QUOTE(CommodoreAmiga @ Dec 24 2022, 09:58 AM)

I am targeting 1.2 - 1.4m by the time I can withdraw all. Unless FD suddenly became 10%, then I would stop self contributing there. Lol.

you intend to withdraw all? where will you put next?

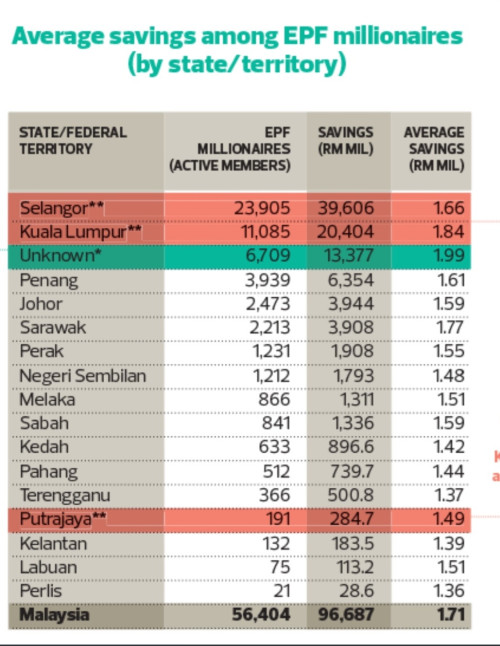

my intention is once hit 1 mil, i can use those additional dividend if i need for my expenses. then unused ones can continue grow from there

5% of 1 mil is 50k/ yr.= 4k/ month, which helps a lot in one's daily life.

thats why its important for people to hit 1 mil asap, but people seem to prefer playing the 'epf will go bankrupt soon' tune.

fd 10%? haha, when inflation is 20% and we will all rekt.

QUOTE(Ankle @ Dec 24 2022, 10:03 AM)

Ironically those like you who can afford better toys in life such as a bigger car than old city or ifong 14 pro are the very ones avoiding them

and those not able to are the very ones owning them to the extreme extent of driving new merc while only owning the 4 tyres and steering

while the rest still belongs to the bank. Thats the difference between the financially prudent and the financially non prudent. Save hard, work

hard and invest carefully is the right way to achieve financial independence some day. Outwardly your life may appear boring. Old city, handfon

nobody takes a second look, house paint looks dull, no facebook fotos of holiday in the swiss alps etc. Yes it is boring. But then you can meet

all your financial obligations, pay bills and most of all sleep well. Your final reward will be the money built up over the years that will now look

after you in your sunset years where you can expect to live with dignity without having to beg borrow or steal. No ahlongs coming to splash

red paint on the gate.

tldr, always invest in your future sell, and your future self will thank you.

its like planting tree, from a seed to a 10m tall tree. magnificent to watch how it grows

This post has been edited by gashout: Dec 24 2022, 10:06 AM

Dec 20 2019, 08:12 PM

Dec 20 2019, 08:12 PM

Quote

Quote

0.0414sec

0.0414sec

0.26

0.26

7 queries

7 queries

GZIP Disabled

GZIP Disabled