QUOTE(TOS @ Dec 20 2023, 01:49 PM)

You may have oversimplified things a bit. 15% is given every year (until it's abolished by the government), so it's not spread over 40 years.

Since opening my EPF account in 2019, my IRR for EPF, in MYR terms, is about 10% p.a. (inclusive of both EPF dividend + i-saraan incentive).

Of course if the incentive is removed, the IRR will converge towards EPF dividend rates, but in absolute terms, you are still better off than if you had not started contributing to i-saraan early in your life. Compounding interests really helps, especially if done at the early phase of your life.*

*Sigh... tell this to the young people who go for skydiving and travel all too often...

It's not a lot of money after all, 2000 MYR a year...

ROI looks high for the 1st few years cos of the one time 15% (15%+5.2+6.1+5.0)/3=10.43%, but u cant realise it n withdraw, have to keep it there for 40years.

I was initially tempted but after calculation it is not for me. Anyway my kid not likely to work here.

U have to treat each deposit of rm3333/year separately cos we want to see the effect on this 3333 not next 9 years' deposits (they r treated separately).

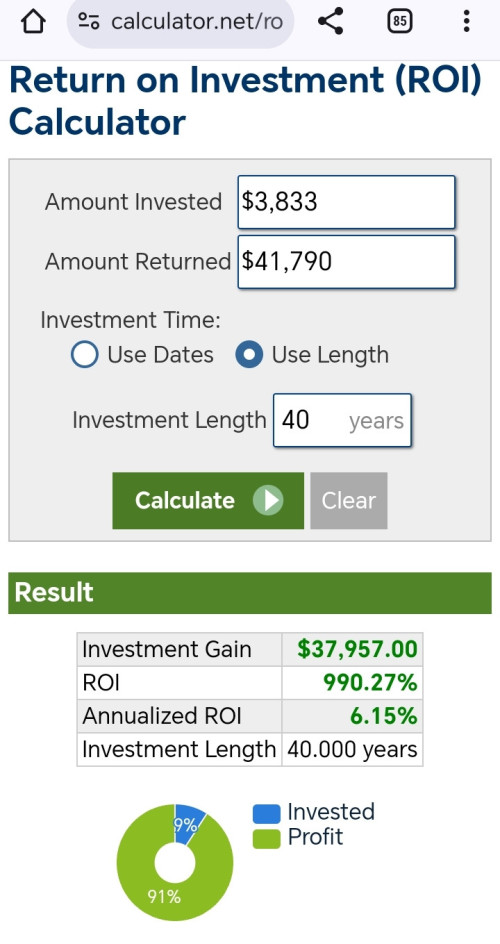

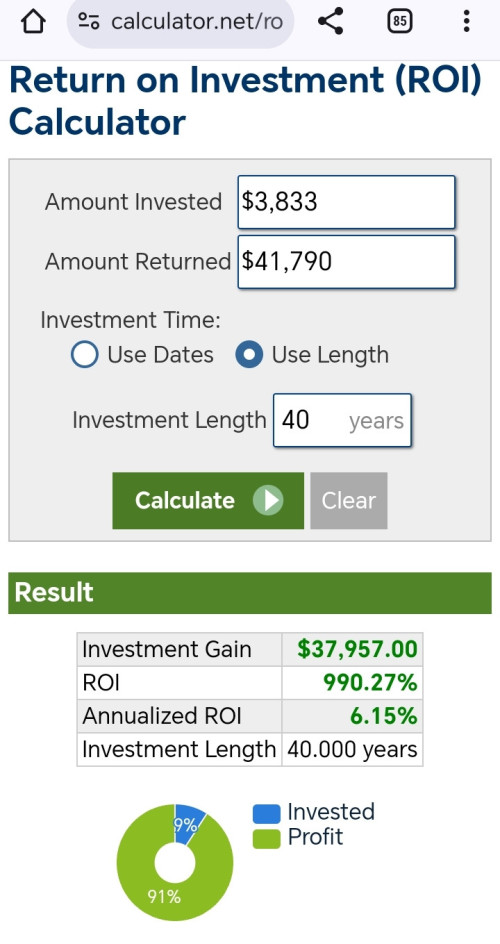

In 2024 u deposit 3333 n get 500, assuming 3333+500=3833 starts from January n epf dividend is 6%, your EOY balance with div for 2024 will be 4063.

Every year for the next 39 years assuming u r getting 6% compounding will get u a final amount of 41790 equivalent to ROI of 6.15%, 0.15% more than the 6% only.

Bare in mind the money is stuck there for 40 years. As a comparison MYR has depreciated against SGD at >3%/year.

This post has been edited by MGM: Dec 20 2023, 03:28 PM

This post has been edited by MGM: Dec 20 2023, 03:28 PM

Aug 18 2023, 03:10 PM

Aug 18 2023, 03:10 PM

Quote

Quote

0.0539sec

0.0539sec

0.36

0.36

7 queries

7 queries

GZIP Disabled

GZIP Disabled