QUOTE(Wolves @ Apr 7 2023, 11:37 AM)

The picture sounds more and more like ah long style. Just need ic not need collateral (then what is kwsp acc 2? You air ah?) And not need guarantor.. fast approval... All ah long keyword. Lol

Best part? First 12 month profit rate first. Die die want to bite you first. 😂 Definitely not a good deal. This is not a term to help borrower lo. Skip~

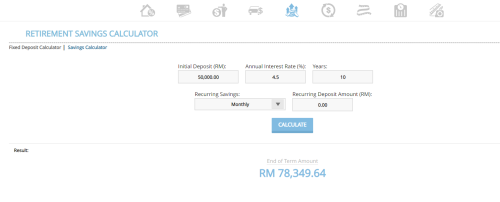

account 2 is the guaranteed collateral... epf will settle with bank first before give you remaining money... Best part? First 12 month profit rate first. Die die want to bite you first. 😂 Definitely not a good deal. This is not a term to help borrower lo. Skip~

my friend desperate last time willing to swipe cc for 'fast loan'...

this scheme do work for these ppl... also if you have cc loan... personal n car loan... this can help immediately lower your burden... my friend now millionaire btw, got some other loan help his company avoid bankrupt...

Apr 7 2023, 11:54 AM

Apr 7 2023, 11:54 AM

Quote

Quote

0.0518sec

0.0518sec

0.56

0.56

7 queries

7 queries

GZIP Disabled

GZIP Disabled