» Click to show Spoiler - click again to hide... «

This post has been edited by TOS: Mar 4 2023, 01:25 PM

EPF DIVIDEND, EPF

|

|

Mar 4 2023, 01:24 PM Mar 4 2023, 01:24 PM

Return to original view | Post

#121

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

» Click to show Spoiler - click again to hide... « This post has been edited by TOS: Mar 4 2023, 01:25 PM |

|

|

|

|

|

Mar 4 2023, 01:27 PM Mar 4 2023, 01:27 PM

Return to original view | Post

#122

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

lol

|

|

|

Mar 4 2023, 01:32 PM Mar 4 2023, 01:32 PM

Return to original view | Post

#123

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Will continue half an hour later.

https://www.youtube.com/watch?v=ohADd6ta7kg This post has been edited by TOS: Mar 4 2023, 01:32 PM |

|

|

Mar 4 2023, 01:42 PM Mar 4 2023, 01:42 PM

Return to original view | Post

#124

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Official announcement: https://www.kwsp.gov.my/en/web/guest/w/epf-...members-savings

|

|

|

Mar 9 2023, 03:07 PM Mar 9 2023, 03:07 PM

Return to original view | Post

#125

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(prophetjul @ Mar 9 2023, 03:04 PM) QUOTE Australian residents must declare and pay tax on their worldwide income (that is, income they earn in Australia and from overseas sources). https://www.ato.gov.au/individuals/income-a...rldwide-income/ |

|

|

Mar 10 2023, 04:34 PM Mar 10 2023, 04:34 PM

Return to original view | Post

#126

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

|

|

|

Apr 17 2023, 12:15 PM Apr 17 2023, 12:15 PM

Return to original view | Post

#127

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

EPF turns to MoF to cover potential defaulted Account 2 loans?

QUOTE KUALA LUMPUR: The Employees Provident Fund (EPF) has turned to the Ministry of Finance (MoF) directly after a government guarantee scheme provider rejects the plan to cover defaulted loans under the EPF Account 2 Support Facility programme, sources said. According to the sources, a proposal was made that Syarikat Jaminan Pembiayaan Perniagaan Bhd (SJPP) be roped in to provide the necessary fund for the matter but was turned down by the Finance Minister Incorporated (MoF Inc)-owned firm. "A due diligence was carried out by SJPP for the matter including reviewing the terms and conditions of personal financing under MBSB Bank, which, at the time, was the only participating bank offering the facility."But the proposal did not materialise. "This is especially because SJPP does not cater for personal financing. Its claim fund would not be able to accommodate additional non-performing loans (NPLs)," a source told NST Business. Sinchew reports: https://www.sinchew.com.my/20230417/epf%e7%...bf%9d%ef%bc%9f/ This post has been edited by TOS: Apr 17 2023, 12:16 PM |

|

|

Apr 17 2023, 02:01 PM Apr 17 2023, 02:01 PM

Return to original view | Post

#128

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(PueRTeaA @ Apr 17 2023, 01:21 PM) "A due diligence was carried out by SJPP for the matter including reviewing the terms and conditions of personal financing under MBSB Bank, which, at the time, was the only participating bank offering the facility."But the proposal did not materialise. Just a typo from the editors. They mean "at that time" instead of "at the time".Old news? MBSB Bank is the only bank ?? 15 April BSN already accept new application. Today already 17 April. 2 day pass already still report MBSB the only bank... The sinchew article corrects that. At that time, MBSB was probably the first and only participating bank, then BSN joins in later. Anyway, these stuffs would be behind closed curtains. The public won't know the exact details. |

|

|

Aug 18 2023, 02:28 PM Aug 18 2023, 02:28 PM

Return to original view | Post

#129

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Wolves @ Aug 18 2023, 02:05 PM) It's usually paid in September. Here're the dates for the past 3 years. 2020: 24/09/2020 2021: 08/09/2021 2022: 19/09/2022 |

|

|

Aug 18 2023, 03:24 PM Aug 18 2023, 03:24 PM

Return to original view | Post

#130

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Oct 1 2023, 09:45 AM Oct 1 2023, 09:45 AM

Return to original view | Post

#131

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Dec 19 2023, 10:20 PM Dec 19 2023, 10:20 PM

Return to original view | IPv6 | Post

#132

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Ahyo I open at age 18 just tell counter "tolong mak buat kerja rumah ada dapat elaun" already can open.

Nothing new lah, at our age can get double digit EPF returns... syiok Government borrow money from us to pay us back |

|

|

Dec 20 2023, 10:43 AM Dec 20 2023, 10:43 AM

Return to original view | IPv6 | Post

#133

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

|

|

|

Dec 20 2023, 01:49 PM Dec 20 2023, 01:49 PM

Return to original view | IPv6 | Post

#134

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(MGM @ Dec 20 2023, 01:33 PM) 15% isaraan rebates spread over 40years is ~0.375%/year using simple maths. After 41years at age 55, what will happen to MYR? 43years ago 1.02MYR=1.00SGD. You may have oversimplified things a bit. 15% is given every year (until it's abolished by the government), so it's not spread over 40 years. Personally i wont do it for my kid. Since opening my EPF account in 2019, my IRR for EPF, in MYR terms, is about 10% p.a. (inclusive of both EPF dividend + i-saraan incentive). Of course if the incentive is removed, the IRR will converge towards EPF dividend rates, but in absolute terms, you are still better off than if you had not started contributing to i-saraan early in your life. Compounding interests really helps, especially if done at the early phase of your life.* *Sigh... tell this to the young people who go for skydiving and travel all too often... It's not a lot of money after all, 2000 MYR a year... This post has been edited by TOS: Dec 20 2023, 01:50 PM CommodoreAmiga liked this post

|

|

|

Dec 20 2023, 04:12 PM Dec 20 2023, 04:12 PM

Return to original view | IPv6 | Post

#135

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

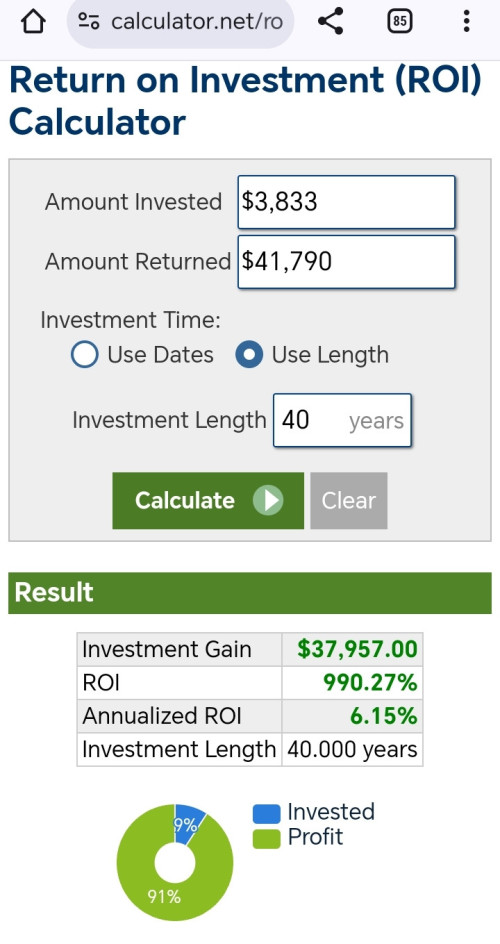

QUOTE(MGM @ Dec 20 2023, 02:51 PM) ROI looks high for the 1st few years cos of the one time 15% (15%+5.2+6.1+5.0)/3=10.43%, but u cant realise it n withdraw, have to keep it there for 40years. Oh, I am assuming every year there is 500 MYR coming in. You look at one year 500 MYR only and deduce the ROI from there. Fair enough, I don't know when will the 500 MYR candy stops flowing. And 2k MYR is not a lot in SGD terms... that is 567 SGD only... for some exposure to MYR is ok lah I was initially tempted but after calculation it is not for me. Anyway my kid not likely to work here. U have to treat each deposit of rm3333/year separately cos we want to see the effect on this 3333 not next 9 years' deposits (they r treated separately). In 2024 u deposit 3333 n get 500, assuming 3333+500=3833 starts from January n epf dividend is 6%, your EOY balance with div for 2024 will be 4063. Every year for the next 39 years assuming u r getting 6% compounding will get u a final amount of 41790 equivalent to ROI of 6.15%, 0.15% more than the 6% only. Bare in mind the money is stuck there for 40 years. As a comparison MYR has depreciated against SGD at >3%/year.  As for SGD thing... MAS NEER is sloping upwards at 3% p.a. as recent as a few months back, so yea that explains the strong SGD/MYR rate you see recently. Historically, it varies from flat to 1.5 or 2% p.a. Now that NEER is trading near the upper band, any hint of a reduction in slope rate may cause SGD to depreciate slightly in the near term. This post has been edited by TOS: Dec 20 2023, 04:17 PM |

|

|

Dec 20 2023, 09:13 PM Dec 20 2023, 09:13 PM

Return to original view | IPv6 | Post

#136

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(MGM @ Dec 20 2023, 05:04 PM) Each person 10x 500. I got around 6.6% p.a. You can have a look and see if there are any problems. Put in 3334 each year to get 500. U have to calculate the ROI based on each 3334 deposited cos it contributes the 500. 1.03^43=3.56, in 1980 MYR=SGD.  Lowyat_EPF_MGM_Calculation.zip ( 10.96k )

Number of downloads: 22

Lowyat_EPF_MGM_Calculation.zip ( 10.96k )

Number of downloads: 22For computing IRR, the 500 MYR i-saraan contributions cannot be withdrawn, so they are not cash inflow/outflow per se and the whole investment is assumed to be withdrawn at the start of age 55 (end of age 54). |

|

|

Dec 20 2023, 09:53 PM Dec 20 2023, 09:53 PM

Return to original view | IPv6 | Post

#137

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Mar 3 2024, 03:13 PM Mar 3 2024, 03:13 PM

Return to original view | Post

#138

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(AVFAN @ Mar 3 2024, 03:03 PM) read above link and this too. Good point bro. Last year MSCI World Index returns 20% p.a., plus USD.MYR depreciation of around 4-5% last year should yield almost 25% p.a. in MYR terms. https://www.freemalaysiatoday.com/category/...tment-says-epf/ what is still surprising is with 38% foreign inv, RM weakened so much, yet return is 8+% only...?? there must be some other explanation not highlighted yet. 8% is more like a balanced portfolio's USD return... |

|

|

Mar 3 2024, 03:21 PM Mar 3 2024, 03:21 PM

Return to original view | Post

#139

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Mar 3 2024, 03:33 PM Mar 3 2024, 03:33 PM

Return to original view | Post

#140

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Cubalagi @ Mar 3 2024, 03:25 PM) That msci index returns is increase in value. Not realised gains. The news article says ROI, not dividends or something else... Epf diviends works on realised gains from actual.selling of their portfolio. So its not apples to apples. I assume ROI means dividends + capital gains hehe |

| Change to: |  0.0573sec 0.0573sec

0.26 0.26

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 10:53 PM |