QUOTE(ChessRook @ Feb 21 2019, 01:30 PM)

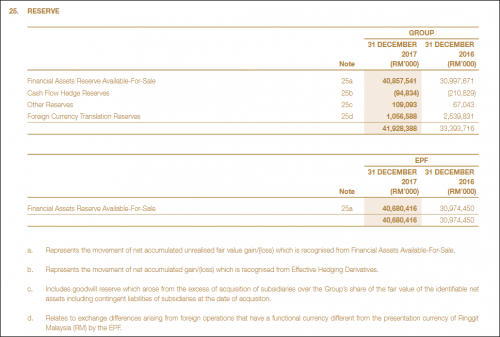

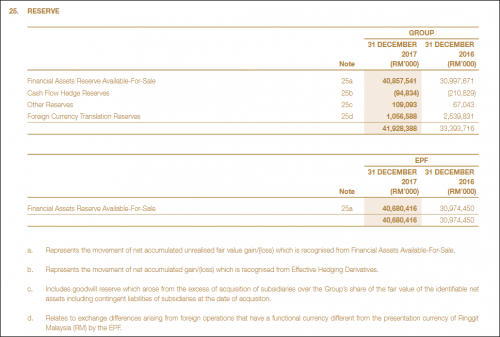

Have a looked at note 25 of the 2017 financial statement.

The reserves are not what layman think as reserves. The reserves are accounting attribution and revaluation due to unrealised gains/losses from the assets they hold. These reserves are there so that the users are able to see the gains / losses for the current year (even when the assets are not sold yet).

My previous posting about the reserves are wrong and i will amend that.

Thanks!The reserves are not what layman think as reserves. The reserves are accounting attribution and revaluation due to unrealised gains/losses from the assets they hold. These reserves are there so that the users are able to see the gains / losses for the current year (even when the assets are not sold yet).

My previous posting about the reserves are wrong and i will amend that.

This is helpful. Looks like the reserves are not be cashed out yet. Hedging contracts, etc?

Feb 21 2019, 01:51 PM

Feb 21 2019, 01:51 PM

Quote

Quote 0.0325sec

0.0325sec

0.52

0.52

7 queries

7 queries

GZIP Disabled

GZIP Disabled