QUOTE(Diamondhands91 @ Dec 28 2022, 06:50 AM)

Hey guys, it's end of the yr, if I do 10k self contribution I can get 6% dividen straight or it's prorated ya?

ProratedEPF DIVIDEND, EPF

|

|

Dec 28 2022, 06:51 AM Dec 28 2022, 06:51 AM

Return to original view | IPv6 | Post

#21

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(Diamondhands91 @ Dec 28 2022, 06:50 AM) Hey guys, it's end of the yr, if I do 10k self contribution I can get 6% dividen straight or it's prorated ya? Prorated Diamondhands91 liked this post

|

|

|

|

|

|

Dec 28 2022, 06:53 AM Dec 28 2022, 06:53 AM

Return to original view | IPv6 | Post

#22

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(Kopistall @ Dec 28 2022, 06:19 AM) Okay. Thanks for all the feedback. 1 more question. Why can't epf be like bank. Anytime can withdraw a small amount monthly. Why must wait till old & weak only withdraw ? Everyday I think about my $$$ inside epf. Dunno can trust or not this government. I used to deal with land office/pejabat tanah, the officers there totally hopeless beyond imagination. Cause it's a retirement fundEmployees' Provident Fund is a federal statutory body under the purview of the Ministry of Finance. It manages the compulsory savings plan and retirement planning for private sector workers in Malaysia. Wikipedia |

|

|

Dec 28 2022, 07:43 AM Dec 28 2022, 07:43 AM

Return to original view | IPv6 | Post

#23

|

Senior Member

5,741 posts Joined: Apr 2019 |

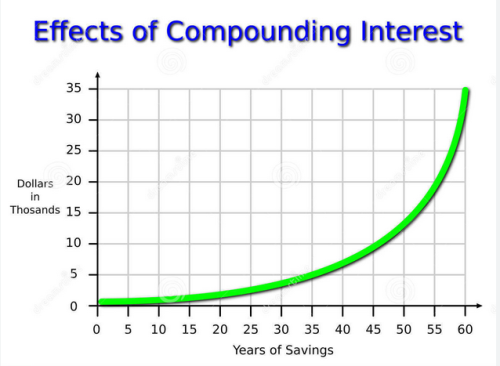

QUOTE(guy3288 @ Dec 27 2022, 10:34 PM) refused to admit taking out EPF money which pays higher dividend to pay a loan charging a lower rate is a negative move? using EPF money to pay for house loan is always a negative move. you tried to tell us the value of the house sure higher value than EPF contribution what logic are you using there? People are talking about leave money in EPF to earn higher returns, continue pay loan installment charged at lower rates , It is about better to use money from the bank or from EPF what has it got to do with the value of the house itself or EPF contribution amount? Say house RM1 million, and he took same RM1 million from EPF, now what? twist and turn you win. but logics no. yes, house may increase in value, but EPF goes by compounding growth. that even house can't beat which only has linear growth. epf has 0 maintenance cost for its final interest rate, house has cukai pintu, cukai tanah, bil air, bil elektrik, maintenance fee, wear and tear costs etc etc.  |

|

|

Dec 28 2022, 08:04 AM Dec 28 2022, 08:04 AM

Return to original view | IPv6 | Post

#24

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(prophetjul @ Dec 28 2022, 08:01 AM) That depends. time and effort to put into looking after the place, find tenant, clean place. On your entry price and rental returns. When I bought a house in 1996, it cost Rm145k. Rents came in at 15k per annum. That's more than 10% yield. I was able to rent at that rent for many years till I sold in 2016 for Rm700k. That is 8% cagr. Plus the rental minus minor repairs, it's approx 10%. Much better than EPF. if everything needs a number, then put time and effort a value to them too. then it will be less than 10%. one needs lots of effort one needs 0 work. two very different things. |

|

|

Dec 28 2022, 12:45 PM Dec 28 2022, 12:45 PM

Return to original view | IPv6 | Post

#25

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(kevyeoh @ Dec 28 2022, 10:32 AM) dude... property in this country has changed. house value rise regardless if you take loan or take money to pay from EPF.... i am free now so i take a bit of time to write a bit more detail... scenario A: house value RM1 mil. Take house loan RM 1mil for simplicity sake @ 4% interest rate Keep RM 1mil in EPF, generate 5% interest rate scenario B: house value RM1 mil Take EPF money out RM1mil to buy house After 5 years, house value up 10%. scenario A: house value RM1.1 mil. Take house loan RM 1mil for simplicity sake @ 4% interest rate Keep RM 1mil in EPF, generate 5% interest rate you still earning 1% every year on top of the 10% house value you earn. scenario B: house value RM1.1 mil Take EPF money out RM1mil to buy house you earn 10% of house value correct me if i'm wrong...but that's my understanding... shoe box sizes property up 10% 5 years? past 10 years have been stagnant. only developers and banks are winners. you can 200% guarantee house price goes up 10% every 5 years? people write here without thinking about time cost, distance cost, lawyer cost, bill costs to attend to the house. CommodoreAmiga liked this post

|

|

|

Dec 28 2022, 02:55 PM Dec 28 2022, 02:55 PM

Return to original view | IPv6 | Post

#26

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(guy3288 @ Dec 28 2022, 01:22 PM) wait till you read his even more outrageous reply next... but if you can lay hand on below market price properties - how much time you put on it?i knew him from his previous nick before he was permanently banned. yeah just to show properties can win over EPF also. nothing is guaranteed in investment but if you can lay hand on below market price properties with almost assured tenancy in that location and known rental rate it is not difficult to decide then.. edit: incomplete without the picture of costs involved..... it takes time to find, bid, clean, work on it etc. if keep on talking like this, might as well call it business, and anytime can say it's better than epf. EPF is passive, effortless, mindless. is property investment the same? so i don't compare them cause they are not equal. to each their own. some do well in property, good for them. some prefer epf, good for them. HolyCooler liked this post

|

|

|

|

|

|

Dec 28 2022, 03:08 PM Dec 28 2022, 03:08 PM

Return to original view | IPv6 | Post

#27

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(CommodoreAmiga @ Dec 28 2022, 03:00 PM) Unker old already. Dun care. All properties debt settled very early. Can sleep at night. Now only manage cash. Cash is king. yes, try liquidate properties right now, remember to deduct lawyer, agent, document fee etc. 3-6 months also cannot see the money.Frankly, i aint gonna touch property anymore. Will only buy REITS. No headache maintenance, sinking fund, chasing tibai tenant who won't pay bill, water and electric. And yeah, the days of glorious up up up in properties are over. Today buy new properties, probably cannot cover installment and and other fees. I repeat: CASH IS KING. I belip in Bossku. try withdraw epf now, its done as soon as possible how to compare both. i wont own anymore property in malaysia too, all loans paid. nothing but a game of developers and banks, leading malaysians to be in debt for 30 years living in a shoe box. LIQUIDITY IS KING. CommodoreAmiga liked this post

|

|

|

Dec 29 2022, 06:22 AM Dec 29 2022, 06:22 AM

Return to original view | IPv6 | Post

#28

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(Kopistall @ Dec 29 2022, 05:12 AM) Okay you guys are right. But shouldn't there be an emergency clause to withdraw for urgent usage like during difficult times ? I think there are many ways you can withdraw epf. I withdrew 120k before. I already find them very lenient in allowing people to withdraw. Hence don't mind keep putting more fund into epf Consider that a forced and disciplined saving But if your kind of emergency isn't listed in any of those, then maybe finance 101: to have 3-6 mths min of emergency fund. I never think I'm entitled to my epf before i hit 50. They're for my future self, not current self who couldn't manage finance well. wongmunkeong liked this post

|

|

|

Dec 30 2022, 06:54 AM Dec 30 2022, 06:54 AM

Return to original view | IPv6 | Post

#29

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(Kopistall @ Dec 30 2022, 04:51 AM) Nice knowing epf is lenient to you. But how about me ? Let's say I need the money to spend or buy whatever I like. Is it possible epf will be lenient or not ? Whatever you want? Then have a pot of your own money to do that. Epf isn't meant for that. How difficult to have a pot of money to buy whatever you want? If you don't have that pot of money, even more important you shouldn't touch epf. Young and bright already no savings of your own and want to touch your old age fund. Don't you think it's very irresponsible? What's need? A brand new phone? A brand new clothes? A brand new watch? A brand new car? Salary X 11% to EPF 10% income tax (simply put a number) You've around 80% to play with your budget. Bills, monthly loan payment, daily expenses and savings. The usual is, pay all bills and loans first, put X amount of money as additional savings and the rest you can freely spent. If you can't even save 10% from that 80% to have that pot of money to put whatever you want and need to dip your hands into the last 11% of your salary meant for old age, then you clearly have overspent . MFLooi liked this post

|

|

|

Dec 30 2022, 11:11 AM Dec 30 2022, 11:11 AM

Return to original view | IPv6 | Post

#30

|

Senior Member

5,741 posts Joined: Apr 2019 |

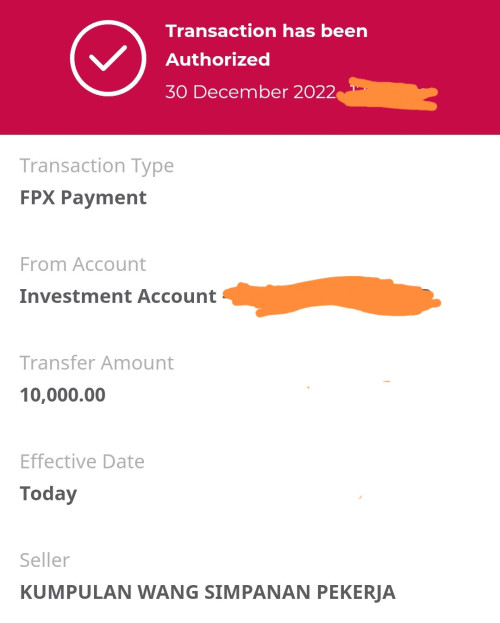

QUOTE(Cubalagi @ Dec 30 2022, 10:51 AM) Property and other better investmentI think best we remain this an epf topic Passive Effortless Low risk Did my last round of contribution for year 2022 for my future self. 🙏  This post has been edited by gashout: Dec 30 2022, 12:24 PM CommodoreAmiga liked this post

|

|

|

Dec 30 2022, 02:32 PM Dec 30 2022, 02:32 PM

Return to original view | IPv6 | Post

#31

|

Senior Member

5,741 posts Joined: Apr 2019 |

|

|

|

Dec 31 2022, 06:05 AM Dec 31 2022, 06:05 AM

Return to original view | IPv6 | Post

#32

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(HolyCooler @ Dec 31 2022, 12:57 AM) It is the last day of the year again. This year is quite fruitful for me and hope everything is going well next year. You smashed it on this one. An example for many to follow.Contributed RM 195k into EPF this year, until this moment i still think i did the right move and will continue to do so.  Hope they will agree to increase the self contribution limit to be RM 100k and i will aim to contribute RM 280K-300K next year. Have a good 2023 everyone! Wishing everyone a good 2023 too HolyCooler liked this post

|

|

|

Dec 31 2022, 11:47 AM Dec 31 2022, 11:47 AM

Return to original view | IPv6 | Post

#33

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(rx330 @ Dec 31 2022, 11:27 AM) self contribution epf, are we able to withdraw? not touching those monthly contributions on salary follow terms and conditions as set in epf website.and do not have 1m in epf account 2 can still be withdrawn, yes. https://www.kwsp.gov.my/member/withdrawals |

|

|

|

|

|

Dec 31 2022, 12:54 PM Dec 31 2022, 12:54 PM

Return to original view | IPv6 | Post

#34

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(rx330 @ Dec 31 2022, 12:18 PM) thank you best to never touch your epf until your old ageso regardless how much I pump in, only the acc 2 I can withdraw, unless I have 1m in it since 1m is still a long way to go for me, would it be safe to say I just park it in normal FD with lower interest as compare to EPF just in case I needed the money if need, only acc 2, if you also want to touch your acc 1, then you really dont have enough to spend, even more reason not to touch acc 1 or epf. set a target for 2023, how much you want your epf account to have. This post has been edited by gashout: Dec 31 2022, 12:54 PM rx330 liked this post

|

|

|

Dec 31 2022, 09:58 PM Dec 31 2022, 09:58 PM

Return to original view | IPv6 | Post

#35

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(Wedchar2912 @ Dec 30 2022, 12:31 PM) Do tell me if this contribution will make it in time.... cos if it is sent today, i have the impression that it will only be reflected the next biz day, which is 2nd of Jan 2023. QUOTE(guy3288 @ Dec 30 2022, 01:41 PM) Yes ,all. more queries bring to prop thread Did yesterday.i have done mine, you may be abit late now. property's not my forte also. you didnt get the whole picture it started with one regretted taking all EPF money pay house loan it was pointed out that a wrong move. Then came tongue twister who said no, it was ok properties will appreciate more use EPF money which was shot down repeatedly someone shot the above, properties return better than EPF another came said No, that was because you bought in 1996, after 2013 if you buy no way can be so good.... i shared my data to show buy later also can be as good. it is better that we see the whole big picture before we quickly press the button. abstain if we are unsure what is contention there. In today Wedchar2912 liked this post

|

|

|

Jan 3 2023, 03:54 PM Jan 3 2023, 03:54 PM

Return to original view | IPv6 | Post

#36

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(koaydarren @ Jan 3 2023, 01:04 PM) How come in lowyat, everyone is so rich can easily transfer 60k or 120k just like this, or just that I'm poor? Feel bad for myself. Everyone is on a different journeyDifferent lives, stories, challenges, income, expenses Just do your best If you're not buying Starbucks and eat out everyday or change new car and hp every year, you're doing well CommodoreAmiga liked this post

|

|

|

Jan 3 2023, 04:01 PM Jan 3 2023, 04:01 PM

Return to original view | IPv6 | Post

#37

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(magika @ Jan 3 2023, 01:37 PM) QUOTE(Ankle @ Jan 3 2023, 03:21 PM) Might be I hv overlooked this part. not sure about difference between Monthly contribution that obtain pro-rated dividend i.e. dividend for the n-month will get (12-n) month dividend. For example, the September contribution (n=9) will obtain a 3 months dividend. Under Section 27 of the EPF Act 1991, the guaranteed minimum dividend rate is 2.5% per year on members' savings.early of month and end of month. Can someone workout what is the difference? Lol Sept 1 put in also no count Same like Sept 30 So make sure put before Oct to earn Oct dividend So best put end September to start earning October |

|

|

Jan 3 2023, 08:15 PM Jan 3 2023, 08:15 PM

Return to original view | IPv6 | Post

#38

|

Senior Member

5,741 posts Joined: Apr 2019 |

|

|

|

Jan 4 2023, 11:02 PM Jan 4 2023, 11:02 PM

Return to original view | IPv6 | Post

#39

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(Ankle @ Jan 4 2023, 07:46 PM) Stay optimistic, we have a new team to bring the country forward. PM 10 effect will only show in the coming few yearsAlready billions have been saved in the short time they are in power. It can only get better and better. If you asked which govt is better PM8 or PM9, the answer would be PM10 though its still too early to say for surely sure. Only time will tell. 2022 dividend will still be based on past leadership |

|

|

Jan 6 2023, 12:52 PM Jan 6 2023, 12:52 PM

Return to original view | IPv6 | Post

#40

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(Ankle @ Jan 6 2023, 09:57 AM) Ya man , retire early man , life is short make it sweet. agree. correctIt was mentioned by a very rich man that if one has cash 20m any amount above it will not make much difference. Donno lah , I personally think 5m pun ok dy and can live very senang life , ifong , maid , annual holidays , fine dining , massage hehehe , dan macam macam. Anyway human is leasehold , even anything freehold , one cant pegang forever. 5m in EPF dividend 5pct 250k , about mouth watering 20k per mth , apa lagi mauu ??? Correct or not ?? dont work till die. life also no time to enjoy must enjoy life! HolyCooler liked this post

|

| Change to: |  0.0391sec 0.0391sec

0.24 0.24

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 04:37 PM |