QUOTE(MUM @ Nov 15 2024, 08:56 PM)

At that age, 30 or more % of that monthly income of 2.5k would be parted into medical insurance premiums...

This yearly premium 7.4k annual premium only covers 90k medical annually after 62.

Expected it to double by age 72

Now many of younger age are already having a million coverage. Wondering how much their premium would cost annually at age 62

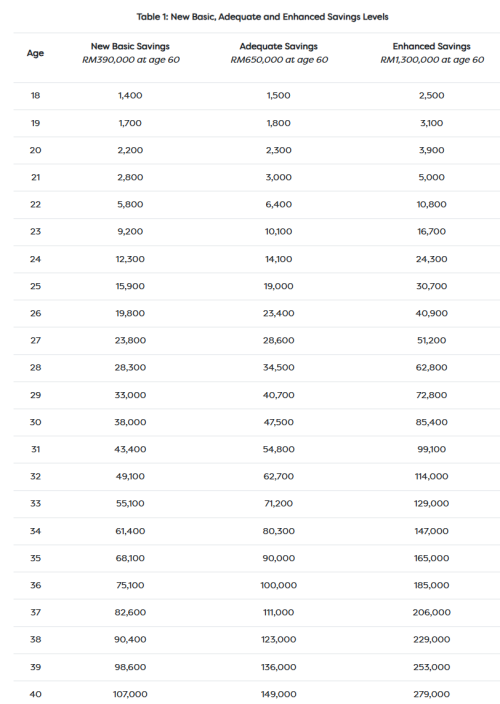

the thing is... the article's object is about retiree having a certain "basic" networth (600K rm) to allow him/her to live comfortably (with 2.5K pm spending power). But one of the many contention is what does comfortably mean?

i would say having such medical insurance should not be factored in.. in Malaysia's context, seeking treatment from GH is adequate. This is available to every citizen.

If one wants a higher class condition/package, then have to allocate even more funds. The basic nestegg should not factor this in.

Else some will claim they want to go to the alps to sky every winter and go to NZ for the summers and claim that's why everyone should set 4 million nestegg as the target.

yeah, I am aware of the medical premium dilemma... i used to comment about how unscrupulous insurance agents are whenever they say buy as expensive a plan as one can afford... but I no longer bother to comment anymore and let idiots (cos they refused to listen to me and some even retort back stupidly) get conned by these agents... they will wise up sooner or later, but it is usually quite late already by then. The other is life insurance... completely useless except for certain cases.

Nov 15 2024, 01:15 PM

Nov 15 2024, 01:15 PM

Quote

Quote

0.0537sec

0.0537sec

1.53

1.53

7 queries

7 queries

GZIP Disabled

GZIP Disabled