QUOTE(Dreamer09 @ Jan 11 2021, 03:42 PM)

Total dividend payout for 2019 was RM45.82b. The breakdown was RM41.68bn for Simpanan Konvensional (SK) and RM4.14b for Simpanan Shariah (SS). The payout amount required for every 1% dividend rate for 2019 for SK was RM41.68b divided by 5.45% = RM7.65b while for SS was RN4.14b/5% = RM828m. Source: https://www.kwsp.gov.my/-/appendix-epf-2019-performance

Earlier, it is projected that to pay 1% dividend, the amount is expected to increase from RM7.65b to RM9.2b....Previously, they did mention that in order to generate 5% dividend, they need at least RM46.0bn. Hence, RM46.0b/5% = RM9.2b for each 1%. Source https://www.theedgemarkets.com/article/epf-...5-dividend-2020

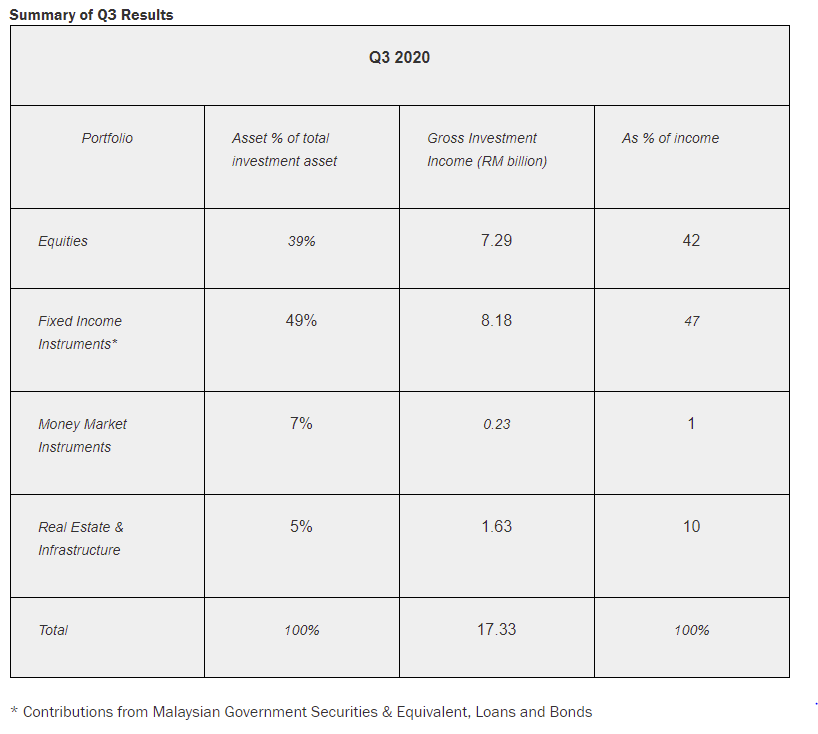

Recap for the past 3 quarters EPF performance,

1Q2020 - Gross investment income was RM12.16b, net investment income was at RM7.5b, while total investment asset was fell to RM874.0b (from RM924.75b) https://www.theedgemarkets.com/article/what...t-2020-dividend

2Q2020 - Gross investment income was RM15.12b, net investment income was at RM13.46b, while total investment asset grew to RM929.64b https://www.theedgemarkets.com/article/what...s-2020-dividend

3Q2020 - Gross investment income was RM17.33b, net investment income was at RM16.87b, while total investment asset grew to RM941.77b https://www.thestar.com.my/business/busines...me-of-rm1733bil

If we sum it up for the past 3 quarters, the total gross investment income totaled RM44.6b (full year for 2019 was only RM50.29b), while net investment income was RM37.83b (the net figures were not reported in 2019).

Assuming EPF requires RM9.2b to pay 1% of dividend, RM37.83b/RM9.2b = 4.1%, this has yet to add in 4Q2020 figures (barring any unforeseen circumstances like in 1Q2020 whereby about RM50b was written off in asset....EPF still manage to remain positive during the quarter)

However, with the various withdrawal schemes and the extension for contribution payment from the 15th to the 30th of every month from April until December 2020 by employers, am not too sure how it affects the dividend declaration. On the bright side, total investment asset continues to grow.

i was thinking the same. The investment income has grown from 2019 by a substantial sum. i cannot see it less than 4.5%.Earlier, it is projected that to pay 1% dividend, the amount is expected to increase from RM7.65b to RM9.2b....Previously, they did mention that in order to generate 5% dividend, they need at least RM46.0bn. Hence, RM46.0b/5% = RM9.2b for each 1%. Source https://www.theedgemarkets.com/article/epf-...5-dividend-2020

Recap for the past 3 quarters EPF performance,

1Q2020 - Gross investment income was RM12.16b, net investment income was at RM7.5b, while total investment asset was fell to RM874.0b (from RM924.75b) https://www.theedgemarkets.com/article/what...t-2020-dividend

2Q2020 - Gross investment income was RM15.12b, net investment income was at RM13.46b, while total investment asset grew to RM929.64b https://www.theedgemarkets.com/article/what...s-2020-dividend

3Q2020 - Gross investment income was RM17.33b, net investment income was at RM16.87b, while total investment asset grew to RM941.77b https://www.thestar.com.my/business/busines...me-of-rm1733bil

If we sum it up for the past 3 quarters, the total gross investment income totaled RM44.6b (full year for 2019 was only RM50.29b), while net investment income was RM37.83b (the net figures were not reported in 2019).

Assuming EPF requires RM9.2b to pay 1% of dividend, RM37.83b/RM9.2b = 4.1%, this has yet to add in 4Q2020 figures (barring any unforeseen circumstances like in 1Q2020 whereby about RM50b was written off in asset....EPF still manage to remain positive during the quarter)

However, with the various withdrawal schemes and the extension for contribution payment from the 15th to the 30th of every month from April until December 2020 by employers, am not too sure how it affects the dividend declaration. On the bright side, total investment asset continues to grow.

UNLESS they with hold declaring all the income as dividend.

Jan 12 2021, 09:14 AM

Jan 12 2021, 09:14 AM

Quote

Quote

0.0558sec

0.0558sec

0.80

0.80

7 queries

7 queries

GZIP Disabled

GZIP Disabled