19 vs Q1'20 is a drop of 22%.Q1'19 9.7mil profit Q1'20 7.5mil profit FY 2019 dividend 5.45% We expect Apr n most of May to be weak due to global lockdown. So, likely Q2'20 just as mediocre? However, past events 1987, 2000, 2008 have shown KWSP maintain dividend at minimum 2.5% above the annual 2.0% inflation. Question, will KWSP FY 2020 dividend be any different? Is MY currently experiencing deflation n will jobs/businesses liquidation phase get worse in the coming months - sinking KWSP dividend to a new 20 year low?  If all things being equal till year end FY 2020 dividend may be 4.25% |

|

|

Jun 19 2020, 08:55 AM Jun 19 2020, 08:55 AM

Return to original view | IPv6 | Post

#296

|

All Stars

12,268 posts Joined: Oct 2010 |

|

|

|

Jun 19 2020, 09:05 AM Jun 19 2020, 09:05 AM

Return to original view | IPv6 | Post

#297

|

All Stars

12,268 posts Joined: Oct 2010 |

QUOTE(Cubalagi @ Jun 19 2020, 09:02 AM) Developed nations in the west have good social security system. Meaning you get some income when you retire, even if you have no savings. Not much, but covers essentials to survive. But we, unless we are pension eligible govt servants, l only have EPF and our own additional savings. But they are also forcing the retirees to delay their retirement. The pension system does not have enough to cater to their retirement. So in effect the system is failing. They do contribute to their pension funds too. Much like EPF. |

|

|

Jun 19 2020, 09:21 AM Jun 19 2020, 09:21 AM

Return to original view | IPv6 | Post

#298

|

All Stars

12,268 posts Joined: Oct 2010 |

QUOTE(Cubalagi @ Jun 19 2020, 09:15 AM) My point is that they have an additional level of income protection other than a fund contribution type system like epf. We dont have any. Yes. But they do contribute to the pension funds much like EPF. Of course this pension system has its own problems and is underfunded right now, esp due to low interest rates. But their govt will just print money later when it becomes due. Only difference is they are paid annuity, not lump sum like ours. So essentially same thing. No. The funds have to generate their own returns in a perfect world. Thats the reason the retirement age is deferred. Low return of investment. |

|

|

Jun 30 2020, 08:27 AM Jun 30 2020, 08:27 AM

Return to original view | IPv6 | Post

#299

|

All Stars

12,268 posts Joined: Oct 2010 |

QUOTE(GrumpyNooby @ Jun 29 2020, 10:01 PM) What the EPF’s 1Q says about 2020 dividend WHY is he using data which is 11 years old? A. RM50 billion write-down? Excluding the unspecified amount of write-downs from “mainly equities” that resulted in a net investment income of RM7.5 billion for 1Q2020, the headline gross investment income of RM12.16 billion for 1Q2020 was not too shabby compared with the RM9.6 billion booked in 1Q2019 — which incidentally was the EPF’s worst quarter last year as income from equities fell by about RM2 billion compared with the subsequent quarters. The EPF’s total investment assets of RM874 billion as at end-March 2020, however, were down just over RM50 billion or 5.5% compared with RM924.75 billion as at end-2019. B. Even 4% dividend tough Alizakri reminded yet again that the threshold to deliver every 1% of dividend has risen substantially in the past decade and is still increasing. In 2009, the EPF needed RM3.43 billion to pay 1% of dividend. That means that the RM45.82 billion dividend declared for 2019 would have been enough to pay more than the 13% dividend declared in 2009. The EPF has yet to release its 2019 annual report and financial statements, which need to be approved in Parliament beforehand. The EPF only needs to deliver at least a 2.5% nominal dividend and beat inflation by at least 2% on a rolling three-year basis. https://www.theedgemarkets.com/article/what...t-2020-dividend |

|

|

Jun 30 2020, 08:48 AM Jun 30 2020, 08:48 AM

Return to original view | IPv6 | Post

#300

|

All Stars

12,268 posts Joined: Oct 2010 |

QUOTE(wendygoh @ Jun 30 2020, 08:39 AM) you will be more worried. yklooi liked this post

|

| Change to: |  0.0380sec 0.0380sec

0.26 0.26

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 06:34 PM |