QUOTE(T231H @ Oct 10 2017, 08:54 PM)

is this just same as FSM?Fund Investment Corner v3, Funds101

Fund Investment Corner v3, Funds101

|

|

Oct 11 2017, 04:32 PM Oct 11 2017, 04:32 PM

|

Junior Member

523 posts Joined: Aug 2007 |

QUOTE(T231H @ Oct 10 2017, 08:54 PM) is this just same as FSM? |

|

|

|

|

|

Oct 11 2017, 04:45 PM Oct 11 2017, 04:45 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Oct 11 2017, 04:45 PM Oct 11 2017, 04:45 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Oct 14 2017, 10:01 PM Oct 14 2017, 10:01 PM

|

Junior Member

489 posts Joined: Jun 2009 |

any difference invest monies into prs thru eUnit trust and FSM?

|

|

|

Oct 15 2017, 10:30 AM Oct 15 2017, 10:30 AM

|

All Stars

11,954 posts Joined: May 2007 |

no different

|

|

|

Oct 23 2017, 03:55 PM Oct 23 2017, 03:55 PM

|

Junior Member

428 posts Joined: Sep 2017 |

Majority here purchase fund/ UT online i.e: FSM, Eunittrust?

Personally may try to open FSM account, refer back previous post, saying that there are platfrom fees, how to waive it? other than online trade? any method to buy and sell? Is it Funds is game rules same as ASN unfixed price fund? feel free to share the different.. |

|

|

|

|

|

Oct 23 2017, 06:56 PM Oct 23 2017, 06:56 PM

Show posts by this member only | IPv6 | Post

#2507

|

All Stars

24,392 posts Joined: Feb 2011 |

QUOTE(mephyll @ Oct 23 2017, 03:55 PM) Majority here purchase fund/ UT online i.e: FSM, Eunittrust? Yes. Personally may try to open FSM account, refer back previous post, saying that there are platfrom fees, how to waive it? other than online trade? any method to buy and sell? Is it Funds is game rules same as ASN unfixed price fund? feel free to share the different.. Platform fees is applicable for bond funds and managed portfolio if bought from FSM. How to bypass it? 1) Buy bond funds from eUT whenever they have promo. Applicable only if you bought min RM5 during promo. No min RM5k, no talk 2) Switch over to POEMS SG (drastic but you will be earning SGD rather than RM - 0% service charge, 0% platform fees, 0% switching fee) All online. Why do you need another way? I guess is more or less the same as they are variable price fund. Do not confused with the fixed price funds. |

|

|

Oct 23 2017, 07:13 PM Oct 23 2017, 07:13 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

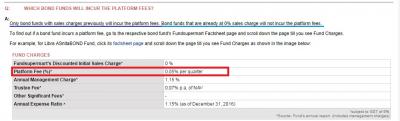

QUOTE(mephyll @ Oct 23 2017, 03:55 PM) Q1: Majority here purchase fund/ UT online i.e: FSM, Eunittrust? A1: no idea can't speak for others....Q2: Personally may try to open FSM account, refer back previous post, saying that there are platfrom fees, how to waive it? Q3: other than online trade? any method to buy and sell? Is it Funds is game rules same as ASN unfixed price fund? feel free to share the different.. A2: Platform fees in FSM applies to some bond funds...see attached image or here for more details about FSM platform fees.... https://www.fundsupermart.com.my/main/faq/1...atform-Fee-8467 A3: maybe go to their office to do it directly? A4: I guess more or less the same.... Attached thumbnail(s)

|

|

|

Oct 24 2017, 10:34 AM Oct 24 2017, 10:34 AM

|

Junior Member

428 posts Joined: Sep 2017 |

QUOTE(Ramjade @ Oct 23 2017, 06:56 PM) Yes. Platform fees is applicable for bond funds and managed portfolio if bought from FSM. How to bypass it? 1) Buy bond funds from eUT whenever they have promo. Applicable only if you bought min RM5 during promo. No min RM5k, no talk 2) Switch over to POEMS SG (drastic but you will be earning SGD rather than RM - 0% service charge, 0% platform fees, 0% switching fee) All online. Why do you need another way? I guess is more or less the same as they are variable price fund. Do not confused with the fixed price funds. QUOTE(T231H @ Oct 23 2017, 07:13 PM) A1: no idea can't speak for others.... Kinda headache on their fees... need to study what to charge what not to charge and so on.A2: Platform fees in FSM applies to some bond funds...see attached image or here for more details about FSM platform fees.... https://www.fundsupermart.com.my/main/faq/1...atform-Fee-8467 A3: maybe go to their office to do it directly? A4: I guess more or less the same.... Then how the POEMS SG makes money? i dont know how safe it is goes online, worry when goes ceases, what will happen to my $$. (old folk minded yet, still studying how secure it is) Not all funds contribute dividend ya? so for those fund have no contribute dividend, profit can only makes when buy at lower price, and sell at higher price ? just like share market? |

|

|

Oct 24 2017, 10:47 AM Oct 24 2017, 10:47 AM

|

All Stars

14,943 posts Joined: Mar 2015 |

QUOTE(mephyll @ Oct 24 2017, 10:34 AM) Kinda headache on their fees... need to study what to charge what not to charge and so on. yes,...It is always good to study, understand, weight its cost about the fees and charges to be incurred both knowingly and unknowing to you before investing in unit trust funds.Then how the POEMS SG makes money? i dont know how safe it is goes online, worry when goes ceases, what will happen to my $$. (old folk minded yet, still studying how secure it is) Not all funds contribute dividend ya? so for those fund have no contribute dividend, profit can only makes when buy at lower price, and sell at higher price ? just like share market? in the online platform there are FAQs to answers common queries related to something like "what if it ceased operation?" "Is your invested money safe if it happens?" "Not all funds contribute dividend ya? so for those fund have no contribute dividend, profit can only makes when buy at lower price, and sell at higher price ? just like share market?" yes not all funds contribute dividend (UT calls them dividend distribution) after dividend distribution...the price of the fund (NAVs) will drops.... thus the monetary value of money you have in that fund will remains the same. so got dividend or not.....no impact to one's wealth yes,...something like buy low sell higher just like stock markets..... |

|

|

Oct 24 2017, 02:21 PM Oct 24 2017, 02:21 PM

|

Junior Member

428 posts Joined: Sep 2017 |

|

|

|

Oct 24 2017, 03:34 PM Oct 24 2017, 03:34 PM

|

All Stars

14,943 posts Joined: Mar 2015 |

QUOTE(mephyll @ Oct 24 2017, 02:21 PM) What makes different between stock and fund then? mutual funds vs stocks pros and consjust coz stock market the admin fees is higher? need go through broker? FSM aka middle man pun kan? https://www.google.com/search?rlz=1C1AOHY_e.....0.aP4dfZI7xUU |

|

|

Oct 25 2017, 12:16 AM Oct 25 2017, 12:16 AM

Show posts by this member only | IPv6 | Post

#2513

|

All Stars

24,392 posts Joined: Feb 2011 |

QUOTE(mephyll @ Oct 24 2017, 10:34 AM) Kinda headache on their fees... need to study what to charge what not to charge and so on. How do they make money? Then how the POEMS SG makes money? i dont know how safe it is goes online, worry when goes ceases, what will happen to my $$. (old folk minded yet, still studying how secure it is) Not all funds contribute dividend ya? so for those fund have no contribute dividend, profit can only makes when buy at lower price, and sell at higher price ? just like share market? - They don't just sell UT. They offer lots of things. Stocks, CFD, forex, margin trading, managed portfolio (auto buy and sell on your behalf) - For UT, there is something call trailer fees. If they are selling a particular fund, the fund house will pay them some commission for selling their fund. This is already calculated in the management fees. - Service charge + platform fees is just extra revenue. - If more people buy the fund, the more commission they get. This you have to ask elea88. She's the expert on SG transfer after one is deceased. QUOTE(mephyll @ Oct 24 2017, 02:21 PM) What makes different between stock and fund then? To pay dividend from a company stock, the company must have ready cash. How do they get it? just coz stock market the admin fees is higher? need go through broker? FSM aka middle man pun kan? - Make profit - Take loan to pay - Use cash reserve. A fund is different. It don't need to be profitable as it can give out the money monthly and then market it as 10%p.a but in actual fact, they are making a loss. Fund is a basket of stocks/bonds. Stock is well a stock of a company. Stock market fees is cheaper if you carry out big transaction. It's more expensive if you carry out small transactions. For stocks, the lowest is 0.05% (M+ silver) For unit trust investing, it's the same regardless of how much you pump in Malaysia (FSM will give you special cheaper rates but you can't beat 0% sales charge by POEMS SG) Do they really don't charge for service charge? Yes. Me and elea88 can testify to that. This post has been edited by Ramjade: Oct 25 2017, 12:21 AM |

|

|

|

|

|

Oct 25 2017, 06:46 AM Oct 25 2017, 06:46 AM

Show posts by this member only | IPv6 | Post

#2514

|

Senior Member

4,174 posts Joined: Dec 2008 |

QUOTE(mephyll @ Oct 24 2017, 10:34 AM) Kinda headache on their fees... need to study what to charge what not to charge and so on. everything is online.. only unsafe part is when your own PC kena virus maybe.. Then how the POEMS SG makes money? i dont know how safe it is goes online, worry when goes ceases, what will happen to my $$. (old folk minded yet, still studying how secure it is) Not all funds contribute dividend ya? so for those fund have no contribute dividend, profit can only makes when buy at lower price, and sell at higher price ? just like share market? Singapore is Financial Hub of Asia , I do not think they will lari with your $$... if you want open POEMS i can recommend u my agent. he is quite efficient. however i did not bother open FSM SG. if can have 0 service charge why want pay 0.8 in FSM? |

|

|

Oct 25 2017, 11:09 AM Oct 25 2017, 11:09 AM

|

All Stars

24,392 posts Joined: Feb 2011 |

QUOTE(elea88 @ Oct 25 2017, 06:46 AM) everything is online.. only unsafe part is when your own PC kena virus maybe.. What's your agent name? Got WhatsApp? Mind agent ignoring my sms and doesn't want to give WhatsApp (I believed no one does not have WhatsApp this days).Singapore is Financial Hub of Asia , I do not think they will lari with your $$... if you want open POEMS i can recommend u my agent. he is quite efficient. however i did not bother open FSM SG. if can have 0 service charge why want pay 0.8 in FSM? |

|

|

Oct 25 2017, 02:30 PM Oct 25 2017, 02:30 PM

Show posts by this member only | IPv6 | Post

#2516

|

Senior Member

4,174 posts Joined: Dec 2008 |

|

|

|

Oct 28 2017, 11:03 AM Oct 28 2017, 11:03 AM

|

All Stars

11,954 posts Joined: May 2007 |

sorry why need agent to open POEM SG account/.

|

|

|

Nov 1 2017, 11:09 PM Nov 1 2017, 11:09 PM

|

Senior Member

704 posts Joined: Aug 2016 |

anyone knows whether PRS can put RM1000 only? after get the incentive just leave it there ?

|

|

|

Nov 1 2017, 11:28 PM Nov 1 2017, 11:28 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Nov 1 2017, 11:57 PM Nov 1 2017, 11:57 PM

|

All Stars

24,392 posts Joined: Feb 2011 |

QUOTE(Karen1995 @ Nov 1 2017, 11:09 PM) You can put how much you want but max tax relief per year until 2021 is RM3k.So dont stop at just RM1k. Max it out to RM3k. It's your money and you can withdraw it when you retire. So pay less income tax + pay yourself, you don't want? |

| Change to: |  0.0213sec 0.0213sec

0.75 0.75

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 16th December 2025 - 12:53 AM |