QUOTE(nexona88 @ Jan 13 2025, 03:35 PM)

didnt notice anything change... cannot remember if the i-saraan signup page pop up automatically after login.

oh, and it was quite slow and sluggish the website.

EPF DIVIDEND, EPF

|

|

Jan 13 2025, 06:27 PM Jan 13 2025, 06:27 PM

Return to original view | Post

#1081

|

Senior Member

3,688 posts Joined: Apr 2019 |

|

|

|

|

|

|

Jan 13 2025, 07:52 PM Jan 13 2025, 07:52 PM

Return to original view | Post

#1082

|

Senior Member

3,688 posts Joined: Apr 2019 |

|

|

|

Jan 18 2025, 12:47 PM Jan 18 2025, 12:47 PM

Return to original view | Post

#1083

|

Senior Member

3,688 posts Joined: Apr 2019 |

QUOTE(plumberly @ Jan 18 2025, 11:04 AM) agree... super agree... najib's time, all announce in Feb...10 Feb 2018 announcement was 6.90%...... batman1172 and nexona88 liked this post

|

|

|

Jan 22 2025, 10:42 PM Jan 22 2025, 10:42 PM

Return to original view | Post

#1084

|

Senior Member

3,688 posts Joined: Apr 2019 |

QUOTE(fuzzy @ Jan 22 2025, 09:34 PM) The problem is the RM1mil isn't going to have the same spending power. If I just use the inflation calculator from DOSM, RM1mil in 2000 is equivalent to RM1.6mil today. So what's the value of RM1mil when they hit 55? See... EPF is very good and is also thinking for those in the T20 and above... This is why the EPF, with their all-knowing thought process and benevolent intentions, decided that the new limit should be RM 1.3 million before one can withdraw the excess, starting three years from this year. Your calculation indicated 24 years to go up by 60%.... while EPF's calculation just needed 4 years to go up by 30%.... |

|

|

Jan 23 2025, 12:55 PM Jan 23 2025, 12:55 PM

Return to original view | Post

#1085

|

Senior Member

3,688 posts Joined: Apr 2019 |

|

|

|

Jan 23 2025, 02:38 PM Jan 23 2025, 02:38 PM

Return to original view | Post

#1086

|

Senior Member

3,688 posts Joined: Apr 2019 |

QUOTE(nexona88 @ Jan 23 2025, 02:20 PM) Only if there's change from 55yo to 60yo for full withdrawal yeah... but who knows... But from what I see... When they increased the retirement age from previous 55yo to current 60yo The withdrawal at 55yo maintain 👍🙏 remember a short while back, lotsa news about how epf should disallow members to take all out... and must have minimum in epf, effectively forcing retirees to take annuities? so... who knows what may change in the future. even retirement age may not remain fixed at 60... nexona88 liked this post

|

|

|

|

|

|

Jan 25 2025, 11:26 PM Jan 25 2025, 11:26 PM

Return to original view | Post

#1087

|

Senior Member

3,688 posts Joined: Apr 2019 |

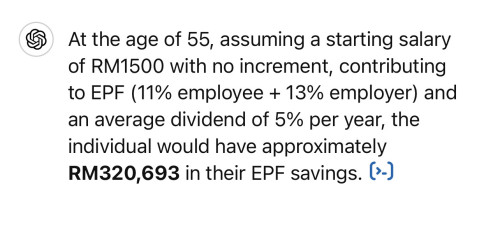

QUOTE(Avenger_2012 @ Jan 25 2025, 11:15 PM)  Note: This is based on starting age of 24. There is absolutely no way someone cannot achieve 240k over 30 years, as long as he is an active contributor. Epf is trying to paint a picture in which certain groups are poor with less than 10k and so on. However, the fact is that none of them are active contributors. then at 55 years old, should have more than 1 million ringgit. |

|

|

Feb 2 2025, 11:59 AM Feb 2 2025, 11:59 AM

Return to original view | Post

#1088

|

Senior Member

3,688 posts Joined: Apr 2019 |

QUOTE(nexona88 @ Feb 2 2025, 11:06 AM) either early 80s or late 70s???earliest i can remember paying for my own food was in primary school standard 1... that also like 40 to 50 cent for a small bowl of noodle. nexona88 liked this post

|

|

|

Feb 5 2025, 12:12 PM Feb 5 2025, 12:12 PM

Return to original view | Post

#1089

|

Senior Member

3,688 posts Joined: Apr 2019 |

QUOTE(fuzzy @ Feb 5 2025, 11:31 AM) yeah, 5.5K pm for a family is too tight.... for single elderly person should be fine, especially if can get medical support from our nice kkm for 1rm CommodoreAmiga liked this post

|

|

|

Feb 5 2025, 02:43 PM Feb 5 2025, 02:43 PM

Return to original view | Post

#1090

|

Senior Member

3,688 posts Joined: Apr 2019 |

QUOTE(MUM @ Feb 5 2025, 01:02 PM) Unknown to how much medical insurance one had purchased when young. Unfortunately, some retirees may have no choice but to fully rely on kkm 1rme plan if the gov and bnm don't take stronger actions in curtailing the money grubbing practices of insurance firms and hospitals. Like currently read posting saying medical insurance coverage in millions. If not fully prepared to sustain it well or fully have the capability to sustain it when retired,...... I think Those medical premium would increase 50% every 5 years. (Especiially after 51) else, almost everyone above the age of 70 will just drop their medical card plans as premium will be sky-high and exceed a few K per month. (I recently learned that a friend was paying over 1.x K monthly for medical card ... just crazy) If this trend continues, it will be super teruk for gov cos everyone will just go to GH for treatment |

|

|

Feb 5 2025, 02:46 PM Feb 5 2025, 02:46 PM

Return to original view | Post

#1091

|

Senior Member

3,688 posts Joined: Apr 2019 |

QUOTE(BenChiew @ Feb 5 2025, 11:33 AM) concur.... say 2 million in epf => 10K pm spending moneyanother 4 million invested elsewhere => another 20K pm to spend or reinvest.... 30K rm pm of passive income... can be comfortable to luxurious for an elderly or 2 (spouse). BenChiew liked this post

|

|

|

Feb 5 2025, 07:57 PM Feb 5 2025, 07:57 PM

Return to original view | Post

#1092

|

Senior Member

3,688 posts Joined: Apr 2019 |

QUOTE(Cubalagi @ Feb 5 2025, 06:34 PM) something like 80K active members have more than 1 million |

|

|

Feb 6 2025, 10:32 PM Feb 6 2025, 10:32 PM

Return to original view | Post

#1093

|

Senior Member

3,688 posts Joined: Apr 2019 |

QUOTE(trumpkampung @ Feb 6 2025, 09:33 PM) i just did some projection now if you are ok with working (either enjoy or neutral), then should work as long as you can.... would seem like a waste to just leave cash on the table in exchange of 5 years.... if work till 50, cash + epf .5.5mil but still have hs loan installment 8k pm if work till 55, cash + epf 8mil with no more housing loan hmmmmm so the most smart time to fire is 55. a bit too late I feel.., but the other flip side of things is everyone of us pretty much only has 80 years (or as i like to say 80 diamonds)... 30 diamonds vs 25 diamonds left is a difference of 20%. plus the final 10 to 5 diamonds are not as valuable vs the diamonds representing the age of 50 to 70. I think by 55, can just call it retire already lar... not really fire'd... |

|

|

|

|

|

Feb 9 2025, 01:07 PM Feb 9 2025, 01:07 PM

Return to original view | Post

#1094

|

Senior Member

3,688 posts Joined: Apr 2019 |

|

|

|

Feb 10 2025, 03:37 PM Feb 10 2025, 03:37 PM

Return to original view | Post

#1095

|

Senior Member

3,688 posts Joined: Apr 2019 |

QUOTE(nexona88 @ Feb 10 2025, 03:26 PM) 2008 was like one of the greatest bubble burst... that also Epf was paying 4.5%we should not be so negative and depressed to even look at that level for 2024 div... nexona88 liked this post

|

|

|

Feb 10 2025, 06:26 PM Feb 10 2025, 06:26 PM

Return to original view | Post

#1096

|

Senior Member

3,688 posts Joined: Apr 2019 |

|

|

|

Feb 15 2025, 08:58 PM Feb 15 2025, 08:58 PM

Return to original view | Post

#1097

|

Senior Member

3,688 posts Joined: Apr 2019 |

QUOTE(Super2047 @ Feb 15 2025, 08:54 PM) Just curious, even if you have 1m in your epf, 5.8% vs 6% is only a good RM2k difference. Why so hype up if dividend is 6% ya? I like your statement...Let me ask you... open your wallet or ewallet or bank account... you pick whichever one... say one of them has 10K rm.... imagine now I take away 2K rm from it... u hype or jump or not? haha (u will understand when you realize that is the reserve ratio some of us are talking about) hennylee, cempedaklife, and 2 others liked this post

|

|

|

Feb 15 2025, 11:23 PM Feb 15 2025, 11:23 PM

Return to original view | Post

#1098

|

Senior Member

3,688 posts Joined: Apr 2019 |

QUOTE(mavistan89 @ Feb 15 2025, 10:23 PM) wah... got 10 million, i think the wanton mee is not the cheap type.... michellin star level one.... 100rm each bowl can? hahabut yeah, its all down to the reserve ratio... that is my benchmark of how fair EPF is to current members. |

|

|

Feb 16 2025, 12:21 PM Feb 16 2025, 12:21 PM

Return to original view | Post

#1099

|

Senior Member

3,688 posts Joined: Apr 2019 |

QUOTE(kevyeoh @ Feb 16 2025, 12:06 PM) To me this analogy is a bit different... Because you already have the money and ppl take away from you... I get your point and agree... my analogy definitely flawed, but just an attempt to introduce the concept. So to be the same situation.. for EPF.. it will be... EPF already announce 5.8% and then they later announce it is 5.6%.... Else... Like now tikam... If announce less 0.2% than what we hope for... I don't feel it even if they announce lower than expected... Its similar to this real life story. There was once during lunch, I tried to convince a ex-colleague to better allocate his cash position from current account to high yield savings.... and I purposely highlighted that on daily basis his bank is taking his money away. He just don't see it that way... and the joke was he "refused" to belanja me the cheap hawker stall lunch despite me saying he is losing basically the same lunch money to the bank everyday. ie he was ok for the bank to take his money everyday but not ok to belanja me for a day. |

|

|

Feb 16 2025, 01:54 PM Feb 16 2025, 01:54 PM

Return to original view | Post

#1100

|

Senior Member

3,688 posts Joined: Apr 2019 |

QUOTE(nexona88 @ Feb 16 2025, 01:24 PM) I read somewhere... yeah, i myself experienced the same... my overseas portfolio is doing much better vs EPF's expected 6%. So, I am glad that i did my portfolio rebalancing last year and moved funds out from EPF. Another fund, similar to EPF managed to get 12% ROI for last year... Their allocation for foreign portfolio is around 20%++ only... Majority is in local... I remember correctly, EPF foreign portfolio exposure is way higher.... 30% like that or little more.... So to get 6% is not really hard & impossible.... 🤔🧐😒 What to do... EPF is a government body and some of us already noticed that over the past few years, gov been exerting more and more influence over it. Nonetheless, it is still a great way to store ringgit cash wealth. |

| Change to: |  0.0502sec 0.0502sec

0.65 0.65

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 21st December 2025 - 01:57 AM |